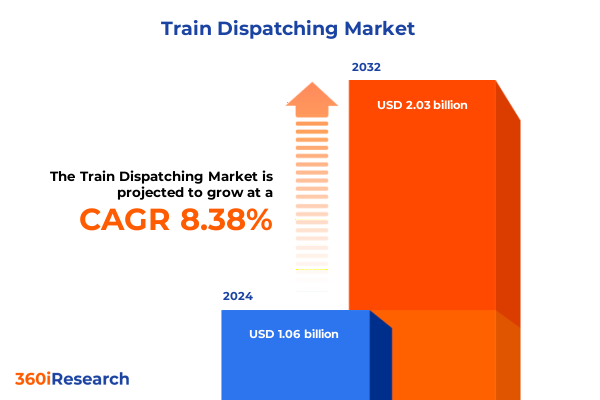

The Train Dispatching Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.24 billion in 2026, at a CAGR of 8.35% to reach USD 2.03 billion by 2032.

Charting the Evolution and Strategic Significance of Train Dispatching as a Cornerstone of Modern Rail Network Efficiency and Reliability

Train dispatching has evolved from manual signal boards and paper timetables into a sophisticated nexus of software, hardware, and human expertise that underpins the seamless movement of freight and passenger services across national rail networks. At its core, dispatching orchestrates the delicate ballet of train movements, balancing safety, punctuality, and capacity utilization to deliver reliable transport. As rail operators grapple with aging infrastructure, rising demand, and complex regulatory frameworks, modern dispatching has emerged as a strategic differentiator rather than a mere operational necessity.

Over the past decade, rail networks have faced intensifying pressures to meet sustainability targets, integrate new rolling stock, and enhance customer satisfaction metrics. In response, dispatch centers have transitioned from centralized, on-premises control rooms to digitally connected operations hubs capable of real-time collaboration. This shift has been catalyzed by investments in cloud connectivity, advanced analytics, and integrated communication networks. Consequently, executives and operations managers now view dispatching not only as the nerve center for train movements, but also as a critical source of performance data that informs capital allocation, infrastructure maintenance, and customer commitments.

Moreover, the proliferation of freight rail and high-capacity commuter corridors has elevated dispatching systems to a strategic planning function. By leveraging predictive modeling and scenario-based simulations, dispatch teams anticipate bottlenecks, allocate assets with precision, and adapt to unforeseen disruptions such as extreme weather or labor actions. This introduction underscores the central thesis of this executive summary: train dispatching has transitioned into a transformative domain where operational agility, technological innovation, and strategic oversight converge to drive network reliability and competitive advantage.

Assessing the Breakthrough Digital Technologies and Operational Paradigm Shifts Revolutionizing Train Dispatching in the Era of Connectivity and Automation

In recent years, train dispatching has undergone transformative shifts driven by digital connectivity, automation, and the integration of data-driven decision support tools. Traditional signaling and timetable adherence are augmented by artificial intelligence algorithms that analyze real-time traffic flow, dynamically optimize routing, and predict maintenance windows. These innovations have turned static schedules into living models that adjust on-the-fly based on traffic density, equipment health metrics, and external factors such as weather forecasts.

Concurrently, the rise of Internet of Things-enabled trackside sensors and communication protocols has bridged silos between field equipment and central control rooms. Dispatchers now receive live diagnostics on axle bearings, rail temperature, and track integrity, enabling proactive interventions that reduce downtime and enhance safety. The convergence of these sensor networks with cloud architectures has also fostered hybrid implementation models, where core dispatch logic resides on enterprise servers while edge devices execute mission-critical responses.

Furthermore, regulatory mandates like Positive Train Control and Communication-Based Train Control have compelled rail operators to upgrade legacy dispatch platforms to support automated enforcement and collision avoidance. This regulatory impetus, paired with competitive pressure to improve on-time performance and capacity utilization, has accelerated partnerships between rail carriers and technology providers specializing in predictive analytics, secure communication gateways, and scalable software-as-a-service offerings. As a result, train dispatching has shifted from a reactive function to a strategic domain that leverages digital twins, machine learning, and integrated communication networks to drive sustainable growth.

Analyzing the Strategic and Operational Consequences of U.S. Tariff Measures in 2025 on Rail Dispatching Systems and Supply Chain Resilience

Deploying tariffs that target steel, aluminum, and specialized rail components has reshaped the cost structure and procurement strategies within train dispatching ecosystems. The U.S. government’s 2025 measures introduced a 25 percent levy on steel and aluminum imports, extending to critical trackside signaling equipment, wayside processors, and communication modules. Additionally, a 10 percent tariff on rail-specific components imported from select trade partners has elevated the total landed cost of hardware and compelled operators to reassess their supply chains.

These levies have had a twofold impact: first, prompting increased lead times for procurement as suppliers navigate classification uncertainties and compliance requirements; and second, pressuring operational budgets that were already strained by the simultaneous rollout of federally mandated safety systems. For example, the extended validation timelines for new trackside devices now reflect the dual challenges of regulatory certification and tariff-induced cost escalation. In turn, dispatch centers have reprioritized technology investments, often delaying non-critical upgrades to maintain compliance with enforcement systems like Positive Train Control and to preserve capital for immediate operational needs.

To mitigate tariff exposure, rail operators and equipment vendors are exploring near-shoring options, dual-sourcing agreements, and local assembly facilities. These strategies aim to preserve the financial viability of large-scale dispatch modernization projects while reducing dependency on vulnerable international supply lines. Taken together, these tariff policies have accelerated a rebalancing of global and domestic sourcing, ushering in a new phase of supply chain resilience and strategic procurement for train dispatching networks.

Uncovering Critical Insights Through Market Segmentation Analysis Spanning Deployment, Component Frameworks and Diverse End User and Solution Perspectives

Insight into the train dispatching market emerges when examined through multiple analytical lenses. Deployment models reveal that on-premises control centers still dominate legacy networks, but cloud-native and hybrid architectures are rapidly gaining traction. Hybrid frameworks, in particular, offer a balance between secure, localized fail‐safe operations and scalable, remote analytics, enabling real-time collaboration across geographically dispersed dispatch hubs.

Looking at component structures, the triad of hardware, software, and services shapes the ecosystem. Hardware encompasses trackside sensors, interlocking systems, and communication gateways; software spans dispatch management platforms, simulation engines, and mobile applications; and services include both managed offerings, where third-party providers run and maintain dispatch operations, and professional engagements for system integration, consulting, and custom engineering. The interplay between predictive maintenance modules and fault diagnostics services is fostering proactive incident response, while professional service engagements accelerate the deployment of tailor-made dispatch workflows.

From the end-user perspective, freight rail networks are investing heavily in automation to maximize asset utilization, whereas passenger rail and mass transit operators are focused on reliability, on-time performance, and seamless passenger communication. Mass transit systems, whether light rail or metro transit networks, are integrating dispatching protocols with customer-facing apps to relay arrival predictions and platform assignments in real time.

Finally, solution segmentation highlights critical functional domains: asset monitoring and diagnostics tools that flag wear, communication and integration suites that harmonize disparate signaling networks, maintenance and fault management structures that include predictive maintenance and fault diagnostics, route planning capabilities covering capacity optimization and timetable planning, and advanced train control systems, ranging from automatic train control to communication-based and positive train control. Each of these segments is interwoven into a cohesive dispatching platform that must deliver operational resilience and adaptability in complex rail environments.

This comprehensive research report categorizes the Train Dispatching market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Deployment

- Component

- End User

Examining Regional Dynamics and Infrastructure Evolution across the Americas, EMEA and Asia Pacific Showcasing Varying Growth Drivers and Operational Challenges

Regional dynamics are driving divergent approaches to dispatching innovation and infrastructure investment. In the Americas, dispatch centers are prioritizing digital integration and public-private partnerships to upgrade aging control towers and expand cloud-enabled traffic management. Early adopters in North America are leveraging pilot programs that network dispatch hubs across cross-border corridors, enabling unified management of freight flows between the United States, Mexico, and Canada.

Meanwhile, in Europe, the Middle East and Africa, interoperability and regulatory alignment take center stage. Trans-European rail corridors are adopting standardized communication protocols to facilitate cross-border dispatching under the European Rail Traffic Management System, while the Gulf Cooperation Council invests in next-generation signaling on its freight and passenger corridors. Across Africa, emerging metro systems are leapfrogging legacy infrastructure by deploying turnkey cloud dispatch solutions that accelerate operational readiness and minimize capital outlay.

In the Asia-Pacific region, the focus is on massive network expansions and smart city integration. Rail operators in China, India, and Southeast Asia are embedding dispatch functions within broader mobility-as-a-service ecosystems, linking train scheduling with urban transit networks and traffic management platforms. These large-scale modernization programs emphasize predictive analytics for rolling stock health and leverage mobile command centers for disaster resilience. As a result, regional priorities-from interoperability in EMEA to passenger integration in Asia-Pacific-paint a mosaic of dispatching strategies aligned with local policy frameworks and infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Train Dispatching market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Players and Strategic Partnerships Shaping the Future of Train Dispatching Through Innovation and Competitive Collaboration

The train dispatching landscape is shaped by a handful of global leaders and an ecosystem of specialized innovators that deliver hardware, software, and managed services. Siemens Mobility has distinguished itself with its proven MobilityLAB digital platform, which integrates real-time train positioning with predictive maintenance analytics to drive network efficiency. Alstom’s Eco Valley system emphasizes modular dispatch control, enabling operators to scale capacity planning and timetable adjustments seamlessly.

Meanwhile, Wabtec Corporation, bolstered by its acquisition of GE Transportation, is capitalizing on seamless interoperability between locomotive electronics and centralized dispatch modules. Hitachi Rail has positioned itself as a turnkey integrator, offering both hardened interlocking solutions and cloud-hosted traffic management, while Thales consistently invests in secure communication backbones that enable cross-border dispatching under stringent cybersecurity standards.

Beyond these major players, a wave of niche providers is advancing capabilities in specialized solution areas. Companies focused on predictive fault diagnostics are leveraging machine learning to extend trackside sensor lifecycles, and cloud native startups are championing rapid deployment of dispatch control centers in emerging markets. The competitive landscape is defined by strategic partnerships-such as joint ventures between signaling suppliers and telecom firms-to deliver integrated dispatch and communication suites that meet evolving regulatory mandates and network demands. This blend of established alliances and disruptive newcomers underscores the dynamic and collaborative nature of the train dispatching industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Train Dispatching market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Avtec, Inc.

- Canadian Pacific Kansas City Limited

- Cisco Systems, Inc.

- Hexagon AB

- Hitachi Rail Ltd.

- Huawei Technologies Co., Ltd.

- Indian Railways

- International Business Machines Corporation (IBM)

- Mitsubishi Heavy Industries, Ltd.

- Motorola Solutions, Inc.

- Rumo Logística Operadora Multimodal S.A.

- San Francisco Bay Area Rapid Transit District

- Siemens Mobility GmbH

- Thales Group

- Toshiba Corporation

- Tracsis plc

- Union Pacific Corporation

- Wabtec Corporation

- Zetron, Inc.

Delivering Actionable Recommendations to Propel Operational Excellence and Growth for Industry Leaders in Next Generation Train Dispatching Solutions

Rail operators and technology providers must prioritize integration and flexibility to harness the full potential of next-generation dispatching. It is critical to establish modular system architectures that support phased upgrades, enabling control centers to adopt advanced analytics and AI-driven routing without wholesale platform replacements. Embracing hybrid deployment models will safeguard mission-critical operations, while permitting the elasticity of cloud-based data processing to manage peak traffic and complex simulations.

Organizations should also invest in comprehensive skills training that bridges traditional signal-centric expertise with data science and cybersecurity competencies. By cultivating multidisciplinary dispatch teams, operators gain the agility to translate real-time insights into rapid decision cycles. Furthermore, forging strategic alliances with component manufacturers and system integrators can mitigate tariff-driven supply chain disruptions by co-locating assembly or maintenance facilities in tariff-free jurisdictions.

Finally, continuous performance monitoring must be institutionalized through key performance indicators that span safety compliance, on-time departures, and asset utilization rates. Establishing clear governance structures that align dispatch objectives with broader corporate sustainability and digitalization goals will ensure that train movement coordination remains a strategic asset rather than a legacy constraint. These actionable measures will empower industry leaders to deliver reliable, scalable, and resilient dispatch solutions amidst evolving market pressures.

Detailing a Rigorous and Transparent Research Methodology Demonstrating Comprehensive Data Collection, Analysis Techniques and Validation Processes

This research was conducted through a rigorous framework that combines primary stakeholder engagement and secondary data validation. The methodology began with interviews and workshops involving dispatchers, rail network operators, technology vendors, and regulatory bodies to capture firsthand operational challenges and technology adoption drivers. These qualitative insights were triangulated with publicly available technical papers, industry white papers, and regulatory filings to ensure comprehensive coverage of regional and global trends.

Quantitative data collection involved a detailed review of equipment certification records, safety compliance reports, and tariff schedules published by government agencies and customs authorities. This information was analyzed using structured data models to identify correlations between tariff impositions and component lead times, as well as between deployment modalities and operational performance outcomes.

Advanced analysis techniques, such as scenario modeling and sensitivity testing, were applied to assess the impact of regulatory mandates and technology shifts under various network load conditions. Validation processes included iterative peer reviews with industry experts and cross-verification against case studies from rail authorities in North America, Europe, and Asia-Pacific. The result is a transparent, multi-layered research approach designed to deliver both strategic insights and actionable guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Train Dispatching market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Train Dispatching Market, by Solution

- Train Dispatching Market, by Deployment

- Train Dispatching Market, by Component

- Train Dispatching Market, by End User

- Train Dispatching Market, by Region

- Train Dispatching Market, by Group

- Train Dispatching Market, by Country

- United States Train Dispatching Market

- China Train Dispatching Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Takeaways and Future Outlook Emphasizing the Strategic Importance of Agile Dispatching and Innovation Readiness

Across the domains of technology, policy, and operations, train dispatching stands at a pivotal inflection point where agility and innovation converge to redefine rail network performance. The emergence of cloud-native and hybrid architectures underscores the importance of flexible deployment frameworks, while the integration of AI, IoT sensors, and advanced analytics highlights the strategic imperative of data-driven decision making. As U.S. tariff measures reshape procurement and supplier strategies, dispatch centers must adopt resilient sourcing models and prioritize modular system upgrades to sustain modernization efforts.

Regional variations in regulatory frameworks and infrastructure maturity demand tailored dispatch solutions that account for interoperability in Europe, cross-border freight coordination in the Americas, and mobility-as-a-service integration in Asia-Pacific. Leading industry players and specialized innovators alike are driving a collaborative ecosystem, forging partnerships that marry signal-level expertise with secure communication and cloud delivery capabilities.

Ultimately, the strategic value of train dispatching will be measured not only by on-time performance metrics and safety compliance, but also by its ability to adapt to shifting market dynamics, regulatory imperatives, and technological breakthroughs. Embracing a holistic approach that aligns dispatch objectives with broader corporate goals will ensure that rail operators capitalize on emerging opportunities and build resilient networks prepared for tomorrow’s challenges.

Connect with Ketan Rohom to Acquire Exclusive Train Dispatching Market Research Insights and Empower Your Organization’s Strategic Decision Making Today

Are you ready to elevate your organization’s decision-making with unparalleled strategic intelligence? Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure exclusive insights into the train dispatching market. Through this personalized consultation, you will gain access to cutting-edge analysis, in-depth intelligence on emerging dispatching technologies, and prioritized briefings on regulatory and tariff developments affecting rail operations. By partnering with Ketan Rohom, your team will benefit from tailored recommendations that align with your unique operational challenges and strategic growth objectives. Reach out today to transform data into actionable pathways that strengthen your competitive edge in an increasingly complex global rail environment and ensure your dispatching strategies are future-proof.

- How big is the Train Dispatching Market?

- What is the Train Dispatching Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?