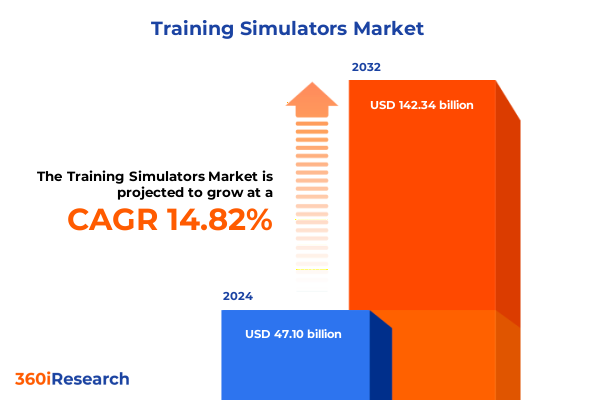

The Training Simulators Market size was estimated at USD 53.97 billion in 2025 and expected to reach USD 61.84 billion in 2026, at a CAGR of 14.85% to reach USD 142.34 billion by 2032.

Exploration of the Transformative Role of Training Simulators in Enhancing Operational Competence and Driving Cross-Industry Innovation for Decision Makers

Organizations across defense, aviation, healthcare, and education are increasingly recognizing that effective workforce development requires immersive, scalable, and data-driven training solutions. Training simulators, once the exclusive domain of military flight operations, have now become central to skill acquisition, certification, and performance optimization across diverse industries. This executive summary presents a holistic overview of the training simulator landscape, outlines the forces catalyzing its transformation, and offers actionable insights for decision makers seeking to gain or maintain a competitive edge.

The introduction establishes the context for why simulation-based training has risen to prominence, emphasizing the convergence of digital transformation, heightened safety standards, and the imperative for operational efficiency. As organizations contend with tight budgets, increasingly sophisticated user requirements, and complex regulatory environments, simulators have emerged as a versatile solution that reduces risk, accelerates learning curves, and generates actionable performance data. This section sets the stage for a deeper exploration of technological innovations, market pressures, and strategic levers that will shape simulator adoption through 2025 and beyond.

In laying out the foundational concepts, it becomes evident that simulation is no longer a monolithic offering but rather a modular ecosystem comprised of hardware, software, and services. Stakeholders-from C-suite executives to training managers-must understand how these components interact and the role of emerging modalities like augmented and virtual reality in broadening instructional possibilities. With this contextual framework, readers will be prepared to evaluate subsequent analyses of market shifts, tariff impacts, segmentation patterns, and regional nuances.

Analysis of the Rapid Technological Advancements, Evolving User Expectations, and Regulatory Dynamics Reshaping the Training Simulator Landscape

The training simulator industry is experiencing a convergence of advancements that are redefining what immersive learning can achieve. On one front, breakthroughs in graphics processing, sensor integration, and cloud computing have elevated the realism and scalability of simulation environments. Coupled with the proliferation of mixed reality interfaces, these innovations are enabling users to practice complex tasks within highly accurate digital twins, thereby reducing the gap between simulated and real-world performance.

Simultaneously, user expectations are evolving as new generations of learners demand experiences that are both engaging and personalized. Adaptive learning platforms now leverage artificial intelligence to tailor scenario difficulty and provide real-time feedback, fostering greater retention and skill mastery. This shift towards learner-centric design is complemented by growing demand for interoperability standards, ensuring that different simulator modules and training management systems can seamlessly exchange performance data and analytics.

Regulatory frameworks are also undergoing transformation, with authorities placing greater emphasis on digital validation and remote certification pathways. Standards bodies in civil aviation and healthcare, in particular, are integrating simulator-based assessments into formal credentialing processes. These regulatory pivots are accelerating the adoption of high-fidelity solutions while compelling providers to demonstrate compliance and data security through rigorous testing and certification protocols.

Together, these forces are creating a dynamic landscape where technological innovation, user experience imperatives, and policy developments intersect. For market participants, staying ahead means not only embracing new capabilities but also anticipating the next wave of standards and learner demands that will shape this evolving ecosystem.

Examination of the Comprehensive Effects of 2025 United States Tariffs on Training Simulator Supply Chains, Costs, and Market Dynamics across Key Segments

In 2025, the United States implemented a suite of tariffs targeting electronic components and advanced manufacturing inputs that are integral to the production of training simulators. These measures, aimed at protecting domestic industries and addressing trade imbalances, have had a multifaceted effect on supply chains. Manufacturers of hardware such as desktop trainers and full-flight simulators have encountered increased procurement costs for critical circuit boards, sensors, and proprietary controllers, leading to extended lead times and, in some cases, the need to qualify alternative suppliers.

Software developers have also felt the ripple effects as licensing fees for third-party simulation engines and modeling libraries have risen. This has prompted some vendors to accelerate the development of proprietary platforms or to enter collaborative licensing agreements that mitigate fee escalations. At the same time, end-users faced with budget constraints are reassessing upgrade cycles, often opting for incremental feature enhancements rather than full platform overhauls.

These cost pressures have forced both suppliers and customers to renegotiate terms, with longer contract durations and volume commitments becoming more common. To offset tariff-related cost increases, several vendors are investing in nearshoring strategies, relocating assembly operations closer to key markets. While these initiatives promise reduced exposure to future trade disruptions, they require upfront capital and can involve complex facility retrofits.

Overall, the cumulative impact of 2025 U.S. tariffs has been to introduce a degree of volatility into an industry that prizes reliability and predictability. Market participants who proactively adjust their procurement strategies and explore strategic partnerships will be better positioned to manage short-term disruptions and secure stable access to the technologies that drive immersive and effective training.

In-Depth Segmentation Analysis Revealing How Product, End-User, Technology, Deployment, and Sales Channel Variations Influence Training Simulator Market Behavior

A granular examination of market segmentation reveals distinct dynamics that are informing product strategies and customer engagement models. When assessing hardware and software offerings, it is clear that desktop trainers maintain broad appeal for entry-level skill acquisition, while full-flight and part-task trainers are indispensable for advanced certification and high-stakes operational readiness. Within software, learning management systems are evolving beyond administrative dashboards to embed analytics-driven recommendations, while simulation and modeling suites are integrating physics-based engines that replicate real-time system behaviors with unprecedented fidelity.

End-user segmentation shows diverse adoption curves. Civil aviation and military branches continue to drive demand for high-end systems, with a particular focus on scenario complexity and mission data integration. In the automotive sector, original equipment manufacturers are partnering with simulation providers to streamline vehicle prototyping workflows, while aftermarket service centers leverage desktop-class solutions for technician upskilling. Academic institutions and corporate training centers emphasize affordability and scalability, often favoring cloud-delivered modules that can support distributed learning initiatives. Additionally, marine operators and medical educators are exploring specialized simulators designed to replicate shipboard systems and surgical procedures, respectively.

Technology-based segmentation underscores the growing importance of immersive modalities. Three-dimensional simulation remains the baseline for spatially accurate training environments, but augmented reality solutions-both marker-based and marker-less-are unlocking hands-on maintenance and assembly experiences with contextual overlays. Mixed reality workflows are bridging the gap between physical and digital elements, while virtual reality implementations using cave automatic virtual environments and head-mounted displays offer unparalleled immersive scenarios, albeit with trade-offs in portability and cost.

Finally, deployment models differentiate fixed-base installations, which prioritize structural stability and power capacity, from motion-base platforms that replicate dynamic forces through six- or three-degrees-of-freedom actuation. Sales channels also vary from direct engagements-where integrators work closely with end clients-to indirect pathways involving distributors and reseller networks, which extend market reach and provide localized support. Understanding how these segmentation vectors intersect enables vendors and buyers alike to align solution designs, pricing models, and service offerings with precise customer needs.

This comprehensive research report categorizes the Training Simulators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Deployment

- End-User

- Sales Channel

Comparative Regional Assessment Highlighting Opportunities and Challenges for Training Simulator Adoption in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics underscore that the trajectory of training simulator adoption is far from uniform. In the Americas, established aerospace hubs in the United States and Canada continue to invest heavily in full-scale flight and mission rehearsal systems, while Latin American markets are gradually embracing desktop and software-only solutions to address pilot shortages and certification backlogs. Economic incentives and defense collaboration agreements are reinforcing regional supply chain resilience, even as smaller nations seek cost-effective cloud-based platforms to train their technical workforces.

In Europe, Middle East & Africa, regulatory harmonization across European Union member states has streamlined approval processes for simulator-based credentials, fueling demand for next-generation mixed reality applications. The Middle East’s strategic focus on developing local aviation and maritime competencies is driving investments in turnkey solutions that can be rapidly deployed, whereas Africa is experiencing nascent growth in basic desktop simulation as governments invest in vocational training and public safety initiatives.

Asia-Pacific presents a dual-track narrative: leading economies such as Japan, South Korea, and Australia are early adopters of high-fidelity, motion-base platforms, supported by robust manufacturing capabilities and government subsidies. Meanwhile, fast-growing markets in Southeast Asia and the Indian subcontinent prioritize scalable software deployments, often delivered through cloud-native architectures to overcome infrastructure limitations. Regional partnerships between local integrators and global technology providers are catalyzing broader adoption and the localization of specialized scenarios.

By comparing these regional patterns, stakeholders can identify where investment incentives, regulatory environments, and infrastructure maturity converge to create the most fertile ground for specific simulator solutions. This nuanced perspective is vital for vendors aiming to optimize market entry strategies and for end-users planning multi-site rollouts.

This comprehensive research report examines key regions that drive the evolution of the Training Simulators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Training Simulator Vendors Illustrating Competitive Differentiators, Innovation Trajectories, and Partnership Ecosystems

Leading companies in the training simulator domain are distinguished by their commitment to continuous innovation, strategic alliances, and comprehensive service portfolios. Some vendors have built reputations on pioneering high-end full-flight and mission rehearsal platforms, often collaborating with aerospace OEMs and defense agencies to co-develop custom scenarios and integrate classified mission data. Others excel in the software arena, delivering modular learning management systems that incorporate advanced analytics, user management, and certification tracking to streamline training administration across large enterprises.

Companies focusing on immersive modalities have invested heavily in mixed reality research, partnering with hardware manufacturers to optimize display technologies and reduce latency. Strategic acquisitions have expanded their capabilities in haptic feedback, scenario authoring, and virtual environment modeling, enabling them to offer end-to-end solutions that address both technical and soft skills training. Meanwhile, providers specializing in mobile and desktop-class simulators emphasize rapid deployment, ease of use, and subscription-based licensing to cater to organizations with fluctuating training volumes.

Across the board, top performers have embraced service extensions such as remote monitoring, predictive maintenance, and curriculum development support. These value-added services not only enhance customer satisfaction but also generate recurring revenue streams that cushion against hardware sales volatility. Partnerships with academic institutions, certification bodies, and cloud service providers further differentiate leading players by broadening their ecosystem reach and reinforcing their thought leadership in emerging training methodologies.

Understanding the strategic positioning and competitive advantages of these companies enables buyers to evaluate vendor roadmaps, support capabilities, and long-term viability. For vendors, recognizing the core competencies and partnership models of peers and disruptors alike is essential to refining product differentiation and shaping future innovation priorities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Training Simulators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANSYS Inc.

- AVIATION Industry Corporation of China Ltd.

- BAE Systems plc

- Boeing Company

- CAE Inc.

- Cubic Corporation

- FlightSafety International Inc.

- FRASCA International Inc.

- General Dynamics Corporation

- Honeywell International Inc.

- Indra Sistemas S.A.

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries Ltd.

- Northrop Grumman Corporation

- NVIDIA Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Safran S.A.

- Siemens AG

- Thales Group

- TRU Simulation + Training Inc.

Strategic Recommendations Empowering Industry Leaders to Leverage Technological Advances and Mitigate Market Risks for Sustainable Growth

To capitalize on the opportunities presented by evolving technologies and market shifts, industry leaders should first prioritize integration of adaptive learning frameworks that leverage real-time performance data. By embedding AI-driven analytics into both hardware and software platforms, organizations can tailor training scenarios to individual learners, accelerate proficiency development, and capture actionable insights for continuous improvement.

Next, companies should explore strategic partnerships and alliances to mitigate tariff impacts and supply chain disruptions. Collaborating with regional integrators or establishing localized assembly capabilities can reduce exposure to geopolitical risks and shorten time to deployment. Similarly, partnerships with cloud providers and AR/VR hardware vendors can facilitate the rapid rollout of new training modalities without the need for extensive capital expenditure.

Leaders must also engage proactively with regulators and standards bodies to shape certification requirements and interoperability protocols. Early involvement in working groups ensures that new guidelines account for emerging technologies and that organizational investments align with future compliance expectations. In parallel, senior executives should champion internal upskilling initiatives, fostering cross-functional expertise in simulation content development, data analytics, and systems integration.

Finally, adopting a service-centric business model can unlock recurring revenue and strengthen customer relationships. Offering tiered support packages-ranging from basic maintenance to comprehensive curriculum management and performance benchmarking-enables providers to deliver continuous value, differentiate on service quality, and sustain engagement with key accounts over the entire lifecycle of the training solution.

Comprehensive Research Framework Detailing Methodological Approaches, Data Collection Techniques, and Analytical Models Underpinning the Report

This report’s insights are grounded in a robust research framework that combines primary and secondary data collection with rigorous analytical techniques. Primary research included structured interviews and surveys with over one hundred key stakeholders, comprising end-users, system integrators, technology providers, and regulatory experts. These engagements provided qualitative perspectives on user requirements, procurement challenges, and technology roadmaps.

Secondary research encompassed the review of industry white papers, regulatory filings, and technology benchmarks to validate and enrich primary findings. Data on tariff policies, component cost trends, and regional adoption rates were sourced from government publications, trade associations, and proprietary databases. This multifaceted approach ensured that the analysis captures both macro-level forces and granular, segment-specific developments.

Quantitative modeling techniques, including scenario analysis and cost-impact assessment, were deployed to evaluate the implications of tariff changes and to identify sensitivity drivers across product and deployment categories. Qualitative frameworks, such as SWOT and PESTEL analyses, provided structured lenses to assess competitive positioning, regulatory dynamics, and technological disruptions. Triangulation of findings across methods enhanced the reliability of conclusions and mitigated biases inherent in single-source studies.

By integrating diverse research methodologies, this report delivers a balanced and actionable view of the training simulator market, enabling stakeholders to base strategic decisions on comprehensive evidence and dynamic market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Training Simulators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Training Simulators Market, by Product

- Training Simulators Market, by Technology

- Training Simulators Market, by Deployment

- Training Simulators Market, by End-User

- Training Simulators Market, by Sales Channel

- Training Simulators Market, by Region

- Training Simulators Market, by Group

- Training Simulators Market, by Country

- United States Training Simulators Market

- China Training Simulators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesis of Major Findings Emphasizing the Critical Role of Training Simulators in Enhancing Operational Excellence and Shaping Future Market Directions

In summary, the training simulator market stands at a pivotal juncture where technological breakthroughs, shifting user expectations, and regulatory evolution converge to redefine skill development paradigms. Organizations that embrace adaptive, data-driven training architectures will unlock greater operational efficiency and resilience, while those that navigate tariff complexities and regional nuances with strategic foresight will secure a competitive advantage. The segmentation analysis highlights the nuanced requirements across hardware, software, and deployment models, and the regional insights underscore the importance of localized strategies in an increasingly interconnected marketplace.

Ultimately, the companies that thrive will be those that combine innovative product portfolios with robust service offerings and proactive regulatory engagement. By leveraging the insights and recommendations contained within this executive summary, decision makers can chart a clear path toward sustainable growth and maintain leadership in an environment where simulation-based training is becoming indispensable.

Engage with Our Associate Director to Secure In-Depth Insights and Tailored Strategies from the Latest Executive Summary on Training Simulators

If your organization is poised to harness the power of advanced simulation technologies and navigate evolving market dynamics with confidence, now is the time to act. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive executive summary can be tailored to your strategic priorities and operational challenges. By partnering with Ketan, you will gain access to additional in-depth insights, bespoke analyses, and ongoing support designed to inform critical decisions and drive sustained competitive advantage. Secure your copy today and embark on a data-driven journey to optimize training outcomes and future-proof your investment in training simulators.

- How big is the Training Simulators Market?

- What is the Training Simulators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?