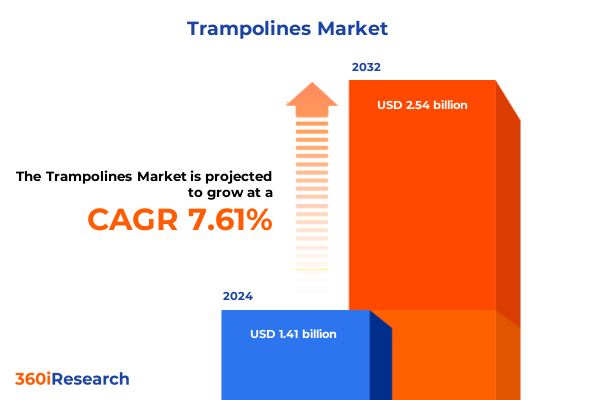

The Trampolines Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.63 billion in 2026, at a CAGR of 7.62% to reach USD 2.54 billion by 2032.

Introduction to the Evolving Trampoline Landscape Bridging Recreation and Fitness Trends in a Rapidly Changing Consumer Market

The trampoline market has undergone significant evolution, emerging as a hybrid nexus between recreational enjoyment and structured fitness applications. Once viewed primarily as children’s backyard play equipment, trampolines are now recognized for their multifaceted potential across wellness, sports training, and entertainment sectors. This shift has accelerated in response to growing consumer emphasis on holistic health, experiential leisure, and family-oriented activities that balance fun with functional exercise. As a result, industry stakeholders from manufacturers to park operators are adapting product designs and business models to meet a spectrum of emerging demands.

Over the past few years, recreational trampoline use has seen a renaissance fueled by both technological advancements and heightened safety awareness. Families have embraced modern enclosure systems and springless architectures that significantly reduce impact injuries. Simultaneously, fitness enthusiasts and rehabilitation specialists are integrating miniature rebounders-advocated by NASA research as yielding cardiovascular efficiency comparable to conventional running-into daily routines to support low-impact training regimes and lymphatic health improvements. In concert with these developments, commercial trampoline parks have expanded globally, offering immersive environments where consumers can pursue both leisure and more structured agility courses under professional supervision.

Unprecedented Transformative Shifts Reshaping the Trampoline Industry Through Innovations in Technology, Materials, and Consumer Engagement

Today’s trampoline industry is being reshaped by unprecedented innovations that span materials science, digital integration, and experiential design. Leading manufacturers have pioneered composite rod technologies that replace traditional steel springs, delivering safer bounce dynamics and reducing risk zones, as exemplified by Springfree’s glass-reinforced plastic frame systems. At the same time, park operators are deploying sensor-driven platforms that capture performance metrics and connect users to gamified digital challenges, laying the groundwork for a future where trampolines serve as interactive wellness portals rather than static recreational devices.

In addition, the rapid adoption of augmented and virtual reality in trampoline parks is elevating the guest experience to new levels. Operators are integrating immersive themed adventures-combining motion sensors, light and sound effects, and customizable obstacle courses-to captivate visitors across age groups. These multisensory environments not only drive repeat visits but also expand the trampoline model into holistic entertainment ecosystems. This convergence of technology, safety engineering, and experiential design represents a fundamental pivot, positioning trampolines at the intersection of home fitness, competitive sport, and next-generation leisure.

Comprehensive Analysis of the 2025 United States Tariff Measures and Their Collective Effects on Trampoline Imports and Domestic Supply Chains

Over recent months, a layered series of U.S. tariff measures has collectively altered the cost structure for trampoline imports and domestic supply chains. Beginning in 2018, U.S. Customs reclassified trampolines from a duty-free category to one subject to a 4.6% ad valorem duty under HTSUS 9506.91.0030, marking the first import levy against these items in modern trade history. This change was instituted to protect local manufacturers and generate revenue, setting a precedent for subsequent tariff policies.

In April 2025, the administration introduced a universal 10% reciprocal tariff on all imported goods, effective April 5, in a bid to press trading partners to lower their own trade barriers. Although a federal court vacated this order on May 28, 2025, a temporary stay by the appeals court reinstated it on May 29, underscoring ongoing legal and operational uncertainties for importers. Shortly thereafter, an additional 20% tariff on all Chinese-origin goods raised the total duty to 30% for trampolines sourced from China, intensifying pressure on U.S. distributors and retailers who rely heavily on Chinese-manufactured components and finished products.

These successive tariff impositions have prompted supply-chain realignments, with many stakeholders exploring alternative manufacturing bases in Southeast Asia and Latin America. Nevertheless, the legal challenge filed in V.O.S. Selections, Inc. v. United States-a landmark case contesting the president’s authority under the IEEPA to enact such tariffs-remains pending appeal, leaving the future status of these duties subject to the Federal Circuit’s ruling due later this summer. Against this backdrop, industry participants are bracing for continued volatility in landed costs and inventory management.

Actionable Insights into Trampoline Market Segmentation Revealing How Product Types and Consumer Profiles Drive Competitive Dynamics

The trampoline market displays a rich tapestry of segments shaped by product geometry, end-use contexts, distribution pathways, and demographic targeting. Oval trampolines, favored by recreational backyard enthusiasts, deliver balanced bounce profiles ideal for family use, while rectangular formats have gained traction in gymnastics centers and professional training facilities for their consistent rebound performance. Round trampolines remain a perennial choice for entry-level consumers, prized for safety features and user-friendly assembly.

Commercial and residential applications further delineate the market landscape. Within the commercial sphere, the rapid proliferation of trampoline parks, school athletic programs, and community center installations underscores a shift toward collective recreational experiences. In contrast, the residential segment emphasizes convenience and compact footprints, with consumers gravitating toward mini and springless rebounders that integrate seamlessly into home fitness routines.

The choice of sales channel exerts a critical influence on purchasing behaviors. Mass retailers offer broad accessibility and price competitiveness, whereas online platforms-from direct-to-consumer portals to third-party marketplaces-cater to both customization and rapid delivery expectations. Specialty stores, including sporting goods outlets and toy retailers, continue to leverage in-store expertise to guide safety-conscious family buyers. Across price tiers, low-cost models drive volume in value-sensitive demographics, while mid-range offerings balance performance and durability. Premium high-end trampolines, constructed from materials such as polypropylene, PVC, and galvanized steel, serve discerning users seeking advanced safety and longevity features.

Segmented by purpose and age, fitness-oriented trampolines appeal to adults and seniors seeking low-impact exercise solutions, while recreational designs target children and teens with vibrant aesthetics and safety enclosures. This multifaceted segmentation underscores the necessity for manufacturers and retailers to tailor product portfolios, messaging, and after-sales services to nuanced consumer profiles in order to maximize market penetration and brand loyalty.

This comprehensive research report categorizes the Trampolines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Material

- Shape

- Sales Channel

- End User

Key Regional Dynamics Highlighting How Trampoline Demand and Regulations Vary Across Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional market dynamics exhibit pronounced variations in regulatory environments, consumer preferences, and growth trajectories. In the Americas, the United States leads with robust demand for both residential fitness rebounders and large-scale trampoline parks, driven by heightened health awareness and the rapid expansion of franchised entertainment venues. North American consumers exhibit a strong affinity for premium safety features, propelling innovation in enclosure systems and composite spring alternatives.

Across Europe, the Middle East, and Africa, stringent safety regulations and harmonized standards govern trampoline design and installation. European markets, particularly Germany and the United Kingdom, demonstrate steady uptake in fitness-oriented rebounders and public athletic installations. In the Middle East, rising disposable incomes in Gulf Cooperation Council countries have fueled interest in indoor family entertainment centers, while African markets remain nascent but promising due to urbanization and infrastructure investments.

Asia-Pacific represents a dynamic frontier characterized by both manufacturing leadership and surging domestic consumption. China and Southeast Asian nations serve as major production hubs for cost-competitive components, while markets in Australia, Japan, and South Korea are experiencing accelerated adoption of high-quality trampolines for home and commercial use. Government-sponsored wellness initiatives have further encouraged trampoline integration into community health programs, amplifying regional growth potential.

This comprehensive research report examines key regions that drive the evolution of the Trampolines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Overview Spotlighting Leading Trampoline Manufacturers and Emerging Companies Driving Innovation and Market Growth

The competitive landscape is defined by a blend of established manufacturers, emerging innovators, and vertically integrated entertainment operators. Springfree Trampoline has distinguished itself through patented composite-rod technology and safety-first design, earning widespread acclaim and industry recognition for its reduction of impact zones and springless approach. Meanwhile, legacy brands such as Skywalker have maintained significant market share in mass retail channels by offering reliable, cost-effective models that appeal to broad consumer segments.

On the commercial front, Altitude Trampoline Park has demonstrated an aggressive expansion trajectory, opening six new parks in multiple U.S. states within the first half of 2025 alone. This achievement underscores the growth potential of franchised entertainment models that leverage standardized operational protocols and diversified revenue streams. In the rebounder space, specialized fitness brands like JumpSport have cultivated a dedicated following by emphasizing low-impact wellness benefits and strategic partnerships with health professionals.

Looking ahead, digitally integrated smart trampolines-equipped with sensor arrays and connectivity features-are poised to emerge as a disruptive category. Although currently in early adoption phases, these products promise enhanced user engagement and data-driven insights, representing a potential inflection point for the industry’s next growth cycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Trampolines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A J Landmark, Inc. Trampolines & Swings

- Acon Finland Oy Ltd.

- Airzone Jump

- Akrobat

- Avyna Inground

- Bellicon AG

- Domi Jump Inc.

- Funmagic Playsystems Private Limited

- Gosolo Services Pvt. Ltd.

- JumpKing International LLP

- JumpSport Inc.

- Kangaroo Hoppers

- Machrus Inc.

- Maskeen Overseas

- MaxAir Trampolines

- Merax Trampolines

- Multiplay International Ltd.

- North Trampoline Inc.

- Plum Products Ltd.

- Rave Sports

- SkyBound USA

- Sportspower Ltd.

Practical Recommendations for Trampoline Industry Leaders to Capitalize on Growth Opportunities and Navigate Regulatory and Market Shifts

Industry leaders should prioritize supply-chain diversification to mitigate tariff exposure, exploring manufacturing partnerships in Southeast Asia and Latin America to balance cost optimization with quality assurance. Concurrently, accelerating the development of springless and composite-rod architectures can preempt regulatory tightening and reinforce brand value through enhanced safety credentials.

Additionally, investing in digital platforms and sensor technologies will enable companies to deliver personalized user experiences, from performance tracking to gamified fitness programs. Strategic alliances with fitness studios, schools, and community organizations can further broaden distribution networks and foster recurring revenue models. Aligning product portfolios with evolving consumer demographics-such as aging populations seeking low-impact exercise and youth segments craving immersive entertainment-will maximize market relevance.

Finally, proactive engagement with regulatory bodies and standards organizations is essential to shape safety guidelines, streamline certification processes, and bolster consumer confidence. By adopting a proactive, innovation-led approach and staying attuned to emerging consumer behaviors, trampoline industry leaders can secure sustainable growth and differentiate their offerings in a competitive landscape.

Robust Research Methodology Detailing the Systematic Approach to Data Collection, Analysis, and Validation Underpinning This Market Study

This study employed a hybrid research framework combining secondary and primary data sources. Secondary insights were derived from publicly available customs rulings, industry association publications, and credible news outlets to establish baseline trends and regulatory impacts. Primary research included structured interviews with equipment manufacturers, park operators, and supply-chain experts to validate assumptions and uncover emergent market dynamics.

Quantitative analysis was conducted using a triangulation approach, cross-referencing import duty schedules, legal filings, and company disclosures to assess tariff implications. Qualitative insights were synthesized through thematic coding of expert interviews, focusing on innovation drivers, safety considerations, and digital integration trends. Data integrity was maintained through rigorous source verification and iterative validation with industry stakeholders.

Analytical frameworks such as SWOT and PESTEL were applied to structure insights, while scenario planning techniques evaluated potential outcomes under varying tariff and regulatory environments. This systematic methodology ensures the findings are robust, transparent, and actionable for strategic decision-making in the trampoline sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Trampolines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Trampolines Market, by Product Type

- Trampolines Market, by Age Group

- Trampolines Market, by Material

- Trampolines Market, by Shape

- Trampolines Market, by Sales Channel

- Trampolines Market, by End User

- Trampolines Market, by Region

- Trampolines Market, by Group

- Trampolines Market, by Country

- United States Trampolines Market

- China Trampolines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Strategic Conclusion Summarizing Critical Findings and Offering Forward-Looking Perspectives on the Global Trampoline Market Trajectory

The trampoline sector stands at a pivotal juncture, buoyed by technological breakthroughs, shifting consumer preferences, and evolving regulatory landscapes. Safety-focused material innovations have redefined product design, while tariff measures and legal challenges have underscored the need for agile supply-chain strategies. Market segmentation insights reveal diverse consumer cohorts-from fitness-oriented adults to thrill-seeking teens-each requiring tailored product experiences and distribution approaches.

Regionally, the Americas lead in park proliferation and premium domestic sales, EMEA markets emphasize stringent safety frameworks, and Asia-Pacific presents both production strengths and burgeoning consumer demand. Leading companies have demonstrated that innovation in design and operational excellence can create sustainable competitive advantages. Meanwhile, commercial entertainment operators are expanding footprints and diversifying offerings to capture a broader audience.

As the industry evolves, stakeholders who proactively embrace digital integration, deepen strategic partnerships, and adapt to regulatory shifts will be best positioned to drive long-term growth. The interplay of safety, technology, and consumer engagement will shape the future trajectory, offering both challenges and opportunities for those ready to lead the next era of trampoline market expansion.

Engage with Our Expert to Secure Comprehensive Trampoline Market Intelligence and Unlock Strategic Advantages for Your Business Today

To explore more detailed insights and gain a decisive competitive edge in the trampoline industry, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise and tailored support will guide you in securing the comprehensive market research report you need to inform strategic decisions, mitigate risks, and capitalize on emerging opportunities. Contact him today to begin leveraging data-driven intelligence and unlock the full potential of your trampoline business.

- How big is the Trampolines Market?

- What is the Trampolines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?