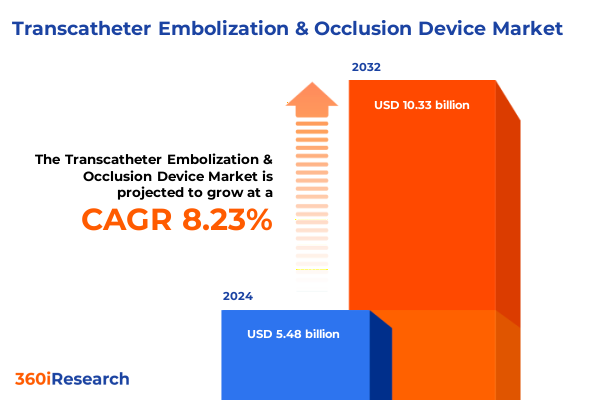

The Transcatheter Embolization & Occlusion Device Market size was estimated at USD 5.89 billion in 2025 and expected to reach USD 6.33 billion in 2026, at a CAGR of 8.34% to reach USD 10.33 billion by 2032.

Emerging Clinical Challenges and Technological Advancements Are Fuelling Transformational Growth in Transcatheter Embolization and Occlusion Therapeutics

The transcatheter embolization and occlusion device sector stands at a pivotal juncture as rising clinical demand for minimally invasive interventions converges with rapid technological innovation. Fueled by an expanding range of applications in hemorrhage control, neurovascular, hepatic, peripheral vascular, and uterine fibroid treatments, the industry is witnessing a surge in procedural volumes alongside an increasing preference for targeted, image-guided therapies. Innovations in microsphere design, flow-directed delivery, and detachable coil mechanisms are enabling clinicians to achieve greater precision and patient safety, thus reshaping standard care algorithms. The infusion of advanced materials-spanning biologically derived embolic agents to next-generation synthetic polymers-is unlocking new therapeutic possibilities while accommodating diverse vessel anatomies and flow characteristics.

Amid shifting reimbursement frameworks and stricter scrutiny of clinical outcomes, manufacturers are intensifying their focus on value-based product development. Sophisticated microcatheter systems are being engineered to integrate seamlessly with digital imaging modalities, facilitating real-time feedback and enabling adaptive embolization strategies. Concurrently, regulatory bodies have issued clearer guidance on device classification and performance testing, streamlining pathways for novel device approvals. This alignment of clinical need, technology maturation, and regulatory clarity is catalyzing robust investment and strategic partnerships, laying the groundwork for the next wave of growth in the embolization and occlusion domain.

Breakthrough Innovations, Regulatory Reforms and Digital Integration Are Reshaping the Global Transcatheter Embolization and Occlusion Device Landscape

The landscape of transcatheter embolization and occlusion has undergone transformative shifts driven by breakthrough innovations, evolving regulatory frameworks, and the integration of digital health technologies. In recent years, the advent of ethylene vinyl alcohol copolymer–based liquid embolic agents has revolutionized the treatment of complex neurovascular malformations by offering superior radiopacity and controlled polymerization, thereby reducing procedural complications and improving occlusion rates. This momentum has been complemented by advancements in particulate embolic materials, which now feature calibrated microspheres capable of delivering chemotherapeutic payloads directly to tumor sites, effectively bridging embolization and targeted drug delivery.

Regulatory agencies have played a critical role in accelerating device availability by refining approval processes. The introduction of harmonized performance standards has shortened review timelines and reduced redundancy in clinical trials. Furthermore, the expansion of real-world evidence initiatives has underpinned post-market surveillance, fostering iterative device enhancements based on comprehensive safety data. As a result, manufacturers are leveraging digital data platforms and sensor-equipped catheters to capture intra-procedural metrics, enabling continuous refinement of occlusion techniques and personalized treatment planning.

Cross-industry collaboration is another hallmark of this transformative era. Device developers, imaging technology firms, and pharmaceutical companies are forging alliances to create integrated systems that combine embolic therapy with diagnostic imaging and therapeutic delivery. These synergies are generating end-to-end solutions that streamline procedural workflows, enhance clinical outcomes, and reduce hospital stays. Together, these shifts are redefining the standards of minimally invasive vascular intervention and setting the stage for sustained innovation in embolization and occlusion therapies.

Analysis of Section 301 Tariff Modifications and Their Cumulative Implications for Transcatheter Embolization Device Supply Chains and Costs in the United States

The cumulative impact of the United States’ Section 301 tariff modifications has introduced new layers of complexity for manufacturers and healthcare providers in the embolization device supply chain. As of January 1, 2025, duties on certain medical products, including rubber medical and surgical gloves, have increased from 7.5% to 50%, complicating the procurement of ancillary consumables used in embolization procedures. Meanwhile, syringes and needles, which are essential for administering liquid embolic agents and contrast media, have faced a 100% tariff since September 27, 2024, imposing significant cost pressures on interventional suites. Although many core embolization devices such as coils and plugs remain exempted under specific tariff codes, the knock-on effects on peripheral components and packaging materials have led to broader logistical challenges.

Moreover, the imposition of a 50% tariff on semiconductors as of January 1, 2025, has reverberated through manufacturers of advanced microcatheter delivery systems that rely on embedded sensor chips and radiofrequency identification modules. Companies sourcing integrated imaging and laser guidance units from China have reported delays in production and elevated unit costs, prompting some to explore nearshoring alternatives or increase onshore inventory buffers. Despite these adaptations, supply chain realignment has contributed to longer lead times and diluted the cost efficiencies achieved through global manufacturing networks.

Healthcare institutions are responding by engaging in strategic sourcing relationships and consolidating orders to mitigate tariff-driven price hikes. Some hospital groups are renegotiating long-term contracts with domestic suppliers, while others are co-investing in regional manufacturing partnerships to localize critical component production. This recalibration underscores the importance of supply chain agility and risk management in preserving access to life-saving embolization therapies.

Deep Dive into Multi-Faceted Segmentation Reveals Key Growth Drivers Across Product Type, Material Technology Application and End-User Perspectives

A nuanced examination of market segmentation reveals how diverse product, material, technology, application, and end-user dimensions are driving differential opportunities and operational considerations within the embolization device arena. Within product type, the proliferating demand for embolization coils-particularly detachable variants-reflects clinician preference for controlled deployment in neurovascular and peripheral applications, while pushable coils maintain relevance in hemorrhage control due to their cost efficiency. Liquid embolic agents, including ethylene vinyl alcohol copolymer and N-butyl cyanoacrylate, are carving out distinct clinical niches, especially in complex arteriovenous malformation management where rapid polymerization and radiographic visibility are paramount. Simultaneously, microspheres and particulate agents are increasingly leveraged for both therapeutic embolization and as carriers for localized drug delivery, bridging interventional radiology and oncology workflows. Vascular plugs continue to serve high-volume applications in peripheral and uterine fibroid procedures where occlusion precision and retrievability are critical.

Material selection further differentiates value propositions across biological and synthetic agent offerings. Biological polymers derived from collagen or gelatin exhibit favorable biocompatibility profiles that support vessel remodeling, whereas synthetic options impart tunable degradation kinetics and mechanical resilience. This material dichotomy informs both clinical decision-making and product development strategies. On the technology front, flow-directed embolization is gaining traction in distal lesion access, while mechanical occlusion modalities are favored in larger vessel interventions. Microcatheter delivery systems stand as the technological backbone, facilitating advanced navigational control and minimizing vascular trauma through ultralow-profile designs.

Applications such as hemorrhage control and neurovascular embolization demand precision and rapid hemostasis, whereas hepatic and peripheral vascular interventions prioritize sustained vessel occlusion and hepatic tumor devascularization, respectively. Uterine fibroid embolization underscores the expanding role of women’s health procedures within the portfolio. In addressing these varied use cases, end users-from ambulatory surgical centers to high-acuity hospital systems and specialized vascular clinics-are tailoring procurement criteria to align device performance with procedural throughput, reimbursement dynamics, and care setting constraints.

This comprehensive research report categorizes the Transcatheter Embolization & Occlusion Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Technology

- Application

- End User

Regional Dynamics Unveiled: How Americas, Europe Middle East & Africa and Asia-Pacific Markets Are Shaping the Future of Embolization and Occlusion Devices

Regional market dynamics are increasingly shaping strategic priorities for embolization and occlusion device stakeholders. In the Americas, robust adoption of minimally invasive therapies is propelled by well-established healthcare infrastructures, high procedural volumes, and favorable reimbursement frameworks for image-guided interventions. Leading interventional radiology centers are early adopters of next-generation liquid embolics and sensor-integrated delivery systems, driving demand for premium devices. Private payor networks and value-based care models are incentivizing efficiency and outcome-driven innovation, leading hospitals to partner with manufacturers on bundled purchasing agreements and performance-based trials.

In Europe, Middle East, and Africa, the landscape is defined by heterogeneous regulatory environments and varying levels of clinical adoption. Western Europe’s centralized health technology assessment bodies are emphasizing cost-effectiveness, prompting manufacturers to demonstrate economic as well as clinical advantages. The Middle East is witnessing rapid investment in state-of-the-art hybrid theaters, creating opportunities for premium embolization platforms. In sub-Saharan Africa, burgeoning interventional programs face challenges in infrastructure and training, underscoring the importance of modular device designs and remote proctoring solutions.

Asia-Pacific is emerging as a high-growth frontier, driven by expanding healthcare access, government-led capacity building, and rising prevalence of vascular pathologies. China and India are anchoring regional growth as domestic manufacturers enhance quality standards and global players pursue local partnerships. Japan’s mature market continues to innovate around microcatheter precision and advanced imaging integration, while Southeast Asian countries are accelerating adoption through public–private collaborations. Across these geographies, supply chain resilience, localization strategies, and regulatory harmonization efforts are pivotal for sustained market penetration.

This comprehensive research report examines key regions that drive the evolution of the Transcatheter Embolization & Occlusion Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships That Are Defining Competitive Dynamics in the Transcatheter Embolization and Occlusion Device Market

Leading players are jostling for position through differentiated portfolios, strategic alliances, and targeted clinical initiatives. Global device manufacturers specializing in microsphere therapies have expanded their offerings through acquisitions of biotech startups developing drug-eluting embolics, thereby enhancing cross-application versatility. Manufacturers with established coil franchises are investing in next-generation detachment mechanisms that improve control and deliver targeted neurovascular occlusion. Several companies developing synthetic polymers have partnered with academic research institutions to validate novel formulations that balance radiopacity with biodegradability.

On the technology integration front, enterprises delivering microcatheter systems are collaborating with imaging solution providers to embed fiber-optic sensors, enabling real-time pressure feedback and advancing safety protocols. Some market leaders have entered joint ventures in Asia-Pacific to localize production and navigate diverse regulatory pathways, leveraging regional R&D hubs to tailor device designs. Meanwhile, start-ups focused on bioresorbable plug technologies are securing venture funding to accelerate pivotal clinical studies, positioning themselves as potential acquisition targets.

These competitive dynamics underscore a dual emphasis on expanding core competencies while pursuing convergence with diagnostic imaging and pharmaceutical domains. By aligning R&D roadmaps with emerging clinical guidelines and reimbursement imperatives, leading companies are forging pathways to sustained differentiation and scalable growth in the embolization and occlusion sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transcatheter Embolization & Occlusion Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AngioDynamics, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cook Medical LLC

- Edwards Lifesciences Corporation

- Johnson & Johnson

- Medtronic plc

- Merit Medical Systems, Inc.

- Penumbra, Inc.

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Actionable Strategic Recommendations for Medical Device Manufacturers to Navigate Market Complexity and Capitalize on Emerging Opportunities in Embolization Therapies

To capture emerging opportunities and mitigate operational risks, industry leaders should prioritize strategic investments in end-to-end digital integration and decentralized manufacturing. Embracing predictive analytics for supply chain optimization can reduce tariff-induced cost volatility and buffer against remote sourcing disruptions. By implementing advanced data-sharing platforms with healthcare systems, manufacturers can co-develop performance-based contracts that tie reimbursement to procedural outcomes and patient satisfaction metrics.

Product development should focus on modular device architectures that accommodate rapid customization across diverse vessel anatomies and clinical indications. Companies can accelerate time to market by leveraging adaptive clinical trial designs and real-world evidence frameworks that satisfy evolving regulatory requirements. Additionally, fostering academic collaborations to validate next-generation materials and delivery mechanisms will enhance the clinical credibility of novel embolics and occlusion solutions.

Finally, expanding geographic reach through targeted partnerships with regional distributors and local manufacturing alliances can reduce lead times and improve market responsiveness. By embedding technical training and remote proctoring services into commercial contracts, device developers can build clinician confidence and drive adoption in emerging interventional radiology centers. This holistic approach-encompassing digital, clinical, and operational dimensions-will enable industry players to navigate complexity and sustain growth in the competitive embolization landscape.

Robust Mixed Method Research Approach Combining Primary Investigations and Secondary Analyses to Deliver Rigorous Insights on Transcatheter Embolization Devices

This research leverages a mixed-methods approach to deliver comprehensive insights into the transcatheter embolization and occlusion device landscape. Primary research activities included in-depth interviews with interventional radiologists, cardiologists, vascular surgeons, procurement executives, and key opinion leaders across major geographic regions. These expert dialogues provided firsthand perspectives on clinical workflows, emerging procedural trends, and barriers to adoption. Complementing this, a series of advisory board sessions synthesized feedback on product performance, device configurations, and unmet clinical needs.

Secondary investigations encompassed rigorous analysis of regulatory filings, patent databases, clinical trial registries, and academic publications. Examination of device registries and institutional procedure logs enabled mapping of adoption trajectories for novel technologies. Furthermore, a detailed review of trade publications, health economics assessments, and policy documents provided the context for tariff impacts and reimbursement drivers. Data triangulation techniques were employed to validate market observations and ensure methodological rigor.

Synthesizing these primary and secondary findings, this report applies scenario-based modeling to illustrate potential strategic pathways for stakeholders. The methodology emphasizes transparency, with all data sources and analytical assumptions delineated in accompanying appendices. This robust framework ensures that insights are not only contextually grounded but also actionable for decision-makers shaping the future of embolization and occlusion therapies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transcatheter Embolization & Occlusion Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transcatheter Embolization & Occlusion Device Market, by Product Type

- Transcatheter Embolization & Occlusion Device Market, by Material

- Transcatheter Embolization & Occlusion Device Market, by Technology

- Transcatheter Embolization & Occlusion Device Market, by Application

- Transcatheter Embolization & Occlusion Device Market, by End User

- Transcatheter Embolization & Occlusion Device Market, by Region

- Transcatheter Embolization & Occlusion Device Market, by Group

- Transcatheter Embolization & Occlusion Device Market, by Country

- United States Transcatheter Embolization & Occlusion Device Market

- China Transcatheter Embolization & Occlusion Device Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives Emphasizing Strategic Imperatives and the Ongoing Evolution of Minimally Invasive Embolization and Occlusion Treatment Modalities

As minimally invasive embolization and occlusion therapies continue to evolve, stakeholders must embrace agility and innovation to remain competitive. The convergence of novel materials, advanced delivery systems, and digital workflow integration underscores a fundamental shift toward precision medicine and value-based care. Clinicians, payors, and manufacturers alike are now redefining success metrics beyond immediate procedural efficacy to encompass longitudinal patient outcomes, cost efficiencies, and quality of life enhancements.

The sustained momentum in product innovation, coupled with dynamic shifts in global trade policies and regional healthcare investments, suggests a protracted era of growth and diversification. However, the ability to navigate supply chain complexities, tariff headwinds, and heterogeneous regulatory landscapes will determine which market players achieve lasting differentiation. Collaborative partnerships, grounded in data-driven insights and patient-centric design, will be instrumental in unlocking new clinical frontiers and expanding the therapeutic scope of embolization interventions.

Ultimately, those who align strategic imperatives with evolving clinical evidence and emergent market realities will shape the next chapter of transcatheter embolization and occlusion therapies, driving progress toward safer, more efficient, and more personalized vascular treatments.

Secure Your Competitive Advantage Today by Connecting with Ketan Rohom to Gain Unparalleled Insights into the Transcatheter Embolization and Occlusion Device Market

For bespoke guidance on harnessing competitive intelligence and navigating critical shifts in the embolization therapeutics arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in strategic market positioning for transcatheter occlusion technologies and can provide tailored briefings, executive presentations, and detailed data breakdowns to support your commercialization, partnership, and investment decisions. Engage directly with Ketan to unlock customized insights and secure priority access to the full research dossier, enabling you to stay ahead of evolving clinical needs and regulatory landscapes.

Advance your strategic roadmap now by contacting Ketan Rohom to discuss how this market research can fuel your growth initiatives and optimize your product portfolio in the dynamic field of embolization and occlusion devices

- How big is the Transcatheter Embolization & Occlusion Device Market?

- What is the Transcatheter Embolization & Occlusion Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?