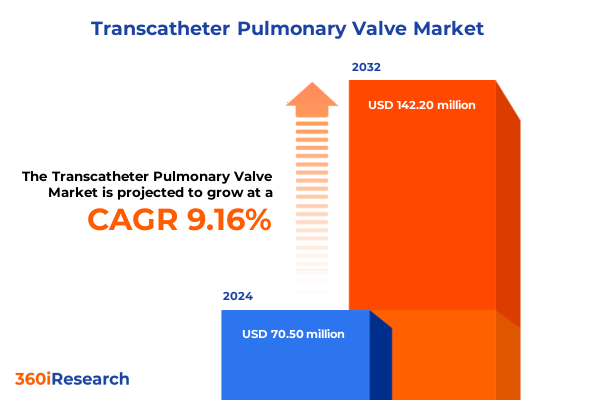

The Transcatheter Pulmonary Valve Market size was estimated at USD 76.20 million in 2025 and expected to reach USD 85.59 million in 2026, at a CAGR of 9.32% to reach USD 142.20 million by 2032.

Unveiling the Pivotal Role of Transcatheter Pulmonary Valve Technology in Shaping Next-Generation Minimally Invasive Cardiac Therapy Landscapes

Transcatheter pulmonary valve interventions have emerged as a cornerstone in the treatment of congenital and acquired right ventricular outflow tract disorders, offering less invasive alternatives to open-heart surgery. Over the past decade, clinical teams worldwide have witnessed substantial improvements in patient outcomes, accelerated recovery times, and reduced procedural morbidity. This introduction presents the critical technological advances and clinical imperatives driving the widespread adoption of percutaneous pulmonary valve replacement, positioning it as an essential component of modern cardiovascular therapeutics.

Minimally invasive access through the femoral or jugular veins has redefined patient experience and broadened eligibility criteria for valve therapy. The development of dedicated delivery systems, enhanced imaging guidance, and patient-specific sizing algorithms has minimized paravalvular complications and optimized hemodynamic performance. As a result, high-risk patients who previously had limited options now benefit from reliable valve function and sustained right ventricular pressure relief. The compelling combination of safety, efficacy, and cost efficiency underscores the transformative potential of transcatheter pulmonary valve technology in meeting rising demand across specialized cardiac centers.

By setting the stage with foundational insights into device design principles, clinical pathways, and key stakeholder engagement, this introduction frames the ensuing analysis. Readers will gain a clear understanding of how collaborative innovations among engineers, interventional cardiologists, and healthcare systems have coalesced to establish a new standard of care for pulmonary valve disease.

Examining Transformational Shifts That Are Redefining the Transcatheter Pulmonary Valve Market Ecosystem and Driver Trends Across Clinical Adoption Journeys

The transcatheter pulmonary valve landscape is undergoing a revolutionary transformation driven by emerging device architectures, regulatory milestones, and integrated digital health platforms. Novel self-expanding nitinol frameworks and conformable polymeric leaflets have enhanced valve durability while enabling better adaptation to complex right ventricular outflow tract geometries. Concurrently, computational modeling tools and artificial intelligence-based sizing systems are refining preprocedural planning, reducing reliance on trial-and-error methodologies, and expediting clinical decision making.

Regulatory agencies have accelerated review pathways for breakthrough valve designs, spurred by compelling real-world evidence demonstrating high rates of procedural success and mid-term valve patency. Expanded indications, including treatment of combined pulmonary stenosis and regurgitation and off-label use in dysfunctional bioprosthetic conduits, have broadened the addressable patient population. At the same time, cross-disciplinary partnerships between device manufacturers, academic research centers, and health systems have fostered multicenter registries that capture longitudinal outcomes and inform iterative product enhancements.

Furthermore, the integration of remote patient monitoring with wearable sensors and telehealth follow-up has redefined post-implant care, enabling early detection of valvular dysfunction and personalized anticoagulation management. These transformative shifts are setting the stage for next-generation clinical pathways that prioritize patient-centricity, resource optimization, and evidence-driven improvements in procedural consistency and long-term performance.

Analyzing the Cumulative Consequences of 2025 United States Tariff Adjustments on Transcatheter Pulmonary Valve Supply Chains and Cost Dynamics

In 2025, the United States implemented targeted tariffs on imported transcatheter heart valve components as part of a broader initiative to strengthen domestic manufacturing. These duties have introduced a new variable into cost structures, prompting manufacturers and healthcare providers to reassess supply chain configurations. As a result, strategic initiatives to source raw materials locally and qualify additional domestic production sites have gathered momentum, offsetting import surcharges but requiring significant capital reinvestment.

Healthcare payers and hospital systems have experienced incremental increases in procedure-related expenses, leading to more rigorous contract negotiations and value-based purchasing agreements. To mitigate margin erosion, device makers have deployed tiered pricing strategies and volume-based rebates, aligning cost to outcomes more closely. In parallel, investment in automation and lean manufacturing within North American facilities has accelerated, reducing per-unit labor costs and cycle times while improving quality control.

These policy-driven shifts have also spurred innovation in component design, targeting reduced reliance on tariff-impacted materials such as cobalt alloys and specialized polymers. Collaborative research consortia are exploring alternative biomaterials and additive manufacturing techniques to maintain device performance and biocompatibility. Looking ahead, the cumulative impact of these tariffs will continue to shape capital allocation, collaborative agreements, and risk evaluation across the transcatheter pulmonary valve value chain.

Delving into Strategic Segmentation Insights That Illuminate Patient Profiles, Clinical Indications, and Healthcare Delivery Channels for Valve Applications

Insight into valve type segmentation reveals distinct trajectories for balloon expandable and self-expanding technologies. Balloons that deploy the valve frame with controlled inflation remain preferred in anatomies featuring preexisting conduits and homogenous vessel compliance. This category includes established devices such as Melody Valve and Sapien Transcatheter Valve, which have amassed extensive clinical data supporting high procedural success and reliable leaflet coaptation. In contrast, self-expanding platforms offer adaptive radial force, particularly advantageous in native outflow tracts with variable diameters. Notable options include Harmony Transcatheter Pulmonary Valve and Venus P-Valve, both engineered for seamless integration within dynamic right ventricular anatomies.

Applications segmentation underscores the varied therapeutic niches addressed by percutaneous pulmonary valve replacement. Patients presenting combined lesions benefit from tailored device selection and multimodal imaging to treat concomitant stenosis and regurgitation in a single catheterization session. Focused indications in pulmonary regurgitation leverage valve designs optimized for minimal paravalvular leak and enhanced leaflet durability under low-pressure conditions. In high-gradient outflow tract stenosis, high radial strength outputs are critical to restoring unobstructed right ventricular ejection.

End-user segmentation highlights how site of care influences procedural workflows and resource utilization. Ambulatory surgical centers capitalize on streamlined valve delivery protocols and same-day discharge pathways, minimizing inpatient occupancy. Specialized cardiac centers integrate multidisciplinary heart teams to manage complex patient presentations and facilitate cross-functional innovation. Hospitals, particularly tertiary care facilities, offer comprehensive support services including advanced imaging, hybrid operating suites, and intensive post-procedure monitoring, accommodating the full spectrum of pulmonary valve interventions.

This comprehensive research report categorizes the Transcatheter Pulmonary Valve market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Application

- End User

Navigating the Distinctive Regional Dynamics Impacting Transcatheter Pulmonary Valve Penetration Across Americas, Europe Middle East Africa, and Asia-Pacific

Across the Americas, the United States leads in adoption rates driven by expansive reimbursement frameworks and established registry infrastructure. High procedural volumes have fostered robust training programs and center of excellence networks, while Canada and Brazil advance gradually through regional pilot initiatives and centralized reference centers. Cross-border collaborations within North America emphasize knowledge exchange and harmonization of clinical guidelines to optimize outcomes and procedural consistency.

In Europe, Middle East, and Africa, heterogenous reimbursement environments and varying regulatory requirements result in uneven market penetration. Western European nations leverage single-payer systems to negotiate favorable device pricing, promoting broader access. Meanwhile, emerging markets in the Middle East explore public-private partnerships to establish high-volume implant centers, and several African regions pilot tele-cardiology initiatives to extend specialist support. Efforts to align clinical standards across the EMEA region aim to reduce disparities and streamline device approvals.

The Asia-Pacific region represents a dynamic frontier as regulatory authorities in China, Japan, and Australia implement expedited review pathways for innovative cardiovascular devices. Local manufacturing capabilities are strengthened through joint ventures, reducing dependence on imports. Meanwhile, early-stage markets such as India and Southeast Asia focus on clinical training and infrastructure upgrades to support minimally invasive valve programs. Strategic partnerships between global players and regional stakeholders are critical in navigating diverse regulatory landscapes and driving sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Transcatheter Pulmonary Valve market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Participants Driving Transcatheter Pulmonary Valve Innovation Strategic Collaborations and Competitive Differentiation in Cardiac Care

The competitive landscape in transcatheter pulmonary valves features established multinational leaders collaborating with nimble specialists to advance device performance. Major players have consolidated supply chain networks to enhance production scalability and quality assurance. Concurrently, emerging enterprises leverage disruptive material science and proprietary delivery mechanisms to carve out clinical niches and secure regulatory clearances.

Strategic partnerships and licensing agreements have become integral to maintaining innovation pipelines. Joint development programs between seasoned valve manufacturers and academic centers enable rapid prototyping and clinical validation of next-generation leaflets and frame architectures. Venture-backed medtech startups are attracting investment to drive breakthrough research in bioresorbable scaffolds and patient-specific device customization, setting the stage for future competitive differentiation.

Mergers and acquisitions are reshaping market dynamics as established device companies seek to broaden their portfolios. Acquisitive strategies focused on complementary technologies and regional distribution assets strengthen market positioning and reinforce comprehensive ecosystem offerings. Meanwhile, targeted alliances with imaging solution providers and digital health ventures amplify procedural precision and post-implant monitoring capabilities, reinforcing long-term customer retention through integrated care solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transcatheter Pulmonary Valve market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Braile Biomedica

- Jude Medical Inc

- Lepu Medical Technology (Beijing) Co., Ltd.

- Lifetech Scientific Corporation

- LivaNova Plc

- Medtronic plc

- MicroPort Scientific Corporation

- TaeWoong Medical Industrial Co., Ltd.

- Umbra Valve Technologies B.V.

- Venus MedTech (Hangzhou) Co., Ltd.

- Xeltis SA

Formulating Actionable Strategic Recommendations to Empower Industry Stakeholders in Leveraging Emerging Opportunities Within the Pulmonary Valve Domain

Industry leaders should pursue a multifaceted growth strategy that integrates local production optimization, strategic stakeholder engagement, and robust data analytics. By establishing or expanding manufacturing footprints within tariff-impacted regions, companies can safeguard margins and strengthen supply continuity. Collaboration with regional regulatory agencies to streamline approval processes will accelerate market entry for novel valve designs and associated delivery tools.

Engaging payers and clinical champions through outcomes-based contracting models will underscore the value proposition of transcatheter pulmonary valve interventions. Capturing real-world evidence on patient quality of life, reduced rehospitalization rates, and long-term valve performance will enhance reimbursement negotiations and support premium pricing for differentiated devices. At the same time, investment in educational initiatives for interventional cardiologists, imagers, and heart team coordinators will build procedural proficiency and drive sustained adoption.

Leveraging digital platforms for remote patient monitoring and predictive analytics can optimize post-implant care while reinforcing proprietary software ecosystems. Partnerships with telehealth providers and wearable sensor developers will create continuity of care that resonates with value-based healthcare frameworks. Additionally, fostering open innovation collaboratives with material science experts and algorithm engineers will expedite product enhancements and ensure competitive leadership.

Outlining Rigorous Research Methodology to Ensure Robust Data Collection Comprehensive Analysis and Unbiased Insights in the Pulmonary Valve Study Process

This research employs a triangulated methodology combining primary expert interviews, peer-reviewed literature review, and rigorous secondary data analysis. In-depth discussions with interventional cardiologists, biomedical engineers, and healthcare administrators provided qualitative insights into clinical practice patterns, device preferences, and procedural bottlenecks. These dialogues were supplemented by an exhaustive review of regulatory filings, scientific conference proceedings, and key opinion leader presentations to map the innovation trajectory.

Secondary research encompassed analysis of published registry outcomes, patent landscapes, and public financial disclosures of leading device manufacturers. Data integrity was ensured through cross-validation against multiple independent sources and proprietary analytics platforms. Quantitative findings were interpreted within the context of evolving clinical guidelines, reimbursement reforms, and policy shifts, ensuring relevance and accuracy.

To reinforce objectivity, an iterative validation process involved peer review from an advisory panel of cardiovascular thought leaders and health economics specialists. Consistency checks, data triangulation, and methodological audits were performed throughout the research lifecycle. Ethical considerations, including informed consent and data privacy, were stringently upheld to produce a robust, unbiased, and actionable study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transcatheter Pulmonary Valve market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transcatheter Pulmonary Valve Market, by Valve Type

- Transcatheter Pulmonary Valve Market, by Application

- Transcatheter Pulmonary Valve Market, by End User

- Transcatheter Pulmonary Valve Market, by Region

- Transcatheter Pulmonary Valve Market, by Group

- Transcatheter Pulmonary Valve Market, by Country

- United States Transcatheter Pulmonary Valve Market

- China Transcatheter Pulmonary Valve Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Synthesis of Critical Insights Highlighting Future Trajectories and Strategic Imperatives in the Evolving Transcatheter Pulmonary Valve Landscape

In closing, the landscape of transcatheter pulmonary valve therapy is defined by rapid device evolution, dynamic policy influences, and intricate segmentation patterns. The convergence of refined valve platforms with advanced imaging and digital health modalities has elevated procedural efficacy and patient outcomes to unprecedented levels. Simultaneously, the introduction of targeted tariffs has prompted strategic supply chain realignments and pricing innovations that will continue to reverberate across value chain stakeholders.

Segmentation insights underscore the nuanced needs of varying patient cohorts, from those requiring balloon expandable solutions in conduit-dependent anatomies to individuals benefiting from adaptive self-expanding platforms in native outflow tracts. Regional analyses reveal divergent adoption trajectories yet highlight opportunities for harmonization of clinical standards and co-development partnerships. Competitive intelligence indicates that collaborative alliances and localized manufacturing are pivotal to sustaining growth and differentiation.

Looking forward, industry participants must remain agile, leveraging data-driven decision-making and stakeholder collaboration to navigate evolving regulatory frameworks and reimbursement landscapes. By aligning R&D investments with emerging clinical needs and embracing innovative materials and digital tools, organizations can chart a sustainable path to leadership in the transcatheter pulmonary valve arena.

Engage with Associate Director of Sales Marketing to Secure the Comprehensive Transcatheter Pulmonary Valve Report and Optimize Strategic Decision Making

To procure an in-depth exploration of surgical innovations, competitive dynamics, and regional nuances shaping transcatheter pulmonary valve technology, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through customized data solutions, specialized trend analyses, and strategic advisory services tailored to your organizational goals. Engaging with him ensures you secure a complete, actionable intelligence package that empowers precise investment decisions, helps optimize clinical partnerships, and accelerates time-to-market strategies. Elevate your market readiness and maintain a competitive edge by contacting Ketan today to discuss access options, licensing frameworks, and bespoke research add-ons designed to drive your success in the evolving pulmonary valve domain.

- How big is the Transcatheter Pulmonary Valve Market?

- What is the Transcatheter Pulmonary Valve Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?