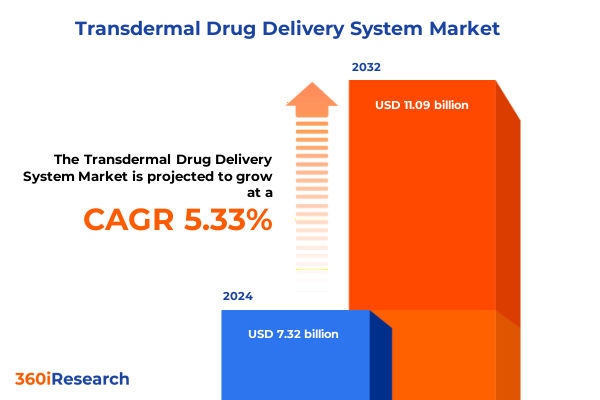

The Transdermal Drug Delivery System Market size was estimated at USD 7.70 billion in 2025 and expected to reach USD 8.11 billion in 2026, at a CAGR of 5.35% to reach USD 11.09 billion by 2032.

Exploring the Rising Importance and Fundamental Advantages of Transdermal Drug Delivery Systems in Modern Therapeutic Modalities

Transdermal drug delivery systems have rapidly emerged as a preferred modality for non-invasive therapeutic administration, offering a compelling alternative to traditional oral and injectable routes. By bypassing the gastrointestinal tract and avoiding first-pass metabolism, these systems facilitate sustained, controlled drug release directly through the skin barrier. Physical enhancement techniques such as iontophoresis employ mild electric currents to drive charged molecules into deeper skin layers, significantly improving bioavailability and reducing systemic side effects compared to conventional methods. Concurrently, sonophoresis leverages ultrasound waves to transiently disrupt the stratum corneum, enabling efficient transport of hydrophilic and larger molecular weight drugs without compromising skin integrity.

Unveiling the Next-Generation Transdermal Breakthroughs Redefining Drug Administration Through Microneedles and Smart Patches

The transdermal landscape is undergoing a transformative evolution driven by technological breakthroughs and patient-centric innovation. Third-generation microneedle patches exemplify this shift, utilizing arrays of microscopic projections to painlessly breach the skin’s outermost layer and deliver macromolecules, proteins, and vaccines with high precision and minimal discomfort. Simultaneously, the integration of biosensors into wearable patches is ushering in an era of smart transdermal systems capable of real-time monitoring of physiological parameters, enabling dynamic, feedback-driven drug release that aligns with individual patient needs.

Assessing the Broad Impact of 2025 U.S. Global Import Tariffs on Transdermal Device Supply Chains and Cost Structures

In April 2025, the United States enacted a universal 10% global tariff on all imports, encompassing active pharmaceutical ingredients, medical devices, and equipment, with the explicit goal of bolstering domestic manufacturing. This across-the-board duty has introduced substantial cost pressures for transdermal system manufacturers reliant on foreign-sourced polymers, adhesive matrices, and specialized components. For instance, transdermal patch producers that import microneedle fabrication materials or advanced adhesives must now absorb or pass on increased expenses, disrupting established supply chains and introducing volatility into production planning.

Delivering Precision Therapeutics Across Creams Gels and Patch Configurations by Leveraging Diverse Actives Technologies and User Settings

Dissecting the market through a multidimensional lens illuminates nuanced performance across product types, active moieties, and delivery technologies. Cream-based formulations cater to localized dermatological applications, while gel vehicles bridge solubility challenges for lipophilic actives. Within patch formats, matrix patches offer streamlined drug incorporation into adhesive substrates, contrasted with reservoir patches that deliver more consistent flux profiles through dedicated drug depots. The choice of estrogen, fentanyl, nicotine, or scopolamine as active ingredients underpins targeted therapeutic objectives spanning hormone replacement, pain management, smoking cessation, and motion sickness control. Underlying these formulations, chemical enhancers temporarily disrupt lipid bilayers, iontophoretic currents propel ionic compounds through cutaneous pathways, and microneedle technologies physically traverse the stratum corneum to accommodate macromolecular payloads. The design of each system hinges on either matrix or reservoir release mechanisms, driving distinct pharmacokinetic signatures. Applications extend across hormone therapy, motion sickness prophylaxis, chronic pain relief, and nicotine tapering, with end-user settings varying from clinical infusion centers to home-based self-administration and hospital pharmacies that integrate technology into inpatient care.

This comprehensive research report categorizes the Transdermal Drug Delivery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Active Ingredient

- Technology

- Delivery Mechanism

- Application

- End User

Comparative Market Dynamics Across Americas Europe Middle East Africa and Asia-Pacific Driven by Infrastructure Demographics and Regulatory Landscapes

Regional market dynamics reveal pronounced differences shaped by healthcare infrastructure, regulatory frameworks, and patient demographics. In the Americas, robust R&D ecosystems and favorable reimbursement environments in the United States drive early adoption of advanced transdermal solutions, particularly for chronic pain and hormone therapies. Meanwhile, Latin American markets are gradually integrating these systems as part of expanding pharmaceutical portfolios and growing private healthcare sectors. Across Europe, Middle East & Africa, stringent regulatory harmonization under the European Medicines Agency bolsters the penetration of smart patch technologies, while Middle Eastern health initiatives prioritize non-invasive options to address rising rates of chronic lifestyle diseases. African markets, though nascent, exhibit promise through public-private partnerships aimed at improving access to essential medicines via transdermal formats. The Asia-Pacific region is characterized by rapid growth in China, India, and Japan, where demographic shifts, government-led healthcare expansions, and technological collaborations have accelerated the deployment of microneedle and smart patch innovations, meeting the needs of aging populations and areas with limited clinical infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Transdermal Drug Delivery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic R&D Investments Acquisitions and Partnerships Fueling Leadership among Established and Emerging Transdermal Delivery Innovators

Leading corporations are forging strategic pathways to secure market leadership through targeted acquisitions, R&D investments, and cross-sector partnerships. Johnson & Johnson’s completion of the Yellow Jersey Therapeutics acquisition underscores a commitment to bolstering its immunology pipeline with microneedle-integrated platforms and expanding regional licensing agreements across Asia-Pacific to navigate local regulatory environments effectively. Concurrently, established medtech firms like 3M and emergent innovators such as MicroDerm LLC and Corium Inc. are leveraging advanced materials science to optimize patch adhesion profiles and enhance patient comfort, while companies including ALZA Corporation and AptarGroup are expanding manufacturing capabilities to scale production of next-generation microneedle arrays.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transdermal Drug Delivery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- 4P Therapeutics, LLC

- Actavis plc

- Hisamitsu Pharmaceutical Co., Inc.

- Kindeva Drug Delivery L.P.

- Lohmann Therapie‑Systeme AG

- LTS Lohmann Therapie-Systeme AG

- Luye Pharma Group Ltd.

- Luye Pharma Group Ltd.

- Medherant Ltd.

- Novartis AG

- Noven Pharmaceuticals, Inc.

- ProSolus, Inc.

- Purdue Pharma L.P.

- Sanofi S.A.

- Sparsha Pharma International Pvt. Ltd.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

- Viatris Inc.

Implementing Strategic Supply Chain Diversification and Collaborative Initiatives to Mitigate Risk and Accelerate Clinical Adoption of Near-Term Innovations

Industry leaders should prioritize diversification of component sourcing to mitigate tariff-induced cost volatility, exploring domestic manufacturing partnerships or alternate supply corridors in Southeast Asia and Europe. Concurrently, accelerating the validation and regulatory submission of smart patch systems will capitalize on growing reimbursement pathways for personalized medicine, ensuring first-mover advantage. Forging consortia with healthcare providers and patient advocacy groups can streamline clinical adoption, generating real-world evidence to support novel indications beyond traditional pain and hormone therapies. Additionally, tailoring value propositions to end-user segments-from clinic-based infusion services to self-care home diagnostics-will unlock latent demand by aligning product design with user experience imperatives. Finally, engaging proactively with trade bodies to seek targeted tariff exemptions for critical drug delivery components can stabilize operational budgets and safeguard R&D investments.

Outlining a Rigorous Methodological Framework Integrating Expert Interviews Patent Analysis and Multi-Source Data Validation for Unbiased Insights

This report synthesizes extensive primary and secondary research, including expert interviews with leading dermatologists, pharmacologists, and supply chain executives across North America, Europe, and Asia-Pacific. Secondary data sources encompass peer-reviewed journals, patent landscapes, regulatory filings, and trade association publications. Quantitative data were triangulated through cross-validation with industry surveys and proprietary import-export customs databases. Qualitative insights were corroborated via advisory board workshops, ensuring methodological rigor and real-world relevance. Data integrity was maintained through a multi-tiered validation process, including senior analyst reviews and stakeholder feedback loops, to deliver comprehensive, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transdermal Drug Delivery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transdermal Drug Delivery System Market, by Product Type

- Transdermal Drug Delivery System Market, by Active Ingredient

- Transdermal Drug Delivery System Market, by Technology

- Transdermal Drug Delivery System Market, by Delivery Mechanism

- Transdermal Drug Delivery System Market, by Application

- Transdermal Drug Delivery System Market, by End User

- Transdermal Drug Delivery System Market, by Region

- Transdermal Drug Delivery System Market, by Group

- Transdermal Drug Delivery System Market, by Country

- United States Transdermal Drug Delivery System Market

- China Transdermal Drug Delivery System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Market Forces Technologies and Regional Realities to Chart the Future Path for Transdermal Drug Delivery Innovation

Transdermal drug delivery systems stand at the nexus of therapeutic innovation and patient-centric care, driven by breakthroughs in microneedles, iontophoresis, and digital health integration. While global tariffs introduce supply chain headwinds, strategic diversification and regulatory engagement can preserve momentum. Segmentation analysis underscores the importance of aligning formulation types, active ingredients, and delivery technologies with target applications and end-user environments. Regional insights highlight varied adoption trajectories shaped by regulatory harmonization and demographic imperatives. Leading companies are solidifying their positions through purposeful acquisitions and material science leadership, paving the way for expanded indications and market penetration. As the landscape evolves, a relentless focus on collaboration, evidence generation, and patient experience will define success in this burgeoning arena.

Secure Expert Guidance and Exclusive Market Research Access with Our Associate Director to Propel Your Transdermal Strategy

To gain an in-depth understanding of the market dynamics driving the evolution of transdermal drug delivery systems, and to leverage actionable insights for strategic growth, we invite you to engage directly with our Associate Director of Sales & Marketing, Ketan Rohom. His expertise in guiding life science and pharmaceutical leaders through the nuances of advanced drug delivery research will ensure your organization is positioned to capitalize on emerging opportunities. By connecting with Ketan Rohom, you can explore tailored research packages, discuss custom data requirements, and secure exclusive access to comprehensive market intelligence that will inform your most critical business decisions. Reach out today to unlock the full potential of our market research offerings and drive innovation in your transdermal product portfolio.

- How big is the Transdermal Drug Delivery System Market?

- What is the Transdermal Drug Delivery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?