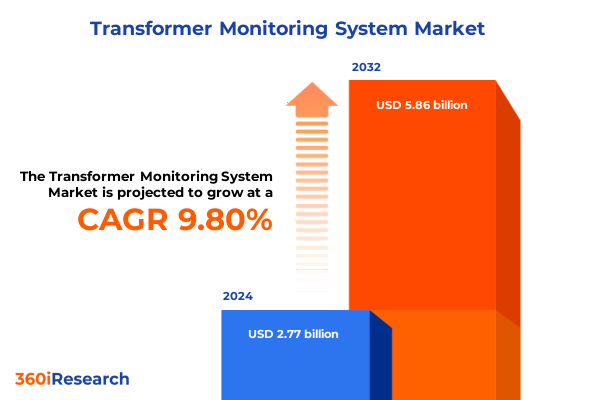

The Transformer Monitoring System Market size was estimated at USD 3.03 billion in 2025 and expected to reach USD 3.32 billion in 2026, at a CAGR of 9.86% to reach USD 5.86 billion by 2032.

Pioneering Advanced Transformer Monitoring Solutions to Enhance Power Grid Reliability, Minimize Unplanned Outages, and Drive Operational Excellence

Power transformers stand as cornerstone assets within power grids worldwide, where even brief unplanned outages can cascade into significant service disruptions and financial impacts. As utilities and industry operators navigate tighter regulatory requirements and heightened reliability expectations, real-time condition monitoring has moved from a differentiator to a foundational necessity. Modern transformer monitoring systems integrate an array of high-precision sensors, advanced analytics platforms, and secure communication networks to detect anomalies long before they escalate into failures. This proactive stance not only safeguards grid stability but also fosters a culture of continuous operational improvement, enabling maintenance teams to transition from scheduled interventions to condition-based strategies that optimize asset life cycles and resource allocation.

Subsequently, the convergence of environmental sustainability mandates, cloud-native architectures, and remote monitoring capabilities has accelerated the evolution of transformer health solutions. By embedding cloud-based analytics into transformer data workflows, operators gain on-demand access to historical performance trends, cross-fleet benchmarking, and dynamic alerting, regardless of location. Moreover, the advent of remote diagnostics tools empowers field teams to troubleshoot potential faults virtually, minimizing the need for on-site dispatches and reducing safety risks in hazardous or hard-to-reach substations. Together, these technological advances set the stage for transformative asset management approaches that amplify reliability, safety, and cost efficiency.

Harnessing IoT Connectivity, AI-Driven Predictive Analytics, and Modular Platforms to Redefine Transformer Monitoring Capabilities Across Power Infrastructures

The landscape of transformer monitoring is undergoing seismic shifts as the Internet of Things permeates every substation corner, ushering in an era of unprecedented data granularity and connectivity. Fiber optic and distributed temperature sensing platforms now offer high-resolution thermal mapping that pinpoints hotspots with sub-degree accuracy, moving beyond legacy oil-based indicators toward real-time insight into winding health and moisture conditions. In turn, these enriched data streams underpin condition-based maintenance frameworks that respond to actual asset health rather than fixed calendar schedules, significantly reducing unplanned downtime and extending transformer service life.

Simultaneously, advanced machine learning and artificial intelligence techniques have emerged as cornerstones of predictive analytics in transformer monitoring. By ingesting historical failure patterns, load profiles, and multi-parameter sensor data, AI-driven models can forecast incipient faults and suggest prescriptive maintenance actions with high confidence. This data-centric approach fosters adaptive maintenance programs that align maintenance windows with risk profiles, ensuring that limited resources are allocated where they deliver maximum reliability impact.

Further redefining the ecosystem, digital twin technologies synthesize real-time sensor inputs with physics-based transformer models to simulate operational scenarios, stress responses, and life-cycle projections. These virtual replicas enable what-if analyses for evolving grid conditions, from renewable integration ramp-ups to emergency load transfers, supporting decision makers in scenario planning and capital investment prioritization. Coupled with open communication protocols and modular software architectures, these innovations are breaking down vendor silos and fostering a collaborative marketplace of interoperable hardware, software, and service offerings.

Evaluating the Strategic Effects of 2025 US Tariff Measures on Transformer Equipment Costs, Supply Chain Resilience, and Grid Modernization Initiatives

In early 2025, newly imposed tariffs on steel, aluminum, and copper imports significantly altered the cost structure for transformer components and monitoring equipment. As the United States relies heavily on imported high-quality electrical steel and copper alloys for transformer cores and windings, the additional duties translated directly into higher capital expenditures for utilities and original equipment manufacturers. This cost headwind intensified existing material inflation pressures and prompted project delays as procurement teams navigated complex supplier negotiations and compliance requirements.

Moreover, the tariffs magnified supply chain vulnerabilities by highlighting the limited domestic production capacity for critical transformer elements, estimated to cover just a fraction of total demand. Utilities faced protracted lead times for custom-specification transformers-often exceeding 12 months-and encountered challenges in qualifying alternative domestic suppliers due to stringent reliability testing protocols. While U.S. manufacturers stood to gain incremental demand, utilities grappled with balancing reshoring incentives against the imperative to maintain affordable and reliable power delivery for industrial, commercial, and residential customers.

Uncovering Targeted Opportunities Through Comprehensive Component, Load, Application, and Monitoring-Type Segmentation Analyses in Transformer Ecosystems

A nuanced segmentation framework is vital for uncovering targeted growth opportunities and tailoring monitoring solutions to specific operational contexts. When market participants dissect offerings by component type-whether advanced connectors, rugged enclosure units, precision sensors, or full-suite data analytics software-they can align product road maps with distinct customer pain points, from installation complexity to data visualization needs. Similarly, distinguishing between oil-immersed and cast-resin transformer types ensures that diagnostic algorithms and sensor calibrations match the dielectric and thermal characteristics inherent to each design.

Examining load capacity segments, from high-load transmission transformers to lower-capacity distribution assets, reveals varying priorities in sampling frequency, data throughput, and on-site analysis capabilities. Parallel insights emerge from the monitoring-type dimension, where bushing surveillance, dissolved gas analysis, load tap changer evaluation, and partial discharge detection each demand specialized sensor integration and analytics methodologies. Moreover, the application focus-whether distribution transformers serving end-consumer networks or power transformers within utility substations-shapes expected reliability thresholds, maintenance intervals, and reporting cadences.

Finally, end-user segmentation, encompassing commercial and residential operators versus heavy-industrial utilities, underscores different procurement cycles, service level expectations, and ecosystem partnerships. By leveraging this multifaceted segmentation approach, providers can craft modular and scalable transformer monitoring portfolios that resonate with each cohort’s unique business drivers and risk tolerances.

This comprehensive research report categorizes the Transformer Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Monitoring Type

- Offering

- Connectivity

- Cooling Type

- Voltage Class

- Deployment Mode

- Installation Type

- End-User Industry

Mapping Regional Dynamics Impacting Transformer Monitoring Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Power Markets

Across the Americas, landmark infrastructure legislation has catalyzed grid modernization programs that integrate advanced monitoring solutions as a core reliability enhancement pillar. Federal funding streams from the Infrastructure Investment and Jobs Act and the Inflation Reduction Act have underwritten smart grid grants and transmission upgrades, enabling utilities to deploy real-time transformer health analytics and remote diagnostics at an unprecedented scale. These initiatives not only bolster resilience against extreme weather events but also support decarbonization objectives through proactive asset management.

In Europe, the European Union’s comprehensive renewable energy targets and stringent grid stability regulations under the Green Deal and REPowerEU directives have driven deep penetration of smart transformer monitoring systems. National mandates on thermal performance and partial discharge surveillance, combined with substantial investments in digital substations, have positioned European utilities at the forefront of deploying interoperable, IEC-compliant monitoring platforms that deliver both reliability and sustainability benefits.

Asia-Pacific stands out as the fastest-growing region for transformer monitoring adoption, propelled by large-scale policy commitments such as China’s Five-Year smart grid upgrade initiatives and India’s expansive renewable capacity targets. Government-mandated sensor integration guidelines and aggressive smart grid roadmaps have accelerated installations of predictive monitoring devices across both transmission and distribution networks, meeting surging urbanization demands and facilitating the smooth integration of variable renewable energy sources.

This comprehensive research report examines key regions that drive the evolution of the Transformer Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Industry Players Driving Innovation and Strategic Partnerships in Transformer Monitoring Through Technological Leadership and Service Excellence

Global technology leaders are deploying differentiated strategies to secure competitive advantage in the transformer monitoring domain. GE Grid Solutions fortified its portfolio in late 2023 by introducing a new generation of dissolved gas analysis devices equipped with enhanced wireless communication modules, enabling low-latency data streams and seamless integration into edge analytics gateways. Concurrently, Siemens Energy partnered with a leading software specialist to launch an AI-based diagnostic suite that synthesizes multi-sensor inputs into actionable failure-prediction reports, streamlining maintenance decision workflows.

On the hardware front, Eaton enhanced its transformer offerings by embedding wireless sensor networks within its enclosure systems, dramatically reducing installation complexity and supporting over-the-air firmware updates. Vaisala entered the competitive arena with an advanced gas-in-oil analytics platform capable of monitoring multiple transformers concurrently, catering to utilities seeking centralized monitoring of large fleets. Meanwhile, Schweitzer Engineering Laboratories expanded its partial discharge monitoring capabilities, delivering high-resolution acoustic and ultrahigh-frequency insights that elevate early fault detection accuracy.

Complementing these hardware innovations, leading software and service providers such as ABB and Honeywell have rolled out next-gen monitoring tool suites that integrate predictive maintenance algorithms and environmental analytics. By blending sensor-to-cloud deployments with expert consulting and 24/7 service support, these companies help utilities and industrial operators realize end-to-end reliability improvements while navigating the complexity of evolving regulatory and performance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transformer Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Baker Hughes Company

- Camlin Group

- Eaton Corporation PLC

- Emerson Electric Co.

- ESCO Technologies

- ETEL LIMITED

- Fuzhou Innovation Electronic Scie&Tech Co., Ltd.

- General Electric Company

- HIOTRON

- Hitachi Limited

- Honeywell International, Inc.

- Hyosung Heavy Industries

- Kirloskar Electric Company Limited

- KJ Dynatech Inc.

- KRYFS Power Components Ltd. by Zetwerk

- M B Control & Systems Pvt Ltd.

- Maschinenfabrik Reinhausen GmbH.

- Megger Group Limited

- MISTRAS Group

- Mitsubishi Electric Corporation

- Mod Tronic Instruments Ltd.

- Motwane Manufacturing Company Pvt. Ltd.

- MTE Meter Test Equipment AG

- Ningbo Ligong Online Monitoring Technology Co., Ltd.

- Qualitrol Company LLC by Fortive Corporation

- S&C Electric Company

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Vaisala Oyj

- Weidmann Electrical Technology AG

- Wilson Transformer Company

- Wipro Limited

- Wookwang Tech Co., Ltd

Empowering Decision Makers with Strategic and Technical Roadmaps to Capitalize on Emerging Technologies and Navigate Policy Challenges in Transformer Monitoring

To fully capitalize on emerging transformer monitoring opportunities, industry leaders should proactively align their strategies with both technological trajectories and policy landscapes. Firstly, prioritizing open-architecture platforms that embrace IEC-compliant communication standards will facilitate multi-vendor integrations and future-proof monitoring deployments against evolving interoperability requirements. In parallel, organizations must invest in modular sensor suites that can be incrementally scaled and customized to address diverse transformer types and load conditions.

Secondly, dedicating resources to advanced analytics capabilities-particularly in artificial intelligence and machine learning-will enable teams to translate vast sensor datasets into precise failure predictions and prescriptive maintenance plans. Equally important is cultivating strategic partnerships with software integrators, cloud providers, and substation automation vendors to ensure seamless end-to-end data flows and real-time operational visibility. Furthermore, timely engagement with regulatory bodies and industry consortia will help shape evolving compliance mandates-such as thermal limit monitoring orders-and position companies as thought leaders in grid modernization dialogues.

Finally, companies should adopt agile service models that combine remote diagnostics, field maintenance support, and data-driven performance benchmarking. By offering monitoring-as-a-service packages and outcome-based contracting, providers can lower adoption barriers for smaller utilities and deliver quantifiable reliability improvements that reinforce long-term customer loyalty.

Leveraging Integrated Primary and Secondary Research Combined with Expert Interviews and Data Validation to Ensure Comprehensive and Actionable Insights

This research initiative commenced with a thorough review of secondary data sources encompassing academic papers, technical standards, and publicly available policy documents. Analysts examined recent journal publications, industry white papers, and regulatory filings to map the evolution of transformer monitoring technologies and relevant legislative drivers. Primary insights were obtained through structured interviews with senior engineering and asset management executives at utilities, original equipment manufacturers, and monitoring solution providers.

Quantitative data were triangulated across multiple channels, including supplier press releases, patent filings, and trade association reports, to validate emerging product capabilities and deployment metrics. To ensure robust analytical foundations, the study leveraged a multi-stage synthesis approach, integrating technology road-mapping with scenario planning exercises. Finally, internal quality checks and peer reviews were conducted to confirm the consistency, relevance, and actionability of the findings, aligning research outcomes with the highest standards of rigor and practical applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transformer Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transformer Monitoring System Market, by Monitoring Type

- Transformer Monitoring System Market, by Offering

- Transformer Monitoring System Market, by Connectivity

- Transformer Monitoring System Market, by Cooling Type

- Transformer Monitoring System Market, by Voltage Class

- Transformer Monitoring System Market, by Deployment Mode

- Transformer Monitoring System Market, by Installation Type

- Transformer Monitoring System Market, by End-User Industry

- Transformer Monitoring System Market, by Region

- Transformer Monitoring System Market, by Group

- Transformer Monitoring System Market, by Country

- United States Transformer Monitoring System Market

- China Transformer Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3816 ]

Synthesizing Key Findings to Illuminate Strategic Pathways and Operational Imperatives for Future-Proof Transformer Monitoring Deployments

Bringing together the multifaceted insights presented, it becomes clear that transformer monitoring systems have transcended basic diagnostic tools to become strategic enablers of grid resilience and operational excellence. The convergence of high-fidelity sensing, artificial intelligence, and digital twin modeling empowers asset managers to anticipate and mitigate risks with unprecedented precision. Furthermore, the policy environment-shaped by infrastructure funding, tariff measures, and renewable integration mandates-underscores the imperative to adopt intelligent monitoring solutions that deliver both performance gains and regulatory compliance.

Segment-based analyses illuminate where tailored monitoring approaches can yield the greatest value, from high-capacity grid transformers to distribution assets serving commercial and residential networks. Regional dynamics further emphasize the need for adaptive strategies that respect local policy frameworks, supply chain landscapes, and grid modernization priorities. Finally, the competitive landscape of technology innovators and solution integrators points toward an ecosystem ripe for collaboration, interoperability, and continuous improvement.

As utilities and industrial operators plan their next-generation asset management road maps, these strategic imperatives and actionable recommendations provide a clear blueprint for realizing sustained reliability, cost efficiency, and environmental stewardship.

Connect with Ketan Rohom to Secure Your Comprehensive Transformer Monitoring System Market Research Report and Propel Your Strategic Decision Making Forward

To explore the comprehensive analysis of transformer monitoring system technologies, market dynamics, and strategic imperatives, connect directly with Ketan Rohom. As Associate Director, Sales & Marketing, he will guide you through tailored research solutions that align with your organization’s objectives and ensure you harness actionable insights for critical decision making. Reach out to arrange a personalized briefing or secure your copy of the full market research report, equipping your team with the intelligence needed to stay ahead in a rapidly evolving energy landscape.

- How big is the Transformer Monitoring System Market?

- What is the Transformer Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?