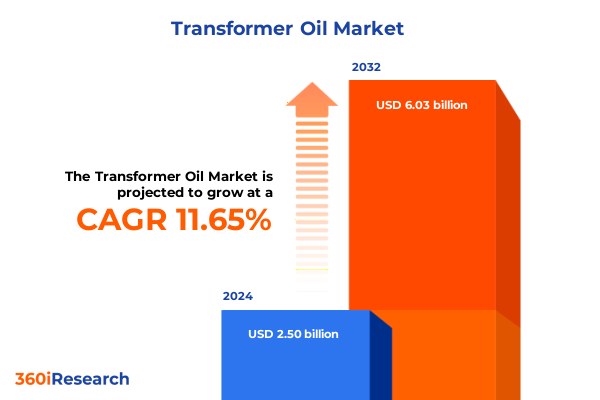

The Transformer Oil Market size was estimated at USD 2.77 billion in 2025 and expected to reach USD 3.07 billion in 2026, at a CAGR of 11.77% to reach USD 6.03 billion by 2032.

Introduction to the Intricacies of Transformer Oil Market Dynamics and its Critical Role in Ensuring Reliability of Electrical Infrastructure Worldwide

Transformer oil serves as the lifeblood of high-voltage electrical equipment, providing critical dielectric insulation, heat dissipation, and arc quenching properties that ensure substations, transformers, and distribution systems operate safely and efficiently. As global investment in grid modernization accelerates, the demand for high-performance dielectrics has never been more pronounced. Companies and utilities alike recognize that the selection of an optimal fluid impacts reliability, maintenance intervals, and overall asset longevity, reinforcing the centrality of transformer oil to energy infrastructure resilience.

Against a backdrop of rising electrification, renewable energy integration, and stringent environmental regulations, stakeholders face the dual challenge of meeting performance benchmarks while adhering to sustainability mandates. At the same time, technological innovations such as real-time oil condition monitoring and additive formulations are transforming conventional maintenance paradigms. As a result, the transformer oil market occupies a nexus between traditional petrochemical supply chains and emerging eco-friendly solutions, demanding a nuanced understanding of material science, regulatory trends, and evolving end-user requirements.

This executive summary distills the essential insights and strategic considerations that underpin informed decision-making. Through a comprehensive exploration of market dynamics, sectional analysis of tariffs, segmentation, regional drivers, and leading company initiatives, this overview equips energy sector decision-makers with a clear roadmap for navigating an increasingly complex landscape. Transitioning into deeper analysis, readers will gain clarity on how to align operational strategies with broader market forces.

Exploring Transformative Shifts in Transformer Oil Market Driven by Sustainability Initiatives, Digital Innovations, and Power Grid Modernization

The transformer oil landscape is undergoing a profound transformation driven by a confluence of sustainability objectives, digital capabilities, and grid resilience priorities. Over recent years, the shift from conventional mineral oils toward biodegradable alternatives such as natural and synthetic esters has intensified under pressure from regulatory bodies seeking to reduce environmental impact. Concurrently, advancements in additive chemistry have improved oxidation stability and moisture tolerance, extending fluid lifecycles and deferring costly maintenance cycles.

Simultaneously, digital innovations are redefining condition monitoring across transmission and distribution networks. Deployment of Internet-enabled sensors and inline dissolved gas analysis systems allows for granular visibility into dielectric degradation, enabling predictive maintenance protocols that minimize unplanned outages. These technologies dovetail with machine learning models capable of forecasting potential failure modes and optimizing sampling schedules based on real-time operational data.

Moreover, global initiatives to modernize aging infrastructure and integrate intermittent renewable power sources have placed additional burdens on transformer assets. Variable load profiles and fluctuating thermal stresses demand fluid chemistries that can tolerate rapid temperature cycling without compromising dielectric strength. As a result, material suppliers and equipment OEMs are collaborating more closely to co-develop fluids that meet both traditional reliability standards and emerging performance benchmarks, fostering a more integrated, innovation-driven ecosystem.

Analyzing the Cumulative Impact of United States 2025 Tariff Adjustments on Transformer Oil Supply Chains and Cost Structures Across Industries

In 2025, revised tariff structures implemented by the United States government have introduced new cost dynamics for transformer oil imports, triggering cascading effects across supply chains. These measures, aimed at protecting domestic manufacturers and reducing dependency on foreign petrochemical feedstocks, have increased import duties on certain ester-based fluids as well as specialized silicone formulations. The immediate outcome was a marked rise in landed costs, compelling end-users to reevaluate sourcing strategies and inventory holdings.

In response, large utilities and industrial end-users have accelerated their efforts to qualify alternative domestic suppliers, negotiate long-term contracts with fixed price mechanisms, and invest in strategic reserves to buffer against further duty fluctuations. Smaller distributors have explored cross-border partnerships and joint procurement consortia to achieve economies of scale and mitigate tariff impact. Simultaneously, research into proprietary local feedstock processing has gained traction as a means of reducing reliance on high-duty imports, bolstering the case for vertically integrated production models.

Over the mid-term, the protective measures may spur enhanced R&D investment in domestic fluid formulations, potentially reshaping the competitive landscape. However, the short-term contractual adjustments and compliance requirements necessitate agile planning from procurement teams, along with proactive engagement with customs brokers and trade compliance specialists. As organizations navigate evolving regulatory parameters, transparent communication and scenario planning will be essential to maintaining operational continuity and controlling total cost of ownership.

Key Segmentation Insights Revealing How Product Types, Applications, End-User Industries, and Distribution Channels Shape Transformer Oil Demand Patterns

Segmentation analysis reveals that fluid selection and market preferences vary significantly according to product type, application, end-user industry, and distribution channel. Within product type, conventional mineral oils continue to command a solid foothold due to cost efficiency and established performance history, while natural ester oils are gaining traction in castor based, rapeseed based, and soybean based variants, valued for their biodegradability and high fire point. Silicone oil and synthetic ester oil further diversify the landscape by addressing needs for extreme temperature stability and extended dielectric lifespans.

Application-driven demands further differentiate the market, with industrial settings requiring robust thermal conductivity and power distribution networks emphasizing oxidative stability under continuous loading. Power transmission segments often prioritize ultra-low viscosity grades for efficient heat dissipation under high voltage, whereas railway traction applications demand fluids formulated to withstand frequent thermal cycling and mechanical vibration.

End-user industry dynamics also influence fluid preference, as manufacturing plants balance cost and safety requirements, oil & gas facilities emphasize corrosion inhibition and moisture tolerance, and utilities focus on minimizing unscheduled outages. Within the renewable energy sector, hydropower installations leverage biodegradable formulations to protect water resources, while solar and wind farms adopt low-odor, high-oxidation resistance oils to meet stringent environmental guidelines.

Finally, distribution channel strategies shape market access and service models. Direct supply arrangements foster closer technical collaboration between fluid producers and large end-users, enabling customized fluid blends and onsite testing programs. Distributor networks provide regional availability and logistics support for mid-market customers, and OEM partnerships integrate pre-filled transformers that streamline commissioning for EPC contractors. Together, these segmentation layers create a multifaceted market where product, application, end-use, and channel requirements intersect to guide strategic decision-making.

This comprehensive research report categorizes the Transformer Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End-User Industry

- Distribution Channel

Key Regional Insights Uncovering Distinct Demand Drivers and Market Characteristics Across Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional disparities in regulatory landscapes, infrastructure maturity, and environmental awareness have given rise to distinct regional trajectories. In the Americas, legacy grid infrastructure and a focus on reliability have anchored demand in the United States and Canada, where utilities prioritize oxidation-resistant mineral oils while selectively adopting natural esters to meet state-level environmental mandates. Latin American markets, characterized by rapid electrification and urbanization, exhibit growing interest in cost-effective fluid solutions supported by local blending facilities and technical service offerings.

Europe, Middle East & Africa presents a diverse mosaic of market drivers. Western European nations, underpinned by strict ecological directives, are moving swiftly toward biodegradable oils and mandating periodic oil health assessments. In the Middle East, ambitious infrastructure projects and expanding power networks stimulate demand for high-temperature performance fluids, whereas African markets show nascent adoption of advanced monitoring solutions alongside reliance on regional distribution partnerships to improve supply chain resilience.

Asia-Pacific remains the most dynamic region, driven by electrification programs in China and India, electrified railway networks in Southeast Asia, and renewable energy integration across Australia and Japan. High-growth markets are increasingly embracing natural and synthetic esters to satisfy fire safety regulations in urban centers, while grid expansion initiatives in emerging economies prioritize fluids that balance affordability with basic performance standards. This constellation of regional trends underscores the need for fluid producers to tailor product portfolios and service capabilities to the unique regulatory, climatic, and infrastructural conditions of each territory.

This comprehensive research report examines key regions that drive the evolution of the Transformer Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Highlighting Strategic Initiatives, Portfolio Diversification, and Innovative Collaborations among Leading Transformer Oil Manufacturers

Leading transformer oil producers are executing strategic initiatives to differentiate their offerings and capture emerging opportunities. Established petrochemical manufacturers are extending their product portfolios with branded synthetic ester and silicone oil formulations, leveraging advanced additive packages to secure high-performance segments. Several firms have entered into joint ventures with technology companies to integrate digital monitoring services, enabling predictive maintenance and outcome-based service agreements.

In parallel, niche specialists in natural ester oils have ramped up production capacity and forged partnerships with agricultural cooperatives to secure consistent feedstock supplies across castor based, rapeseed based, and soybean based streams. These players also emphasize third-party certification to validate biodegradability and fire safety performance, aligning with regulatory benchmarks and utility procurement standards.

Meanwhile, major engineering contractors and transformer OEMs are increasingly pre-filling transformer units with proprietary bespoke fluid blends, offering turnkey solutions that reduce on-site commissioning risk. Collaboration between fluid suppliers and equipment manufacturers has accelerated the pace of innovation, resulting in co-branded offerings and extended warranty programs tied to fluid performance warranties. Collectively, these strategic maneuvers illustrate how leading companies prioritize portfolio diversification, supply chain integration, and technology alliances to secure competitive positioning in a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transformer Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apar Industries Limited

- BASF SE

- Calumet Specialty Products Partners, L.P.

- Cargill, Incorporated

- Castrol Limited

- Chevron Corporation

- CITGO Petroleum Corporation

- Engen Petroleum Limited

- Ergon, Inc.

- Exxon Mobil Corporation

- Gandhar Oil Refinery (India) Limited

- Gulf Oil International Ltd.

- HCS Holding GmbH

- Hydrodec Group PLC

- LODHA Petro

- Mineral Oil Corporation

- Nynas AB

- PETRONAS Lubricants International

- Phillips 66 Company

- Royal Dutch Shell PLC

- San Joaquin Refining Co. Inc.

Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency, Sustainability Practices, and Competitive Positioning in the Transformer Oil Sector

Industry leaders should adopt a multipronged approach to capitalize on evolving market dynamics. Prioritizing investment in biodegradable ester and silicone oil formulations will position organizations to meet tightening environmental regulations while fulfilling fire safety requirements in urban and industrial centers. Simultaneously, broadening collaborative research partnerships with additive innovators and sensor manufacturers can accelerate the development of fluids with enhanced oxidation stability and real-time monitoring compatibility.

Supply chain resilience should be fortified through diversified sourcing strategies that include domestic feedstock procurement, dual-sourcing agreements, and strategic stockpile planning to mitigate tariff and logistic disruptions. Integrating digital platforms for supply chain visibility will further enable demand forecasting accuracy and agile response to market fluctuations.

On the customer engagement front, industry leaders should expand turnkey service offerings by coupling fluid supply with advanced condition assessment and maintenance planning. Leveraging data analytics to generate predictive insights and risk scores will create value-added service models that foster deeper customer loyalty and unlock new revenue streams. Additionally, active participation in standard-setting bodies and sustainability certification programs will reinforce market credibility, ensuring alignment with global best practices and regulatory trajectories.

By executing these strategic imperatives, companies can drive operational efficiency, reduce total cost of ownership for end-users, and maintain a leading edge amid intensifying competition.

Comprehensive Research Methodology Detailing Data Collection, Validation Processes, and Analytical Techniques Employed in Transformer Oil Market Examination

This study employs a robust mixed-methods research framework designed to ensure data validity, comprehensiveness, and analytical rigor. Primary research comprises structured interviews with technical experts at utilities, OEMs, and specialist fluid producers, alongside surveys of procurement and maintenance personnel to capture real-world performance feedback and purchasing criteria. Secondary research sources include peer-reviewed industry journals, technical white papers, regulatory publications, and company disclosures for detailed information on fluid chemistries, additive technologies, and compliance requirements.

Data validation processes involve cross-referencing disparate information streams, reconciling anecdotal insights with quantitative performance metrics, and engaging multiple industry stakeholders to verify findings. Analytical techniques applied in this report include thematic analysis to surface prevailing trends, SWOT analysis to assess competitive strengths and vulnerabilities, and Porter’s Five Forces framework to contextualize market attractiveness. Value chain mapping elucidates cost and value drivers across production, logistics, and service phases, while case study examination highlights successful adoption scenarios and best practice guidelines.

Throughout the research process, a rigorous peer-review protocol ensures objectivity and minimizes bias. Findings undergo multiple rounds of internal review by domain specialists and external validation by senior industry practitioners, culminating in a comprehensive report that integrates strategic insights with actionable intelligence for stakeholders operating across the transformer oil ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transformer Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transformer Oil Market, by Product Type

- Transformer Oil Market, by Application

- Transformer Oil Market, by End-User Industry

- Transformer Oil Market, by Distribution Channel

- Transformer Oil Market, by Region

- Transformer Oil Market, by Group

- Transformer Oil Market, by Country

- United States Transformer Oil Market

- China Transformer Oil Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusion Summarizing Core Findings and Strategic Imperatives Arising from the Transformer Oil Market Analysis for Informed Decision-Making

The transformer oil market stands at a pivotal juncture shaped by environmental mandates, digital transformation, and evolving regulatory landscapes. The transition toward biodegradable ester and silicone based fluids reflects a broader commitment to sustainability without compromising on electrical performance or safety. Concurrently, digital monitoring technologies and additive innovations are redefining maintenance frameworks, enabling predictive strategies that minimize asset downtime and optimize lifecycle costs.

Tariff measures introduced in the United States during 2025 have underscored the importance of agile supply chain management and domestic production capabilities. At the same time, segmentation analysis illuminates how product chemistry, application requirements, end-user industry demands, and distribution channels collectively dictate market dynamics. Regional insights highlight varied adoption patterns and strategic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific, emphasizing the need for locally nuanced approaches.

Leading companies are responding with strategic portfolio expansion, technology collaborations, and service integration to meet emerging requirements. Looking forward, the imperative for continuous innovation, regulatory alignment, and operational agility will define competitive success. By integrating the insights and recommendations presented in this analysis, decision-makers can deliver resilient, sustainable, and cost-effective transformer oil solutions that support the evolving demands of modern power infrastructure.

Unlock In-Depth Market Intelligence and Propel Your Business Growth by Partnering with Ketan Rohom to Acquire the Complete Transformer Oil Market Report Today

For those seeking to deepen their understanding and secure a competitive advantage, collaboration with Ketan Rohom provides an ideal path to obtaining the full transformer oil market research report. With expertise in market dynamics, product innovations, and regulatory impacts, Ketan can guide you through tailored insights and actionable data that address your organization’s strategic objectives. Engage directly to explore exclusive access to comprehensive tables, proprietary qualitative analysis, and customized strategic frameworks that will empower your team to make data-driven decisions. Reach out now to unlock the complete report and elevate your market positioning today.

- How big is the Transformer Oil Market?

- What is the Transformer Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?