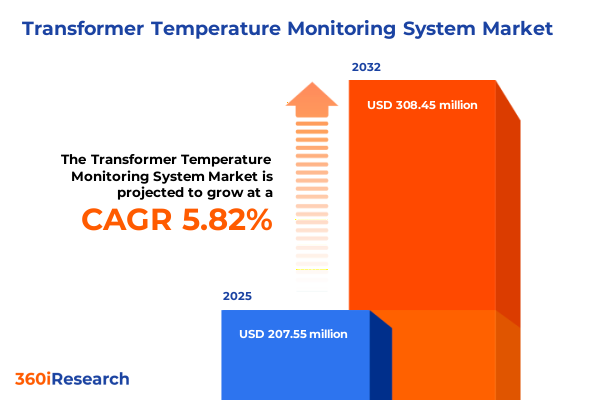

The Transformer Temperature Monitoring System Market size was estimated at USD 207.55 million in 2025 and expected to reach USD 221.42 million in 2026, at a CAGR of 5.82% to reach USD 308.45 million by 2032.

Introduction to Next-Generation Transformer Temperature Monitoring Systems Shaping Reliability and Resilience Through Intelligent Data Acquisition and Analytics

Transformer temperature monitoring has become a cornerstone of electrical asset management, driving reliability and resilience across power grids worldwide. As aging infrastructure confronts growing demand, utilities and industrial operators prioritize condition-based monitoring to preempt service interruptions and extend transformer lifespans. Advanced sensing technologies and analytics now enable continuous visibility into critical hot spots, ensuring that early-stage anomalies are detected well before they escalate into costly failures.

Traditional inspection regimes relied heavily on manual thermographic surveys and periodic maintenance cycles, creating windows of unseen risk. In contrast, next-generation systems integrate online and offline monitoring modes to offer both high-frequency data streams and scheduled validation checks. By unifying hardware, software, and service components under a cohesive architecture, organizations can streamline operations and reduce the total cost of ownership while enhancing safety standards.

This executive summary introduces the state of transformer temperature monitoring in 2025 and outlines the transformative shifts shaping the landscape. It highlights the impact of regulatory changes, evolving segmentation dynamics, regional considerations, leading industry participants, and actionable recommendations. Through this lens, decision-makers will gain a holistic understanding of current capabilities, emerging opportunities, and strategic imperatives necessary to secure grid stability and deliver optimal asset performance.

Emergence of Digital IoT and Predictive Maintenance Transforming Transformer Temperature Monitoring With Increased Interoperability and Real-Time Decision Support

The landscape of transformer temperature monitoring has experienced dramatic transformation driven by digitalization, predictive analytics, and the proliferation of the Internet of Things. Historically, monitoring systems focused on standalone hardware devices capturing discrete temperature points. Today, these sensors integrate seamlessly into networked platforms that deliver real-time insights directly to control centers, enabling rapid response to thermal excursions and environmental stresses.

Concurrently, advances in monitoring technology-from fiber optic distributed sensing to handheld infrared devices-have expanded measurement capabilities and resolution. Fiber optic solutions now support both distributed and point temperature sensing along transformer windings, while infrared methods provide fixed and mobile thermal profiling. Thermistor-based sensors offer cost-effective deployment for both contact and non-contact readings. Together, these monitoring technology modalities form a multi-tiered approach that addresses diverse application and installation requirements.

Regulatory emphasis on grid reliability and asset health, combined with mounting pressure to integrate renewable generation and smart grid assets, has accelerated the adoption of predictive maintenance strategies. As utilities shift from reactive to condition-based models, data-driven insights guide targeted interventions, reduce unplanned outages, and optimize maintenance budgets. These transformative shifts underscore a new era in which transformer temperature monitoring serves as a vital enabler of operational excellence and strategic asset management.

Assessing the Comprehensive Effects of 2025 United States Tariff Adjustments on Transformer Temperature Monitoring Components and Supply Chain Dynamics

In 2025, cumulative tariff measures instituted by the United States government have created complex challenges for global supply chains that support transformer temperature monitoring systems. Section 232 tariffs on imported steel and aluminum continue to influence the cost of sensor housings and data acquisition enclosures, imposing additional duties that reverberate through the hardware segment. At the same time, Section 301 tariffs targeting goods from specific trading partners have raised import duties on certain electronic components, including precision sensors and communication modules.

These layered tariff structures have driven manufacturers to reevaluate sourcing strategies, balancing nearshoring initiatives with the quest for high-quality materials. Some organizations have increased inventory buffers to mitigate potential duty escalations, while others have pursued strategic partnerships with domestic suppliers to maintain continuity. Consequently, hardware component costs have climbed, prompting a shift toward modular designs that facilitate component replacement and reduce the financial impact of future tariff adjustments.

Beyond hardware, service and software providers have felt the ripple effects through contract renegotiations and revised pricing models. Analytics software vendors and SCADA integrators have adjusted support agreements to reflect the heightened cost of end-to-end system deployment. In response, end users are exploring hybrid communication protocols and modular architectures that allow incremental upgrades rather than full system overhauls. This adaptive approach helps organizations navigate the evolving tariff landscape while preserving system performance and ensuring regulatory compliance.

Essential Segmentation Insights Covering Monitoring Modes Component Types Technologies Applications Protocols and Installation

The market’s complexity becomes apparent when viewed through its core segmentation dimensions. Based on monitoring mode, some operators rely on offline systems to conduct periodic manual assessments, while others leverage online solutions that offer continuous data streaming to remote control centers. Each approach carries distinct operational implications, influencing staffing requirements and maintenance schedules.

Component segmentation reveals a layered architecture. Hardware encompasses data acquisition units, power supplies, and sensors that capture temperature readings. The services domain addresses installation and maintenance, covering everything from initial system commissioning to routine calibration and emergency repairs. Software includes analytics suites, SCADA integration modules, and user interfaces that translate raw sensor data into actionable insights and automated alerts.

Monitoring technology further divides the market into fiber optic, infrared, and thermistor platforms. Fiber optic implementations span distributed temperature sensing along winding lengths and point temperature monitoring at critical junctures. Infrared methods feature both fixed thermal cameras for continuous oversight and handheld devices for targeted inspections. Thermistor solutions offer contact-based probes for direct surface measurements as well as non-contact options that combine affordability with precision.

Applications range from commercial installations in data centers to heavy industrial plants, power generation facilities, and transmission and distribution networks. Communication protocols include hybrid models that mix wired Ethernet or serial connections with wireless options like cellular or RF links. Finally, installation contexts encompass indoor environments, where controlled climates simplify sensor performance, and outdoor settings that demand ruggedized enclosures and enhanced environmental protection.

This comprehensive research report categorizes the Transformer Temperature Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Monitoring Mode

- Component

- Monitoring Technology

- Application

- Communication Protocol

- Installation

Comprehensive Regional Perspectives Highlighting Growth Drivers Challenges and Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping the adoption and growth of transformer temperature monitoring systems. In the Americas, the emphasis lies on modernizing aging infrastructure and enhancing grid resilience against extreme weather events. Regulatory incentives and reliability mandates drive utilities to invest in real-time monitoring platforms that support condition-based maintenance programs. In addition, the increasing integration of renewable generation assets necessitates temperature sensors capable of addressing variable loading conditions and dynamic thermal profiles.

Europe, the Middle East, and Africa present a diverse tapestry of market drivers and challenges. European markets prioritize stringent safety standards and environmental regulations, leading to rapid uptake of fiber optic and thermistor-based monitoring solutions. Meanwhile, in the Middle East, the abundance of critical power assets and oil and gas facilities fuels demand for ruggedized, high-accuracy systems that can operate in harsh climates. In Africa, efforts to expand grid access and improve transmission reliability underscore the need for cost-effective, modular monitoring packages that reduce capital expenditure while enhancing asset longevity.

Across Asia-Pacific, a combination of large-scale utility upgrades and industrial expansion underpins robust growth. China and India focus on digital transformation initiatives, incorporating IoT-enabled sensors and advanced analytics into their grid modernization roadmaps. Southeast Asian nations emphasize flexible, scalable deployments that can accommodate both centralized power plants and distributed generation resources. Collectively, these regional insights highlight the importance of tailored solutions that address local regulatory requirements, environmental conditions, and infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Transformer Temperature Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Innovators and Service Providers Driving Advancements in Transformer Temperature Monitoring Solutions Through Investments

Leading companies in the transformer temperature monitoring arena capitalize on a blend of technological innovation, service excellence, and strategic collaboration. Global conglomerates with deep expertise in electrical infrastructure often integrate temperature monitoring into broader asset management portfolios, leveraging their established customer relationships and robust supply chains. These players invest heavily in research and development, enhancing sensor accuracy, extending communication ranges, and refining machine learning models for predictive analytics.

Technology pure plays and specialized startups inject agility into the market with focused solutions that address niche challenges. They pioneer novel sensing materials, such as advanced fiber coatings for distributed temperature sensing, and agile software platforms that accelerate deployment cycles. By partnering with system integrators and utilities, they co-develop use cases that demonstrate clear return on investment, strengthening their market position and creating reference installations.

Service providers differentiate through comprehensive support offerings that span installation, calibration, maintenance, and lifecycle management. Their field teams possess deep domain expertise, ensuring that system performance meets stringent uptime targets and safety standards. Strategic alliances between hardware manufacturers, software developers, and service organizations further enhance the customer experience, delivering turnkey solutions and reducing vendor fragmentation. This collaborative ecosystem advances the overall maturity of transformer temperature monitoring markets while driving continuous improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transformer Temperature Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Energy Industries, Inc.

- Comem Group

- Doble Engineering Company

- Dynamic Ratings, Inc.

- Easun MR Tap Changers Ltd.

- Eaton Corporation PLC

- Exertherm, Inc.

- Fuzhou Innovation Electronic Sci & Tech Co., Ltd.

- GE Vernova

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Maschinenfabrik Reinhausen GmbH

- OMEGA Engineering, Inc.

- Opsens Inc.

- Orion Italia S.r.l.

- OSENSA Innovations Inc.

- Qualitrol Company LLC

- Siemens Energy AG

- Tecsystem S.r.l.

Strategic Actionable Recommendations Empowering Industry Leaders to Enhance Transformer Temperature Monitoring Capabilities Mitigate Risks and Optimize Performance

Industry leaders should prioritize a holistic approach that balances technology adoption with organizational readiness. First, establishing clear governance structures ensures that data from temperature monitoring systems informs decision-making at executive levels. By integrating monitoring outputs into asset management frameworks and maintenance planning, organizations can allocate resources more effectively and respond swiftly to emerging issues.

Second, investing in skills development is critical to maximize the value of advanced monitoring platforms. Technical training programs for field engineers and control room operators build competence in sensor calibration, data interpretation, and anomaly response. This foundation empowers teams to transition from reactive maintenance to proactive condition-based regimes, reducing unplanned outages and enhancing safety.

Third, fostering strategic partnerships accelerates innovation and de-risks new technology deployments. Collaborating with sensor manufacturers, analytics vendors, and service integrators enables early access to cutting-edge capabilities and bespoke solutions. Piloting hybrid communication architectures can validate performance across wired and wireless protocols, ensuring scalability across diverse application environments.

Finally, embracing modular system architectures supports incremental upgrades that mitigate tariff-induced cost pressures and future-proof investments. By specifying open interfaces and leveraging scalable software platforms, organizations can introduce new sensor types or analytics modules without wholesale system overhauls. This flexible strategy optimizes capital allocation and sustains operational excellence.

Comprehensive Research Methodology Integrating Primary Data Collection Analytical Frameworks and Multistage Validation Processes to Ensure Rigor and Reliability

This analysis integrates a multi-stage research methodology designed to ensure rigor, reliability, and practical relevance. Primary data collection encompassed in-depth interviews with asset owners, system integrators, technology vendors, and industry consultants. These conversations illuminated real-world deployment challenges, adoption barriers, and emerging best practices that shape market dynamics.

Secondary research involved exhaustive review of patent filings, academic publications, regulatory filings, and white papers to capture the latest technological advancements and standards developments. Vendor press releases, product datasheets, and field case studies provided granular detail on sensor performance, communication protocols, and system architectures. Combined, these sources offered a comprehensive understanding of current capabilities and future trajectories.

Analytical frameworks, including technology readiness assessments and adoption maturity models, structured the evaluation of market segments and deployment scenarios. Segmentation criteria were validated through cross-referencing proprietary data with insights from trade associations and standards bodies. Multistage validation processes incorporated expert reviews and peer debriefs to confirm consistency, identify gaps, and refine key findings.

This rigorous approach ensures that the insights and recommendations presented herein rest on a solid foundation of empirical evidence and stakeholder expertise. It provides decision-makers with a clear, actionable roadmap for navigating complex technology and market landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transformer Temperature Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transformer Temperature Monitoring System Market, by Monitoring Mode

- Transformer Temperature Monitoring System Market, by Component

- Transformer Temperature Monitoring System Market, by Monitoring Technology

- Transformer Temperature Monitoring System Market, by Application

- Transformer Temperature Monitoring System Market, by Communication Protocol

- Transformer Temperature Monitoring System Market, by Installation

- Transformer Temperature Monitoring System Market, by Region

- Transformer Temperature Monitoring System Market, by Group

- Transformer Temperature Monitoring System Market, by Country

- United States Transformer Temperature Monitoring System Market

- China Transformer Temperature Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Imperatives Highlighting the Evolutionary Trajectory and Future Outlook of Transformer Temperature Monitoring Ecosystem

The evolution of transformer temperature monitoring systems reflects a broader shift toward intelligent, data-driven asset management across power infrastructures. As sensing technologies have matured-from fiber optic and thermistor probes to infrared imaging and sophisticated analytics-operators have gained unprecedented visibility into critical thermal behaviors. This progression underpins a move away from calendar-based maintenance toward dynamic, condition-based strategies that enhance reliability and reduce lifecycle costs.

Regulatory pressures and tariff-induced supply chain complexities underscore the importance of adaptable, modular system architectures. Organizations that embrace hybrid communication protocols and open interface standards can mitigate cost fluctuations, integrate emerging sensor innovations, and scale deployments across diverse application environments. Moreover, regional variations in grid maturity, environmental conditions, and regulatory frameworks highlight the necessity of tailored solutions rather than one-size-fits-all offerings.

Leading industry participants continue to drive innovation through targeted R&D investments, strategic collaborations, and comprehensive service models. By aligning executive governance, workforce capabilities, and technology roadmaps, asset owners can transform transformer temperature monitoring from a compliance-driven exercise into a strategic enabler of resilience and efficiency. This report provides the critical insights and actionable recommendations necessary to navigate ongoing market shifts and capitalize on emerging opportunities in the transformer temperature monitoring ecosystem.

Engage With Our Associate Director for Tailored Insights and Secure Access to the Comprehensive Transformer Temperature Monitoring Market Research Report

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, offers an invaluable opportunity to tailor insights specific to your operational challenges. With deep expertise in transformer management and a nuanced understanding of emerging market drivers, Ketan can guide you through the complexities of data acquisition units, sensor technologies, software integration, and proactive maintenance strategies. By securing access to the full market research report, you will gain differentiated analysis on monitoring modes, component architectures, communication protocols, and regional dynamics. Reach out today to leverage bespoke recommendations, accelerate decision-making, and position your organization at the forefront of transformer temperature monitoring innovation.

- How big is the Transformer Temperature Monitoring System Market?

- What is the Transformer Temperature Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?