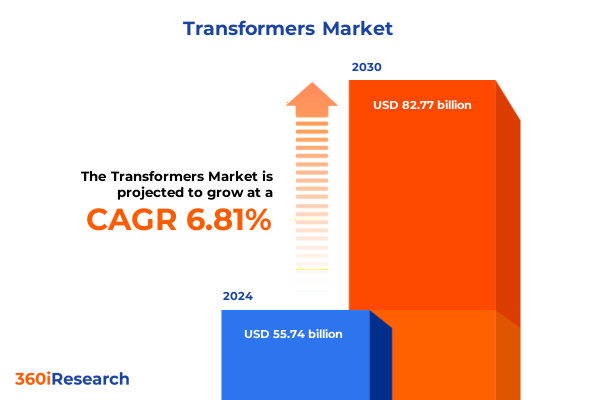

The Transformers Market size was estimated at USD 55.74 billion in 2024 and expected to reach USD 59.38 billion in 2025, at a CAGR of 6.81% to reach USD 82.77 billion by 2030.

Exploring the Dynamic Evolution of the Global Electrical Transformer Landscape Fueled by Renewable Integration, Grid Modernization, and Emerging Technologies

The global electrical transformer market is experiencing a profound transformation driven by the accelerating integration of renewable energy sources, the imperative to modernize aging grid infrastructure, and the proliferation of electrification across diverse end-use sectors. As utilities and infrastructure operators strive to decarbonize and enhance grid resilience, demand for advanced distribution and power transformers is intensifying. The world’s largest transformer manufacturer has warned of an impending supply crunch, highlighting that existing production capacities are struggling to keep pace with surging requirements from renewable energy projects and high-density data centers, a situation exacerbated by the labor-intensive nature of transformer manufacturing and extended project lead times. Concurrently, digital innovations such as IoT-enabled sensors and advanced analytics are reshaping how transformers are designed, monitored, and maintained, enabling real-time performance tracking and predictive maintenance that markedly reduce downtime and optimize asset utilization.

Uncovering Pioneering Technological Shifts Shaping the Future of Electrical Transformers Through Digitalization and Decentralized Grid Architectures

The electrical transformer sector is undergoing sweeping technological advances that are redefining asset performance and operational efficiency. The integration of IoT platforms and advanced analytics has become a cornerstone of modern transformer deployments, empowering utilities and industrial operators to remotely monitor critical parameters such as temperature, load, and insulation health. These insights, processed through AI-driven algorithms, enable predictive maintenance regimes that preempt costly unplanned outages and extend equipment lifecycles, thus driving significant total cost of ownership reductions. Equally disruptive is the emergence of digital twin models, which create virtual replicas of physical transformers to simulate real-time behavior under diverse operational scenarios. This capability facilitates dynamic decision making, from load balancing to fault diagnostics, and underpins the shift toward solid-state and hybrid transformer architectures that offer superior efficiency, compactness, and rapid response times compared to legacy designs. By embracing these pioneering technologies, industry stakeholders are positioning themselves at the vanguard of grid decentralization and smart energy ecosystems.

Assessing the Far Reaching Consequences of United States 2025 Tariff Measures on Imported Electrical Transformers and Domestic Market Dynamics

In March 2025, the United States instituted a comprehensive 25% tariff on steel and aluminum imports, encompassing derivative products crucial to transformer manufacturing, with the aim of safeguarding domestic industries. This measure mandates detailed reporting of content origin and imposes substantial duties on previously exempt trading partners, including Canada, Mexico, the European Union, and Japan. Given that grain-oriented electrical steel constitutes a significant portion of transformer cores, these elevated duties have heightened material costs and procurement complexities, ultimately driving up total project expenditures and extending lead times for both imported and domestically produced units. Network operators and project developers have signaled that these cost pressures risk delaying critical grid upgrades and large-scale infrastructure expansions, particularly in regions with acute transformer shortages.

Deriving Strategic Insights from Core Market Segmentation Across Transformer Types, Voltage Tiers, Cooling Mechanisms, and End User Verticals

Market segmentation provides a strategic lens through which to understand shifting demand patterns and technology adoption across the transformer value chain. Distribution transformers remain the backbone of urban and utility networks, while instrument transformers-encompassing current and potential varieties-ensure precise voltage and current measurement in metering and protection schemes. Isolation transformers, including galvanic isolation and ultra-isolation categories, are pivotal in safeguarding sensitive equipment from electrical noise and ground loop hazards. Power transformers, essential for high-voltage transmission, support long-distance energy delivery. Voltage tiers range from low-voltage units deployed in residential and light commercial settings to medium-voltage systems integral to industrial sites, and high-voltage transformers that form the arteries of national transmission grids. Cooling approaches vary between air-cooled designs favored for lower maintenance and oil-cooled variants that enable higher load capacities. Winding materials, predominantly copper and aluminum, affect thermal performance and cost structures, while single-phase and three-phase configurations address diverse load and network architectures. Insulation technology choices-dry-type or liquid-immersed-balance safety requirements and environmental considerations. Finally, end users span commercial, energy and utilities, industrial, and residential sectors, each with unique performance and compliance imperatives that drive tailored product offerings.

This comprehensive research report categorizes the Transformers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transformer Type

- Voltage Range

- Cooling Type

- Winding Material

- Configuration

- Insulation Type

- End-User

Mapping Critical Regional Variations in Transformer Demand Across Americas, Europe Middle East Africa, and Asia Pacific Power Infrastructure Developments

Regional market trajectories diverge significantly based on infrastructure maturity, regulatory frameworks, and investment priorities. In the Americas, grid modernization initiatives and the accelerated rollout of electric vehicle charging networks are propelling demand for medium- and high-voltage transformers, with major manufacturers scaling up local production to offset the impact of U.S. import tariffs and material cost volatility. Within Europe, Middle East, and Africa, stringent energy efficiency regulations-driven by directives such as the European Ecodesign Regulation and national decarbonization mandates-are spurring manufacturers to develop low-loss core materials and biodegradable insulating fluids, while utilities invest in smart grid pilots to enhance resilience against climate-driven extremes. Meanwhile, the Asia-Pacific region is emerging as a global growth epicenter, supported by rapid urbanization, renewable energy integration targets, and substantial public funding for grid expansion; this dynamic environment has positioned Asia-Pacific at the forefront of grid-interactive and digital transformer deployments, with market valuations outpacing other regions in 2024.

This comprehensive research report examines key regions that drive the evolution of the Transformers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Transformer Manufacturers and Their Strategic Moves in Innovation, Partnerships, and Market Expansion Initiatives in 2025

Leading players are recalibrating their global footprints to enhance supply chain resilience and capture growth opportunities amid shifting trade dynamics. Swiss engineering group ABB is investing over $120 million to expand low-voltage equipment production in Tennessee and Mississippi, aiming to localize over 90% of its output in key markets and mitigate future tariff exposure. Similarly, Siemens Energy has announced plans to commence U.S. production of large industrial power transformers at its Charlotte, North Carolina facility in early 2027, reflecting a long-term strategy to reduce import dependence as over 80% of large power transformers in the U.S. today are sourced externally.

At the same time, Hitachi Energy has committed $250 million through 2027 to expand production capacity at its Virginia, Missouri, and Mississippi factories, a rapid follow-up to a prior $6 billion investment aimed at alleviating critical global shortages driven by surging electricity demand from AI-powered data centers. Schneider Electric is reinforcing its U.S. manufacturing footprint with more than $700 million in planned investments by 2027, targeting medium-voltage product lines that support the burgeoning AI and data center markets while creating over 1,000 new jobs.

South Korean conglomerate Hyosung Heavy Industries is also ramping up, doubling its annual U.S. production capacity from 130 to over 250 units by 2027 at its Memphis, Tennessee plant to secure a double-digit market share in North America. Prolec GE, operating under a joint venture between GE Vernova and Xignux, has invested an additional $85 million to expand single-phase pad-mount transformer output in Monterrey and Goldsboro, North Carolina, underscoring the critical need to bolster domestic manufacturing and maintain supply continuity for utility customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transformers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alstom SA

- Bharat Heavy Electricals Limited

- CG Power & Industrial Solutions Ltd.

- Eaton Corporation plc

- Efacec Power Solutions, SGPS, S.A.

- Elsewedy Electric S.A.E.

- ERMCO, Inc.

- Fuji Electric Co., Ltd.

- GE Vernova

- Hammond Power Solutions Inc.

- HD Hyundai Electric Co., Ltd.

- Henan Di Te Li Electric Co., Ltd.

- Hitachi Energy Ltd.

- Hyosung Heavy Industries Corporation

- JiangSu HuaPeng Transformer Co., Ltd..

- KONČAR d.d.

- Larson Electronics LLC

- MACROPLAST PRIVATE LIMITED

- Mitsubishi Electric Corporation

- Nexans SA

- Pak Elektron Ltd. by Saigol Group

- Prolec-GE Waukesha, Inc.

- Schneider Electric SE

- SGB-SMIT GmbH

- Siemens AG

- TBEA Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Virginia Transformer Corporation

- WEG S.A.

Crafting Action Oriented Strategies for Industry Leaders to Navigate Tariff Challenges, Technological Disruptions, and Evolving Consumer Demands

To thrive amid evolving market dynamics and policy headwinds, industry leaders must adopt a proactive, multi-pronged strategy. Prioritizing investment in digital capabilities, such as IoT-enabled sensors and predictive analytics, will enhance asset reliability and enable new service offerings that differentiate from commoditized equipment. Simultaneously, companies should diversify their raw material supply chains and pursue strategic partnerships to secure access to critical laminations, copper, and high-purity insulating oils, thereby mitigating the impact of future tariff adjustments and geopolitical disruptions. Accelerating the development of solid-state and hybrid transformer prototypes can unlock next-generation efficiency and compactness advantages, appealing to data center and renewable integration use cases. Stakeholders are also encouraged to engage actively with regulatory bodies to shape efficiency standards, promote tariff exemptions for essential grid equipment, and secure long-term infrastructure funding. Finally, embedding sustainability across product lifecycles-through eco-friendly core materials and recyclable components-will align transformer portfolios with net-zero targets and bolster competitiveness in jurisdictions with stringent environmental mandates.

Detailing Rigorous Multi Stage Research Methodology Combining Primary Interviews and Secondary Data Analysis to Deliver Actionable Market Insights

This analysis blends rigorous secondary research with targeted primary engagement to ensure accuracy and actionable insights. The methodology commenced with an exhaustive review of trade association publications, government tariff notices, company press releases, and reputable news outlets, establishing a comprehensive data foundation. Subsequently, structured interviews were conducted with senior executives at transformer manufacturers, key component suppliers, utility operators, and regulatory experts to validate market drivers and capture nuanced operational perspectives. Quantitative data-encompassing import/export volumes, production capacities, and investment commitments-was systematically collated from customs databases and company filings. These inputs were then triangulated with expert feedback through virtual roundtables, enabling iterative refinement of critical findings. Quality checks included cross-referencing multiple data sources and peer review by independent energy sector consultants, delivering a robust and transparent research framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transformers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transformers Market, by Transformer Type

- Transformers Market, by Voltage Range

- Transformers Market, by Cooling Type

- Transformers Market, by Winding Material

- Transformers Market, by Configuration

- Transformers Market, by Insulation Type

- Transformers Market, by End-User

- Transformers Market, by Region

- Transformers Market, by Group

- Transformers Market, by Country

- United States Transformers Market

- China Transformers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Illuminate Growth Opportunities and Strategic Imperatives for Stakeholders in the Evolving Transformer Market

The evolving transformer industry landscape is shaped by converging forces of sustainable energy integration, digital transformation, and trade policy realignment. Renewables-driven demand and aging grid infrastructures are fueling unprecedented investment cycles, while smart grid technologies and digital twins are redefining operational paradigms. U.S. tariff measures, effective in early 2025, have realigned supply chains and prompted leading manufacturers to expand local production, thereby enhancing domestic capacity and resilience. Segmentation analysis highlights distinct growth pockets across transformer types, voltage classes, cooling solutions, and end-user sectors, offering tailored entry points and innovation pathways. Regionally, the Americas, EMEA, and Asia-Pacific each present unique regulatory, technological, and infrastructure drivers that warrant differentiated market strategies. Major players are recalibrating global footprints, advancing R&D in solid-state architectures, and forging partnerships to capture emerging opportunities. Collectively, these insights underscore strategic imperatives for stakeholders to invest in digital capabilities, fortify supply chains, and align product portfolios with decarbonization and reliability objectives.

Engage Directly with Ketan Rohom to Unlock Comprehensive Transformer Market Intelligence and Drive Strategic Decisions with Tailored Research Offerings

Unlock unparalleled insights and elevate your strategic planning by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to secure your definitive transformer market research report. His expertise in articulating complex market dynamics will ensure you receive a tailored briefing on tariff impacts, segmentation nuances, regional opportunities, and emerging technological shifts. Engage in a personalized consultation to explore customizable options that align with your organization’s objectives and budgetary requirements. Reach out to Ketan to access the full suite of data, competitive intelligence, and predictive analyses that will empower your decisions and drive sustainable growth in the transformer industry.

- How big is the Transformers Market?

- What is the Transformers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?