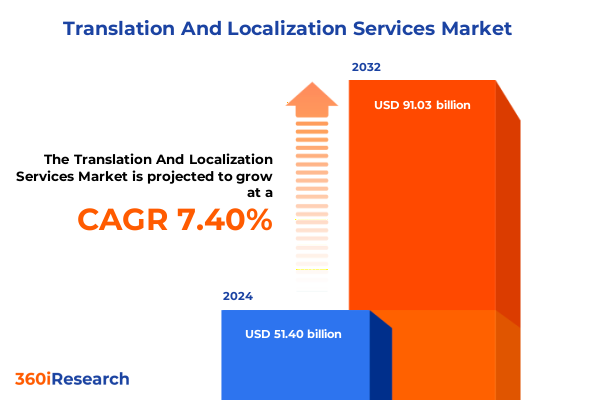

The Translation And Localization Services Market size was estimated at USD 54.98 billion in 2025 and expected to reach USD 58.82 billion in 2026, at a CAGR of 7.46% to reach USD 91.03 billion by 2032.

Setting the Stage for Translation and Localization Services in a Rapidly Evolving Global Market Driven by Digital Transformation and Client Expectations

Translation and localization have transcended their traditional roles as mere support functions to become strategic imperatives for organizations competing on a global stage. As digital platforms proliferate and cross-border e-commerce continues to accelerate, businesses must speak to diverse audiences in ways that resonate authentically across cultures and languages. This evolution reflects an industry-wide realization that localized content is not an optional add-on but a fundamental component of customer experience and brand differentiation.

With the widespread integration of artificial intelligence into content workflows, service providers are increasingly able to automate routine tasks, elevate consistency, and reduce turnaround times. At the same time, evolving data privacy regulations across multiple jurisdictions have introduced new compliance considerations, elevating the importance of secure and ethically managed translation processes. As a result, leading organizations are investing in technologies that harmonize AI-driven efficiency with governance frameworks that safeguard sensitive information.

Meanwhile, end clients are demanding more than direct translations; they seek culturally intelligent narratives that reflect local idioms, user behaviors, and regulatory landscapes. This rising expectation has propelled growth in specialized services such as transcreation, multimedia adaptation, and regulatory localization. Consequently, market participants must continuously refine their capabilities to deliver seamless, end-to-end solutions that align with both corporate objectives and nuanced regional requirements.

Transforming Translation and Localization Services through Digital Innovation and Adaptive Operational Models in a Competitive Global Context

The translation and localization ecosystem is undergoing transformative shifts driven by breakthroughs in generative AI, cloud-based delivery platforms, and agile operational architectures. Enterprises that once relied primarily on human-intensive processes are now leveraging sophisticated neural machine translation engines coupled with human quality assurance, striking a balance between scalability and cultural fidelity. This fusion of man and machine has reshaped service models, enabling nearly real-time localization for high-volume digital content. As organizations grapple with the dual imperatives of speed and quality, they are increasingly adopting DevOps-style workflows that integrate continuous localization into content development cycles.

On the economic front, intensified competition has forced providers to re-examine pricing structures and value propositions. Tiered subscription models, outcome-based pricing, and bundled service offerings have become more prevalent as leaders seek to differentiate through unique combinations of technology, talent, and industry expertise. Operationally, the rise of remote interpreting platforms and cloud-based project management solutions has broadened service accessibility, allowing clients to engage interpreters and translators on demand, anywhere in the world. This flexibility is particularly vital for sectors such as healthcare and emergency services where real-time language support can be mission critical.

Furthermore, geopolitical developments and trade policy fluctuations are influencing global delivery strategies. Recent U.S. tariff reforms and reciprocal regulatory measures have underscored the importance of diversified supply chains and nearshoring options. Companies dependent on offshore language hubs are now reassessing their operational footprints to hedge against rising compliance costs and potential service disruptions. This dynamic environment compels industry stakeholders to remain agile, continuously innovate, and cultivate resilient networks of global and local talent contributors.

Analyzing the Comprehensive Effects of 2025 U.S. Tariff Policies on Cost Structures, Service Delivery, and Global Outsourcing Strategies in Localization

In early 2025, the United States implemented a landmark set of tariff measures that imposed a baseline 10% duty on most imports, with higher reciprocal rates for selected trading partners, and reintroduced a 25% tariff on steel and aluminum products effective March 12, 2025. These actions, framed as efforts to protect domestic industries and address trade imbalances, have introduced new cost pressures for companies reliant on imported hardware and technology infrastructure.

Although translation and localization services are intangible, the industry’s reliance on hardware such as servers, workstations, recording equipment, and end-user devices means that these tariffs translate into increased capital expenditures. Localization budgets are squeezed as clients face higher costs for essential equipment and software licensing fees. Media and entertainment providers, in particular, have reported recalibrated content localization plans due to elevated costs of subtitling and dubbing hardware, which has prompted a shift toward cloud-based rendering solutions and virtual studios.

Moreover, the indirect impact of these trade measures on outsourcing strategies is notable. Heightened compliance requirements and administrative burdens have driven up the total cost of ownership for global delivery centers. Organizations are subsequently exploring nearshore partnerships and hybrid models to mitigate risk. The cascading effects of the 2025 tariff regime underscore the necessity for service providers to optimize equipment procurement routes, renegotiate vendor contracts, and explore innovative delivery models that cushion clients from the full brunt of escalating import duties.

Uncovering Critical Segmentation Dynamics by Service Type, Industry Adoption, Deployment Preferences, and Organizational Scope Shaping Localization Demand

A granular examination of market segments reveals distinct drivers and adoption patterns across service portfolios, industry verticals, deployment modalities, and enterprise scales. Within service types, demand for interpretation continues to diversify as organizations embrace consecutive, remote, and simultaneous modalities to support everything from executive briefings to virtual conferences. Multimedia localization, software localization, and website localization collectively underpin the broader localization segment, fueled by the ubiquity of streaming platforms and SaaS applications. In parallel, subtitling and dubbing have surged ahead to meet consumer expectations for accessible content, while transcreation services remain critical for culturally nuanced marketing campaigns. Meanwhile, translation itself spans crowdsourced contributions, machine translation post-editing, and traditional professional translation, with each approach calibrated against cost, turnaround time, and quality requirements.

Industry vertical dynamics further nuance this outlook. Automotive and IT & telecom sectors leverage localization for user manuals, software interfaces, and in-vehicle infotainment, whereas BFSI organizations prioritize regulatory compliance and multilingual customer communications. Healthcare & life sciences players depend on precise translation of clinical data, patient-facing materials, and regulatory submissions. At the same time, media & entertainment companies pursue high-volume localization to address global audiences, and retail & e-commerce businesses optimize localized product descriptions and customer support to drive conversion rates. The interplay of these verticals underscores the need for specialized workflows and domain expertise that cater to unique regulatory landscapes and customer expectations.

Deployment preferences also reveal a shift toward cloud-based platforms that offer scalability, continuous updates, and collaboration tools essential for distributed teams. Nevertheless, on-premise solutions retain traction among clients with stringent data sovereignty requirements or legacy systems. Finally, large enterprises-armed with robust budgets and global footprints-often engage in end-to-end localization partnerships, while small and medium enterprises pursue modular, pay-as-you-grow models to align with incremental expansion plans. Together, these segmentation dynamics shape a market that demands both breadth and depth of capabilities.

This comprehensive research report categorizes the Translation And Localization Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Language

- Pricing Model

- Application

- Industry Vertical

- Enterprise Size

Examining Regional Variations and Growth Trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific Localization Markets

Regional market characteristics demonstrate divergent growth trajectories and strategic imperatives across the globe. In the Americas, North American enterprises maintain a leadership position, driven by advanced digital infrastructures, high levels of cross-border commerce, and strong regulatory frameworks for data privacy. South American markets present nascent yet rapidly expanding localization opportunities, propelled by surging mobile internet penetration and e-commerce adoption. The region’s linguistic diversity, encompassing Spanish, Portuguese, and indigenous languages, adds complexity and opportunity for targeted service offerings.

In Europe, Middle East & Africa, localization services are influenced by stringent data protection regulations such as GDPR and a tapestry of over twenty official European Union languages. This regulatory and linguistic mosaic has fostered a mature ecosystem of specialized providers equipped to navigate compliance and deliver high-quality localized outputs. Meanwhile, the Middle East and Africa are witnessing accelerated digital government initiatives and content consumption trends, underlining a rising demand for Arabic, French, and Swahili localization, particularly in sectors like education, e-government, and entertainment.

The Asia-Pacific region represents a powerhouse of growth driven by digital innovation, expanding middle-class populations, and proactive government investments in smart cities and digital services. Markets such as China, India, Japan, and Southeast Asian economies are advancing localization efforts to support e-learning, gaming, healthcare, and consumer electronics. Regional fragmentation by language and platform preferences has catalyzed the emergence of local champions and global partnerships, positioning APAC as a critical frontier for service providers aiming to capture long-term growth and scale operations in a cost-competitive environment.

This comprehensive research report examines key regions that drive the evolution of the Translation And Localization Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations by Leading Translation and Localization Providers Driving Competitive Advantage and Market Differentiation

Leading translation and localization providers are executing a range of strategic moves to capture market share and differentiate their offerings. TransPerfect’s acquisition of the German media localization studio SPEEECH Audiolingual Labs in March 2025 has bolstered its presence in the European media and entertainment space, enhancing its capabilities for dubbing, audio post-production, and OTT content distribution. Furthermore, the company’s sustained revenue growth-marked by a 3% increase to $1.23 billion in 2024-has been driven by AI-powered tool adoption and a series of targeted acquisitions across contact center, gaming, and regulatory compliance verticals.

Lionbridge, another sector stalwart, reinforced its position by acquiring Bowne Global Solutions for at least $180 million in June 2025. This move expanded Lionbridge’s service portfolio to include technical writing and interpretation, leveraging Bowne’s specialized expertise to deliver more comprehensive globalization solutions in North America. In parallel, the company has invested in strengthening in-market capabilities, as evidenced by the launch of a second facility in Mexico City to serve Latin American gaming clients with dedicated localization and audio production services.

Other notable industry participants have focused on strategic partnerships and technology alliances. Lionbridge’s collaboration with Le Monde to deliver an English-language edition of the publication showcased its Language Cloud™ AI platform, highlighting the centrality of advanced machine translation and cloud-based workflows in enabling seamless content scaling for global audiences. These strategic and operational initiatives illustrate how market leaders are combining inorganic growth with targeted innovation to establish competitive moats and meet evolving client demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Translation And Localization Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absolute Translations Limited

- Acolad Group

- Alconost Inc.

- Ansh Intertrade Pvt Ltd.

- Appen Limited

- Argos Multilingual

- Feenix Language Solution

- GTE Localize

- Honyaku Center, Inc.

- Keywords Studios plc

- LanguageLine Solutions, Inc.

- Lionbridge Technologies, Inc.

- Lisan India Language Solutions LLP

- Localize Direct AB

- Lyric Labs India Pvt. Limited

- Pactera Technology International Ltd.

- RWS Holdings plc

- Smartling, Inc.

- Tomedes Ltd.

- Transcend Translation LLC

- Translation AZ

- TransPerfect Global, Inc.

- VERBOLABS MEDIA SOLUTIONS LLC

- Welocalize, Inc.

Delivering Actionable Strategic Recommendations for Translation and Localization Executives to Enhance Operational Efficiency and Foster Sustainable Growth

To thrive amid intensifying competition and evolving client expectations, industry leaders should prioritize a multi-pronged strategic agenda. First, integrating next-generation AI and machine learning capabilities into core workflows is essential for achieving scalable efficiency without compromising linguistic accuracy. Providers should implement advanced neural models for initial translation drafts and augment them with human post-editing protocols, establishing metrics that measure both speed and contextual relevance. This approach reduces turnaround times and positions organizations to handle surges in content volumes with minimal incremental cost.

Second, optimizing global delivery footprints is critical in the wake of 2025 tariff reforms and geopolitical uncertainties. By diversifying service hubs across nearshore, offshore, and onshore locations, providers can balance cost advantages with resilience, ensuring uninterrupted service delivery even amid trade disruptions. Strategic partnerships with local language experts and boutique studios can further enhance agility and cultural authenticity.

Third, investing in cloud-based localization management platforms will streamline project collaboration, version control, and quality assurance. Such platforms empower distributed teams to work synchronously, reducing administrative overhead and minimizing scope for miscommunication. Complemented by robust data security protocols and compliance frameworks, these tools reinforce client confidence while enabling iterative content improvements. Lastly, fostering deep vertical specialization-whether in healthcare, automotive, or media-and building dedicated industry teams will allow providers to tailor solutions that address sector-specific regulatory requirements, terminology needs, and audience behaviors. By implementing these recommendations, industry executives can strengthen operational efficiency, elevate service differentiation, and secure long-term, sustainable growth.

Detailing Robust Multi-Method Research Methodology and Analytical Frameworks Employed to Ensure Comprehensive Localization Market Insights

The research methodology underpinning this analysis employs a rigorously structured, multi-stage framework to ensure depth, accuracy, and actionable insights. Secondary data was first consolidated from public trade databases, regulatory filings, and reputable news outlets to construct an initial market landscape. Complementing this, primary interviews were conducted with senior executives, language experts, and enterprise clients across key regions to validate market drivers, service preferences, and competitive dynamics.

A hybrid top-down and bottom-up approach facilitated triangulation of qualitative observations with quantitative indicators, while segmentation scenarios were stress-tested against multiple macroeconomic variables, including digital adoption rates and regulatory changes. Regional and vertical nuances were further refined through expert panels and localized surveys to capture cultural contexts and compliance imperatives. Data integration and analysis leveraged advanced analytics platforms, with iterative validation cycles to resolve discrepancies and ensure coherence. By harmonizing these diverse research streams within a transparent analytical framework, the study delivers a robust, nuanced portrait of the global translation and localization market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Translation And Localization Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Translation And Localization Services Market, by Service Type

- Translation And Localization Services Market, by Delivery Model

- Translation And Localization Services Market, by Language

- Translation And Localization Services Market, by Pricing Model

- Translation And Localization Services Market, by Application

- Translation And Localization Services Market, by Industry Vertical

- Translation And Localization Services Market, by Enterprise Size

- Translation And Localization Services Market, by Region

- Translation And Localization Services Market, by Group

- Translation And Localization Services Market, by Country

- United States Translation And Localization Services Market

- China Translation And Localization Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing Executive Takeaways and Future Outlook for the Translation and Localization Sector amid Technological Progress and Global Trade Dynamics

This executive summary has illuminated the primary forces shaping the translation and localization sector in 2025, from the rapid integration of AI and cloud-based workflows to the ripple effects of sweeping U.S. tariff reforms. Segmentation analysis reveals how service types, industry verticals, deployment preferences, and enterprise scales interact to define service demand, while regional insights highlight the divergent trajectories across the Americas, EMEA, and Asia-Pacific.

Market leaders are actively executing strategic M&A, forging partnerships, and deploying cutting-edge technologies to secure competitive advantage. As digital content volumes continue to surge and client expectations for culturally resonant experiences intensify, the ability to deliver high-quality, scalable solutions will mark the difference between market leaders and laggards. Looking ahead, providers that balance technological innovation with deep domain expertise, diversified delivery models, and resilient supply chains will be best positioned to capitalize on emerging opportunities and navigate geopolitical uncertainties.

In this dynamic environment, stakeholders should monitor evolving regulatory landscapes, invest in data-driven decision-making tools, and foster agile operational structures. By synthesizing these insights with continuous market feedback, organizations can align their strategies to realize sustained growth and long-term success in the translation and localization ecosystem.

Connect with Ketan Rohom to Access the Comprehensive Translation and Localization Market Research Report for Data-Driven Strategic Decision-Making

To gain unparalleled depth into the translation and localization market’s evolving dynamics, contact Ketan Rohom (Associate Director, Sales & Marketing) to secure your comprehensive market research report. This report delivers nuanced insights into segmentation trends, regional variations, company strategies, and the disruptive influence of emerging technologies. By partnering with Ketan Rohom, you will receive expert guidance on leveraging the report’s findings to inform strategic planning, optimize service portfolios, and identify high-potential opportunities.

Reach out to Ketan Rohom to tailor your research package and unlock actionable intelligence that will drive confident, data-driven decision-making across your organization. Whether you seek comparative benchmarks, best practices, or forward-looking analyses, this market research report is your definitive resource for maintaining competitive advantage and future-proofing your localization initiatives.

- How big is the Translation And Localization Services Market?

- What is the Translation And Localization Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?