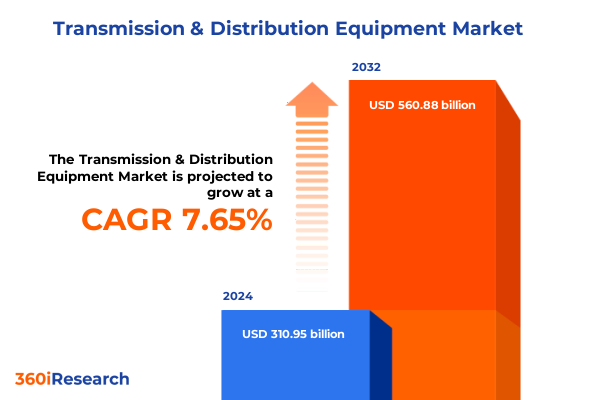

The Transmission & Distribution Equipment Market size was estimated at USD 334.57 billion in 2025 and expected to reach USD 356.42 billion in 2026, at a CAGR of 7.65% to reach USD 560.88 billion by 2032.

Overview of the Transmission and Distribution Equipment Landscape Highlighting Current Dynamics Shaping Utility Infrastructure Worldwide

The transmission and distribution equipment sector underpins every aspect of modern power delivery, serving as the critical backbone for utilities, industries, and communities worldwide. As industry stakeholders face increasing pressure to balance grid reliability, sustainability objectives, and cost efficiency, this foundational landscape is experiencing profound transformation. Legacy systems originally designed for one-way power flow must now accommodate bidirectional energy exchanges driven by distributed generation resources such as rooftop solar, battery storage, and electric vehicle charging networks. Meanwhile, aging infrastructure in many regions demands significant modernization to meet heightened performance and safety requirements. The confluence of digital innovation and regulatory momentum has placed equipment manufacturers and system operators at a pivotal juncture, where strategic investments and targeted innovation initiatives will determine the competitive leaders of tomorrow.

In this evolving milieu, power transformers, switchgear, circuit breakers, capacitor banks, and a suite of complementary equipment are being reengineered to offer enhanced intelligence, remote operability, and plug-and-play compatibility. Additionally, environmental concerns and the drive for decarbonization have imparted urgency to adopt eco-friendly dielectric alternatives and to optimize equipment design for lower life-cycle emissions. As a result, stakeholders must not only monitor emerging technologies and policy shifts but also realign their portfolios to seize opportunities presented by dynamic demand profiles. This introduction offers a concise yet comprehensive lens into the current state of the transmission and distribution equipment landscape, setting the stage for deeper exploration of transformative forces, tariff implications, segmentation developments, and actionable strategic imperatives.

Emerging Technological and Regulatory Innovations Reshaping the Future of Transmission and Distribution Equipment for Utilities

The transmission and distribution equipment realm is being reshaped by a convergence of technological breakthroughs and shifting regulatory frameworks, creating a fertile environment for innovation and operational optimization. Advanced sensors, internet-of-things connectivity, and edge computing are enabling real-time condition monitoring across transformers, switchgear, and breakers, improving reliability and reducing unplanned outages. Artificial intelligence and machine learning algorithms are increasingly leveraged for predictive maintenance, allowing utilities to transition from scheduled servicing to data-driven interventions that lower total cost of ownership. Simultaneously, modular and compact designs are gaining traction, offering faster deployment timelines and reduced footprint, which proves especially valuable in densely populated urban centers.

Moreover, the growing emphasis on cybersecurity within critical infrastructure has prompted the integration of secure communications protocols and hardened control systems. Regulatory bodies across North America and Europe have updated grid codes to mandate stricter performance criteria, particularly concerning fault detection and isolation. In addition, heightened environmental regulations have accelerated the shift toward SF6 alternatives and silicone-based insulation media, aligning equipment specifications with carbon reduction commitments. Consequently, manufacturers are investing heavily in research and development to introduce smart, automated solutions that comply with evolving standards and capitalize on the rising need for a more resilient, efficient grid.

Assessing the Holistic Effects of the 2025 United States Tariffs on Transmission and Distribution Equipment Supply Chains

The introduction of new United States tariffs in early 2025 has exerted significant pressure on the transmission and distribution equipment supply chain, altering competitive dynamics and cost structures. Tariffs affecting key imported components-ranging from transformer steel cores to high-precision switchgear assemblies-have led original equipment manufacturers to reevaluate sourcing strategies. As import duty burdens increased, domestic production capacity has struggled to fully absorb the incremental demand, resulting in longer lead times and higher manufacturing costs. In turn, these shifts have translated to delayed project timelines for utilities and infrastructure developers, who must now account for extended procurement cycles and potential budget overruns.

In response, several key stakeholders have pursued strategic diversification, establishing partnerships with alternative suppliers in non-tariff jurisdictions and accelerating nearshoring initiatives. Localization of certain assembly operations has also been employed to mitigate duty exposure, albeit at the expense of upfront capital investment in new facilities and training. Additionally, collaborative consortia between suppliers and end users have emerged to pool volume commitments and secure preferential pricing arrangements. While these adaptive measures help cushion the immediate impact of tariffs, they underscore the critical importance of supply chain resilience and agility in an environment characterized by policy volatility.

Delving into Comprehensive Segmentation for Equipment Types Insulation Installation Applications and End Users to Reveal Hidden Opportunities

Insights derived from a multifaceted segmentation framework reveal nuanced growth trajectories and strategic inflection points across equipment categories, insulation mediums, installation environments, application contexts, and end-user profiles. Equipment Type analysis underscores the rising adoption of digital state-of-the-art switchgear solutions alongside next-generation power transformers and the continued relevance of pad mounted and pole mounted distribution transformers. Delving deeper, advanced capacitor bank designs-both automatic and fixed-are being deployed to enhance voltage stability and reactive power compensation, while vacuum and SF6 circuit breakers maintain critical roles in high-voltage protection schemes.

Turning to Insulation Type, the juxtaposition of Dry Type and Oil Filled variants highlights a broader industry shift toward solid-insulation systems in urban and environmentally sensitive areas, supporting decentralized generation integration. The distinction between Indoor and Outdoor Installation Types further delineates equipment ruggedness requirements, with outdoor-rated switchgear and regulators serving remote or harsh climate installations. Application segmentation indicates divergent demand drivers across commercial data centers, heavy industrial facilities, residential microgrid pilots, and large-scale utility networks. Complementing this, End User considerations differentiate investments by commercial establishments, residential developments, and primary utilities, while within the industrial domain, the manufacturing sector-spanning automotive, chemical, and food and beverage processors-exhibits a pronounced appetite for energy-efficient and high-reliability T&D equipment. Mining, oil & gas, and transportation verticals similarly demand robust and scalable solutions to support continuous operations, revealing a landscape of tailored requirements and targeted growth pockets.

This comprehensive research report categorizes the Transmission & Distribution Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Insulation Type

- Installation Type

- Application

- End User

Unveiling Strategic Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Markets for T&D Equipment

Regional dynamics play a pivotal role in shaping strategic priorities for transmission and distribution equipment stakeholders. In the Americas, infrastructure modernization programs in the United States and Canada focus heavily on grid resilience initiatives, integrating smart sensors and automated control systems to reduce outage durations and support renewable integration. Latin American nations, grappling with rural electrification and distribution expansion, present opportunities for modular switchgear and compact substations, while regulatory reforms continue to incentivize private-public partnerships.

Across Europe, the Middle East, and Africa, national decarbonization targets are accelerating investments in high-voltage transmission corridors and onshore electrification projects. Europe’s stringent emissions regulations are fostering a surge in SF6-free switchgear and resilient network upgrade contracts, whereas the Middle East’s energy diversification strategies emphasize large-scale transmission projects and renewable-powered microgrids. In sub-Saharan Africa, grid extension efforts and off-grid pilot programs rely on robust, low-maintenance distribution transformers and voltage regulators to improve reliability in challenging environments.

Meanwhile, the Asia-Pacific region continues to witness unparalleled capacity growth, with China and India leading vast transmission expansions to accommodate renewable power generation. Southeast Asian economies are prioritizing smart grid deployments and cross-border interconnections, aiming to bolster regional energy security. Australia’s aging network infrastructure has spurred accelerated adoption of digital substations and condition-based monitoring tools to optimize operational expenditures. These contrasting regional imperatives underscore the importance of tailored market approaches and localized value propositions across global territories.

This comprehensive research report examines key regions that drive the evolution of the Transmission & Distribution Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategic Priorities Collaborations and Innovations Driving the Transmission and Distribution Equipment Sector

Leading industry participants have adapted to evolving market conditions through targeted product innovations, strategic partnerships, and service-oriented business models. One multinational conglomerate has introduced an advanced digital substation suite that integrates high-accuracy sensors with cloud-based analytics platforms, positioning itself at the forefront of grid modernization. Another global manufacturer has expanded its portfolio to include eco-friendly insulating media and gas-insulated switchgear designed to meet stringent environmental regulations, collaborating closely with utilities to pilot zero-emission substations.

Several established players have also pursued joint ventures to secure localized manufacturing footprints in tariff-sensitive markets, thereby mitigating duty exposure while bolstering supply chain resilience. Concurrently, service revenues have become an integral focus, with firms offering outcome-based maintenance contracts that leverage predictive diagnostics and remote support capabilities. In addition, software and data analytics providers have entered the ecosystem, partnering with traditional equipment vendors to deliver end-to-end asset management solutions. Through these collective efforts, industry leaders aim to differentiate on total value delivered, aligning their offerings with the twin imperatives of operational efficiency and decarbonization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transmission & Distribution Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Alstom SA

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Limited

- China XD Group

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- HD Hyundai Electric Co., Ltd.

- Hitachi Energy Ltd

- Hubbell Incorporated

- Larsen & Toubro Limited

- Legrand S.A.

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- Prysmian Group

- S&C Electric Company

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- SGB-SMIT Group

- Siemens Energy AG

- Sumitomo Electric Industries, Ltd.

- TBEA Co., Ltd.

- Toshiba Corporation

Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Efficiency and Growth in the Transmission and Distribution Equipment Market

To thrive amid intensifying competition and policy turbulence, industry leaders should prioritize the integration of smart grid technologies and analytics-driven service portfolios that enhance asset visibility and uptime. Embracing flexible manufacturing strategies-such as modular assembly lines and digital twins-will enable swift reconfiguration of production to accommodate evolving equipment specifications and emerging insulation alternatives. In addition, companies are encouraged to diversify their supplier base by forging partnerships with specialist component makers and non-traditional players, thereby reducing dependency on high-tariff geographies.

Furthermore, unlocking additional revenue streams through performance-based service agreements and data subscription models can reinforce customer relationships and ensure sustained growth. Collaboration with regulatory bodies and standards organizations will be essential to influence evolving grid codes, particularly in areas of cybersecurity and emission reduction targets. Investing in workforce development-through certification programs and cross-disciplinary training-will build the internal capabilities necessary to support advanced digital solutions. Lastly, targeted mergers and acquisitions focused on complementary software or insulation technology providers can accelerate market entry and deliver integrated solutions required by forward-looking utilities and industrial customers.

Detailed Research Methodology Highlighting Data Sources Analytical Approaches and Validation Techniques Ensuring Robust Insights

This research employed a rigorous blend of secondary and primary methods to ensure comprehensive and reliable insights. Secondary research involved exhaustive reviews of technical white papers, regulatory filings, standards documentation, corporate annual reports, and trade association publications to map existing technological and policy landscapes. To supplement these findings, primary research comprised structured interviews with senior executives, grid operators, equipment engineers, and procurement specialists, yielding nuanced perspectives on operational challenges and strategic priorities.

Data validation followed a triangulation process, whereby quantitative inputs from publicly available datasets were cross-verified against insights from expert interviews and proprietary databases. Analytical approaches included scenario analysis to evaluate tariff impact pathways, qualitative comparative assessments of regional dynamics, and thematic coding of interview transcripts to uncover prevailing industry sentiments. All methodological steps were documented in detail to foster transparency and reproducibility, with key assumptions explicitly stated. By adopting a multi-lens framework that balances rigor with real-world practitioner viewpoints, the study delivers robust, actionable intelligence tailored to the evolving needs of transmission and distribution equipment stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transmission & Distribution Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transmission & Distribution Equipment Market, by Equipment Type

- Transmission & Distribution Equipment Market, by Insulation Type

- Transmission & Distribution Equipment Market, by Installation Type

- Transmission & Distribution Equipment Market, by Application

- Transmission & Distribution Equipment Market, by End User

- Transmission & Distribution Equipment Market, by Region

- Transmission & Distribution Equipment Market, by Group

- Transmission & Distribution Equipment Market, by Country

- United States Transmission & Distribution Equipment Market

- China Transmission & Distribution Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Key Takeaways and Strategic Imperatives to Navigate the Evolving Transmission and Distribution Equipment Landscape with Confidence

The transmission and distribution equipment sector stands at a critical crossroad, shaped by technological innovation, geopolitical shifts, and ambitious decarbonization agendas. Key takeaways underscore the necessity for digital integration to enhance asset performance, the imperative of supply chain agility in the face of tariff disturbances, and the strategic value of diversified service offerings. Regional nuances highlight distinct growth catalysts-from regulatory mandates in Europe to capacity expansions in Asia-Pacific-requiring a localized market approach.

Strategic imperatives emerge clearly: prioritize R&D in eco-efficient materials and grid automation, pursue collaborative frameworks to influence standard-setting, and fortify manufacturing ecosystems through nearshoring and flexible production capabilities. By synthesizing segmentation insights, leaders can target high-potential application domains and tailor product roadmaps to specific end-user requirements. Ultimately, organizations that orchestrate technological prowess, operational resilience, and regulatory alignment will emerge as frontrunners, equipped to power the evolving energy landscape with reliability and sustainability.

Empower Your Organization Today by Partnering with Ketan Rohom Associate Director of Sales and Marketing to Access the Full Market Research Report

If your organization seeks to navigate shifting market dynamics and gain a competitive edge in transmission and distribution equipment, reach out to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. By partnering with Ketan, you will gain access to the full market research report that delivers deep insights on technology adoption, tariff impacts, segmentation strategies, regional variations, and leading player best practices. This comprehensive resource is designed to inform strategic decision-making, optimize investment plans, and accelerate growth in an evolving regulatory and commercial landscape. Engage with our expert to obtain tailored guidance, explore customized data packages, and secure the intelligence required to drive resilient and efficient grid modernization initiatives. Take this opportunity today to empower your organization with actionable intelligence and position your business for long-term success in the transmission and distribution equipment arena

- How big is the Transmission & Distribution Equipment Market?

- What is the Transmission & Distribution Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?