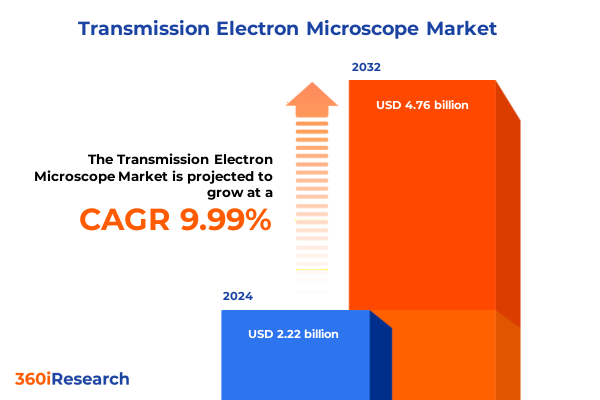

The Transmission Electron Microscope Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.67 billion in 2026, at a CAGR of 10.06% to reach USD 4.76 billion by 2032.

Understanding the Critical Role of Transmission Electron Microscopy in Driving Innovation Across Diverse Scientific and Industrial Applications

Transmission electron microscopy has emerged as an indispensable tool for probing the atomic and molecular architecture of materials across scientific and industrial domains. By harnessing high-energy electron beams transmitted through thin specimens, researchers can visualize structures at sub-nanometer resolutions, fostering breakthroughs in materials science, life sciences, and nanotechnology. This capability has catalyzed a deeper understanding of crystal defects, biomolecular complexes, and semiconductor interfaces, enabling advancements that span from elucidating viral structures to engineering next-generation microelectronic devices.

Building on decades of incremental innovation, contemporary instruments now combine aberration correction with direct electron detection, dramatically enhancing image clarity and analytical throughput. As laboratories grapple with ever-complex research questions, the flexibility of modern electron microscopes supports pivotal in situ experiments under variable environmental conditions, such as gas or liquid cells. These developments underscore the microscope’s transition from a purely observational platform to a dynamic engine for in situ characterization, realizing real-time insights into catalytic reactions, phase transitions, and biological processes.

In this executive summary, key discoveries and emerging patterns are highlighted to assist stakeholders in understanding how technological strides, regional shifts, and regulatory influences intersect to shape strategic pathways in the transmission electron microscopy landscape.

Revealing the Latest Technological Advances and Emerging Use Cases That Are Reshaping Transmission Electron Microscopy Applications Globally

The transmission electron microscopy field is undergoing a profound metamorphosis as it integrates next-generation technologies and addresses evolving research demands. Among the most striking shifts is the widespread adoption of aberration-corrected imaging, which compensates for lens imperfections and unlocks sub-angstrom resolution. This capability has facilitated atomic-scale visualization of complex materials, from two-dimensional crystals to advanced catalysts, refining our grasp of structure-property relationships. Concurrently, the proliferation of environmental cells has expanded experimentation beyond high vacuum, enabling observation of dynamic processes such as nanoparticle growth and chemical reactions in real-time.

Transitioning toward enhanced data analytics, microscopy platforms now incorporate machine learning algorithms to automate feature recognition, reduce operator bias, and accelerate interpretation of vast image datasets. This synergy between instrumentation and software not only increases throughput but also paves the way for predictive modeling of material behavior. In parallel, the miniaturization and modular design trends are making instruments more compact and adaptable, lowering the footprint required in academic and industrial laboratories without sacrificing performance.

As researchers demand greater versatility, hybrid systems that combine scanning transmission electron microscopy with spectroscopic attachments are becoming standard, delivering correlative structural and chemical insights. These transformative advancements are redefining workflows, optimizing resource utilization, and establishing a new paradigm in high-resolution microscopy applications.

Evaluating the Comprehensive Effects of New Tariff Measures on Transmission Electron Microscope Procurement and Operations in the United States in 2025

In 2025, the introduction of targeted tariff measures on imported scientific capital equipment has significantly influenced procurement strategies for advanced analytical instruments. Fresh duty schedules, applicable to a range of electron optics components and complete instrumentation packages, have led to a rise in acquisition expenses and prompted organizations to reassess sourcing decisions. As a result, many purchasers are weighing the benefits of domestic manufacturing alternatives, even if initial lead times may be extended, in order to mitigate vulnerability to cross-border cost fluctuations.

Moreover, supply chains have adapted with a shift toward localized assembly and aftermarket servicing to circumvent the steepest levies. This reconfiguration has promoted closer collaboration between end users and service providers, fostering preventive maintenance agreements that prioritize uptime while controlling total cost of ownership. At the same time, a number of research institutions have successfully petitioned for exclusions or obtained licensing arrangements to alleviate the burden of elevated tariffs on mission-critical upgrades.

While short-term budgetary constraints have led some organizations to defer non-essential enhancements, the demand for specialized customization, such as in situ gas or cryogenic stages, persists unabated. Consequently, instrument vendors are exploring hybrid solutions, pairing refurbished platforms with precision retrofits to deliver cost-effective performance improvements. These evolving procurement patterns illustrate a resilient landscape in which stakeholders balance fiscal discipline with the imperative to maintain state-of-the-art analytical capabilities.

Uncovering Critical Segmentation Parameters That Drive Diverse Applications and Purchasing Decisions in Transmission Electron Microscopy Markets

A nuanced understanding of segmentation parameters reveals how diverse research requirements and purchasing preferences drive instrument selection and service agreements. By distinguishing between aberration-corrected, conventional, environmental, and scanning variants, organizations can align their investment with the specific resolution, contrast mechanisms, and in situ capabilities needed for their applications. Additionally, image acquisition modes-whether bright field for intuitive contrast or dark field for interface visualization-inform the choice of detectors and data processing pipelines that deliver targeted analytical outputs.

Component segmentation further refines procurement strategies, as customers evaluate the merits of advanced electron guns-field emission devices that offer superior coherence versus thermionic sources prized for robustness-and discern the performance attributes of lens architectures designed to mitigate spherical or chromatic distortions. Complementary modules such as high-sensitivity detectors or precision specimen stages become critical in workflows that demand maximal signal-to-noise ratios and stability during extended acquisitions. Buyers also consider vacuum subsystems whose specifications ensure repeatable operation across a range of experimental conditions.

Commercial models vary from traditional capital purchases to leasing contracts and subscription-based services that bundle software updates and maintenance, enabling flexible budget management. Resolution tiers, extending from sub-0.1 nanometer to ranges approaching half a nanometer, address everything from atomic lattice imaging to broader phase contrast studies. Finally, application-driven segmentation encompasses domains like geology, material science, and nanotechnology, alongside life sciences sub-fields such as cell biology, structural biology, and virology, with end users spanning academia, diagnostic centers, pharmaceutical and biotechnology enterprises, and semiconductor and electronics manufacturers.

This comprehensive research report categorizes the Transmission Electron Microscope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mode

- Component

- Lens Abberation

- Application

- End User

Mapping Regional Dynamics and Adoption Trends Across America, Europe, Middle East & Africa, and Asia-Pacific in Transmission Electron Microscopy

Regional insights underscore how economic dynamics, funding landscapes, and infrastructure maturity shape adoption trajectories. In the Americas, sustained investment from government agencies and private sector partnerships has fostered robust capabilities at academic and research institutions, while diagnostic facilities leverage electron microscopy for advanced pathology and pharmaceutical validation. North American manufacturers and service providers continue to expand aftermarket networks to meet demand for rapid instrument deployment and technical support.

Meanwhile, Europe, Middle East, and Africa exhibit a heterogeneous profile. Western European research hubs in Germany, the United Kingdom, and France lead in materials characterization and semiconductor research, supported by collaborative consortia and public-private initiatives. In the Middle East, emerging science parks in the Gulf Cooperation Council region are integrating state-of-the-art microscopy centers to drive diversification away from traditional energy sectors. Africa’s growing emphasis on mineral exploration sees microscopy applications in geology laboratories, although capacity constraints and training gaps remain challenges.

Asia-Pacific outpaces other regions in growth momentum, propelled by national programs in China, Japan, South Korea, and India that prioritize nanotechnology, electronics, and healthcare innovation. Local manufacturing ecosystems for core components, coupled with competitive labor costs, have attracted instrument assemblers and third-party service firms. As a result, laboratories across the region benefit from reduced lead times and tailored service agreements, further accelerating the deployment of next-generation electron microscopy solutions.

This comprehensive research report examines key regions that drive the evolution of the Transmission Electron Microscope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Instrument Manufacturers and Innovators Shaping the Competitive Landscape of Transmission Electron Microscopy Solutions

Top instrument producers and specialized technology developers are investing heavily to differentiate their offerings and capture emerging growth pockets. Legacy manufacturers continue to refine electron optical performance while integrating digital analytics to deliver turnkey workflows. Concurrently, technology-focused entrants are carving niches in specialized components, such as ultra-fast direct detection cameras and microelectromechanical system-based specimen stages, challenging traditional paradigms and driving competitive pricing.

Strategic alliances between instrument vendors and software companies have created holistic platforms that span acquisition, processing, and visualization, catering to users who require seamless interoperability and automated reporting. Service providers are enhancing their value proposition through global maintenance networks, remote diagnostics, and modular upgrade programs, enabling customers to extend equipment lifecycles and manage operational risks effectively.

Furthermore, a wave of regional players in Asia-Pacific is emerging with localized manufacturing capabilities, offering cost advantages and customization for domain-specific applications. This geographic diversification of supply underscores a broader trend toward flexible sourcing and collaborative innovation, as companies leverage cross-sector partnerships to stay ahead in a rapidly evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transmission Electron Microscope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc

- Beike Nano Technology Co., Ltd.

- Bruker Corporation

- Carl Zeiss AG

- CIQTEK Co.,Ltd.

- Cordouan Technologies

- Corrected Electron Optical Systems GmbH

- Danaher Corporation

- Delong Instruments a. s.

- DENSsolutions

- Hitachi Ltd.

- Hummingbird Scientific

- JEOL Ltd.

- Keyence Corporation

- Kitano Seiki Co., Ltd.

- Lasertec Corporation

- NanoScience Instruments, Inc.

- Nikon Corporation

- Nion Co.

- Norcada Inc.

- Opto-Edu (Beijing) Co., Ltd.

- Oxford Instruments PLC

- Protochips Incorporated

- TESCAN Group, a.s.

- Thermo Fisher Scientific Inc.

- TVIPS - Tietz Video and Image Processing Systems GmbH

Strategic Guidance and Best Practices to Drive Growth, Enhance Efficiency, and Foster Innovation in Transmission Electron Microscopy Operations

To capitalize on emerging opportunities, industry leaders should prioritize investments in advanced aberration correction technologies that deliver unmatched resolution while reducing alignment complexity. Pairing these systems with artificial intelligence-driven image analysis tools will accelerate throughput and enable predictive maintenance, minimizing downtime. Equally important is the adoption of subscription-style service agreements, which provide regular software updates and technical support, aligning expenditure with operational cadence and fostering long-term partnerships.

Moreover, organizations can build resilience by diversifying component suppliers and establishing localized assembly or refurbishment facilities to mitigate the effects of cross-border disruptions. Engaging in strategic collaborations with academic and government laboratories to co-develop application-specific modules-such as cryogenic stages for biological research or environmental cells for catalytic studies-can unlock new revenue streams while enhancing instrument utility.

Finally, aligning product roadmaps with key end-user needs by offering scalable resolution tiers and flexible financing options will broaden market reach. By embedding sustainability practices in manufacturing and service logistics, companies can also meet growing regulatory expectations and corporate responsibility goals. Proactive stakeholder engagement and transparent communication about performance enhancements will cement brand credibility and support accelerated adoption of next-generation electron microscopy solutions.

Detailing the Rigorous Research Framework, Data Sources, and Analytical Techniques Underpinning the Transmission Electron Microscopy Study

The study applies a multi-stage research framework designed to ensure comprehensive coverage and analytical rigor. Initial scoping involved exhaustive literature reviews of peer-reviewed journals, technical white papers, and industry periodicals, laying the foundation for topic validation. This was followed by primary consultations with key opinion leaders, including senior microscopists, instrumentation engineers, and procurement specialists across academic, industrial, and clinical settings.

Subsequent phases incorporated structured data collection from equipment sales reports, service logs, and governmental policy updates to map regulatory impacts and regional deployment trends. Qualitative and quantitative datasets were synthesized through triangulation techniques, reconciling diverse viewpoints and verifying consistency against independent secondary sources. Advanced analytical methods, such as trend correlation and segmentation mapping, were employed to distill actionable patterns and uncover latent opportunities.

Lastly, the preliminary findings underwent validation workshops with select end users and sector analysts, ensuring that interpretations align with real-world experiences and operational imperatives. This iterative approach, underpinned by transparency and methodological robustness, provides stakeholders with confidence in the insights and recommendations delivered.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transmission Electron Microscope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transmission Electron Microscope Market, by Type

- Transmission Electron Microscope Market, by Mode

- Transmission Electron Microscope Market, by Component

- Transmission Electron Microscope Market, by Lens Abberation

- Transmission Electron Microscope Market, by Application

- Transmission Electron Microscope Market, by End User

- Transmission Electron Microscope Market, by Region

- Transmission Electron Microscope Market, by Group

- Transmission Electron Microscope Market, by Country

- United States Transmission Electron Microscope Market

- China Transmission Electron Microscope Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights and Emerging Opportunities to Inform Strategic Decisions in Transmission Electron Microscopy Advancements

In synthesizing the critical insights from this analysis, it is evident that transmission electron microscopy stands at a pivotal juncture. Technological leaps-most notably in aberration correction, direct detection, and artificial intelligence integration-are redefining performance benchmarks and opening new avenues for in situ experimentation. Simultaneously, tariff-driven procurement shifts in the United States have underscored the importance of supply chain agility and strategic sourcing to maintain continuity of advanced analytical capabilities.

A refined segmentation perspective illuminates how resolution requirements, imaging modes, and component preferences shape end-user decisions, while regional dynamics reveal divergent growth patterns driven by funding priorities and domestic manufacturing ecosystems. The competitive arena is evolving through a blend of legacy expertise and disruptive innovation, as companies pursue alliances, modular offerings, and localized services to differentiate their value propositions.

Looking ahead, organizations that embrace flexible sales models, invest in collaborative development, and embed sustainability into their operations will be best positioned to harness the full potential of next-generation electron microscopy. By adopting the recommended strategic initiatives, stakeholders can accelerate discovery, optimize resource allocation, and secure a leadership stance in a rapidly transforming landscape.

Partner with Ketan Rohom to Unlock In-Depth Intelligence and Acquire the Comprehensive Transmission Electron Microscopy Research Offering

For exclusive insights into the transmission electron microscopy domain, securing the complete research report is a decisive step toward informed decision-making. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to explore detailed findings, customize analytical depth, and review licensing arrangements. His expertise ensures that your organization receives tailored guidance aligned with your strategic objectives and operational priorities.

By reaching out, you can discuss package options that meet your budgetary parameters and gain access to supplementary data modules, including in-depth case studies and proprietary supplier assessments. Ketan Rohom stands ready to facilitate seamless acquisition of the report and guide you through next steps for immediate application of critical insights.

- How big is the Transmission Electron Microscope Market?

- What is the Transmission Electron Microscope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?