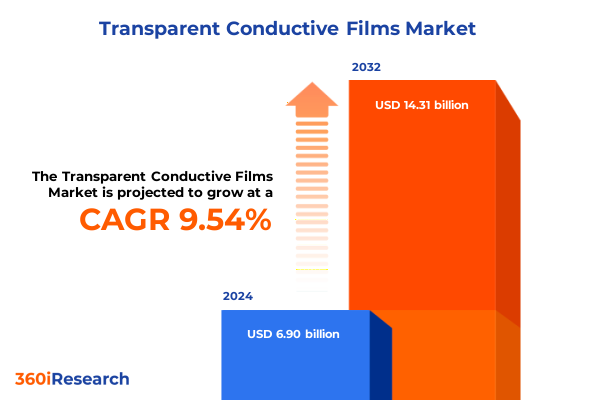

The Transparent Conductive Films Market size was estimated at USD 7.51 billion in 2025 and expected to reach USD 8.20 billion in 2026, at a CAGR of 9.63% to reach USD 14.31 billion by 2032.

Exploring Foundational Drivers and Emerging Opportunities Guiding the Rise of Transparent Conductive Films Across Diverse Applications

Transparent conductive films have emerged as critical enablers of modern electronic interfaces, underpinning seamless integration of optical clarity and electrical performance across a broad array of devices. These films serve as the essential bridge between circuitry and user interaction, finding their way into touchscreens, flexible displays, and emerging energy applications. While indium tin oxide established itself as the dominant material for decades due to its exceptional conductivity and transparency, rising concerns around indium scarcity and film brittleness have catalyzed a wave of material innovation. Today, alternatives such as carbon nanotubes, conductive polymers, graphene, and silver nanowires are being refined to balance performance with durability and cost-effectiveness.

As demand for higher-resolution touch interfaces intensifies, manufacturers and end users are gravitating toward materials and processes that support thinner, more flexible form factors. This shift is complemented by growth in renewable energy technologies, where transparent conductive coatings enhance photovoltaic cell efficiency and enable smart window functionalities. Concurrently, sustainability considerations are driving interest in recyclable substrates and low-temperature deposition techniques to reduce energy consumption during production. Against this backdrop, the transparent conductive films sector stands poised at the intersection of innovation, supply chain transformation, and escalating application requirements, charting a course toward next-generation solutions.

Examining Groundbreaking Technological Advances and Evolving Supply Chain Dynamics Shaping the Transparent Conductive Films Industry

Recent years have witnessed transformative breakthroughs in both material science and manufacturing processes that are redefining the transparent conductive films industry. Advances in graphene synthesis techniques have unlocked large-area, high-purity films with conductivity rivaling traditional materials, while silver nanowire networks have demonstrated remarkable mechanical resilience in bendable electronics. Carbon nanotubes and conductive polymers continue to evolve with improved alignment and doping strategies, delivering tailored electrical properties alongside enhanced substrate compatibility.

On the manufacturing front, atomic layer deposition (ALD) has emerged as a precision technology capable of controlling film thickness at the atomic scale, thereby reducing defects and optimizing transparency. Meanwhile, roll-to-roll coating methods are gaining traction for high-throughput production of polymer-based films, striking a balance between cost efficiency and performance. Chemical vapor deposition (CVD) processes have also been refined to produce uniform graphene layers, supporting integration into photovoltaic and display applications.

Supply chain dynamics are likewise shifting to accommodate these innovations. Strategic partnerships between material developers, equipment suppliers, and end users are streamlining technology transfer, while localized production hubs are mitigating risks associated with geopolitical tensions and raw material shortages. As a result, the landscape is evolving from reliance on a handful of legacy suppliers toward a diversified ecosystem of specialized players collaborating to drive the next wave of application-specific breakthroughs.

Understanding the Ripple Effects of 2025 United States Tariffs on Supply Chains, Production Costs, and Strategic Sourcing for Conductive Films

In 2025, newly imposed tariffs by the United States have triggered a ripple effect across the transparent conductive films value chain, reshaping sourcing strategies and cost structures. Tariffs targeting imported indium raw materials and specialized deposition equipment have elevated input costs, compelling manufacturers to reassess long-standing supply agreements. This policy shift has not only prompted a realignment of procurement channels but also accelerated the pursuit of alternative materials less exposed to tariff fluctuations.

Consequently, firms are intensifying efforts to develop domestically sourced or tariff-exempt alternatives, such as carbon-based nanomaterials and conductive polymers. These alternatives offer potential resilience against protectionist measures while presenting new technical challenges related to uniformity and large-area scalability. Additionally, vertical integration strategies are gaining momentum as stakeholders seek to internalize critical production steps and secure greater control over throughput and quality.

Global trade partners have responded with a mix of reciprocal tariffs and renewed free trade negotiations focused on technology-intensive goods. In parallel, collaborative consortia have formed to advocate for harmonized standards and to lobby for tariff waivers that recognize the essential role of transparent conductive films in broader digital infrastructure. As these developments unfold, the combined impact of protective measures and cooperative trade diplomacy is reshaping competitive dynamics and redefining pathways to cost-competitive, innovation-driven growth.

Unraveling Segment-Level Insights by Material, Substrate, Form Factor, Technology, Application, and End Use Industry Trends in Conductive Films

Insights into the transparent conductive films market are best gained through a multi-dimensional segmentation lens that encompasses material composition, substrate compatibility, form factor, deposition technology, application-specific requirements, and end use industry drivers. From a materials perspective, legacy indium tin oxide continues to anchor high-performance applications, but emerging contenders like carbon nanotubes and graphene are gaining traction for flexible and wearable electronics. Conductive polymers offer cost advantages in large-area coating, while silver nanowire architectures are prized for their robustness under mechanical stress.

Substrate choices play an equally critical role, with rigid glass remaining the substrate of choice for high-resolution displays, even as metal foils and plastic films unlock novel form factors for foldable devices. Flexible form factors themselves are a significant growth vector, driving demand for bendable and rollable displays that challenge traditional deposition processes. In response, technologies such as atomic layer deposition enable atomic-scale precision on complex geometries, whereas sputtering and chemical vapor deposition maintain their status as reliable methods for uniform, high-quality coatings.

Application segmentation reveals that touchscreens and flexible displays still represent the largest end-use segments, yet photovoltaics are emerging as a rapidly expanding arena-particularly in building-integrated systems and concentrated photovoltaic modules. In the industrial domain, specialized touch interfaces for human-machine interfaces have created niches around reliability and environmental resistance. Meanwhile, industries ranging from aerospace and defense to automotive and medical are integrating transparent conductive coatings to enhance performance, reliability, and aesthetic appeal across a diverse array of products.

This comprehensive research report categorizes the Transparent Conductive Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Substrate Type

- Form Factor

- Technology

- Application

- End Use Industry

Identifying Regional Nuances Driving Adoption Rates and Innovation Trends Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics are shaping distinct adoption patterns for transparent conductive films across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust demand from consumer electronics and growing solar installations have fueled investments in production capacity, particularly in the United States where policy incentives support domestic manufacturing. This environment has encouraged collaboration among local research institutions and private players, advancing both material development and pilot-scale manufacturing.

Across Europe, Middle East & Africa, regulatory emphasis on energy efficiency and smart infrastructure has driven interest in smart windows and building-integrated photovoltaics. The European Union’s Green Deal and related environmental mandates are incentivizing the deployment of transparent conductive coatings in construction projects, while Gulf Cooperation Council countries explore large-scale solar parks with integrated smart window installations to optimize building energy management.

Asia-Pacific stands out as the most dynamic arena, with major display manufacturers in South Korea and Japan leading high-volume production of both rigid and flexible films. China’s aggressive expansion into photovoltaic equipment and display panel manufacturing has resulted in significant capacity build-out, while emerging markets in India are beginning to adopt conductive films for both consumer electronics and renewable energy applications. Collectively, these regional nuances underscore the importance of tailored market strategies that address specific policy frameworks, infrastructure priorities, and supply chain configurations.

This comprehensive research report examines key regions that drive the evolution of the Transparent Conductive Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Innovation Focus, and Competitive Dynamics Among Leading Players in the Transparent Conductive Films Landscape

The competitive landscape of transparent conductive films is characterized by a blend of established specialty glass and materials corporations alongside agile technology startups. Leading players have bolstered their positions through strategic investments in R&D, focusing on alternative materials such as graphene and silver nanowires as well as novel deposition techniques to improve throughput and energy efficiency. Partnerships between equipment suppliers and material innovators have emerged as a key mechanism for accelerating time-to-market for next-generation coatings.

In parallel, several companies have pursued vertical integration, acquiring upstream raw material suppliers or downstream processing units to secure supply continuity and margin control. Patent activity remains high, with innovators protecting breakthroughs in film synthesis, surface functionalization, and scalable coating processes. These intellectual property portfolios are becoming critical differentiators as the market evolves toward more specialized application requirements.

Moreover, collaborative research initiatives between industry consortia and academic institutions are fostering pre-competitive ecosystems that address foundational challenges such as large-area uniformity and long-term durability under extreme environmental conditions. As a result, firms that combine targeted R&D investments with strategic alliances are best positioned to capture emerging opportunities and influence evolving industry standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transparent Conductive Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abrisa Technologies by HEF Group

- AccuCoat, Inc.

- AGC Inc.

- Agfa-Gevaert N.V.

- Applied Films Corporation

- Blue Nano, Inc.

- C3 Nano, Inc.

- Cambrios Film Solutions Corporation

- Canatu OY

- Chang Chun Plastics Co., Ltd.

- CHASM Advanced Materials, Inc.

- Cima NanoTech, Inc.

- Dai Nippon Printing Co., Ltd.

- DONTECH, INC.

- DuPont de Nemours, Inc.

- Eastman Kodak Company

- Eikos, Inc.

- Evaporated Coatings, Inc.

- Fujifilm Corporation

- GEOMATEC Co., Ltd.

- Gunze Limited

- H. L. Clausing, Inc.

- Iljin Display Co., Ltd.

- JTOUCH Corporation

- Kaneka Corporation

- Max Speciality Films Limited

- Merck KGaA

- Meta Materials Inc.

- Mogreat Technologies Co.,Ltd.

- Nano Cintech S.L.

- Nanogap Sub-Nanometric Materials S.L.

- NanoIntegris Technologies, Inc.

- Newport Industrial Glass, Inc.

- Nitto Denko Corporation

- Nuovo Film, Inc.

- OFILM Group Co., Ltd.

- OIKE & Co., Ltd.

- Panasonic Holdings Corporation

- Sekisui Chemical Co., Ltd.

- Showa Denko Materials Co., Ltd.

- Sumitomo Chemical Company, Limited

- TDK Corporation

- Teijin Limited

- ThinfIlms, Inc.

- Tokyo Ohka Kogyo Co., Ltd.

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Zytronic plc

Offering Strategic Imperatives for Industry Leaders to Navigate Tariff Headwinds, Embrace Technological Shifts, and Capitalize on Growth Opportunities

To thrive amid shifting trade policies, rapid technological evolution, and intensifying competition, industry leaders must undertake several strategic imperatives. First, diversifying raw material sources and forging flexible supply partnerships will mitigate exposure to tariff-induced cost volatility. By proactively identifying alternative material platforms and establishing dual sourcing arrangements, organizations can safeguard production continuity while capturing upside from emerging innovations.

Second, prioritizing investment in scalable deposition technologies-particularly those compatible with flexible substrates-will unlock growth in high-value segments such as wearables and foldable displays. Collaborating with equipment partners to co-develop customized roll-to-roll processes or atomic layer deposition systems can accelerate commercialization timelines and enhance product differentiation.

Third, aligning product development with sustainability goals and regulatory frameworks will strengthen market positioning. Implementing lifecycle assessments, optimizing energy consumption during manufacturing, and exploring recyclable substrate options will resonate with environmentally conscious end users and policy makers alike.

Finally, forging alliances across the value chain-through joint ventures, consortium memberships, or co-innovation platforms-will enable shared investment in pre-competitive research, expedite standardization efforts, and ultimately reduce time-to-market for next-generation transparent conductive solutions.

Detailing Rigorous Research Framework Incorporating Primary Interviews, Secondary Data, and Expert Validation to Ensure Robust Market Insights

This research leverages a dual-pronged methodology, integrating primary and secondary insights to ensure comprehensive coverage and rigorous validation. Primary research entailed structured interviews with key stakeholders, including material scientists, equipment manufacturers, and end users across major application sectors. These interviews provided firsthand perspectives on technology adoption hurdles, cost optimization strategies, and evolving performance requirements.

Secondary research complemented this qualitative foundation by synthesizing data from publicly available sources, peer-reviewed journals, patent databases, and industry white papers. Technical performance metrics and process parameters were cross-referenced with corporate disclosures and trade publications to corroborate emerging trends and substantiate observed shifts in material preferences.

Furthermore, the study employed a data triangulation approach, reconciling divergent insights through iterative analysis and expert panel reviews. This framework enabled the identification of consistent patterns and the isolation of outliers, thereby enhancing confidence in the resulting thematic conclusions. Finally, all findings underwent peer validation by an internal review board to ensure methodological soundness and impartiality, delivering actionable insights grounded in robust empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transparent Conductive Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transparent Conductive Films Market, by Material

- Transparent Conductive Films Market, by Substrate Type

- Transparent Conductive Films Market, by Form Factor

- Transparent Conductive Films Market, by Technology

- Transparent Conductive Films Market, by Application

- Transparent Conductive Films Market, by End Use Industry

- Transparent Conductive Films Market, by Region

- Transparent Conductive Films Market, by Group

- Transparent Conductive Films Market, by Country

- United States Transparent Conductive Films Market

- China Transparent Conductive Films Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Drawing Conclusive Perspectives on Key Market Forces, Technological Trajectories, and Strategic Considerations Shaping Conductive Film Innovations

In sum, the transparent conductive films sector is undergoing a pivotal transformation driven by technological breakthroughs, shifting trade policies, and evolving end-use demands. While legacy materials such as indium tin oxide continue to anchor established applications, alternative materials and novel deposition techniques are expanding the industry’s horizons toward flexible, sustainable, and high-performance solutions. Concurrently, tariff measures introduced in 2025 have underscored the strategic necessity of supply chain diversification and localized innovation.

Segment-level insights reveal that material composition, substrate flexibility, and application specificity will define winners and laggards in this competitive arena. Regional variations further emphasize the importance of tailored strategies that reflect policy landscapes and infrastructure capabilities across the Americas, Europe Middle East & Africa, and Asia-Pacific. Moreover, leading companies are distinguishing themselves through targeted R&D investments, strategic alliances, and vertical integration initiatives that secure intellectual property and supply security.

Looking forward, the industry’s trajectory will hinge on stakeholders’ ability to harmonize performance goals with sustainability imperatives, while leveraging collaborative ecosystems to accelerate technology maturation. By adopting the strategic imperatives outlined and staying attuned to emerging regional and application-driven dynamics, market participants can position themselves for sustained success in a rapidly evolving landscape.

Encouraging Direct Engagement with Associate Director Ketan Rohom to Access Comprehensive Transparent Conductive Films Market Intelligence

To gain comprehensive insights into the evolving transparent conductive films landscape and unlock strategic advantages, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure the full market research report. Ketan combines deep technical understanding with market acumen to help you navigate emerging opportunities and address critical challenges. Engage directly to discuss tailored solutions for your organization’s priorities and accelerate informed decision-making with the most up-to-date analysis available.

- How big is the Transparent Conductive Films Market?

- What is the Transparent Conductive Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?