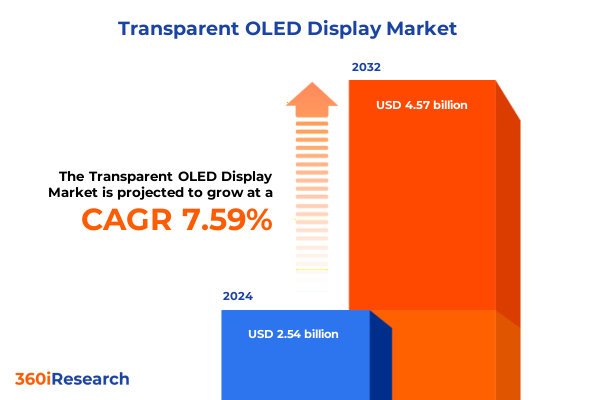

The Transparent OLED Display Market size was estimated at USD 2.72 billion in 2025 and expected to reach USD 2.92 billion in 2026, at a CAGR of 7.67% to reach USD 4.57 billion by 2032.

Exploring the Cutting-Edge Potential of Transparent OLED Technology to Transform User Experiences and Drive Innovation Across Visual Display Applications

Transparent organic light-emitting diode (OLED) technology represents a quantum leap in display innovation, enabling panels that can render vivid imagery while offering near-invisible transparency when not in use. By layering organic emissive materials between conductive substrates on ultrathin transparent electrodes, engineers have created displays that combine the hallmarks of OLED performance-high contrast, wide color gamut, fast response times and flexibility-with the ability to integrate seamlessly into glass surfaces. This convergence of aesthetics and functionality positions transparent OLED as a medium that transcends traditional display boundaries, delivering visually stunning, context-aware applications in public and private environments.

This technology has captured the attention of diverse stakeholder groups, from architectural firms envisioning windows that double as digital canvases to automotive manufacturers exploring immersive head-up display systems. Beyond static glass displays, transparent OLED supports creative form factors, including curved and free-shape implementations, opening the door to advertising installations that blend art and information with ergonomic consumer devices that preserve design minimalism. As engineering breakthroughs drive transparency levels above 40 percent without sacrificing luminance, the industry is witnessing the emergence of use cases previously deemed impractical.

Consumer and enterprise demand for engaging, space-efficient, and responsive interfaces underpins transparent OLED’s growing relevance. Early adopters report that the technology enhances user engagement through its novelty and intuitive integration with environments. Looking ahead, further material research and manufacturing scale-ups promise to accelerate deployments, enabling transparent OLED to transition from niche showcase installations to mainstream solutions across sectors.

Identifying the Key Technological and Market Shifts Steering Transparent OLED Displays Toward Unprecedented Adoption and Performance

The transparent OLED landscape has undergone a profound metamorphosis in recent years, fueled by advances in both materials science and fabrication processes. Key breakthroughs in organic emissive compounds have delivered enhanced charge mobility and stability, enabling panels to operate reliably at higher luminance levels. Simultaneously, the refinement of transparent conductive oxides and ultrathin encapsulation techniques has mitigated degradation pathways, pushing device lifetimes beyond the thresholds required for commercial deployments.

Equally transformative are the manufacturing innovations that have reduced production costs while improving yield. High-volume deposition methods, such as roll-to-roll printing of organic layers and laser patterning for high precision, have brought economies of scale within reach. These process optimizations not only drive down per-unit costs but also expand panel size capabilities, accommodating large-format displays for retail signage and architectural applications without compromising uniformity or transparency.

Beyond the factory floor, shifts in end-user expectations and complementary technology trends have elevated demand for transparent OLED. The convergence of augmented reality frameworks, Internet of Things platforms and smart city initiatives has created high-value applications that rely on integrated displays. Automotive and transportation sectors, in particular, are embracing transparent OLED for next-generation cockpit interfaces, as adaptive head-up systems deliver contextually relevant information without obstructing driver sightlines.

In parallel, environmental and regulatory standards around energy efficiency and material sustainability are steering R&D efforts toward biodegradable substrates and low-power architectures. This alignment between innovation and responsibility ensures that transparent OLED not only meets performance criteria but also resonates with broader societal imperatives around resource stewardship.

Assessing How United States Trade Policies and Tariff Adjustments in 2025 Are Reshaping the Economics of Transparent OLED Display Supply Chains

In April 2025, the United States implemented a significant escalation in "reciprocal tariffs" on Chinese origin goods, raising the levy to 125 percent in addition to pre-existing Section 301 and IEEPA tariffs. This measure effectively layered punitive duties on a broad array of imports, encompassing critical components such as display materials and modules, and amplified the total tariff burden to 170 percent on many product categories.

Following diplomatic negotiations in Geneva, a mutual tariff reduction agreement announced on May 12, 2025 temporarily lowered the reciprocal tariff on Chinese-origin inputs to 10 percent for 90 days, while preserving all baseline Section 301 duties ranging from 7.5 percent to 25 percent and existing fentanyl-related IEEPA duties at 20 percent. Despite this 90-day respite, the underlying structure of layered tariffs remains intact, signaling sustained cost pressures for manufacturers reliant on cross-border supply chains.

The compounded effect of these duties has driven component-level cost increases upward of 30 to 55 percent for display materials and touchscreen assemblies, while printed circuit boards have experienced 25 to 45 percent higher landed costs. Connectors and passive elements exhibit tariff-driven price impacts of 20 to 40 percent, intensifying expense volatility across the value chain. As a result, companies report an average reduction in gross margins of 3 to 5 percent, with an estimated 60 to 85 percent of incremental tariff costs ultimately being passed through to end customers.

Revealing Critical Insights from Diverse Segmentation Criteria to Illuminate Opportunities Within the Transparent OLED Display Market Landscape

An in-depth segmentation analysis reveals that the transparent OLED market’s complexity is rooted in panel-type differentiation, display-size variation, application diversity and distribution channel dynamics. Within the panel-type domain, bottom-emission designs offer high transparency yet face brightness constraints, while dual-emission architectures balance luminance and clarity. Top-emission modules, in contrast, prioritize peak brightness at the expense of reduced see-through ability, tailoring performance to contexts where ambient light is elevated.

Display size further influences market positioning: large-format screens capture attention in retail windows and outdoor signage, medium sizes cater to hospitality and smart home interfaces, and compact panels integrate seamlessly into wearable devices and consumer electronics. These size segments inform manufacturing roadmaps and capital investment decisions, as production tooling for wide-area deposition diverges from the precision tooling required for micro-module assembly.

Application segmentation unlocks specialized value propositions. Automotive display offerings encompass head-up systems that project critical data onto windshields, infotainment clusters for real-time navigation and multimedia experiences, and passenger entertainment displays. Commercial advertising spans digital billboards, interactive signage, retail point-of-sale displays and immersive video walls. Consumer electronics applications include transparent laptops, smartphones, tablets and wearables, while healthcare displays refine patient monitoring interfaces, high-resolution medical imaging and surgical display solutions. Smart home implementations feature home automation panels embedded in architectural glass, security system touchpoints and smart mirrors that deliver contextual information overlays.

Distribution channel analysis shows that traditional offline networks drive large-scale B2B and enterprise installations with value-added reseller support, whereas online avenues facilitate direct-to-consumer sales, customizable configurations and rapid prototyping services. Together, these segmentation criteria create a multi-dimensional market landscape where targeted strategies optimize reach and resource allocation.

This comprehensive research report categorizes the Transparent OLED Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Panel Type

- Display Size

- Application

- Distribution Channel

Uncovering Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific for Transparent OLED Innovation Adoption

Across the Americas, the United States leads transparent OLED adoption, leveraging strong partnerships between display integrators and automotive OEMs, alongside an ecosystem of smart–building developers. Canada supports pilot deployments in retail and cultural institutions, while Latin American markets remain in early stages, focusing on premium signage and experiential marketing in urban centers. Overall, favorable regulatory frameworks for energy-efficient technologies and government incentives for advanced manufacturing continue to underpin investments in North America.

In Europe, the Middle East and Africa, demand is driven by high-visibility applications in luxury retail, transportation hubs and public art installations. Western European nations emphasize strict compliance with environmental standards, pushing suppliers to adopt sustainable materials. The Middle East’s investment in landmark projects fuels large-scale transparent OLED installations in flagship venues. Meanwhile, African markets exhibit nascent interest, often importing turn-key solutions for digital signage in hospitality and telecommunications sectors, laying the groundwork for sustained regional growth.

Asia-Pacific remains a pivotal force, with Korea and Japan advancing core technologies through deep R&D investments and robust patent portfolios. Chinese manufacturers exert cost leadership by scaling capacity at major fabrication facilities, while India’s emerging ecosystem trials localized production and integration. Southeast Asian economies, buoyed by governmental industrial initiatives, attract investments in joint manufacturing ventures. Collectively, these dynamics create a regional mosaic where local policy, supply base proximity and end-user demand converge to accelerate transparent OLED deployments.

This comprehensive research report examines key regions that drive the evolution of the Transparent OLED Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Roles and Competitive Differentiators of Leading Innovators in the Fast-Evolving Transparent OLED Display Ecosystem

LG Display continues to set benchmarks with its high-transparency OLED panels, forging strategic alliances with leading automotive brands and retail conglomerates. Emphasis on flexible form factors and durability has positioned the company to address both exterior architectural glass surfaces and dynamic in-vehicle city mapping projections.

Samsung Display complements its flexible OLED expertise with transparent modules optimized for wearables and smart appliances. Its extensive patent portfolio safeguards innovations in polymer and phosphorescent emissive layers, while ongoing collaborations with consumer electronics OEMs accelerate integration into next-generation smartphones and interactive home devices.

BOE Technology has emerged as a formidable competitor, leveraging scale-economics to offer cost-competitive transparent displays in the signage sector. Backed by supportive government policies, BOE’s investments in larger substrate lines and vertical integration of raw materials supply provide resilience against tariff-induced cost fluctuations.

Niche players such as Visionox and Tianma specialize in microdisplay solutions tailored to augmented reality head-mounted displays and precision head-up modules. Their partnerships with chip manufacturers and technology incubators enable rapid iteration of prototype designs, positioning them as agile innovators within highly specialized market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transparent OLED Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AU Optronics

- BOE Technology Group Co., Ltd.

- Konica Minolta, Inc.

- LG Display Co., Ltd.

- Panasonic Corporation

- Samsung Display Co., Ltd.

- Sharp Corporation

- Sony Group Corporation

- Tianma Microelectronics Co., Ltd.

- Truly International Holdings Limited

- Visionox Technology Inc.

Defining Actionable Strategic Initiatives for Industry Leaders to Capitalize on Transparent OLED Display Advancements and Strengthen Market Positioning

Industry leaders should prioritize research and development investments that push the transparency-luminance boundary further. By materially optimizing emissive and conductive layers, organizations can deliver panels that simultaneously meet the high-visibility requirements of commercial signage and the clarity demands of automotive head-up displays. Piloting collaborative R&D consortia can expedite breakthroughs while diffusing development costs across multiple stakeholders.

Building robust partnerships across the supply chain-from specialty glass suppliers to system integrators-will enhance resilience against component shortages and quality variances. Shared innovation frameworks with material chemistry experts and encapsulation technology providers can streamline paths from prototype to mass production, ensuring rapid time to market.

To mitigate tariff exposure, companies are advised to diversify manufacturing footprints into regions with trade-friendly agreements, such as Southeast Asia or Mexico. Establishing alternate sourcing corridors for key inputs like substrates, encapsulation films and driver ICs will reduce single-region dependence and buffer against abrupt policy shifts.

Go-to-market strategies should align with the most lucrative segments, leveraging transparent OLED’s value proposition in experiential retail, safety-critical automotive interfaces and immersive architectural applications. Integrating digital services, such as content management platforms and analytics, can create recurring revenue models that complement hardware sales.

Embracing sustainability by adopting circular design principles and energy-efficient operation not only meets regulatory expectations but also differentiates brands in an increasingly eco-conscious buying environment. Transparent OLED solutions that offer low-power standby modes, recyclable components and reduced packaging footprint will resonate with end users and procurement officers alike.

Detailing the Rigorous Multi-Method Research Framework Employed to Deliver Comprehensive and Reliable Insights on Transparent OLED Display Market Trends

This research utilizes a comprehensive multi-method framework combining primary and secondary data sources. Extensive interviews were conducted with technology officers, product managers and supply chain directors across panel manufacturers, system integrators and end-users to capture qualitative insights on innovation drivers and operational challenges.

Secondary research encompassed a rigorous review of scientific literature, patent filings, regulatory documents and industry whitepapers to map technological trajectories and benchmark performance metrics. Financial reports and corporate disclosures were analyzed to understand investment patterns and capacity expansions.

Quantitative analysis employed both top-down and bottom-up modeling approaches to validate market dynamics. Macro-economic indicators, trade statistics and industry shipment data were synthesized to contextualize growth drivers, while proprietary survey results provided nuanced views of adoption rates and purchasing criteria.

Segmentation was conducted using four key dimensions-panel type, display size, application and distribution channel-to ensure granularity in opportunity identification. Regional mapping incorporated the Americas, EMEA and Asia-Pacific, capturing local market drivers and regulatory influences.

Tariff impact assessment drew upon official government publications, trade agreement fact sheets, and consultations with international trade experts. All data points underwent triangulation against at least two independent sources to ensure reliability and accuracy of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transparent OLED Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transparent OLED Display Market, by Panel Type

- Transparent OLED Display Market, by Display Size

- Transparent OLED Display Market, by Application

- Transparent OLED Display Market, by Distribution Channel

- Transparent OLED Display Market, by Region

- Transparent OLED Display Market, by Group

- Transparent OLED Display Market, by Country

- United States Transparent OLED Display Market

- China Transparent OLED Display Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Takeaways and Implications from Transparent OLED Innovations to Guide Decision-Making and Future Strategic Directions

Transparent OLED displays represent a convergence of material science innovations, production efficiencies and evolving user expectations. Technological shifts have elevated transparency levels while balancing luminance requirements, ensuring that the medium is suitable for critical applications ranging from automotive head-up systems to high-impact commercial signage. Manufacturing advancements have further lowered barriers to scale, enabling cost structures that support broader deployment.

However, the 2025 tariff landscape has introduced new cost dynamics, with layered duties on Chinese-origin components driving material prices higher and compressing supply-chain margins. While temporary tariff relief agreements offer short-term reprieve, sustained strategic planning is necessary to navigate persistent trade uncertainties and maintain competitive pricing.

A holistic view of segmentation reveals diverse entry points and growth pathways: panel-type and size considerations determine technical specifications, application categories dictate value-chain partnerships and distribution channels shape go-to-market models. Regional distinctions underscore the importance of aligning strategies with local regulatory frameworks, supply-base proximities and end-user readiness.

Key market participants are leveraging differentiated strengths in R&D, production scale-economics and niche microdisplay innovations to secure leadership positions. Their strategic initiatives underscore the value of cross-industry collaboration, agile supply-chain management and sustainability focus.

Ultimately, transparent OLED’s trajectory is defined by its ability to deliver immersive, context-aware interfaces. Companies that combine innovation excellence with proactive risk mitigation and targeted market strategies will be best positioned to capitalize on this transformative display technology.

Drive Strategic Action and Secure Exclusive Market Intelligence with Personalized Support from Associate Director of Sales and Marketing

If you are ready to harness deep insights and tailor a strategic roadmap for transparent OLED display innovations, contact Ketan Rohom for a personalized consultation and exclusive access to the comprehensive market research report. With a robust understanding of evolving technologies, tariff impacts, segmentation nuances, and regional dynamics, this report will equip your organization to make data-driven decisions and secure competitive advantage. Ketan Rohom, Associate Director of Sales & Marketing, is available to discuss custom deliverables, address specific business challenges, and guide you through a seamless acquisition process. Reach out today to unlock the full potential of transparent OLED displays and drive your strategic initiatives forward.

- How big is the Transparent OLED Display Market?

- What is the Transparent OLED Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?