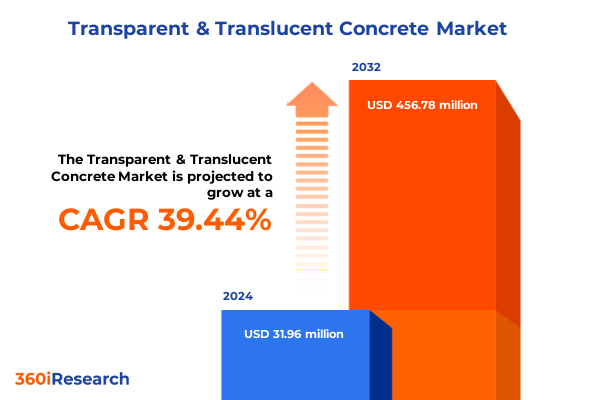

The Transparent & Translucent Concrete Market size was estimated at USD 44.34 million in 2025 and expected to reach USD 63.61 million in 2026, at a CAGR of 39.53% to reach USD 456.77 million by 2032.

Exploring the Emergence and Advantages of Transparent and Translucent Concrete as a Revolutionizing Architectural Material in Modern Construction

Transparent and translucent concrete represents a breakthrough in material science that merges traditional cementitious properties with embedded light-transmitting elements. By integrating optical fibers or photoluminescent additives into a concrete matrix, this innovative material enables structures to convey natural or artificial light through solid surfaces. This intersection of form and function expands design possibilities, transforming walls, floors, facades, and furnishings into luminous canvases.

Over the past decade, advances in fiber optic technology and photoluminescent compounds have dramatically improved translucency levels, allowing architects and engineers to achieve desirable aesthetics without sacrificing structural integrity. These improvements have been driven by a growing appetite for sustainable building solutions that reduce energy consumption through passive lighting while maintaining the durability and load-bearing capacity of conventional concrete. As a result, transparent and translucent concrete has evolved from a novel concept to a viable material choice for high-profile architectural and infrastructural projects.

In this executive summary, we explore the foundational principles behind transparency in cementitious composites, assess the key drivers accelerating adoption, and consider the challenges that must be addressed to realize widespread market penetration. We place particular emphasis on how the convergence of technological innovation, design sensibilities, and regulatory frameworks is shaping the trajectory of this emerging category within construction materials.

Identifying Pivotal Technological, Environmental, and Design-Driven Transformations Reshaping the Transparent and Translucent Concrete Market Landscape

The transparent and translucent concrete market is undergoing transformative shifts propelled by the convergence of design-driven innovation, environmental imperatives, and supply chain reconfiguration. On the design front, creative professionals are increasingly leveraging translucency to craft immersive spatial experiences that blur the boundary between light and structure. High-performance optical fibers and novel photoluminescent aggregates are enabling more consistent light diffusion, empowering designers to incorporate seamless luminous surfaces into building envelopes and interior elements.

Environmental considerations are also reshaping the landscape, as stakeholders pursue materials that mitigate carbon footprints and optimize energy efficiency. Passive lighting enabled by translucent concrete reduces reliance on artificial illumination, supporting sustainable building certifications and tightening regulatory standards. This trend intersects with the rise of circular economy principles, as manufacturers explore recycled glass and industrial byproducts to serve as photoluminescent media or aggregate substitutes, thereby minimizing raw material consumption.

Simultaneously, supply chain disruptions have spurred the localization of production capabilities, prompting strategic partnerships between material innovators and regional precast operators. These alliances facilitate timely delivery, cost containment, and enhanced quality control. As these dynamics accelerate, the transparent and translucent concrete sector is evolving from early-stage experimentation to a more mature ecosystem defined by standardized offerings, streamlined logistics, and an expanding range of application-specific solutions.

Assessing the Cumulative Repercussions of 2025 United States Tariffs on Transparent and Translucent Concrete Supply Chains and Industry Dynamics

In 2025, the United States implemented consolidated tariffs on imported cementitious composites and specialized optical fibers, prompting a reevaluation of sourcing strategies and cost structures within the transparent and translucent concrete market. These measures were introduced to protect domestic producers of advanced construction materials and encourage local manufacturing expansion. As import duties increased, companies faced heightened input costs, compelling them to seek alternative suppliers or invest in domestic production capabilities.

The immediate effect of the tariff adjustments was a notable shift in procurement behavior. Original equipment manufacturers and precast fabricators expedited partnerships with regional optical fiber producers and photoluminescent compound suppliers to mitigate supply chain risk. Concurrently, investment in in-situ casting techniques gained traction, as on-site integration eliminates cross-border freight expenses and reduces exposure to tariff volatility. These adaptations have fostered closer collaboration among local cement producers, specialized additive developers, and architectural firms seeking resilient supply chains.

Looking ahead, the cumulative impact of these policies is likely to recalibrate competitive positioning within the sector. While short-term cost pressures remain inevitable, the emphasis on localized production is expected to yield downstream benefits, including reduced lead times, lower environmental footprints, and greater regulatory compliance. Ultimately, the tariff-driven realignment underscores the strategic importance of agility and vertical integration in maintaining cost efficiency and market responsiveness.

Uncovering Critical Product, Application, End Use, and Distribution Channel Dimensions Driving the Transparent and Translucent Concrete Market Segmentation Landscape

Transparent and translucent concrete exhibits marked differentiation when evaluated across product configurations, reflecting distinct performance characteristics and installation methods. Within cast in situ solutions, fiber optic variants deliver high-intensity light transmission and precision routing capabilities, whereas photoluminescent formulations offer passive glow-in-the-dark effects suited for wayfinding applications. Precast outputs manifest in blocks that facilitate rapid wall assembly, panels that integrate seamlessly into modular facades, and tile systems that lend themselves to decorative accents on floors and furniture surfaces.

Diverse application contexts further shape material selection and processing techniques. Facade installations may either adopt non-ventilated monolithic panels to maximize light diffusion or employ ventilated rainscreen systems to optimize thermal performance. Flooring solutions leverage translucent exterior tiles to create illuminated pathways in public spaces, while interior variants capitalize on integrated lighting effects for dramatic ambiance. Furniture designers increasingly harness translucent concrete in chairs and tables, embedding fibers for accent lighting, and they exploit decorative formulations to evoke distinct sensory experiences.

End-use sectors underscore where the material’s unique attributes deliver greatest value. Commercial environments such as hospitality venues incorporate luminous panels for immersive guest experiences, and office spaces apply translucent partitions to balance openness with privacy. Industrial facilities utilize photoluminescent markers in manufacturing zones and warehousing aisles for safety enhancement. Infrastructure projects, including bridges and sound barriers, highlight translucent inserts to improve nighttime visibility and aesthetic integration, while residential applications embrace lightweight tile products for decorative interior enhancements.

The distribution landscape accommodating these offerings spans direct sales channels for bespoke project requirements and online origins that facilitate streamlined procurement. Manufacturer websites serve as educational hubs for specifiers seeking performance data and case studies, whereas third-party e-commerce platforms support repeat orders of standard tile and panel formats.

This comprehensive research report categorizes the Transparent & Translucent Concrete market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Distribution Channel

- Application

- End Use

Examining Key Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific Influencing Transparent and Translucent Concrete Adoption Patterns

Regional dynamics exert a profound influence on the adoption trajectory of transparent and translucent concrete, as climatic conditions, regulatory regimes, and design preferences diverge across global markets. In the Americas, robust infrastructure spending and architecture trends favoring immersive lighting experiences have fostered early adoption of exterior facade panels and pedestrian walkways illuminated by embedded fibers. North American building codes increasingly recognize photoluminescent aggregates as safety features for egress pathways, reinforcing demand among commercial and institutional clients.

Across Europe, the Middle East, and Africa, sustainability mandates and high-profile architectural projects serve as catalysts. European municipalities with stringent energy performance targets are integrating translucent concrete in retrofits to reduce lighting loads, while Middle Eastern developers in resort destinations leverage vibrant glow-in-the-dark tile installations to enhance nighttime allure. In Africa, infrastructural investments in bridges and noise barriers incorporate translucent elements to convey design innovation, albeit adoption rates vary with access to specialized raw material supplies.

The Asia-Pacific region remains the fastest-growing frontier, driven by rapid urbanization, expanding hospitality sectors, and government-led smart city initiatives. Metropolitan centers in East Asia demonstrate a keen interest in fiber optic-infused facades for iconic skyscrapers, and Southeast Asian municipalities incorporate photoluminescent markers in public transit hubs to bolster safety and wayfinding at reduced energy consumption. Regional precast operators have scaled up localized production to meet surging demand, illustrating how dynamic market forces and policy frameworks converge to shape material innovation across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Transparent & Translucent Concrete market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Profiles and Competitive Positioning of Leading Players Shaping the Transparent and Translucent Concrete Industry Landscape

Leading organizations in the transparent and translucent concrete domain are distinguished by their integrated material expertise, proprietary light-transmission technologies, and strategic collaborations with architectural firms. A number of pioneering manufacturers have expanded beyond traditional cement blending to co-develop specialty optical fibers that optimize luminous performance while preserving structural cohesion. These partnerships often extend into funded R&D initiatives that explore next-generation photoluminescent chemistries targeting extended afterglow durations and enhanced color stability.

Complementing material innovators, select precast fabricators have invested in automated casting systems capable of embedding fiber arrays with precise spatial orientation. By aligning production capabilities with digital design platforms, these fabricators deliver bespoke panels and tiles that meet exacting aesthetic and performance specifications. Meanwhile, distributors focused on digital channels have introduced configurators and virtual showrooms to facilitate pre-purchase visualization, thereby reducing specification errors and accelerating procurement cycles.

Service providers specializing in testing and certification also play a pivotal role, particularly in validating compliance with international standards for light transmission, fire resistance, and load-bearing capacity. By offering turnkey validation services, these laboratories ensure product reliability and expedite project approvals. Collectively, this ecosystem of material developers, precast operators, digital platforms, and certification partners defines a competitive landscape characterized by innovation, collaboration, and increasing value-added services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Transparent & Translucent Concrete market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Beton Broz

- Butong AB

- CRE Panel GmbH

- Dupont Lightstone

- Fapinex LLC

- Florack Bauunternehmung GmbH

- Glas Beton GmbH

- Gravelli

- Italcementi SpA

- Laticrete International, Inc.

- LCT GmbH

- LiTraCon Oy

- Luccon

- LUCEM GmbH

- Pan-United Corporation Ltd.

- Stylepark AG

Strategic Action Plan for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Transparent and Translucent Concrete Markets

To capitalize on emerging opportunities in transparent and translucent concrete, industry stakeholders should prioritize integrated innovation models that unite material science with digital design workflows. Establishing cross-functional teams devoted to co-developing next-generation fiber optic and photoluminescent composites will accelerate product differentiation and secure first-mover advantages in target segments such as hospitality and smart infrastructure.

Furthermore, firms must reinforce supply chain resilience by forging partnerships with regional raw material suppliers and precast fabricators. Localizing production of key additives and standard panel formats diminishes exposure to import tariffs and logistical disruptions while enabling faster response times to client demands. Concurrently, expanding digital sales channels through immersive configurators and virtual prototyping tools enhances customer engagement and streamlines specification processes.

Investing in sustainability credentials and third-party certifications is equally essential. Demonstrating compliance with energy efficiency, circular economy, and fire safety standards elevates material credibility among architects and regulators. Collaborative pilot projects that document performance outcomes in real-world settings will strengthen the evidence base for broader adoption.

By aligning strategic R&D, localized production, digital engagement, and sustainability validation, industry leaders can drive the next wave of growth in transparent and translucent concrete markets and secure a lasting competitive edge.

Detailing the Comprehensive Research Framework, Data Collection Techniques, and Analytical Approaches Utilized to Evaluate Transparent and Translucent Concrete Markets

This research initiative combined primary and secondary data collection methodologies to construct a holistic view of the transparent and translucent concrete landscape. Primary insights were gathered through in-depth interviews with architects, material scientists, precast manufacturers, and regulatory experts across key geographies. These direct consultations provided qualitative perspectives on performance requirements, adoption drivers, and supply chain dynamics.

Secondary research encompassed an extensive review of technical whitepapers, patent databases, construction standards, and academic publications related to fiber optics and photoluminescent aggregates. Regional policy documents and building codes were analyzed to assess the evolving regulatory environment, while trade publications and specialized forums illuminated case studies of high-profile installations.

The analysis framework integrated segmentation lenses-product type, application, end use, and distribution channel-to identify nuanced market pockets and growth vectors. Cross-regional comparisons were conducted to highlight how climate considerations, sustainability mandates, and infrastructure spending patterns influence adoption rates. Finally, competitive mapping and value chain assessments were performed to delineate strategic partnerships and innovation hotspots.

By synthesizing qualitative insights with technical documentation, this comprehensive approach ensures that the findings reflect both the current state and the prospective trajectory of transparent and translucent concrete innovations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Transparent & Translucent Concrete market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Transparent & Translucent Concrete Market, by Product

- Transparent & Translucent Concrete Market, by Distribution Channel

- Transparent & Translucent Concrete Market, by Application

- Transparent & Translucent Concrete Market, by End Use

- Transparent & Translucent Concrete Market, by Region

- Transparent & Translucent Concrete Market, by Group

- Transparent & Translucent Concrete Market, by Country

- United States Transparent & Translucent Concrete Market

- China Transparent & Translucent Concrete Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings to Illuminate the Future Trajectory and Strategic Imperatives for Stakeholders in the Transparent and Translucent Concrete Sector

Transparent and translucent concrete has transitioned from a conceptual novelty to a material with demonstrable performance and aesthetic advantages. The convergence of advanced fiber optic technologies, photoluminescent chemistries, and sustainable design mandates underpins its growing relevance in architecture and infrastructure. Regional dynamics and policy shifts-particularly tariff realignments-have further influenced sourcing strategies and production localization.

Segmentation analysis reveals that distinct product configurations, application contexts, and end-use sectors each present unique pathways to value creation. Distribution models that leverage both direct sales for high-end projects and online platforms for standardized offerings enable comprehensive market coverage. Leading players have responded by forging collaborative R&D partnerships, investing in automated precast systems, and deploying digital engagement tools, thereby enriching the ecosystem with enhanced capabilities.

Looking ahead, the material’s ability to merge structural performance with embedded illumination positions it as a solution for next-generation smart buildings, resilient infrastructure, and experiential design. Stakeholders must maintain agility in innovation, supply chain management, and regulatory compliance to fully harness the transformative potential of transparent and translucent concrete. The insights presented herein offer a roadmap for strategic decision-making, emphasizing the integration of technical excellence, sustainability credentials, and customer-centric engagement strategies.

Engage with Ketan Rohom, Associate Director of Sales and Marketing to Secure Your Comprehensive Report on Transparent and Translucent Concrete Market Insights

To access a definitive resource that delves deeply into the market forces, competitive trends, and strategic imperatives shaping transparent and translucent concrete today, reach out to Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings a nuanced understanding of industry dynamics and can guide you through the tailored insights contained within this comprehensive report. By engaging with Ketan Rohom, you will gain exclusive clarity on the evolving material innovations and regulatory landscapes that influence project outcomes across global markets.

This report equips decision-makers with the actionable intelligence necessary to optimize material selection, streamline supply chain considerations, and align product development with emerging design trends. Whether you are a manufacturer seeking to refine your R&D roadmap or an architectural firm aiming to leverage translucency for aesthetic differentiation, Ketan Rohom can facilitate the acquisition process and ensure you receive timely, customized support.

Secure your copy today to harness the full spectrum of transparent and translucent concrete insights that will inform strategic planning, foster competitive advantage, and drive future-ready innovation. Contact Ketan Rohom to transform data into strategic action and elevate your organization’s market positioning in this dynamic materials domain.

- How big is the Transparent & Translucent Concrete Market?

- What is the Transparent & Translucent Concrete Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?