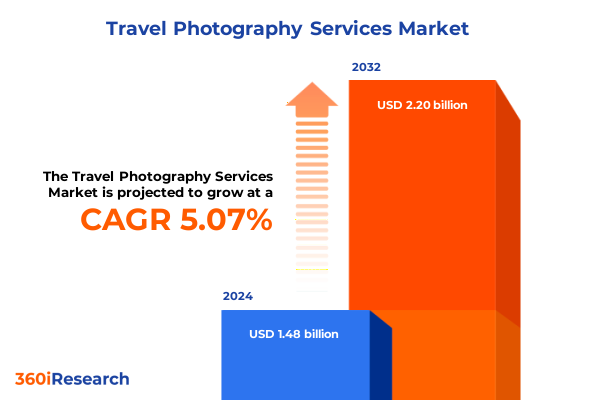

The Travel Photography Services Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 8.00% to reach USD 2.27 billion by 2032.

Exploring the Ever-Evolving World of Travel Photography Services from Content Creation to Immersive Visual Storytelling Across Global Journeys

The world of travel photography services has become integral to experiential storytelling and brand marketing. Social media now acts as a travel planning tool, with platforms like TikTok and Instagram serving as modern travel agents by offering destination inspiration and direct booking recommendations, reshaping how photography services align with consumer journeys.

Amid this digital transformation, the role of professional photographers has expanded beyond capturing scenic vistas. Personalized consultations, on-location expertise, and curated post-production offerings have garnered a preference among modern travelers; reports note that clients engaging in face-to-face viewing appointments realize higher satisfaction and repeat bookings, underscoring the growing demand for bespoke visual experiences in both personal vacation shoots and commercial campaigns.

Embracing Technological, Cultural, and Social Media Transformations Driving the Future of Travel Photography Services Worldwide

Advancements in imaging technology are revolutionizing the travel photography landscape. Drone platforms equipped with 8K capture capabilities and intelligent tracking features offer entirely new vantage points, while emerging 3D cameras deliver immersive panoramas that enhance the emotional resonance of travel narratives. Concurrently, artificial intelligence tools streamline post-production workflows, enabling photographers to focus on creative vision while automated culling and editing accelerate delivery timelines.

Social media trends continue to redefine service delivery models. Short-form videos on platforms such as Instagram Reels and TikTok have become primary engagement drivers, prompting providers to integrate micro-influencer collaborations and interactive content into their offerings. This shift towards authentic, bite-sized storytelling has encouraged brands to forge deeper connections with niche audiences and deliver highly personalized visual experiences that resonate long after a trip concludes.

Sustainability and experiential authenticity are now core expectations among discerning travelers. Eco-conscious customers seek services that demonstrate carbon-neutral practices and community support, driving providers to develop green itineraries and highlight responsible travel credentials. At the same time, demand for local immersion experiences has surged, with bespoke workshops and behind-the-scenes cultural sessions forming a competitive advantage for service operators committed to environmental stewardship and meaningful engagement.

Unpacking the Multifaceted Impact of 2025 United States Import Tariffs on Travel Photography Equipment, Services, and Supply Chains

The April 2025 U.S. import tariff regime has introduced a baseline 10% levy on all photographic equipment, with elevated rates on select countries that sharply increase the landed cost of cameras, lenses, drones, and accessories. Industry leaders report sudden price spikes of up to 50% for gear sourced outside the United States, compelling both retailers and rental houses to recalibrate pricing models and navigate acute supply chain disruptions.

Equipment rental providers face particular challenges in maintaining inventory levels and competitive rates. Companies that formerly relied on cross-border sourcing have grappled with unpredictable tariff adjustments and material shortages, leading to service delays and reservation cancellations. Smaller operators invested in stockpiling components ahead of tariff implementation, but many now confront the limitations of finite storage capacity and inflated carrying costs, triggering a reevaluation of make-versus-rent business models.

Rising import costs are cascading through the value chain, compelling brands and agencies to execute selective price increases rather than blanket hikes. As retailers such as Shein and major automotive suppliers have demonstrated, "surgical" pricing strategies mitigate consumer backlash while preserving margins. Meanwhile, tourism businesses note that additional lodging and meal surcharges driven by higher import duties may further dampen inbound travel demand, necessitating nimble pricing strategies and enhanced value communications to maintain customer loyalty.

Gaining Deep Insights into Service, Product, Category, Duration, Use Case, Booking and Customer Type Segmentation Dynamics in Travel Photography

Travel photography services encompass a diverse array of offerings. Clients can commission bespoke content creation tailored to digital campaigns, or access equipment rental solutions that include cameras, drones, lenses, and lighting kits. Personalized events such as weddings and corporate retreats sit alongside photo tours and immersive workshops designed to cultivate technical skills and local knowledge, forming a multifaceted service spectrum for providers.

Product portfolios extend across digital and physical formats. Service providers distribute customizable editing presets and LUTs, grant access to secure online galleries, and deliver raw or retouched image files per client specifications. Simultaneously, tangible merchandise including branded apparel, fine art prints, framed canvases, and bespoke photo books enhances emotional resonance and offers additional revenue streams.

Category segmentation distinguishes between shooting services, delivering on-location capture expertise, and after-sales engagements covering archival and storage, digital hosting, and post-production editing. This bifurcation ensures end-to-end solutions that satisfy both technical and creative client requirements.

The temporal dimension of offerings spans single-day excursions for quick portfolio shoots, extended multi-day photographic voyages for immersive exploration, and ongoing subscription models delivering fresh content or gear access on a recurring basis. These flexible duration structures support a wide range of customer needs.

Use-case scenarios bifurcate into commercial assignments-corporate photoshoots, resort imagery, influencer collaborations, lifestyle campaigns, real estate and tourism marketing content-and personal experiences such as engagement sessions, graduation or celebration trips, honeymoon portraits, social media blogs, and vacation memory documentation.

Booking channels encompass direct arrangements, online portals via mobile applications and websites, strategic social media promotions, and traditional travel agency partnerships, ensuring comprehensive market coverage. Finally, customer profiles range from corporate clients requiring brand storytelling to couples and families seeking personal milestones, event planners orchestrating experiential engagements, and influencers or content creators building dedicated audiences.

This comprehensive research report categorizes the Travel Photography Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Product

- Category

- Duration

- Use Cases

- Booking Platform

- Customer Type

Revealing Regional Dynamics and Growth Patterns for Travel Photography Services in the Americas, Europe Middle East Africa and Asia Pacific

In the Americas, shifting trade policies and heightened equipment costs have produced a nuanced dynamic. The United States and Canada have seen declines in international visitor bookings following tariff announcements, yet a parallel surge in domestic demand for memory-making services has prompted providers to tailor packages for local travelers and road-trip experiences. This pivot underscores a resilience driven by adaptive service models and regional marketing initiatives.

Europe, the Middle East, and Africa showcase a strong appetite for boutique and luxury photography workshops. Heritage cities such as Paris and Rome remain top destinations for global travelers seeking curated photoshoots, prompting marketplaces to expand their networks of local photographers. Meanwhile, emerging markets across the Middle East and North Africa are witnessing increased investments in experiential tourism, elevating demand for specialized event-based photography that captures cultural festivals and high-end resort experiences.

Asia-Pacific continues to lead in technological adoption, with drone and mirrorless camera services rapidly gaining traction. Countries like Japan and Australia host advanced training tours that leverage cutting-edge gear, while Southeast Asian operators bundle eco-tourism photography experiences with sustainability education. This region’s emphasis on innovation and environmental consciousness has driven differentiated offerings that blend high-definition capture with responsible travel practices.

This comprehensive research report examines key regions that drive the evolution of the Travel Photography Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players and Innovative Service Providers Shaping the Competitive Travel Photography Landscape in 2025

Major equipment rental firms have responded to market disruptions by diversifying inventory and reinforcing customer service. Lensrentals, now merged with BorrowLenses, has solidified its position as the largest U.S.-based online rental platform by expanding maintenance capabilities and offering rapid replacement guarantees. Customer testimonials highlight the reliability of their service and the strategic value of pay-toward-purchase options on rental equipment.

In the experiential segment, Flytographer remains a leading marketplace for vacation photography, operating across hundreds of global cities and forging partnerships with premier hospitality brands to deliver seamless booking experiences. Its network of vetted local professionals continues to scale, driven by high client satisfaction rates and robust brand collaborations that reinforce its market leadership.

Boutique agencies and local collectives are also shaping the landscape, leveraging community relationships to offer culturally immersive photo tours and workshops. At the same time, digital delivery platforms are innovating with secure hosting and AI-driven tagging features, enabling clients and commercial stakeholders to manage and monetize image libraries more efficiently.

This comprehensive research report delivers an in-depth overview of the principal market players in the Travel Photography Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alamy Ltd.

- Angle Inc

- COCO Creative Studio pte. Ltd

- Depositphotos, Inc.

- Dreamstime.com, LLC

- Flytographer Enterprises Ltd.

- Getty Images, Inc.

- Griffin Marketing Agency

- ILLUMINATION by Inveniam Corporation

- Impact Travel Group

- Kiss Me in Paris

- Leah Flores Designs LLC

- Light & Land

- Local Lens LLC

- Localgrapher s.r.o.

- Luxury Escapes

- MAY Travel Content & Marketing Ltd

- Perfocal Ltd.

- Picture This Travel Photography

- Rooted Media House

- Shutterstock, Inc.

- SweetEscape

- Tempest Travel Photography

- The Paris Photographer

- Toehold Travel and Photography Pvt. Ltd.

- TripShooter

- Viavoya

- VISUM Foto GmbH

- WanderSnap

Delivering Actionable Strategies for Industry Leaders to Enhance Competitiveness and Drive Growth in the Travel Photography Sector

Industry leaders should diversify their service portfolios by integrating virtual consultations and modular subscription options to address evolving client preferences and build recurring revenue streams. By blending online previews with on-site shoots, providers can deliver heightened convenience and capture new market segments while maintaining high engagement levels across customer touchpoints.

Detailing Rigorous Qualitative and Quantitative Research Methodologies Underpinning the Comprehensive Analysis of Travel Photography Services

This research integrates qualitative expert interviews with leading service providers, structured primary surveys targeting end users, and comprehensive secondary analysis of industry publications, trade journals, and government data. Our methodology includes rigorous data triangulation to validate findings across multiple sources, ensuring robust insights into market dynamics.

Segmentation analysis employs both cluster and factor analytic techniques to map service, product, and customer dimensions, while regional assessments leverage macroeconomic indicators and tourism statistics. The synthesis of these approaches yields a holistic perspective on the strategic opportunities and operational challenges confronting travel photography services.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Travel Photography Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Travel Photography Services Market, by Service Type

- Travel Photography Services Market, by Product

- Travel Photography Services Market, by Category

- Travel Photography Services Market, by Duration

- Travel Photography Services Market, by Use Cases

- Travel Photography Services Market, by Booking Platform

- Travel Photography Services Market, by Customer Type

- Travel Photography Services Market, by Region

- Travel Photography Services Market, by Group

- Travel Photography Services Market, by Country

- United States Travel Photography Services Market

- China Travel Photography Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings and Strategic Implications to Conclude the Evolutionary Journey of Travel Photography Services in a Dynamic Market

The convergence of advanced imaging technologies, dynamic social media influences, and environmental expectations heralds a new era for travel photography services. Our analysis uncovers how tariffs have reshaped supply chains, prompting strategic pivots toward local markets and diversified revenue models.

Segmentation and regional insights reveal nuanced demand patterns that align with distinct client needs, while competitive profiling highlights innovative approaches to equipment rental, digital delivery, and experiential offerings. Collectively, these findings underscore the imperative for agility, customer-centric design, and technological integration in capturing market opportunities and driving sustainable growth.

Empowering Decision Makers with Exclusive Insights and Inviting Engagement to Acquire the Definitive Travel Photography Services Market Report

If you’re ready to transform your strategic initiatives with actionable insights and in-depth analysis, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through tailored options and demonstrate how our comprehensive market intelligence will empower you to make informed decisions in the dynamic travel photography services arena. Reach out today to secure your copy of the definitive research report and gain a competitive advantage in capturing the future of visual storytelling.

- How big is the Travel Photography Services Market?

- What is the Travel Photography Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?