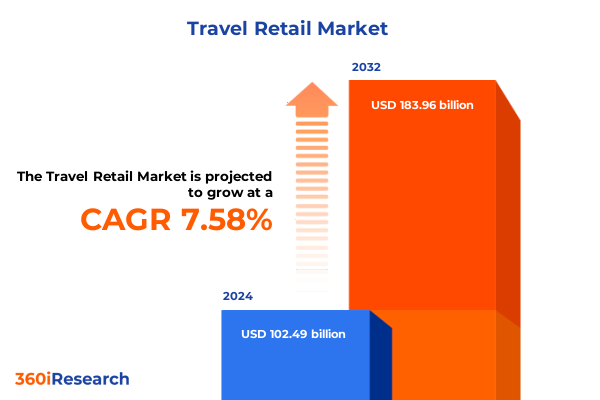

The Travel Retail Market size was estimated at USD 110.07 billion in 2025 and expected to reach USD 118.22 billion in 2026, at a CAGR of 7.61% to reach USD 183.96 billion by 2032.

Travel Retail's New Frontier: Insights into Consumer Evolution, Regulatory Shifts, and Channel Innovations Driving Industry Transformation

Travel retail stands at a pivotal juncture as consumer expectations evolve and global travel rebounds from recent disruptions. The sector, traditionally rooted in duty-free transactions, is undergoing a fundamental shift driven by technology, regulatory changes, and experiential demands. As travelers increasingly seek curated experiences and personalized interactions, retailers and brands must adapt rapidly to meet these new benchmarks.

Against this backdrop, digitalization has emerged as a cornerstone for future growth. Innovations ranging from AI-driven personalization engines to omnichannel ordering platforms are redefining how shoppers discover and purchase products during their journeys. Meanwhile, shifting trade policies, including tariff adjustments and customs reforms, are adding complexity to cross-border commerce. This introduction sets the stage for a nuanced exploration of the transformative shifts, regulatory headwinds, segmentation strategies, and regional dynamics shaping the travel retail landscape today.

Unprecedented Consumer Behaviors and Technological Innovations Redefining Travel Retail Experiences Globally

The travel retail ecosystem is experiencing unprecedented change as digital and experiential paradigms converge. Brands are moving beyond simple point-of-sale transactions to create immersive environments that resonate with today’s consumer. Augmented reality activations and pop-up installations are reimagining airport concourses, turning transit spaces into dynamic showrooms that entertain and engage travelers at every touchpoint.

In parallel, sustainability and purpose-driven initiatives have risen to prominence, reflecting a broader consumer demand for environmental stewardship. Retailers are adopting eco-friendly packaging solutions and carbon-neutral operations, while also curating product assortments that align with ethical sourcing standards. Moreover, the integration of loyalty programs across airlines, airports, and retail outlets is fostering seamless experiences, allowing travelers to accumulate and redeem rewards across multiple platforms. This hybridization of channels and partnerships is redefining value creation, ensuring that the journey is as rewarding as the destination.

Assessing the Far-Reaching Ramifications of U.S. Tariff Increases on Travel Retail Profitability and Consumer Spending

In 2025, sweeping U.S. tariff revisions have introduced substantial cost pressures across the travel retail value chain. By raising baseline duty rates to levels significantly above historical norms, import costs for key categories-particularly luxury goods, electronics, and beverages-have surged. Economic analyses indicate that a 15 percent minimum tariff floor could translate into a two percent increase in overall retail prices, with consumer goods like apparel and footwear facing even steeper hikes.

These escalated duties have rippled through the travel and tourism sectors. The hospitality and retail segments within airports have reported diminished footfall and lower average transaction values as travelers recalibrate spending behaviors. A governmental study noted a 3.3 percent decline in overseas visitor arrivals during the first quarter of 2025, attributing much of this downturn to adverse perceptions surrounding elevated travel costs. Despite these headwinds, stakeholders are exploring mitigation strategies-ranging from localized sourcing to tariff-hedging agreements-to preserve margins and sustain shopper engagement.

Dissecting Product and Channel Segmentation to Reveal Differentiated Growth Drivers and Shopper Preferences

Segmenting the travel retail market by product type reveals pronounced variances in performance and resilience. Within Beauty and Personal Care, cosmetics and fragrances retain robust demand even under price pressures, fueled by exclusive launches and limited-edition collaborations. Haircare and skincare categories, meanwhile, are leveraging wellness trends, positioning sustainable formulations and clean label claims to capture environmentally conscious travelers.

Fashion and Accessories segments-including apparel, handbags, jewelry, sunglasses, and watches-are navigating a dichotomy between premium affluent spend and value-seeking trend shoppers. Brands in this space are deploying digital concierge services and virtual try-on technologies to personalize recommendations and elevate purchase confidence. In the Wines and Spirits domain, premiumization remains a central theme, with Champagne, vodka, whiskey, and select wine variants commanding premium margins through duty-free exclusives.

Distribution channel segmentation underscores Airports as the primary revenue engine, driven by high passenger throughput and extensive retail footprints. Border shops continue to appeal to road-travel demographics, while Cruise Lines are integrating retail with onboard entertainment venues. Online Travel Retail is emerging as a strategic complement, enabling travelers to pre-order and collect at point of departure, thus enhancing convenience and basket size.

This comprehensive research report categorizes the Travel Retail market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

Unveiling Regional Dynamics Highlighting the Americas, EMEA, and Asia-Pacific as Distinct Growth Arenas

Across the Americas, domestic travel has surged, buoyed by robust consumer confidence and infrastructural investments in airport retail expansions. Limited-time product exclusives and experiential activations are stimulating spend despite elevated travel costs, indicating a resilience among North American shoppers. Meanwhile, duty-free retail at major U.S. gateways is adapting to regulatory headwinds by streamlining supply chains and forging brand partnerships to maintain price competitiveness.

In Europe, Middle East & Africa, a rebound in intra-regional tourism is propelling growth. European hubs are emphasizing digital wayfinding and contactless payment to enhance passenger flow and drive retail engagement. Gulf airports, benefiting from strategic geographical positioning, continue to invest in luxury retail precincts, leveraging duty-free incentives and premium services to captivate high-net-worth travelers.

The Asia-Pacific region remains the powerhouse of travel retail expansion, with explosive demand from outbound Chinese tourists gradually normalizing after pandemic-induced disruptions. Emerging markets in Southeast Asia and Oceania are witnessing rapid development of airport retail infrastructure, with a marked focus on local artisan goods and region-exclusive offerings to diversify product portfolios and attract discerning international travelers.

This comprehensive research report examines key regions that drive the evolution of the Travel Retail market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Dominant Operators and Emerging Innovators Steering the Competitive Frontier of Travel Retail

Leading industry operators continue to redefine the competitive landscape. Dufry, as a global market leader, leverages extensive airport networks and strategic partnerships to optimize its duty-paid and duty-free portfolios, while investing in digital platforms to offer pre-order and home delivery services. Lagardère Travel Retail differentiates through its integration of media and retail, deploying cross-channel marketing to enhance traveler engagement across Europe and North America.

DFS Group, under LVMH ownership, capitalizes on luxury brand synergies to curate exclusive product assortments in prime Asia-Pacific locales. Gebr. Heinemann’s strength lies in its diversified channel mix, combining airport shops with cruise line and border retail, supported by robust supply chain capabilities that ensure product availability across over 100 countries.

Other notable players-Lotte Duty Free, King Power International, China Duty Free Group, Dubai Duty Free, and Avolta-are aggressively expanding their footprints, exploring joint ventures and technology partnerships to enhance in-store experiences and digital reach. This evolving competitive set underscores a universal imperative: to balance legacy strengths with innovative offerings that meet the expectations of a new traveler generation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Travel Retail market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3Sixty Duty Free

- Aer Rianta International

- Bahrain Duty Free

- China Duty Free Group Co., Ltd.

- DFS Group Limited

- Dubai Duty Free

- Dufry AG

- Duty Free Americas, Inc.

- Flemingo International

- Gebr. Heinemann SE & Co. KG

- King Power International Group Co., Ltd.

- Lagardère Travel Retail

- Lotte Duty Free Co., Ltd.

- Mumbai Travel Retail Pvt. Ltd.

- Qatar Duty Free

- The Shilla Duty Free Co., Ltd.

- WHSmith PLC

Implementing Data-Driven Omnichannel, Experiential, and Sustainability Strategies to Thrive Amidst Disruption

Industry leaders must prioritize an omnichannel strategy that seamlessly integrates online and offline touchpoints. By adopting AI-powered recommendation engines and virtual try-on tools, retailers can personalize interactions and drive conversion rates. Investing in contactless mobile payment and pre-order platforms will further reduce friction and enhance shopper convenience.

To counteract tariff pressures, brands should explore regional sourcing alternatives and negotiate duty-deferral agreements. Partnerships with local distributors can mitigate import costs while supporting sustainability goals. Concurrently, retailers must deepen experiential programming-curating pop-ups, live demonstrations, and exclusive launches that resonate with Gen Z and affluent segments seeking authenticity and engagement.

Finally, embedding sustainability into brand narratives is no longer optional. Eco-friendly packaging, carbon-offset initiatives, and transparent supply chain reporting will strengthen consumer trust and differentiate offers in a crowded marketplace. By aligning operational efficiency with purpose-driven values, organizations can drive loyalty, enhance brand equity, and secure long-term growth.

Integrating Robust Secondary Research and Primary Stakeholder Interviews to Deliver Credible, Actionable Market Insights

Our research approach combined rigorous secondary and primary methodologies. We conducted an exhaustive review of government publications, industry reports, and trade association data to establish a foundational understanding of market dynamics. Key macroeconomic and regulatory sources, including customs authorities and financial institutions, were analyzed to quantify the impact of recent tariff policies.

Complementing desktop research, we engaged over 30 stakeholders-ranging from airport retail executives to brand marketing leads-in structured interviews. These insights provided nuanced perspectives on operational challenges and innovation priorities. A structured survey, disseminated to travel retail professionals across Americas, EMEA, and Asia-Pacific, captured quantitative indicators of segment performance and channel effectiveness.

Data triangulation techniques were employed to validate findings and ensure consistency across sources. Segmentation analyses by product and channel were informed by custom modeling, while regional insights were benchmarked against global travel and tourism trends. All methodologies adhere to best practices in market intelligence, ensuring the robustness and reliability of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Travel Retail market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Travel Retail Market, by Product Type

- Travel Retail Market, by Distribution Channel

- Travel Retail Market, by Application

- Travel Retail Market, by Region

- Travel Retail Market, by Group

- Travel Retail Market, by Country

- United States Travel Retail Market

- China Travel Retail Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Charting a Comprehensive Roadmap to Navigate Tariffs, Technology, and Traveler Trends in the Modern Travel Retail Ecosystem

The travel retail sector is poised for continued transformation as it navigates a complex interplay of consumer evolution, regulatory recalibrations, and technological innovations. While elevated tariffs pose immediate headwinds, they also catalyze strategic adaptations in sourcing, pricing, and channel optimization. By embracing omnichannel engagement, experiential activations, and sustainability imperatives, industry players can unlock new avenues of growth.

Regional divergences-exemplified by dynamic Asia-Pacific expansion, resilient Americas spend, and EMEA’s digitalization push-highlight the importance of localized strategies within a global framework. Leading companies are capitalizing on their core competencies while investing in digital ecosystems and partnerships that anticipate future traveler needs.

Ultimately, the winners in this increasingly competitive landscape will be those who balance operational agility with a deep understanding of evolving shopper motivations. With a rigorous methodology underpinning our analysis, this report offers decision-makers a clear roadmap to anticipate trends, mitigate risks, and harness opportunities in the travel retail market.

Secure Expert Guidance and Actionable Insights from Ketan Rohom to Accelerate Your Travel Retail Success

Elevate Your Strategic Vision with Our Comprehensive Travel Retail Report

Ready to unlock deep insights into the forces reshaping travel retail and leverage data-driven strategies to stay ahead? Reach out today to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to explore how this definitive market research report can fortify your competitive advantage and drive profitable growth in an era of rapid transformation.

- How big is the Travel Retail Market?

- What is the Travel Retail Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?