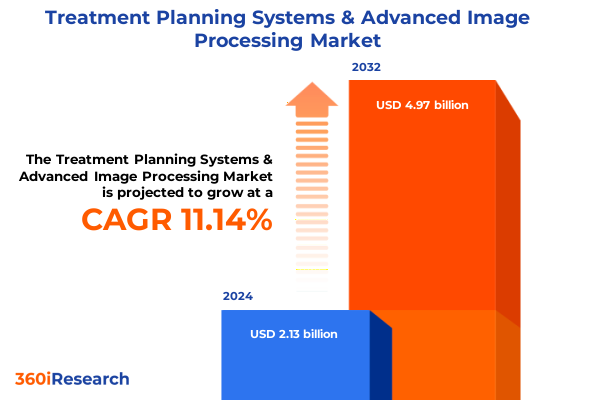

The Treatment Planning Systems & Advanced Image Processing Market size was estimated at USD 2.37 billion in 2025 and expected to reach USD 2.63 billion in 2026, at a CAGR of 11.15% to reach USD 4.97 billion by 2032.

Setting the Stage for Next-Generation Treatment Planning Systems and Advanced Image Processing in Modern Oncology and Radiotherapy Environments

The field of treatment planning systems and advanced image processing has undergone a profound metamorphosis, driven by the imperative to enhance precision, personalize therapy pathways, and improve patient outcomes across oncology and radiotherapy. As multidisciplinary teams converge around a single goal-delivering safer, more effective interventions-digital tools have evolved from simple contouring aids to fully integrated platforms that harness artificial intelligence and high-resolution imaging modalities. This convergence marks a critical turning point in how clinicians conceptualize and execute treatment strategies, shifting from manual processes to automated, data-driven workflows that emphasize reproducibility and accuracy.

Against this backdrop, the industry has witnessed the emergence of sophisticated software architectures capable of integrating multi-modal data streams, such as computed tomography, magnetic resonance imaging, and positron emission tomography. These platforms now support functions ranging from automated registration and dose calculation to advanced visualization and quality assurance. Simultaneously, hardware improvements in imaging detectors and accelerators have amplified the granularity of diagnostic data, feeding more robust algorithms that accelerate planning cycles and unlock novel clinical insights.

Looking ahead, this report delves into the transformative shifts, tariff implications, segmentation nuances, regional dynamics, and competitive strategies shaping this ecosystem. By examining qualitative and quantitative research findings, stakeholders will gain a comprehensive perspective on the forces influencing adoption patterns, operational models, and partnership opportunities. This introduction sets the stage for a detailed exploration of how technology, policy, and market dynamics coalesce to redefine the future of treatment planning and image processing.

Exploring the Pivotal Technological and Clinical Shifts Redefining Treatment Planning Systems and Advanced Image Processing in Healthcare Delivery

Technological breakthroughs and evolving clinical paradigms are rewriting the playbook for treatment planning systems and advanced image processing. In recent years, machine learning and deep learning algorithms have matured from experimental modules to integral components of contouring and dose calculation workflows, enabling unprecedented levels of automation and consistency. As a result, clinicians can now leverage predictive analytics to anticipate anatomical changes over the course of therapy and adjust parameters in real time, thereby improving therapeutic ratios.

Moreover, the rise of cloud computing and distributed processing architectures has dismantled traditional barriers to collaboration. Remote access to secured platforms allows multidisciplinary teams to review cases, iterate on plans, and validate outcomes without being confined to a single imaging workstation. Interoperability standards, such as DICOM-RT and emerging FHIR profiles, facilitate seamless data exchange between imaging devices, planning servers, and electronic health records. Consequently, the integration of genomics and radiomics features into decision-support pipelines has become achievable, laying the groundwork for truly personalized care.

Finally, regulatory bodies have begun to recognize the distinct nature of AI-enabled medical software, promulgating guidance on algorithm validation, clinical effectiveness, and post-market surveillance. This evolving regulatory landscape encourages transparency and data integrity while fostering innovation through clearly defined pathways for approval. Taken together, these shifts underscore a broader transition toward systems that deliver faster planning cycles, more reliable outputs, and enhanced collaboration across the continuum of care.

Assessing the Ripple Effects of 2025 United States Tariffs on Treatment Planning Solutions and Advanced Image Processing Supply Chains and Operations

The imposition of comprehensive United States tariffs on imported medical imaging equipment and software components in early 2025 has reverberated across supply chains and operational budgets within the treatment planning ecosystem. Manufacturers reliant on offshore production of critical hardware elements such as imaging detectors, linear accelerator subsystems, and high-performance computing modules have encountered unexpected cost pressures. Consequently, procurement teams are recalibrating supplier portfolios to mitigate exposure to tariff escalations, exploring alternative regions for manufacturing, and renegotiating long-term agreements to preserve service levels without compromising clinical throughput.

From an operational perspective, service providers and software vendors have responded by revising maintenance contracts and support offerings to reflect new cost structures. Some vendors have introduced tiered subscription models to offset upfront duties, enabling customers to spread expenses over a multi-year horizon. Concurrently, end users in hospitals, clinics, and research institutes have had to adapt capital planning cycles, prioritizing upgrades for high-yield applications like contouring automation and dose precision while deferring less critical system enhancements.

In the longer term, the tariffs are catalyzing strategic shifts toward vertical integration and nearshoring. Industry players are investing in domestic production capabilities for critical components and forging alliances with local technology partners to ensure supply resilience. Although these adaptations require capital deployment and operational realignment, they position stakeholders to navigate future policy uncertainties and strengthen regional self-sufficiency.

Unveiling Key Component, Application, Modality, Delivery Mode, and End User Trends Pioneering the Evolution of Treatment Planning and Image Processing

A nuanced analysis across component categories reveals that hardware, services, and software offerings interact synergistically to drive clinical adoption and operational efficiency. Hardware advances in imaging detectors and computing modules empower algorithmic innovations, while professional services ensure seamless integration and ongoing optimization. Software platforms, in turn, capitalize on these foundations to deliver sophisticated functionality that spans the care continuum.

Turning to application domains, the progression from manual contouring to automated segmentation has markedly reduced inter-operator variability, while advanced dose calculation engines now incorporate Monte Carlo methods and machine learning models for enhanced accuracy. Registration tools link multi-modal datasets to provide holistic patient views, and visualization suites enable interactive exploration of three-dimensional dose distributions and anatomical structures. This comprehensive suite of capabilities supports clinicians in making well-informed decisions at every stage of the planning process.

Examining the modality dimension underscores the dual pillars of imaging and radiotherapy. Within imaging, computed tomography remains the backbone of anatomical reconstruction, magnetic resonance imaging adds soft-tissue contrast, and positron emission tomography integrates functional metrics. Radiotherapy further subdivides into brachytherapy, external beam, and proton therapy. Brachytherapy encompasses both high dose rate and low dose rate approaches, while external beam solutions include intensity modulated radiotherapy, stereotactic radiotherapy, and volumetric modulated arc therapy. Proton therapy differentiates between passive scattering and pencil beam scanning techniques, each offering distinct therapeutic profiles.

Delivery mode considerations reflect a growing preference for cloud-native solutions that provide scalability and collaboration across geographies, even as some institutions maintain on-premise deployments for data sovereignty and latency control. Finally, end users ranging from smaller clinics to large academic hospitals and specialized research institutes demonstrate varied adoption curves; clinics often prioritize streamlined workflows, hospitals require integrated enterprise capabilities, and research centers focus on interoperability and advanced analytics. Together, these segmentation insights illuminate the multifaceted pathways through which stakeholders can optimize performance and innovation.

This comprehensive research report categorizes the Treatment Planning Systems & Advanced Image Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Modality

- Application

- Delivery Mode

- End User

Analyzing Divergent Adoption Patterns in Americas, Europe Middle East and Africa, and Asia Pacific for Treatment Planning and Advanced Image Processing

Regional dynamics play a pivotal role in shaping how technologies are adopted, with each geography presenting distinct drivers and barriers. In the Americas, sustained investment in healthcare infrastructure and a culture of early technology adoption have created favorable conditions for advanced planning solutions. Private payor models and well-established clinical networks accelerate procurement cycles, while leading academic centers serve as incubators for novel imaging and planning workflows.

By contrast, Europe, the Middle East, and Africa present a mosaic of regulatory environments, reimbursement policies, and resource constraints. Systems in Western Europe benefit from centralized approval frameworks and collaborative research initiatives, whereas emerging economies in Eastern Europe and the Middle East often contend with limited capital budgets and variable clinical training. At the same time, pan-regional consortia are fostering knowledge exchange and pooled procurement strategies that reduce the total cost of ownership and democratize access to advanced capabilities.

In Asia-Pacific, rapid urbanization and rising healthcare expenditure have catalyzed investments in next-generation radiology and radiotherapy platforms. Countries like China, Japan, and South Korea lead in domestic innovation, launching indigenous imaging and planning suites optimized for local clinical workflows. Meanwhile, markets such as India, Australia, and Southeast Asia exhibit heightened demand for cloud-based, subscription-driven models that lower entry barriers and support scaling across diverse clinical environments. These regional contrasts underscore the importance of tailored strategies that align technology roadmaps with local policy, economic conditions, and care delivery models.

This comprehensive research report examines key regions that drive the evolution of the Treatment Planning Systems & Advanced Image Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Collaborations and Innovation Portfolios of Leading Manufacturers in Treatment Planning and Advanced Image Processing

Leading organizations have embraced varied approaches to capture value in this rapidly evolving sector. Some manufacturers emphasize organic innovation, funneling resources into in-house research to develop proprietary AI algorithms that enhance contouring precision and accelerate dose calculations. Others focus on forging strategic partnerships with cloud providers and cybersecurity specialists to deliver end-to-end solutions that span data acquisition, planning, and clinical archiving.

Collaboration between device companies and specialized software firms has intensified, creating ecosystems where modular architectures allow users to select best-in-class tools for each stage of the workflow. Concurrently, a wave of mergers and acquisitions has consolidated IP portfolios, enabling larger players to integrate niche capabilities for personalized therapy planning. At the same time, a cadre of nimble startups continues to challenge incumbents by introducing disruptive features such as real-time adaptive planning, radiomic-driven risk stratification, and immersive visualization for clinician training.

These competitive dynamics reflect a broader industry imperative: to assemble technology stacks that can ingest diverse data sources, apply robust analytics, and deliver actionable insights in clinically relevant timeframes. Companies that excel in aligning product roadmaps with emerging clinical protocols, compliance mandates, and user experience expectations will likely establish lasting leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Treatment Planning Systems & Advanced Image Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuray Incorporated

- Brainlab AG

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- DOSIsoft SA

- Elekta AB

- Fujifilm Holdings Corporation

- General Electric Company

- Koninklijke Philips N.V.

- MIM Software Inc.

- Prowess, Inc.

- RaySearch Laboratories AB

- Siemens Healthineers AG

- Varian Medical Systems, Inc.

- ViewRay, Inc.

Outlining Strategic Initiatives to Propel Competitive Differentiation and Operational Excellence for Leaders in Treatment Planning and Image Processing

To navigate the complexities of this environment and capture strategic advantage, industry leaders should prioritize several key initiatives. First, investing in modular, open-architecture platforms will facilitate rapid integration of new algorithms and third-party tools, ensuring adaptability as clinical needs evolve. By fostering an ecosystem of certified partners, vendors can accelerate time to value and reinforce their position as central hubs for treatment planning workflows.

Second, forging alliances with cloud infrastructure and cybersecurity providers can address growing concerns around data privacy and regulatory compliance. Deploying hybrid models that balance on-premise control with cloud scalability will allow institutions to meet stringent data sovereignty requirements while enabling collaborative planning across multiple locations.

Third, organizations should cultivate multidisciplinary centers of excellence that blend clinical, technical, and operational expertise. Structured training programs for medical physicists, dosimetrists, and oncologists will ensure that new functionalities are adopted seamlessly and used to their full potential. Finally, establishing continuous feedback loops with end users-through formalized advisory boards and real-world evidence initiatives-will guide R&D investments toward features that deliver measurable clinical and operational impact.

Detailing the Rigorous Qualitative and Quantitative Research Framework Supporting Analysis of Treatment Planning and Advanced Image Processing Trends

This study employs a rigorous mixed-methods approach that combines primary stakeholder interviews, expert panel reviews, and comprehensive secondary research. Initially, qualitative interviews were conducted with senior executives, clinical specialists, and technical leads across hospitals, clinics, and research organizations to capture firsthand perspectives on solution requirements, pain points, and emerging priorities. These insights were validated by an advisory board comprising medical physicists, oncologists, and imaging scientists.

Concurrently, secondary research spanned peer-reviewed journals, patent filings, regulatory submissions, and publicly available white papers to contextualize technological innovations and policy developments. Each data point underwent triangulation through cross-reference checks to ensure accuracy and relevance. Quantitative analyses incorporated adoption rate benchmarks, procurement cycle timelines, and supplier profiles to delineate competitive landscapes without divulging sensitive financial metrics.

Finally, the research framework emphasizes transparency and reproducibility. All assumptions, data sources, and analytical methods are documented comprehensively, providing readers with the clarity needed to assess the applicability of insights to their own strategic initiatives. This methodology underpins the credibility of the findings and guides stakeholders toward informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Treatment Planning Systems & Advanced Image Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Treatment Planning Systems & Advanced Image Processing Market, by Component

- Treatment Planning Systems & Advanced Image Processing Market, by Modality

- Treatment Planning Systems & Advanced Image Processing Market, by Application

- Treatment Planning Systems & Advanced Image Processing Market, by Delivery Mode

- Treatment Planning Systems & Advanced Image Processing Market, by End User

- Treatment Planning Systems & Advanced Image Processing Market, by Region

- Treatment Planning Systems & Advanced Image Processing Market, by Group

- Treatment Planning Systems & Advanced Image Processing Market, by Country

- United States Treatment Planning Systems & Advanced Image Processing Market

- China Treatment Planning Systems & Advanced Image Processing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Future Imperatives for Navigating the Evolving Ecosystem of Treatment Planning Systems and Advanced Image Processing

This executive summary has traced the evolution of treatment planning systems and advanced image processing from manual, siloed workflows to integrated, data-driven platforms, highlighting breakthroughs in AI, cloud computing, and interoperability standards. The analysis explored the ramifications of new tariff regimes, which have disrupted supply chains and catalyzed strategic realignments toward nearshoring and vertical integration. Detailed segmentation insights revealed how component, application, modality, delivery mode, and end-user dynamics collectively influence technology adoption and performance across diverse clinical settings.

Regional examination underscored the distinct drivers in the Americas, Europe Middle East and Africa, and Asia Pacific, illustrating the need for bespoke approaches that align with local regulatory frameworks and economic conditions. Competitive analysis illuminated how manufacturers and startups alike are leveraging partnerships, mergers, and focused R&D investments to differentiate offerings and accelerate innovation cycles. Based on these findings, the summary articulated actionable recommendations centered on modular platform design, hybrid deployment models, and cross-disciplinary centers of excellence.

As the treatment planning and image processing ecosystem continues to mature, stakeholders who embrace agility, data transparency, and user-centric development will be best positioned to deliver superior clinical outcomes and realize sustained operational benefits. The future will belong to those who can seamlessly integrate emerging technologies while maintaining unwavering focus on patient safety and care quality.

Connect with Ketan Rohom to Secure the In-Depth Market Research Report and Unlock Actionable Insights on Treatment Planning Systems and Advanced Image Processing

To explore the full depth of insights presented in this report and gain access to precise strategic guidance, reach out to Ketan Rohom (Associate Director, Sales & Marketing) who stands ready to facilitate your acquisition of the comprehensive study. Engaging with Ketan Rohom will open the door to real-time discussions on how the findings can be tailored to your unique operational challenges and growth ambitions. His expertise will ensure that decision-makers receive the critical intelligence needed to drive innovation, optimize investment decisions, and strengthen competitive positioning. Don’t miss the opportunity to capitalize on this actionable intelligence and position your organization for leadership in the evolving landscape of treatment planning systems and advanced image processing. Contact Ketan Rohom today to secure your copy of the full report and begin implementing insights that can transform your strategic roadmap.

- How big is the Treatment Planning Systems & Advanced Image Processing Market?

- What is the Treatment Planning Systems & Advanced Image Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?