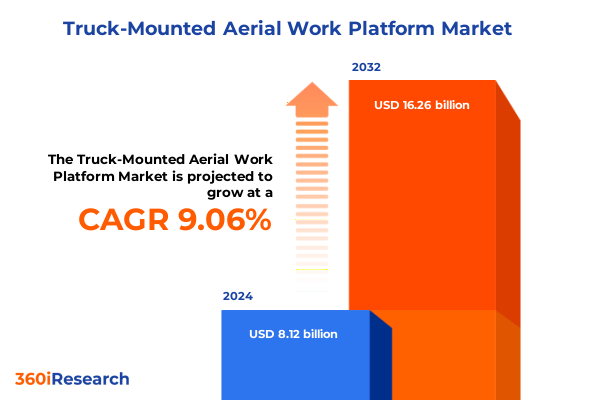

The Truck-Mounted Aerial Work Platform Market size was estimated at USD 8.86 billion in 2025 and expected to reach USD 9.50 billion in 2026, at a CAGR of 9.06% to reach USD 16.26 billion by 2032.

Setting the Stage for Truck-Mounted Aerial Work Platforms Amid Rapid Technological Advances and Expanding Infrastructure Needs Worldwide

In today’s fast-paced infrastructure environment, the role of truck-mounted aerial work platforms has become indispensable for a wide range of industrial operations. As urban centers expand and maintenance demands intensify, these versatile machines serve as the backbone of tasks that require safe, elevated access-from telecommunications tower servicing to power line inspections and bridge repairs. Against this backdrop, market participants must orient themselves toward technological innovations, regulatory changes, and shifting end-user requirements that collectively reshape equipment expectations and procurement strategies.

Over the past several years, advances in control systems, materials science, and modular design have elevated both performance and safety standards. These developments have driven adoption beyond traditional construction applications, with utilities and infrastructure maintenance companies increasingly relying on aerial platforms to minimize downtime and ensure compliance with stringent occupational safety regulations. At the same time, a rise in project complexity-spurred by smart grid rollouts, urban renewal initiatives, and renewable energy installations-has placed a premium on machines that can deliver higher reach, precise maneuverability, and lower environmental impact.

This report provides a holistic view of the truck-mounted aerial work platform domain, blending qualitative insights with rigorous segmentation analysis. Through an exploration of key market drivers, barriers, and transformative forces, stakeholders are equipped to understand not just where the industry stands today, but where it’s headed. By examining everything from power source transitions to regional nuances, this introduction sets the stage for a deep dive into the competitive and regulatory factors defining the next phase of growth.

Uncovering the Transformational Trends and Technology Disruptors Reshaping the Truck-Mounted Aerial Work Platform Industry Landscape

The truck-mounted aerial work platform industry is experiencing a wave of transformation driven by converging technological and environmental mandates. Electrification efforts are gathering pace, reshaping product road maps to include hybrid diesel-electric systems and fully electric drivetrains that reduce emissions, noise, and operational costs. Meanwhile, digital integration-from telematics and predictive maintenance algorithms to advanced sensor suites-has redefined expectations for uptime and asset management, allowing operators to schedule servicing proactively and avoid costly interruptions.

In parallel, stringent safety regulations and evolving certification standards have prompted OEMs to incorporate redundancies into boom stabilization and fail-safe mechanisms, raising the bar for equipment reliability. This shift is reinforced by a broader cultural emphasis on worker well-being, pushing manufacturers to develop platforms with enhanced fall-arrest technology, intuitive control interfaces, and ergonomic basket designs that reduce operator fatigue.

Furthermore, the convergence of automation and remote-operation capabilities is opening new frontiers for accessing difficult or hazardous work zones. Drones and autonomous survey tools complement aerial platforms by providing preliminary inspections, while semi-autonomous boom positioning systems empower less experienced operators to perform complex maneuvers with confidence. Together, these transformative shifts are redefining the overall value proposition of truck-mounted aerial work platforms, enabling industry leaders to deliver safer, more efficient solutions that align with environmental, regulatory, and operational imperatives.

Understanding the Broad-Spectrum Effects of 2025 Tariff Adjustments on Truck-Mounted Aerial Work Platform Supply Chains and Cost Structures

In 2025, new tariff regulations imposed on imported aerial platform components have introduced both cost pressures and strategic recalibrations across supply chains. Steel and aluminum tariff increments have elevated input prices for chassis and boom assemblies, compelling manufacturers to reevaluate sourcing strategies and engage more strategically with domestic suppliers. Although some producers have absorbed these duties to maintain competitive end-user pricing, others have transferred costs downstream, influencing purchase orders and long-term maintenance contracts.

These levies have also accelerated investments in local fabrication capabilities. By onshoring key production stages-such as boom welding and hydraulic system assembly-OEMs not only mitigate exposure to fluctuating trade barriers but also gain greater control over quality assurance and delivery timelines. At the same time, certain raw material suppliers are locking in multi-year contracts to hedge against further tariff escalations, demonstrating how the cumulative effect of 2025 adjustments extends beyond immediate cost hikes to shape strategic procurement decisions.

Despite initial concerns about margin compression, companies that proactively restructured their component networks report improved agility and shorter lead times. This has, in turn, bolstered customer confidence, particularly among utilities and municipal clients that require dependable service schedules. As a result, the tariff environment of 2025 has catalyzed a more resilient supply base, emphasizing the importance of diversified sourcing, transparent cost modeling, and collaborative risk-sharing agreements.

Deriving Actionable Insights from Comprehensive Market Segmentation Across Equipment Types Height Ranges Capacities Mobility and Power Sources

A nuanced understanding of market segmentation is essential for aligning product portfolios with end-user requirements and usage scenarios. When considering equipment type, articulating boom configurations are further tailored to height ranges-Up To 20 M, 20 To 30 M, and Above 30 M-each serving distinct access profiles. For example, lower-reach articulating systems are ideal for congested urban settings, while higher-reach variants facilitate work on utility transmission corridors and tall structures. Telescopic boom platforms, categorized across the same height brackets, deliver extended horizontal reach and faster deployment times, making them well suited for large-scale wind turbine maintenance and bridge inspection tasks.

End-user segmentation reveals that construction enterprises favor high-capacity machinery capable of supporting multiple technicians and heavy equipment payloads, whereas infrastructure maintenance operations prioritize stability and precision for tasks like road sign repair or water treatment facility servicing. Utility providers, by contrast, require equipment with robust insulation and surge-protection features to comply with electrical safety standards. Height range considerations intersect with platform capacity metrics-Up To 200 Kg for single-operator tasks, 201 To 300 Kg for dual-operator inspection routines, and Above 300 Kg for integrated load-handling operations-underscoring the need for models that balance lift performance with user flexibility.

Mobility classification further stratifies the market into Light Duty vehicles, valued for ease of maneuvering and lower operating costs, and Heavy Duty platforms, engineered for rugged terrain and extended service intervals. Finally, power source segmentation, spanning Diesel and Electric options, highlights a divergence between legacy operational models reliant on diesel engines and emergent electrified solutions designed to meet zero-emission mandates in urban centers. Together, these segmentation lenses provide a granular framework that informs product development, marketing strategies, and asset management decisions across the industry.

This comprehensive research report categorizes the Truck-Mounted Aerial Work Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Height Range

- Platform Capacity

- Mobility Class

- Power Source

- End User

Examining Regional Market Dynamics and Growth Drivers in the Americas Europe Middle East Africa and the Asia-Pacific Regions

Regional dynamics significantly shape investment priorities and adoption rates for truck-mounted aerial work platforms. In the Americas, strong infrastructure renewal programs and fiber-to-home broadband initiatives continue to drive demand for versatile, high-reach platforms. North American utilities are also integrating platform fleets into digital asset ecosystems, using telematics to optimize deployment during peak maintenance seasons. Latin American markets, meanwhile, are exhibiting steady growth fueled by urbanization and expanding construction activity, although political and economic volatility occasionally tempers capital expenditure plans.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing carbon reduction and workplace safety have incentivized the uptake of electric and hybrid aerial platforms. Western European nations are at the forefront, deploying fully electric models in dense urban cores to minimize emissions and noise. In contrast, emerging markets in Eastern Europe and the Levant region are gradually modernizing rental fleets, influenced by infrastructure grants tied to environmental performance.

The Asia-Pacific region presents a spectrum of opportunity, from Japan’s precision-focused maintenance sector-where compact, agile platforms are in demand-to Southeast Asia’s burgeoning construction markets seeking cost-effective solutions that can withstand tropical environments. Australia and New Zealand continue to invest in heavy duty, diesel-powered platforms for mining and large-scale infrastructure projects, although pilot programs for electric drivetrains are gaining traction. This mosaic of regional priorities underscores the importance of tailored go-to-market strategies that account for local regulations, terrain challenges, and customer use cases.

This comprehensive research report examines key regions that drive the evolution of the Truck-Mounted Aerial Work Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Moves and Competitive Strengths of Leading Truck-Mounted Aerial Work Platform Manufacturers and Suppliers

Leading players in the truck-mounted aerial work platform market have adopted differentiated strategies to capture emerging opportunities and fortify their competitive positions. Some manufacturers, for instance, invest heavily in research and development to pioneer electric boom systems, leveraging battery-management expertise from adjacent industrial sectors. These organizations are also forging partnerships with telematics providers to embed advanced analytics capabilities, positioning themselves as end-to-end solution architects rather than mere equipment vendors.

Other companies concentrate on operational excellence, streamlining global supply chains through strategic alliances with domestic fabricators and logistics firms. By co-locating production facilities near key customer clusters, they achieve faster lead times and demonstrate commitment to local content requirements, enhancing appeal among public sector clients. In addition, select suppliers emphasize service reliability, building out comprehensive maintenance networks that include remote diagnostics, preventative inspections, and rapid parts distribution to minimize customer downtime.

Some market participants differentiate on customization, offering modular platform attachments tailored to niche applications such as broadcast camera mounts, wind blade inspection baskets, or firefighting nozzles. This high-mix, low-volume approach enables premium pricing and fosters long-term client relationships, particularly in specialized sectors where regulatory compliance and technical precision are non-negotiable. Collectively, these varied tactics illustrate how leading companies are aligning their value propositions with evolving customer needs and industry imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Truck-Mounted Aerial Work Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altec Inc.

- Bronto Skylift Oy Ab

- Cela S.R.L.

- CMC S.R.L.

- CTE S.p.A.

- Dinolift Oy

- Dur-A-Lift Inc.

- Elliott Equipment Company

- Haulotte Group

- Hunan Sinoboom Intelligent Equipment Co. Ltd.

- J C Bamford Excavators Ltd.

- JLG Industries Inc.

- Klubb Srl

- Liebherr International AG

- Linamar Corporation

- Manitex International Inc.

- Manitou Group

- Morita Holdings Corporation

- Niftylift Ltd.

- Oil & Steel S.p.A.

- Palfinger AG

- Ruthmann GmbH & Co. KG

- Socage S.r.l.

- Tadano Ltd.

- Terex Corporation

- Time Manufacturing Company

- Toyota Industries Corporation

- Zhejiang Dingli Machinery Co. Ltd.

- Zoomlion Heavy Industry Science & Technology Co.

Actionable Strategies for Industry Stakeholders to Leverage Emerging Trends and Build Competitive Advantage in Aerial Work Platforms

To capitalize on market momentum and navigate emerging disruptors, industry stakeholders should prioritize investments in electrification and digital integration. By adopting hybrid-electric powertrains or full battery-electric systems, companies can secure early-mover advantages in urban markets where emissions restrictions are tightening. Simultaneously, embedding telematics and predictive maintenance tools in platform fleets will drive operational efficiencies and bolster customer loyalty through data-driven service agreements.

Collaboration across the value chain is equally critical. OEMs, component suppliers, and end users must develop transparent cost-sharing models to mitigate the impacts of tariff volatility, while co-innovation partnerships can accelerate development of next-generation boom materials and safety systems. Additionally, stakeholders should cultivate modular product architectures that simplify customization for verticals such as utilities, construction, and infrastructure maintenance, enabling rapid configuration changes without extensive retooling.

Finally, companies should adopt regional go-to-market strategies that reflect local policy landscapes and terrain challenges. In areas with stringent noise and emission regulations, prioritizing electric platform rollouts will facilitate regulatory compliance and enhance corporate sustainability credentials. For markets with rugged terrain and extended service cycles, reinforcing heavy duty platform offerings with robust after-sales networks will differentiate providers in competitive bid processes. Through these actionable steps, industry participants can build resilience, unlock new revenue streams, and maintain a trajectory of sustainable growth.

Detailing the Robust Research Framework and Methodological Approaches Underpinning the Comprehensive Aerial Work Platform Market Analysis

This analysis draws on a robust research framework that integrates both primary and secondary methodologies to ensure comprehensive coverage and rigorous validation of findings. Primary research involved structured interviews with equipment manufacturers, rental operators, and end-user maintenance teams, gathering firsthand insights into procurement drivers, operational challenges, and technology adoption patterns. These qualitative inputs were cross-referenced with a detailed survey conducted across multiple geographies, capturing quantitative data on equipment utilization rates, servicing intervals, and power source preferences.

On the secondary research front, the study reviewed a wide array of industry publications, patent filings, regulatory databases, and whitepapers to trace historical developments and emerging trends. Data triangulation techniques were employed to reconcile discrepancies between disparate sources, ensuring consistency in segmentation definitions and nomenclature. Key performance indicators such as average platform uptime, maintenance turnaround times, and unit retrofit rates were synthesized from vendor literature and service manuals.

Analytical rigor was upheld through internal peer reviews and expert validation sessions, where preliminary findings were presented to independent consultants and veteran industry practitioners. Feedback loops were established to refine assumptions around tariff impacts, regional adoption rates, and technology diffusion curves. The result is a methodologically sound report that blends empirical evidence with strategic foresight, providing stakeholders with a reliable compass for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Truck-Mounted Aerial Work Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Truck-Mounted Aerial Work Platform Market, by Type

- Truck-Mounted Aerial Work Platform Market, by Height Range

- Truck-Mounted Aerial Work Platform Market, by Platform Capacity

- Truck-Mounted Aerial Work Platform Market, by Mobility Class

- Truck-Mounted Aerial Work Platform Market, by Power Source

- Truck-Mounted Aerial Work Platform Market, by End User

- Truck-Mounted Aerial Work Platform Market, by Region

- Truck-Mounted Aerial Work Platform Market, by Group

- Truck-Mounted Aerial Work Platform Market, by Country

- United States Truck-Mounted Aerial Work Platform Market

- China Truck-Mounted Aerial Work Platform Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Observations and Strategic Implications for Stakeholders Navigating the Truck-Mounted Aerial Work Platform Sector

In conclusion, the truck-mounted aerial work platform market stands at the intersection of technological innovation, regulatory evolution, and shifting operational demands. The ongoing transition toward electrified power sources, coupled with digital integration and enhanced safety standards, is redefining the parameters of equipment design and service delivery. At the same time, tariff adjustments and regional policy differences underscore the necessity of agile supply chain strategies and localized go-to-market approaches.

Key segmentation insights highlight the importance of matching boom configurations, height ranges, platform capacities, mobility classes, and power sources to distinct use cases-whether in construction, utilities, or infrastructure maintenance. Regional analyses further emphasize how market dynamics in the Americas, EMEA, and Asia-Pacific diverge based on environmental mandates, terrain considerations, and infrastructure priorities. Leading companies are responding with a spectrum of strategies, from R&D collaborations in battery technology to modular product architectures and reinforced service networks.

Ultimately, stakeholders who embrace electrification, invest in digital capabilities, and cultivate cross-industry partnerships will secure the greatest competitive advantages. By grounding strategic decisions in the comprehensive insights presented herein, industry participants can navigate uncertainties, unlock new value streams, and drive sustainable growth in a rapidly evolving aerial work platform landscape.

Engaging with Ketan Rohom for Expert Guidance and Securing Your Comprehensive Truck-Mounted Aerial Work Platform Market Intelligence Report Today

For organizations seeking to deepen their understanding of the truck-mounted aerial work platform landscape and capitalize on growth opportunities, direct engagement with Ketan Rohom, Associate Director, Sales & Marketing, presents the fastest path to securing the full market intelligence report. By leveraging Ketan’s expertise in articulating how market trends intersect with strategic imperatives, stakeholders can obtain tailored insights that align with their investment and operational objectives. The comprehensive research dossier outlines critical influencers from global tariff shifts to power source transitions, enabling decision-makers to craft resilient strategies and optimize equipment deployments.

Reach out today to obtain detailed executive summaries, bespoke competitive benchmarking, and priority access to ongoing market updates. Ketan Rohom will facilitate customized packages that address specific segments-whether articulating boom configurations, utility-driven applications, or emerging electric-power capabilities-ensuring that each client gains a nuanced understanding that drives both near-term wins and long-term value creation. Secure your copy now and stay ahead of evolving regulatory, technological, and regional dynamics shaping the aerial work platform sector.

- How big is the Truck-Mounted Aerial Work Platform Market?

- What is the Truck-Mounted Aerial Work Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?