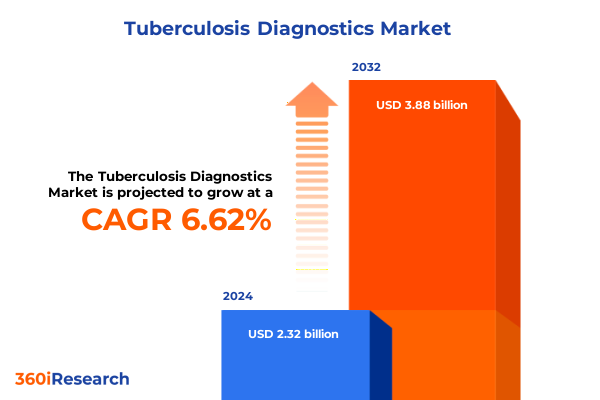

The Tuberculosis Diagnostics Market size was estimated at USD 2.45 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 6.77% to reach USD 3.88 billion by 2032.

Unveiling the Critical Role of Advanced Diagnostic Solutions in Addressing the Global Burden of Tuberculosis and Strengthening Public Health Responses

Over the past decade, tuberculosis diagnostics have undergone a remarkable transformation, integral to controlling one of the world’s most persistent infectious diseases. Historically reliant on slow, labor-intensive microbiological culture methods, the diagnostic landscape has progressively incorporated rapid molecular assays, enabling more timely detection of Mycobacterium tuberculosis. This shift has not only accelerated case identification but also improved patient outcomes through earlier intervention and targeted therapy. Advancements in nucleic acid amplification techniques, imaging platforms, and immunodiagnostic tests have collectively fortified global efforts to reduce transmission rates and ameliorate antibiotic resistance concerns, reaffirming the critical role of technology in public health initiatives.

In parallel, governments, multilateral organizations, and private stakeholders have intensified their focus on diagnostic accessibility, especially in high-burden regions. Funding streams have diversified to encompass point-of-care solutions, decentralized testing, and digital health integrations, thereby broadening diagnostic coverage in both urban centers and remote communities. Regulatory frameworks have adapted to facilitate accelerated approval pathways for novel assays, while procurement strategies increasingly recognize the value of precision diagnostics in resource-limited settings. Consequently, the market is now characterized by a dynamic interplay between innovation, policy, and patient-centric deployment.

This executive summary delves into the multifaceted dimensions of the tuberculosis diagnostics market, encompassing transformative technological shifts, policy-driven market dynamics, and strategic segmentation insights. By synthesizing these elements, decision makers can better navigate emerging opportunities and anticipate potential roadblocks. Through an authoritative analysis of evolving trends and stakeholder priorities, this report aims to equip industry leaders, public health authorities, and investors with the actionable intelligence required to shape the next frontier in tuberculosis control.

Examining Breakthrough Innovations and Policy Developments That Are Redefining the Future of Tuberculosis Diagnostics and Patient Care Delivery

Recent years have witnessed a series of disruptive breakthroughs that are fundamentally redefining how tuberculosis is diagnosed and managed. High-throughput molecular platforms now enable rapid multiplexed detection of Mycobacterium tuberculosis alongside key drug resistance markers in under two hours, dramatically compressing diagnostic turnaround times. Meanwhile, portable, battery-powered point-of-care devices extend reliable testing into peripheral clinics and community outreach programs, effectively closing the gap between sample collection and treatment initiation. As a result, healthcare providers in underserved areas can now leverage robust diagnostic data without reliance on centralized laboratories, thereby reducing diagnostic losses and improving patient retention within cascade-of-care frameworks.

Furthermore, the convergence of digital health innovations and diagnostic technologies is creating new paradigms for data-driven decision making. Advanced imaging algorithms powered by artificial intelligence are enhancing the interpretation of chest radiographs, facilitating automated screening that complements molecular assays. Cloud-based connectivity solutions ensure real-time transmission of test results to national surveillance databases, enabling swift epidemiological tracking and targeted intervention strategies. Integration with mobile health applications provides clinicians and patients with seamless access to digital reports and treatment monitoring tools, enhancing adherence and supporting personalized care pathways.

Policy developments and strategic collaborations have concurrently accelerated market momentum. Regulatory bodies have introduced expedited approval mechanisms for high-priority diagnostics, reducing time to market for innovative assays. Public-private partnerships and philanthropic funding have catalyzed large-scale pilot programs, validating the clinical utility of next-generation platforms in diverse settings. With stakeholders embracing value-based procurement models, the emphasis has shifted from per-test cost to overall impact on patient outcomes, incentivizing developers to align technological innovation with affordability and accessibility objectives.

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Supply Chains, Cost Structures, and Accessibility of Tuberculosis Diagnostic Tools

Beginning in early 2025, the United States government instituted a new schedule of tariffs on imported diagnostic reagents, consumables, and instrumentation critical to tuberculosis testing. These measures, aimed at bolstering domestic manufacturing and protecting strategic supply chains, levied additional duties ranging from modest percentage increases on microfluidic cartridges to substantial levies on high-end molecular sequencers. While the policy intent was to stimulate investment in local production capacity, the immediate effects reverberated across laboratory budgets, procurement cycles, and downstream healthcare economics.

In practical terms, clinical laboratories and reference centers faced elevated unit costs for imported kits and reagents, leading some institutions to recalibrate their testing volumes or adjust cost-recovery models. Equipment vendors reported elongated sales cycles as prospective purchasers weighed the total cost of ownership under the revised tariff regime. Supply chain disruptions emerged as secondary distributors hesitated to stock high-cost items with unpredictable duty adjustments, prompting concerns around buffer stock depletion. These tensions manifested most sharply in high-burden jurisdictions that lack indigenous manufacturing capabilities, potentially undermining diagnostic coverage targets and threatening progress toward elimination goals.

Stakeholders are now exploring mitigation strategies to alleviate tariff-induced pressures. Domestic OEMs are evaluating technology transfer agreements and joint ventures to localize the production of key consumables. Laboratories are forging collaborative agreements with consortium-based procurement platforms to aggregate demand and negotiate volume-based concessions. Regulatory authorities are considering tariff waivers for specific essential diagnostics under humanitarian exceptions. As the tariff landscape continues to evolve, agile supply chain management and proactive stakeholder engagement will be essential to safeguarding equitable access to life-saving diagnostic technologies.

Deriving Deep Strategic Insights from Multidimensional Segmentation of Products, Technologies, Test Types, End Users, and Applications in Tuberculosis Diagnostics

Deep segmentation analysis provides a nuanced understanding of the tuberculosis diagnostics landscape by delineating market dynamics across five critical dimensions. When examined through the lens of product categorization, the market bifurcates into consumables and instruments, with consumables further differentiated into kits tailored for rapid assay deployment and reagents designed for laboratory workflows. This distinction underscores the interplay between one-time capital investment in instrumentation and recurring expenditure on test materials, influencing procurement strategies and lifecycle management decisions.

From a technological perspective, the market journey can be traced along the molecular and nonmolecular spectrum. Molecular methodologies encompass genotypic assays that decode genetic resistance signatures and nucleic acid amplification tests that amplify target sequences with high specificity. In contrast, nonmolecular approaches rely on imaging modalities for radiographic assessment and immunological assays that detect host antibody responses or antigen presence. The dual pathways reinforce the necessity for complementary diagnostic strategies that balance sensitivity, specificity, and operational feasibility in diverse clinical settings.

Evaluating test types reveals a division between detection tests and drug susceptibility testing. Detection modalities span blood-based immunoassays, culture-based phenotypic screens, molecular tests offering rapid nucleic acid detection, skin tests leveraging intradermal antigen challenges, and traditional smear microscopy. Drug susceptibility testing is classified into molecular assays that identify resistance-conferring mutations and phenotypic tests that empirically observe microbial growth in the presence of antibiotics. This differentiation guides stewardship initiatives aimed at optimizing treatment regimens and curtailing the emergence of resistant strains.

Consideration of end users further refines market insight by distinguishing between clinics, hospitals, and reference laboratories. Clinics often demand portable or rapid assays to support point-of-care diagnostics, whereas hospital-based laboratories require integrated systems capable of high-throughput processing under stringent regulatory compliance. Reference laboratories, typically serving as regional centers of excellence, prioritize advanced instrumentation and comprehensive test menus to support epidemiological surveillance and confirmatory testing.

Lastly, application-based segmentation illuminates the distinct requirements for active and latent tuberculosis detection. Active disease assessment incorporates both pulmonary and extrapulmonary specimen workflows, reflecting varied organ involvement and specimen complexity. Conversely, latent TB identification focuses on host immune response profiling, essential for targeted preventive therapy in high-risk populations. Together, these segmentation dimensions equip stakeholders with a multidimensional framework to align product development, marketing strategies, and deployment tactics with evolving clinical needs and resource constraints.

This comprehensive research report categorizes the Tuberculosis Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Test Type

- End User

- Application

Highlighting Critical Regional Dynamics Shaping the Tuberculosis Diagnostics Market across the Americas, Europe Middle East Africa, and Asia Pacific Zones

Regional dynamics exert significant influence over the adoption and deployment of tuberculosis diagnostics, with each geographic cluster reflecting unique epidemiological patterns, healthcare infrastructures, and policy environments. In the Americas, the United States and Canada benefit from advanced laboratory networks, stringent regulatory oversight, and robust reimbursement frameworks that drive the uptake of cutting-edge molecular assays and digital reporting platforms. However, pockets of high incidence persist in parts of Latin America, where constrained healthcare budgets and logistical barriers necessitate cost-effective, point-of-care testing solutions. These market disparities underscore the imperative to tailor product design and distribution strategies to both high-resource urban centers and resource-limited rural communities.

Europe, the Middle East, and Africa present a tapestry of divergent market conditions spanning mature Western European healthcare systems, emerging Middle Eastern economies prioritizing public health modernization, and sub-Saharan African nations contending with high tuberculosis burdens and limited diagnostic capacity. In Western Europe, the emphasis is on integrating novel imaging algorithms and next-generation sequencing into comprehensive diagnostics pipelines. Meanwhile, public health agencies in the Middle East are investing in mobile screening initiatives to address migrant populations, and African governments are partnering with international donors to expand access to molecular point-of-care platforms. These variations highlight the necessity for flexible business models that can accommodate public-sector procurement norms and donor-driven funding cycles.

Asia-Pacific stands out as a critical battleground in the global fight against tuberculosis, with countries such as India, China, and Indonesia bearing a significant proportion of the world’s case load. In this region, government-led mass screening programs leverage pooled sampling approaches and digital surveillance networks to identify cases early and monitor treatment adherence. Local manufacturers are scaling up production of both molecular and immunodiagnostic kits, often in collaboration with multinational technology providers. Rapid urbanization, combined with rising healthcare investment, is paving the way for expanded diagnostic reach into peri-urban and rural districts, making Asia-Pacific a focal point for innovation, collaboration, and capacity building.

This comprehensive research report examines key regions that drive the evolution of the Tuberculosis Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Breakthrough Development and Market Expansion in Tuberculosis Diagnostic Technologies

Leading diagnostic innovators have continually reshaped the tuberculosis testing landscape through strategic investments in research and development, collaborative partnerships, and targeted acquisitions. One prominent player has leveraged its expertise in cartridge-based molecular platforms to streamline sample-to-answer workflows, reducing hands-on time and minimizing the risk of contamination. Another global life science conglomerate has expanded its portfolio by acquiring a specialist in next-generation sequencing reagents, enabling integrated solutions that combine rapid pathogen detection with comprehensive resistance profiling.

Several mid-tier companies have differentiated themselves by focusing on immunodiagnostic assay development, delivering low-cost, scalable solutions for latent TB screening in community settings. These organizations have forged alliances with digital health startups to integrate mobile data capture and result reporting, enhancing patient follow-up and adherence tracking. Meanwhile, certain reference laboratory network operators have established in-house testing divisions, investing in high-throughput platforms and automation technologies to meet increasing demand for bulk screening and surveillance.

Recent merger and partnership activity underscores the industry’s drive toward consolidation and cross-disciplinary collaboration. Technology providers specializing in imaging analytics have entered strategic alliances with assay manufacturers to develop hybrid diagnostic workflows that combine radiographic prescreening with confirmatory molecular tests. Venture-backed biotechs are attracting attention by demonstrating proof-of-concept for novel biosensor technologies with potential to decentralize testing even further. Collectively, these corporate maneuvers reflect an ecosystem that values agility, integrated solutions, and alignment with public health goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tuberculosis Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Molecular Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Cepheid, Inc.

- Hain Lifescience GmbH

- Hologic, Inc.

- Molbio Diagnostics Private Limited

- Oxford Immunotec

- QIAGEN N.V.

- Roche Diagnostics International AG

- Thermo Fisher Scientific Inc.

Offering Practical Strategic Roadmaps for Industry Leaders to Enhance Innovation, Optimize Operations, and Strengthen Resilience in Tuberculosis Diagnostics

To thrive in an increasingly complex and dynamic landscape, industry leaders must adopt proactive strategies that balance innovation, operational efficiency, and market responsiveness. Companies should prioritize investment in modular platform architectures that support seamless upgrades and assay expansions, enabling rapid entry into emerging diagnostic niches without disruptive equipment overhauls. By fostering open innovation ecosystems through collaborations with academic institutions and digital health startups, organizations can accelerate the translation of cutting-edge research into scalable diagnostic solutions.

Supply chain diversification is equally critical; businesses should pursue dual sourcing agreements and regional manufacturing partnerships to mitigate the risks associated with trade policy fluctuations and logistic bottlenecks. Engaging with public-sector agencies and multilateral procurement consortia can yield volume-based purchasing agreements, reducing the per-unit cost of consumables while ensuring reliable supply continuity. Concurrently, aligning commercialization strategies with local healthcare infrastructures-whether urban reference labs or rural clinics-will enhance market penetration and foster long-term stakeholder trust.

Aligned with these initiatives, companies must navigate evolving regulatory environments by establishing dedicated functions for policy intelligence and compliance. Early engagement with health authorities can streamline approval pathways and secure designation under accelerated programs for priority diagnostics. Complementing these efforts with robust post-market surveillance and real-world evidence generation will demonstrate clinical utility and reinforce reimbursement value propositions. Ultimately, a holistic approach that integrates technological innovation, supply chain resilience, and regulatory foresight will position industry leaders to capture growth opportunities and contribute meaningfully to global tuberculosis control objectives.

Detailing Rigorous Methodological Approaches and Robust Data Collection Techniques Underpinning Comprehensive Tuberculosis Diagnostics Market Analysis

This analysis is underpinned by a rigorous methodology that combines comprehensive secondary research with targeted primary data collection to ensure accuracy and depth. The secondary research phase involved systematic review of publicly available literature, including peer-reviewed journals, regulatory filings, government policy documents, and industry white papers. Proprietary databases were consulted to extract historical performance metrics and technology adoption rates, providing a robust baseline for trend analysis.

Primary research consisted of in-depth interviews with a cross section of stakeholders, including laboratory directors, infectious disease clinicians, regulatory experts, and procurement officers. These qualitative insights were triangulated with quantitative survey data from decision makers across clinical and reference laboratories in multiple regions. A series of validation workshops convened subject matter experts to refine assumptions, reconcile divergent viewpoints, and stress-test scenario projections. This iterative process ensured that the analysis reflects real-world operational constraints and emerging priorities.

Data synthesis employed a combination of statistical modeling and qualitative thematic analysis to identify key drivers, barriers, and strategic inflection points. Segmentation frameworks were applied to isolate distinct market dynamics across product categories, technology platforms, test types, end-user segments, and application areas. Regional deep dives incorporated epidemiological data from international health agencies and procurement trends drawn from government tender databases. Throughout the research lifecycle, stringent quality control measures, including peer review and cross-functional validation, were implemented to safeguard data integrity and reinforce the credibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tuberculosis Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tuberculosis Diagnostics Market, by Product

- Tuberculosis Diagnostics Market, by Technology

- Tuberculosis Diagnostics Market, by Test Type

- Tuberculosis Diagnostics Market, by End User

- Tuberculosis Diagnostics Market, by Application

- Tuberculosis Diagnostics Market, by Region

- Tuberculosis Diagnostics Market, by Group

- Tuberculosis Diagnostics Market, by Country

- United States Tuberculosis Diagnostics Market

- China Tuberculosis Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Synthesis of Emerging Trends, Ongoing Challenges, and Strategic Imperatives Shaping the Future Trajectory of Tuberculosis Diagnostics Innovation

As the tuberculosis diagnostics landscape continues to evolve, stakeholders are confronted with a convergence of technological innovation, policy transformation, and market realignment. Rapid molecular assays and digital health integrations have demonstrated their potential to accelerate case detection and optimize treatment pathways, while evolving tariff structures and supply chain considerations have highlighted the vulnerability of global diagnostic networks. Against this backdrop, granular segmentation analyses and regional market insights offer clarity on where investments and strategic interventions can yield the greatest impact.

Leading companies with integrated portfolios and collaborative partnerships hold a distinct advantage, yet emerging biotechs and niche innovators are poised to disrupt established paradigms through novel assay formats and biosensor technologies. For public health authorities and procurement entities, balancing cost-effectiveness with diagnostic accuracy remains paramount, particularly in high-burden and resource-constrained settings. Adoption of flexible financing models, joint procurement mechanisms, and regulatory harmonization efforts will be essential to sustaining diagnostic coverage and driving toward elimination targets.

Looking ahead, the interplay between active and latent tuberculosis applications will shape future pipelines, demanding that assay developers address both rapid case identification and preventive screening imperatives. Investments in decentralized testing, digital connectivity, and real-world evidence generation will further inform policy decisions and catalyze market expansion. By synthesizing actionable insights across product, technology, end-user, and regional dimensions, decision makers can navigate a landscape defined by complexity and opportunity, ultimately advancing the collective goal of ending tuberculosis as a public health threat.

Accelerate Your Strategic Growth with Exclusive Tuberculosis Diagnostics Intelligence by Engaging Directly with Ketan Rohom Associate Director Sales Marketing

In a market defined by rapid innovation and evolving stakeholder expectations, having timely access to comprehensive intelligence is indispensable. Our detailed report offers an in-depth examination of the tuberculosis diagnostics ecosystem, empowering your organization to anticipate emerging trends, optimize strategic investments, and navigate regulatory complexities. Ketan Rohom, the Associate Director of Sales and Marketing, stands ready to guide you through the report’s insights, ensuring a tailored understanding of how these findings align with your operational priorities.

By engaging directly with Ketan Rohom, you gain privileged access to expert analysis on market segmentation, regional dynamics, tariff impacts, and leading company strategies. This dialogue will clarify how the report’s actionable recommendations can be adapted to your organizational context, whether you are seeking to expand into new markets, refine product portfolios, or strengthen supply chain resilience. We invite you to schedule a consultation that unlocks the full potential of the report’s insights, positioning your team to lead in the fight against tuberculosis and drive sustainable growth.

To initiate your consultation and secure a copy of the full research report, please reach out to Ketan Rohom. His expertise in aligning market intelligence with sales and marketing strategies will ensure that your organization remains at the forefront of tuberculosis diagnostics innovation. Take decisive action today to transform insight into impact and solidify your leadership in this critical healthcare domain.

- How big is the Tuberculosis Diagnostics Market?

- What is the Tuberculosis Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?