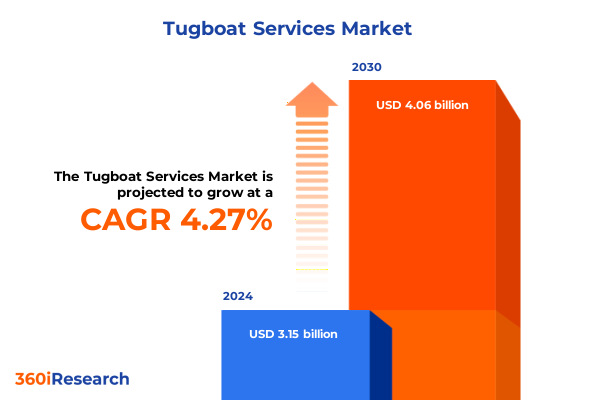

The Tugboat Services Market size was estimated at USD 3.15 billion in 2024 and expected to reach USD 3.28 billion in 2025, at a CAGR of 4.27% to reach USD 4.06 billion by 2030.

Exploring the Critical Role of Tugboat Services in Ensuring Safe, Efficient Maritime Operations Across Global Shipping and Emerging Offshore Sectors

Maritime transportation depends on precision, resilience, and adaptability to ensure that vessels of all sizes navigate busy ports and remote offshore installations without incident. At the heart of these critical operations lies the specialized skillset and robust equipment of tugboat services, which have evolved from simple ship assist functions into a multifaceted ecosystem supporting commercial shipping, offshore energy development, and terminal operations. A dynamic blend of operational excellence, stringent safety protocols, and strategic investments in technology has solidified the role of tugboats as indispensable assets in contemporary maritime logistics. As global trade volumes continue to expand and regulatory regimes tighten environmental standards, the demands placed upon tug services have never been greater.

In this context, the introduction to our executive summary sets the stage for a comprehensive exploration of the tugboat services landscape. We aim to illuminate the operational challenges that industry participants face, the transformative trends reshaping service delivery, and the strategic considerations driving fleet and infrastructure decisions. Anchored by qualitative insights from sector experts and corroborated through extensive secondary research, this introduction establishes the foundation for understanding how tugboat services will adapt and thrive amid shifting economic, regulatory, and technological currents.

Navigating the Waves of Change: Key Technological Innovations, Regulatory Reforms, and Market Dynamics Shaping Modern Tugboat Services

The tugboat sector is undergoing a period of profound transformation as technology, sustainability imperatives, and evolving customer expectations converge to redefine service standards. Advanced propulsion systems such as hybrid-electric and LNG-powered engines are increasingly prioritized to meet stringent emissions regulations set by the International Maritime Organization and various national agencies. These cleaner energy adaptations not only reduce carbon footprints but also drive significant life-cycle cost savings through optimized fuel economies and lower maintenance demands. Alongside propulsion upgrades, real-time vessel positioning, remote monitoring, and predictive maintenance platforms have revolutionized operational reliability, enabling service providers to anticipate equipment wear and schedule proactive interventions without disrupting port schedules.

Concurrently, regulatory reforms are reshaping market entry barriers and compliance requirements. Port emission control areas are expanding to include additional coastal jurisdictions, imposing tighter sulfur oxide and nitrogen oxide caps that necessitate cleaner fuel usage and improved onboard treatment systems. Meanwhile, trade policy adjustments and tariff regimes are influencing procurement strategies for newbuild tugs and retrofits, with organizations recalibrating supply chains to mitigate cost volatility. These regulatory shifts, combined with an accelerated pace of mergers and acquisitions among service providers and growing alliances with offshore wind developers, underscore the dynamic market forces redefining tugboat services.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Tugboat Service Costs, Supply Chains, and International Competitiveness

In 2025, the United States government implemented targeted tariffs on imported steel, vessel components, and specialty marine equipment that materially affect the capital and operating costs of tug fleets. Steel tariffs have driven up the cost of new hull construction and major refits by as much as 15 percent, compelling operators to reevaluate build locations, negotiate longer-term contracts with domestic suppliers, and seek alternative materials where feasible. At the same time, increased levies on key propulsion system parts-such as high-grade castings and precision bearings-have introduced delays in retrofit schedules as manufacturers and service yards adjust their production pipelines to accommodate higher input costs.

These tariff-induced pressures extend beyond direct cost impacts, as they ripple through global supply chains and procurement timelines. Operators are reporting lead times stretching by up to 20 weeks for critical spares, which heightens the risk of service interruptions and escalates logistics complexity. From a competitiveness standpoint, U.S.-based providers face a nuanced environment: while domestic fleets are insulated from certain cross-border cost fluctuations, they also contend with higher capital expenditure profiles compared to regions with lower import duties. In response, many stakeholders are exploring strategic partnerships with domestic equipment fabricators and investing in modular vessel designs that facilitate component interchangeability while insulating operations from external pricing shocks.

Unveiling Market Segmentation Insights: Service Types, End Use Industries, Propulsion, Power Ranges, and Vessel Classes Driving Tugboat Services

An in-depth analysis of market segmentation reveals the diverse service offerings and customer requirements that underpin tugboat operations. When categorized according to service type, the sector comprises vessels dedicated to escort missions, which specialize in safeguarding large tankers and container ships as they traverse constrained waterways; harbor towing vessels that undertake routine maneuvers within port basins; offshore support vessels designed to serve exploration rigs and wind farm installations; and salvage tugs equipped for emergency recovery operations. Understanding these distinctions is crucial, as each segment demands tailored vessel design, crew training, and equipment capabilities.

Delving into end use industry provides additional clarity on where demand is concentrated. The commercial shipping segment commands a significant share of tug engagements, driven by the ongoing expansion of global trade and the trend toward ever-larger containerships. Simultaneously, the offshore renewables sector is experiencing rapid growth, particularly in offshore wind, tidal energy, and wave energy projects that require specialized support vessels for turbine installation and maintenance. The oil and gas segment remains a foundational end market, with legacy platforms and new deepwater fields necessitating robust escort and towing services. Ports and terminals also represent a critical end use cluster, as operators seek to optimize berth schedules and handle increasingly complex cargo flows.

Propulsion type continues to be a defining factor in fleet configuration and lifecycle economics. Azimuth stern drive tugs are prized for their unmatched maneuverability and precise station-keeping, while conventional propulsion systems maintain a strong foothold due to proven reliability and simpler maintenance regimes. Voith Schneider propulsion, though less ubiquitous, offers rapid directional responsiveness, making it ideal for high-density port environments.

Examining engine power range exposes a further layer of market nuance. A subset of high-power vessels-those rated at 10,000 to 14,999 horsepower and 15,000 horsepower and above-fulfill the demands of ultra-large crude carriers and liquefied natural gas vessels. Mid-tier power categories, spanning from 5,000 to 7,499 horsepower and 7,500 to 9,999 horsepower, cater to versatile offshore support duties and larger harbor operations. The 2,000 to 2,999, 3,000 to 3,999, and 4,000 to 4,999 horsepower cohorts are favored for standard harbor towing and coastal transfers, whereas smaller craft in the 500 to 1,000, 1,001 to 1,500, and 1,501 to 1,999 horsepower brackets deliver cost-effective handling of feeder vessels and inland craft.

Vessel class distinctions provide a final lens for segmentation insight. Harbor tugs excel at quick-response maneuvers within port confines, ocean-going tugs are built for extended blue-water assignments, offshore support tugs are outfitted for multi-day rig transfers, and terminal tugs focus on high-frequency operations in specialized terminal environments. By integrating these segmentation dimensions, stakeholders can tailor investment, fleet renewal, and operational strategies to match precise market demands.

This comprehensive research report categorizes the Tugboat Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Vessel Class

- Propulsion

- End User

Regional Perspectives on Tugboat Markets: Distinct Growth Drivers and Challenges Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics exert a profound influence on tugboat service demand, creating distinct competitive landscapes and investment priorities across geographies. In the Americas, strong momentum in LNG exports and container throughput growth has spurred port authorities and private operators to upgrade tug fleets capable of handling increasingly larger vessels. Expansion of offshore wind initiatives along the U.S. East Coast is also generating new requirements for vessels designed to assist in turbine installation, highlighting an emerging niche for multipurpose support tugs.

Across Europe, Middle East, and Africa, environmental regulation is a primary catalyst driving fleet modernization. The European Union’s Fit for 55 package and Emission Control Area expansions compel operators to invest in cleaner propulsion systems and retrofits, while emerging markets in the Middle East are leveraging major port development projects to introduce high-performance harbor and ocean-going tugs. In Africa, burgeoning oil and gas exploration along West African coasts is creating pockets of demand for robust escort and salvage services, albeit tempered by infrastructure and regulatory maturity challenges.

The Asia-Pacific region remains the largest contributor to tugboat service volumes, buoyed by rapid port expansion in China, Southeast Asia, and India, as well as the ongoing renovation of Australia’s coal export terminals. Shipbuilding hubs in South Korea and Japan continue to reset global standards for hull design and tug efficiency, with indigenous players introducing innovative propulsion technologies that are gradually permeating international markets. Meanwhile, port authorities throughout the region are forging public–private partnerships to finance hybrid-powered fleets, reflecting broader efforts to reconcile growth ambitions with decarbonization objectives.

This comprehensive research report examines key regions that drive the evolution of the Tugboat Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Deconstructed: Performance Drivers and Strategic Initiatives of Leading Players in Tugboat Services

The competitive fabric of the tugboat services market is woven from a blend of established maritime operators and specialized niche players, each leveraging unique strengths to build market share. Legacy operators that have developed multi-decade relationships with major port authorities often emphasize comprehensive service portfolios, integrating towing, escort, salvage, and offshore support under unified brand platforms. These companies typically prioritize fleet size and geographic coverage, investing in both newbuild programs and strategic acquisitions to secure access to key ports and offshore fields.

In contrast, technology-focused entrants are carving out leadership positions by delivering advanced propulsion solutions and digital service offerings. Partnerships with engine manufacturers and software developers enable these players to offer predictive maintenance packages, fuel optimization services, and real-time performance analytics, appealing to customers who view tugs as integrated elements of a broader supply chain ecosystem. Midmarket and regional operators are finding success by specializing in particular vessel classes or end use segments-such as high-horsepower escort tugs for VLCC maneuvering or shallow-draft terminal tugs for riverine operations-and cultivating tight customer relationships based on reliability and rapid response times.

Recent mergers and partnerships illustrate the ongoing consolidation trend, as larger firms absorb nimble innovators to expand service portfolios and upgrade technological capabilities. Strategic alliances with offshore wind developers, oil majors, and global shipping lines further underscore the importance of cross-sector collaboration, with tug service providers jointly developing customized support packages that combine vessel operations with project logistics and environmental compliance expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tugboat Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ardent Marine Services

- Boluda Corporación Marítima

- Bourbon Maritime S.A.

- Chantiers de l'Atlantique

- COSCO Shipping Heavy Industry Co., Ltd.

- Crowley Maritime Corporation

- Damen Shipyards Group.

- Eastern Shipbuilding Group, Inc.

- Edison Chouest Offshore, LLC

- Fairplay Schleppdampfschiffs-Reederei Richard Borchard GmbH

- Fincantieri S.p.A.

- Foss Maritime Company

- GAC Group

- General Dynamics Corporation

- Hanwha Ocean co., Ltd.

- Harbor Star Shipping Services, Inc.

- Huntington Ingalls Industries, Inc.

- Hyundai Heavy Industries Co., Ltd.

- Imperial Marine Services

- Island Tug and Barge, Inc.

- K-Line Towage & Offshore

- Kawasaki Heavy Industries, Ltd.

- Kirby Corporation

- Kotug International B.V.

- Marquette Transportation Company LLC

- McAllister Towing and Transportation Company, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Moran Towing Corporation

- Multraship Towage & Salvage

- Navantia, S.A.

- Resolve Marine Group, Inc.

- Royal Boskalis Westminster N.V.

- Samsung Heavy Industries Co., Ltd.

- Sanmar Denizcilik A.S

- Seabulk Towing, LLC

- SEAGATE CORPORATION Co.,LTD.

- Signet Maritime Corporation

- Sociedad Matriz SAAM S.A.

- Solstad Offshore ASA

- Svitzer Group A/S

- Swire Pacific Limited

- Tidewater Inc.

Strategic Opportunities for Industry Leaders: Targeted Actions to Capitalize on Emerging Trends and Mitigate Operational Risks

To navigate the complexities of modern maritime operations, industry leaders should adopt a series of targeted strategies that align organizational priorities with market realities. First, accelerated investment in alternative propulsion technologies will not only ensure compliance with emerging emissions standards but also create long-term operational cost advantages, strengthening competitiveness in ports subject to stringent environmental controls. Companies should evaluate hybrid, LNG, or fully electric power solutions in the context of total cost of ownership, including infrastructure readiness and crew training requirements.

Second, resilience in procurement and supply chain management must be enhanced through diversified sourcing strategies and modular design frameworks. By adopting standardized component interfaces and maintaining multi-supplier agreements, operators can reduce exposure to tariff fluctuations and minimize downtime risks associated with part shortages. Third, digital transformation initiatives that leverage predictive analytics, remote monitoring, and integrated port management platforms will improve fleet utilization rates and enable data-driven decision-making. Establishing cross-functional teams to drive these initiatives ensures that IT and operations remain aligned around common performance metrics.

In addition, expanding service offerings within high-growth segments-such as offshore renewables support and specialized salvage operations-can unlock new revenue streams while leveraging existing vessel capabilities. Forming strategic partnerships with project developers and port authorities will facilitate access to long-term contracts and joint investment opportunities. Finally, workforce development and safety management must remain at the forefront of any growth strategy, with continuous crew training programs and rigorous adherence to international safety codes ensuring operational excellence and reinforcing customer confidence.

Rigorous Research Methodology Employed: Data Collection Techniques, Analytical Frameworks, and Validation Processes for Robust Market Insights

This analysis draws upon a rigorous research framework designed to deliver robust, actionable market insights. Primary research comprised in-depth interviews with senior executives at tugboat operators, port authorities, shipbuilders, and equipment suppliers, ensuring a balanced array of firsthand perspectives. Secondary research involved a systematic review of maritime industry publications, vessel registry databases, regulatory filings, and technical white papers to validate key trends and corroborate quantitative observations.

Segmentation analyses were conducted by deconstructing the market according to service type, end use industry, propulsion technology, engine power range, and vessel class, thereby illuminating discrete demand drivers and identifying overlap opportunities. A qualitative scoring model assessed technology adoption rates, regulatory impact, and service reliability, while a quantitative framework examined vessel deployment patterns, retrofit cycles, and capital expenditure profiles. Data triangulation and cross-validation with expert feedback were integral to establishing confidence in the findings, and all conclusions were subjected to peer review by experienced maritime consultants to ensure methodological rigor and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tugboat Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tugboat Services Market, by Service Type

- Tugboat Services Market, by Vessel Class

- Tugboat Services Market, by Propulsion

- Tugboat Services Market, by End User

- Tugboat Services Market, by Region

- Tugboat Services Market, by Group

- Tugboat Services Market, by Country

- United States Tugboat Services Market

- China Tugboat Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings: The Strategic Imperatives and Future Outlook for Tugboat Services in a Rapidly Evolving Maritime Environment

The confluence of stricter environmental standards, rapid technological advances, and shifting trade policies has fundamentally reshaped the tugboat services sector, positioning it at the intersection of operational necessity and strategic opportunity. Investments in cleaner propulsion and digital platforms have emerged as nonnegotiable imperatives, while the ongoing expansion of offshore renewables and evolving port traffic patterns present avenues for differentiation and growth. At the same time, tariff-related cost pressures and supply chain uncertainties underscore the need for agile procurement strategies and resilient design principles.

Moving forward, stakeholders who embrace data-driven decision-making, diversifying service portfolios, and forging cross-sector partnerships will be best positioned to capture the next wave of market expansion. Insight into segmentation dynamics-from escort and harbor towing to offshore support and salvage-enables tailored asset allocation and targeted service offerings. Regional market nuances further highlight the importance of customizing approaches, whether that involves retrofitting fleets for European emission zones, scaling up high-horsepower deployments in the Americas, or leveraging Asia-Pacific shipbuilding innovations. These strategic imperatives point toward a future where agility, sustainability, and collaboration define market leaders’ success.

Engage Directly with Ketan Rohom to Secure Comprehensive Tugboat Services Market Intelligence and Drive Informed Decision-Making

If you’re seeking to translate these insights into strategic advantage, the next step is simple. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the wealth of detailed analysis contained within the full Tugboat Services market research report. By engaging with Ketan, you’ll gain tailored support in selecting the specific market intelligence modules that align with your organization’s priorities-whether that involves deep dives into region-specific demand dynamics, detailed competitive benchmarking, or granular segmentation analyses that help you refine service offerings. Ketan’s expertise will ensure that your purchase decision delivers maximum value, equipping your leadership team with actionable data, precise trend tracking, and scenario-based insights to inform investment, fleet modernization, or business development strategies. Contact Ketan Rohom today to secure the comprehensive report and position your organization at the forefront of the evolving tugboat services market.

- How big is the Tugboat Services Market?

- What is the Tugboat Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?