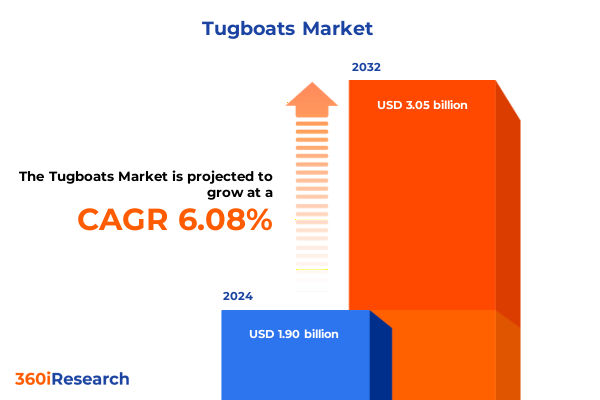

The Tugboats Market size was estimated at USD 1.90 billion in 2024 and expected to reach USD 2.01 billion in 2025, at a CAGR of 6.08% to reach USD 3.05 billion by 2032.

Exploring the Evolution and Strategic Significance of Tugboats within the Maritime Ecosystem and Their Role in Modern Trade Dynamics

Tugboats occupy a pivotal position within the maritime ecosystem, serving as the workhorses of port operations, coastal logistics, and offshore support. Historically, these versatile vessels have orchestrated the safe maneuvering of larger ships, enabling efficient berthing and unberthing processes that underpin global trade. The evolution of tugboat design, propulsion, and operational strategy has mirrored broader shifts in maritime commerce, responding to the increasing scale of cargo vessels and the growing complexity of port infrastructures.

Over the past decade, tugboats have transcended their traditional roles, integrating advanced navigation systems, remote monitoring technologies, and hybrid propulsion solutions. These enhancements have not only improved safety margins but also driven operational efficiency, reduced emissions, and lowered lifecycle costs. As international regulations and environmental mandates gain momentum, the tugboat sector is at the forefront of innovative adaptation, redefining industry benchmarks for reliability and sustainability.

This introduction lays the foundation for a comprehensive analysis of current market dynamics, regulatory landscapes, and technological advancements. By framing the strategic significance of tugboats in modern maritime commerce, this section establishes the context for deeper exploration of transformative shifts, tariff impacts, segmentation nuances, regional variances, and competitive strategies shaping the future of the industry.

Navigating Technological Advances and Environmental Mandates Redefining the Tugboat Landscape for Enhanced Operational Efficiency

The tugboat industry is witnessing unprecedented transformation driven by technological breakthroughs, regulatory pressure, and shifting customer expectations. Autonomous navigation systems are rapidly maturing, leveraging artificial intelligence and machine learning to optimize route planning, fuel efficiency, and predictive maintenance. This technological infusion is complemented by the rise of digital twins, enabling operators to simulate vessel performance, assess risk scenarios, and refine decision models in real time.

Environmental mandates have also emerged as a powerful catalyst for change. Stringent emissions standards, carbon-neutral initiatives, and port environmental regulations are compelling fleet operators to accelerate the adoption of low-carbon propulsion systems. Hybrid-electric configurations, along with zero-emission hydrogen prototypes, are transitioning from pilot projects to mainstream deployment. As a result, vessel designers are integrating modular battery packs, fuel cell systems, and energy recovery mechanisms to meet evolving compliance requirements.

Simultaneously, global supply chain realignments are reshaping procurement and maintenance practices. Scarcity of critical components, coupled with geopolitical uncertainties, highlights the need for resilient logistics strategies. Towboat operators are forging strategic partnerships with equipment manufacturers and service providers to secure long-term availability of spare parts and specialized services. These converging trends are redefining the competitive landscape, setting new benchmarks for operational performance, environmental stewardship, and digital agility.

Assessing How US Steel and Aluminum Tariffs since 2018 Have Reshaped Tugboat Production, Cost Structures, and International Competitiveness

Since the introduction of steel and aluminum tariffs in recent years, tugboat manufacturers and operators have grappled with elevated input costs and supply chain complexities. Section 232 tariffs, which imposed significant duties on imported steel and aluminum, have driven material expenses upward, compelling vessel designers to reassess construction methodologies. The resulting cost pressures have been partially absorbed through enhanced design efficiencies, but a portion has been passed through to end users via charter rates and contract terms.

Furthermore, retaliatory measures and trade policy uncertainty have intensified procurement challenges for specialized components sourced from Europe and Asia. Manufacturers with vertically integrated operations have exhibited greater resilience, capturing competitive advantage through in-house metal fabrication and long-term supplier agreements. Conversely, operators reliant on imported vessels or retrofitting older assets have encountered longer lead times and constrained capacity, affecting project timelines and profitability ratios.

Nevertheless, the cumulative impact of these trade measures has stimulated a resurgence in domestic production capacity, encouraging investment in local shipyards and steel mills. Public–private collaborations have emerged to bolster workforce skills, modernize fabrication facilities, and support R&D in advanced materials. Through these initiatives, the industry is gradually offsetting tariff-induced cost increases while strengthening its manufacturing base against future policy shifts.

Revealing the Diverse Segmentation Landscape Unveiling Critical Performance, Propulsion, Application, and End User Dynamics Shaping the Tugboat Market

The tugboat market encompasses a diverse array of vessel configurations and operational requirements, each addressing specific performance needs. Vessel types range from Azimuth Stern Drive units offering exceptional maneuverability to traditional Harbor Tugboats optimized for confined port environments. River Tugboats provide specialized shallow-draft solutions, whereas Seagoing Tugboats facilitate long-distance escort and towage missions. Unique drive systems, including Voith Schneider and Z-drive configurations, deliver precise thrust vectoring critical for high-accuracy station keeping.

Propulsion choices further differentiate the competitive landscape. Conventional diesel engines remain prevalent due to their proven reliability and widespread service network. However, Electric & Hybrid powertrains are rapidly gaining traction among operators targeting lower emissions and reduced maintenance intervals. Gas-fueled turbines, while niche, appeal to operators seeking high power density with lower airborne pollutants, particularly in emissions-regulated zones.

Power capacity segmentation reveals distinct operational profiles. Low-power units up to 1,500 HP excel in port tug assist, where agility and minimal draft are paramount. Mid-range vessels spanning 1,500 to 3,500 HP strike a balance between harbor duties and short-range coastal towage. Larger platforms between 3,500 and 5,500 HP handle heavier ship sizes and moderate offshore assignments, while specialty units exceeding 5,500 HP undertake demanding escort and offshore support tasks.

Application focus underscores end-user value propositions. Berthing Assistance vessels are engineered for precision ship approach and departure, leveraging thrust control systems and dynamic positioning. Coastal Towage craft handle near-shore cargo transfers and emergency towing. Offshore Support tugs extend the operational envelope by servicing floating wind farms and providing platform assistance, where enhanced station-keeping and environmental resilience are essential.

End users across the maritime value chain reflect the versatile utility of tugboats. Logistics companies rely on towage services for seamless cargo transshipment, marine construction firms employ tugs for heavy-lift and salvage operations, and port authorities depend on dedicated fleets to ensure efficient vessel flow and harbor safety. Each end-user segment drives procurement strategies and fleet specifications, reinforcing the need for tailored vessel designs and service models.

This comprehensive research report categorizes the Tugboats market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Energy Source

- Propulsion Configuration

- Power Capacity

- Bollard Pull Class

- Applications

- End User

Illuminating Regional Market Dynamics Highlighting Growth Drivers and Regulatory Influences across Americas, EMEA, and Asia-Pacific

Regional landscapes in the tugboat industry vary considerably, shaped by regulatory frameworks, infrastructure maturity, and trade volumes. In the Americas, North American ports emphasize emission reduction through alternative fuels and electrification pilots, while South American nations pursue riverine asset expansion to support inland logistics corridors. Economic development initiatives and port modernization projects in the region stimulate demand for both newbuilds and retrofits, highlighting a dual focus on capacity growth and environmental compliance.

Across Europe, the Middle East, and Africa, stringent emission control areas and carbon neutrality pledges have driven accelerating adoption of hybrid and zero-emission tugs. Northern European shipyards have become centers of excellence for green tug development, exporting advanced designs to global markets. Meanwhile, Middle Eastern ports are enhancing dredging and terminal infrastructure to support larger vessel classes, creating opportunities for high-power seagoing tugs. In sub-Saharan Africa, incremental improvements in port operations and offshore exploration activities sustain stable demand for versatile harbor vessels.

Asia-Pacific presents a mosaic of high-growth and mature markets. East Asian maritime hubs lead technological integration with autonomous navigation trials and remote monitoring systems. In Southeast Asia, rising container throughput and offshore energy projects drive coastal towage procurement. Australasia focuses on environmental stewardship, implementing emission control regulations that favor electric and hybrid solutions. The regional diversity underscores the necessity for adaptable vessel platforms and supply chains capable of serving heterogeneous operational requirements.

This comprehensive research report examines key regions that drive the evolution of the Tugboats market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves and Innovation Strategies of Leading Industry Participants Shaping the Tugboat Market’s Competitive Frontier

Leading participants in the tugboat sector are amplifying their competitive advantage through targeted innovation, strategic partnerships, and capacity expansion. Established shipbuilders are investing in research and development of next-generation propulsion systems, leveraging collaborations with technology providers and academic institutions to bring hydrogen and battery-electric prototypes to commercialization. Simultaneously, service providers are enhancing digital platforms that integrate fleet management, predictive maintenance, and performance analytics, enabling operators to optimize asset utilization and minimize downtime.

Mergers and joint ventures have emerged as preferred strategies for scaling capabilities and expanding geographic reach. Partnerships between local shipyards and global design firms facilitate technology transfer and expedite project delivery. Meanwhile, operational alliances between towing companies support fleet sharing models that improve asset efficiency and lower capital expenditure requirements. These ecosystem partnerships are critical for service providers seeking to offer turnkey solutions encompassing vessel construction, crew training, and after-sales support.

Moreover, smaller specialized firms focusing on autonomous navigation modules and remote telemetry systems are attracting strategic investment and forging alliances with traditional shipbuilders. By integrating modular autonomy kits and digital dashboards, these innovators are accelerating the transition toward unmanned towage operations and reinforcing safety protocols. Collectively, these corporate maneuvers are reshaping the competitive frontier, driving a convergence of traditional maritime expertise with cutting-edge technology.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tugboats market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bollinger Shipyards

- Cheoy Lee Shipyards Ltd

- Conrad Industries, Inc.

- Damen Shipyards Group

- Eastern Shipbuilding Group, INC

- Foss Maritime Company

- GRANDWELD SHIPYARDS

- Kanagawa Dockyard Co., Ltd.

- KTU Shipyard

- Navalt Limited.

- Nichols Brothers Boat Builders

- Nordic Tugs

- Peida Machinery Group Co. ,Ltd.

- Ranger Tugs by Fluid Motion LLC

- Robert Allan Ltd.

- SANMAR DENIZCILIK A.S.

- SYM Naval

- TSUNEISHI SHIPBUILDING Co., Ltd.

- Uzmar Gemi Insa San. ve Tic. A.S.

- Vigor Industrial LLC

- Wilson Sons S.A.

- ZAMAKONA YARDS CANARIAS, S.L.

- Zhenjiang Glory Heavy Machinery Co.,Ltd

Strategic Imperatives for Maritime Stakeholders to Capitalize on Evolving Standards, Technology Adoption, and Market Expansion Opportunities

Industry stakeholders must prioritize scalable investments in green propulsion technologies to align with increasingly rigorous emissions standards. By allocating research budgets toward modular retrofit kits and hydrogen fuel cell trials, fleet operators can phase in low-carbon vessels without compromising operational readiness. Equally important is the establishment of robust digital infrastructure, enabling real-time data exchange between vessels and shore-based command centers, which enhances predictive maintenance and fuel optimization.

Collaboration with policy makers and port authorities will also prove instrumental in shaping incentive programs and regulatory pathways. Proactive engagement can secure favorable berth allocations, pilot funding for infrastructure upgrades, and subsidies for alternative fuel adoption. In parallel, diversifying procurement strategies to include regional shipyards and component suppliers can mitigate tariff exposure and buffer supply chain volatility.

Additionally, forging cross-sector alliances with renewable energy companies positions towage operators to capture emerging opportunities in offshore wind support and energy transition logistics. By co-developing bespoke tug models optimized for wind farm installation and maintenance, stakeholders can unlock new service revenue streams. Finally, embedding sustainability metrics into corporate governance frameworks will signal commitment to environmental stewardship, strengthening brand reputation and facilitating access to green finance instruments.

Demonstrating a Robust Multi-Method Approach Combining Primary Interviews, Secondary Data, and Rigorous Triangulation to Ensure Valid Insights

This research integrates multiple data collection methodologies to ensure comprehensiveness and accuracy. Secondary data sources include regulatory filings, industry white papers, patent databases, and technical journals, providing a foundational understanding of market drivers, competitive landscapes, and technological platforms. These insights were complemented by detailed vessel registries and port operation reports to map fleet composition and utilization trends.

Primary research involved structured interviews and consultations with a cross-section of subject-matter experts, including naval architects, shipyard executives, port directors, and towage service managers. These interviews uncovered firsthand perspectives on operational challenges, investment priorities, and strategic roadmaps. Additional quantification was achieved through targeted surveys distributed to fleet operators and maritime procurement professionals to validate thematic findings and gauge adoption timelines for emerging technologies.

Data triangulation played a critical role in refining insights, aligning qualitative feedback with quantitative indicators to identify high-impact trends. Throughout the process, rigorous quality checks and validation protocols were applied, ensuring consistency and reliability across disparate information sources. This multi-method approach has produced a nuanced, actionable depiction of current and future tugboat market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tugboats market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tugboats Market, by Type

- Tugboats Market, by Energy Source

- Tugboats Market, by Propulsion Configuration

- Tugboats Market, by Power Capacity

- Tugboats Market, by Bollard Pull Class

- Tugboats Market, by Applications

- Tugboats Market, by End User

- Tugboats Market, by Region

- Tugboats Market, by Group

- Tugboats Market, by Country

- United States Tugboats Market

- China Tugboats Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Converging Technological, Regulatory, and Market Forces are Poised to Redefine Tugboat Industry Trajectories Worldwide

The tugboat industry stands at a pivotal juncture as converging technological, regulatory, and economic forces coalesce to redefine fleet composition, operational models, and service offerings. Advancements in autonomous navigation and low-carbon propulsion are set to enhance efficiency and environmental performance, while evolving port regulations and trade policies continue to influence procurement strategies and supply chain resilience.

Regional market variations underscore the need for adaptable vessel designs and tailored service models, reflecting diverse infrastructure investments and environmental priorities. Segmentation analysis reveals that performance, propulsion preferences, application scope, and end-user requirements collectively determine competitive positioning and growth pathways. For industry participants, the most successful strategies will integrate cross-sector partnerships, digital transformation, and forward-looking sustainability measures.

By synthesizing these insights, decision makers can navigate the complexities of modern towage operations, align their investment agendas with emerging regulatory frameworks, and capitalize on new market segments such as floating wind support. The combined effect of these trends will shape the future trajectory of the tugboat sector, reinforcing its essential role in the global maritime ecosystem.

Engage with an Expert to Unlock the Full Spectrum of Market Insights and Drive Informed Decision-Making through a Comprehensive Report

To explore the full breadth of actionable insights, specialized analyses, and strategic foresight delivered in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to secure your personalized copy and chart a path toward optimized operations, informed investment decisions, and sustainable growth in the tugboat sector. Elevate your competitive edge by partnering with an expert who can guide you through the complexities of market dynamics and regulatory shifts. Take the next step in maritime intelligence and ensure your organization is positioned to capitalize on emerging opportunities and mitigate potential challenges with confidence and clarity

- How big is the Tugboats Market?

- What is the Tugboats Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?