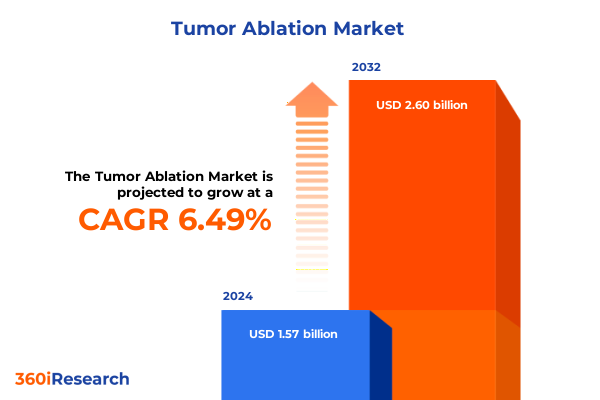

The Tumor Ablation Market size was estimated at USD 1.67 billion in 2025 and expected to reach USD 1.78 billion in 2026, at a CAGR of 6.52% to reach USD 2.60 billion by 2032.

Unveiling the Critical Role of Tumor Ablation Innovation in Shaping Next-Generation Oncological Treatment Paradigms for Enhanced Patient Survival

The landscape of oncology treatment has undergone a profound transformation with the rise of minimally invasive tumor ablation techniques, ushering in a new era of patient-centric care and therapeutic precision. Historically, surgery and systemic therapies have dominated the management of solid tumors, often carrying significant morbidity and extended recovery times. By contrast, ablation modalities harness focused energy sources to eradicate malignant tissue while preserving surrounding healthy structures, offering the promise of reduced hospital stays and improved quality of life for patients.

Throughout the past decade, technological advancements have accelerated the mainstream adoption of ablation procedures across a broad spectrum of indications, from liver and kidney tumors to lung and prostate malignancies. These innovations have not only expanded treatment options for otherwise inoperable cases but have also forged pathways for combination approaches that integrate ablation with immunotherapy, targeted agents, and image-guided interventions. Consequently, healthcare providers are increasingly recognizing ablation as a cornerstone of multimodal oncology strategies, driving further investment in device design and clinical protocol development.

As we look ahead, the tumor ablation sphere is poised for continued disruption through the convergence of artificial intelligence, enhanced energy delivery systems, and precision imaging. This executive summary sets the stage by exploring emerging shifts, regulatory influences, and segmentation imperatives essential for stakeholders aiming to capitalize on the significant growth and innovation potential within this dynamic market.

Harnessing Technological and Clinical Breakthroughs to Propel the Evolution of Tumor Ablation Practices Across Diverse Oncological Specialties

The tumor ablation domain is witnessing transformative shifts driven by the integration of cutting-edge technologies and refined clinical methodologies. Leading the charge is the incorporation of advanced imaging platforms-such as fusion ultrasound, contrast-enhanced MRI, and real-time CT guidance-which enable precise targeting of malignant lesions while minimizing collateral damage. These capabilities have unlocked new procedural frontiers, allowing practitioners to treat tumors in anatomically intricate locations with a level of accuracy that was previously unattainable.

Simultaneously, the infusion of artificial intelligence and machine learning into procedural planning and outcome prediction is enhancing operator confidence and facilitating personalized treatment regimens. Algorithms now assist clinicians in mapping ablation zones, forecasting efficacy, and optimizing energy delivery parameters to achieve complete tumor necrosis. In parallel, the rise of robotic-assisted ablation systems has improved needle placement accuracy, reduced procedural variability, and bolstered reproducibility across diverse clinical settings.

Moreover, the advent of novel energy modalities-including irreversible electroporation, high-intensity focused ultrasound, and laser interstitial thermal techniques-has broadened the therapeutic armamentarium beyond conventional radiofrequency and microwave approaches. When coupled with immunomodulatory strategies, these modalities show promise in eliciting systemic anti-tumor responses, hinting at a paradigm where localized ablation serves as both a direct cytotoxic tool and an adjunct immunotherapy primer. Collectively, these shifts underscore the rapid evolution of the tumor ablation landscape and lay the foundation for continued innovation and adoption.

Assessing the Far-Reaching Implications of United States Tariff Policies in 2025 on the Cost Structure and Accessibility of Tumor Ablation Solutions

In 2025, the United States implemented revised tariff measures on imported medical devices, encompassing critical components for tumor ablation systems such as electrodes, generators, and specialized probes. These policy adjustments have introduced incremental cost pressures for manufacturers reliant on global supply chains, necessitating strategic reassessments of sourcing and pricing models. As a result, device producers are deploying a mix of cost optimization initiatives and value-based contracting to preserve margin integrity without compromising access for healthcare providers.

The ripple effects of these tariffs extend to end users, including ambulatory surgical centers and cancer care institutions, where budget constraints may delay equipment upgrades or the adoption of next-generation ablation offerings. In response, some providers are exploring long-term service agreements and capital leasing structures to mitigate upfront capital expenditures. Simultaneously, device makers are accelerating local assembly and in-region manufacturing partnerships to circumvent tariff burdens and secure continuity of supply.

Looking beyond cost containment, industry stakeholders are engaging in advocacy dialogues to influence tariff schedules and regulatory frameworks, underscoring the critical impact of ablation technologies on patient outcomes and healthcare efficiencies. Through collaborative engagement with policymakers, there is an opportunity to align trade policy with public health imperatives, ensuring that clinicians and patients maintain timely access to life-saving ablation therapies despite evolving import duties.

Revealing Strategic Insights from Multidimensional Segmentation to Unlock Opportunities Across Product Categories Treatment Modalities Applications and End Users

An in-depth review of market segmentation reveals a tapestry of opportunity delineated by multiple dimensions, each offering unique strategic pathways. Based on product, the landscape is anchored by electrodes and generators, where incremental design enhancements and compatibility optimization are defining competitive differentiation. When viewed through the lens of type, the market encompasses cryoablation, high-intensity focused ultrasound, irreversible electroporation ablation, laser interstitial thermal ablation, microwave ablation, and radiofrequency ablation; here, energy efficiency, real-time monitoring, and safety profiles guide clinician preference and technology adoption.

Further segmentation by treatment highlights the relative merits of laparoscopic ablation, percutaneous ablation, and surgical ablation, with each approach tailored to specific patient anatomies, tumor locations, and institutional capabilities. Application-wise, opportunities span breast cancer, kidney cancer, liver cancer, lung cancer, and prostate cancer, driving targeted product development and clinical protocol refinement to address tissue-specific challenges and oncologic outcomes. Lastly, segmentation based on end user-encompassing ambulatory surgical centers, cancer care centers, and hospitals and clinics-illuminates the necessity of aligning device portfolios with varied facility infrastructures, procedural volumes, and reimbursement landscapes. Navigating these intersecting segments demands an integrated strategy that balances technological innovation with operational considerations, ensuring that stakeholders capture the most compelling growth vectors across the tumor ablation ecosystem.

This comprehensive research report categorizes the Tumor Ablation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Treatment

- Application

- End User

Identifying Region-Specific Growth Drivers and Market Dynamics Shaping Tumor Ablation Adoption Across the Americas EMEA and Asia-Pacific Ecologies

Geographical dynamics are shaping differential growth trajectories and adoption rates, driven by localized healthcare policies, reimbursement frameworks, and clinical practice patterns. Within the Americas, robust investment in oncology infrastructure and favorable reimbursement for minimally invasive procedures have solidified the region’s leadership in ablation utilization. Providers are expanding service lines to integrate ablation into broader cancer care pathways, supported by an ecosystem of specialized training and procedural standardization.

In contrast, Europe, the Middle East, and Africa present a mosaic of regulatory environments and reimbursement variances. While Western Europe has established reimbursement codes for most ablation modalities, penetration in segments such as high-intensity focused ultrasound remains nascent, awaiting broader inclusion in national health service formularies. In parts of the Middle East and Africa, market education and infrastructure limitations are key barriers, yet public-private partnerships are catalyzing hospital upgrades and clinician training initiatives to bridge access gaps.

Asia-Pacific is emerging as a high-growth frontier, propelled by aging populations, rising cancer incidence, and expanding healthcare expenditure. Countries such as Japan and South Korea are at the forefront of adopting next-generation ablation platforms, whereas China and India are scaling percutaneous and laparoscopic approaches through government-led screening programs. Across the region, stakeholders are forging alliances with local distributors to navigate complex regulatory landscapes and streamline product registrations, positioning Asia-Pacific as a pivotal driver of global market expansion.

This comprehensive research report examines key regions that drive the evolution of the Tumor Ablation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Market-Leading Innovators and Strategic Collaborators Driving Advancement and Competitive Differentiation in the Tumor Ablation Ecosystem

The competitive landscape of tumor ablation is anchored by an ensemble of established medical device leaders and agile specialized innovators. Leading the charge are companies focusing on technology integration, strategic partnerships, and incremental innovation to bolster their portfolios. Global medical technology firms are deploying cross-functional teams to expedite next-generation system launches, combining energy modalities with advanced imaging guidance to deliver end-to-end procedural solutions.

Mid-sized pure-play ablation specialists are distinguishing themselves through targeted investments in research and development, focusing on energy efficiency, probe miniaturization, and biocompatible materials. These players often collaborate with academic centers to conduct head-to-head comparative studies, reinforcing clinical evidence and driving physician adoption. Additionally, partnerships between device manufacturers and digital health providers are yielding platforms that capture intraoperative data, enabling performance benchmarking and outcome analytics.

Strategic collaborations with imaging leaders have become increasingly common, as vendors aim to optimize workflow and reduce procedure times. Meanwhile, selective mergers and acquisitions are reshaping market dynamics, enabling companies to access novel technologies, expand geographic reach, and enhance service capabilities. Ultimately, the interplay between established conglomerates and nimble innovators fosters an environment of continuous advancement, ensuring that the ablation segment remains vibrant and competitive.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tumor Ablation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angiodynamics, Inc.

- Bioventus LLC.

- Boston Scientific Corporation

- BVM Medical Limited

- Chongqing Haifu Medical Technology Co., Ltd.

- CONMED Corporation

- CooperSurgical, Inc.

- EDAP TMS S.A.

- Erbe Elektromedizin GmbH

- H.S. Hospital Service S.p.A.

- HealthTronics, Inc.

- IceCure Medical Ltd.

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Medtronic PLC

- Merit Medical Systems, Inc.

- Mermaid Medical A / S

- Novian Health Inc.

- Olympus Corporation

- Profound Medical Corporation

- Smith & Nephew PLC

- STARmed Co., Ltd.

- Stryker Corporation

- Theraclion S. A.

- Varian Medical Systems, Inc. by Siemens Healthineers AG

Empowering Industry Leaders with Actionable Paths to Navigate Technological Integration Regulatory Dynamics and Patient Care Transformation in Tumor Ablation

To secure a leadership position in the evolving ablation field, industry executives should prioritize multi-channel strategies that combine technology investment, stakeholder engagement, and operational excellence. Accelerating research in emerging energy modalities and integrating real-time monitoring capabilities will strengthen product differentiation and clinical value propositions. At the same time, cultivating partnerships with imaging and artificial intelligence solution providers can streamline workflows, reduce procedural variability, and unlock data-driven insights.

On the policy front, proactive engagement with regulatory bodies and trade authorities is essential to mitigate the impact of tariffs and expedite device approvals. Companies should spearhead advocacy coalitions that underscore the health-economic benefits of ablation, thereby influencing reimbursement policies and trade frameworks. Furthermore, bolstering supply chain resilience through diversified manufacturing sites and strategic inventory planning will safeguard against geopolitical disruptions and import duties.

Finally, establishing comprehensive training programs for clinicians and support staff will accelerate technology uptake and ensure consistent procedural outcomes. By embedding patient-centric metrics into post-market surveillance and leveraging collaborative research networks, organizations can refine product enhancements and sustain competitive advantage. This holistic approach will empower stakeholders to navigate complexities, unlock new growth avenues, and deliver on the promise of minimally invasive cancer care.

Detailing Rigorous Data Collection Frameworks and Expert Validation Techniques Powering the Research Methodology Behind Tumor Ablation Market Analysis

The research underpinning this executive summary is anchored in a methodical blend of primary and secondary data collection, ensuring both depth and rigor. Initially, an extensive review of peer-reviewed literature, regulatory filings, and clinical trial registries provided a foundational understanding of ablation technologies, clinical performance benchmarks, and procedural guidelines. This secondary research was complemented by an examination of policy documents and trade publications to elucidate tariff developments and their implications for device manufacturers.

To enrich these insights, in-depth interviews were conducted with key opinion leaders, including interventional radiologists, surgical oncologists, and procurement executives from varied healthcare settings. These discussions illuminated real-world adoption challenges, clinician preferences, and the operational considerations that drive purchasing decisions. Concurrently, consultations with trade experts and policy advisors offered granular perspectives on import duties, regulatory trajectories, and market access barriers.

Data triangulation methodologies were employed to validate findings and reconcile disparate inputs, leveraging statistical cross-checks and qualitative consistency assessments. Maintaining objectivity, the research adhered to a structured analytical framework, segmenting the market by product, type, treatment approach, application, and end user. This framework was reviewed by an advisory panel of industry veterans, ensuring that the final deliverables reflect the latest trends, robust analysis, and actionable insights tailored to stakeholders across the tumor ablation spectrum.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tumor Ablation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tumor Ablation Market, by Product

- Tumor Ablation Market, by Type

- Tumor Ablation Market, by Treatment

- Tumor Ablation Market, by Application

- Tumor Ablation Market, by End User

- Tumor Ablation Market, by Region

- Tumor Ablation Market, by Group

- Tumor Ablation Market, by Country

- United States Tumor Ablation Market

- China Tumor Ablation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Illuminate Strategic Imperatives and Future Pathways for Stakeholders in the Tumor Ablation Landscape

In synthesizing the myriad insights presented, several strategic imperatives emerge for entities operating within the tumor ablation value chain. First, the seamless integration of imaging and energy-delivery platforms is not merely a competitive differentiator but a clinical necessity that drives procedural efficacy and safety. Second, the interplay between trade policies and supply chain configurations underscores the importance of agile sourcing strategies and proactive policy engagement to preserve market access.

Moreover, the multidimensional segmentation analysis highlights the need for tailored product and support models that resonate with diverse clinical use cases and end-user capabilities. Whether addressing the unique requirements of ambulatory surgical centers or the complex protocols of tertiary cancer care facilities, vendors must align their commercialization strategies with localized demand profiles and reimbursement realities.

Ultimately, stakeholders that embrace collaboration-across disciplines, geographies, and technology domains-will be best positioned to harness emerging opportunities. By anchoring investments in R&D, forging strategic partnerships, and leveraging robust data frameworks, organizations can drive sustainable growth and deliver meaningful innovations in cancer care. This comprehensive landscape underscores that the future of tumor ablation will be defined by convergence, agility, and a relentless focus on patient outcomes.

Connect with Associate Director Ketan Rohom to Acquire the Definitive Tumor Ablation Market Insights Report and Drive Strategic Growth Initiatives

If you’re ready to accelerate your strategic initiatives and gain a competitive edge in the rapidly evolving tumor ablation space, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in oncology market dynamics and can guide you through the comprehensive insights captured in our definitive tumor ablation market report. Whether you need detailed competitive intelligence, segmentation analysis, or guidance on emerging opportunities, Ketan is available to discuss how these findings can be tailored to your organization’s growth objectives. Connect today and equip your team with the actionable intelligence needed to drive innovation, optimize resource allocation, and enhance market positioning in one of the most promising frontiers of cancer treatment.

- How big is the Tumor Ablation Market?

- What is the Tumor Ablation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?