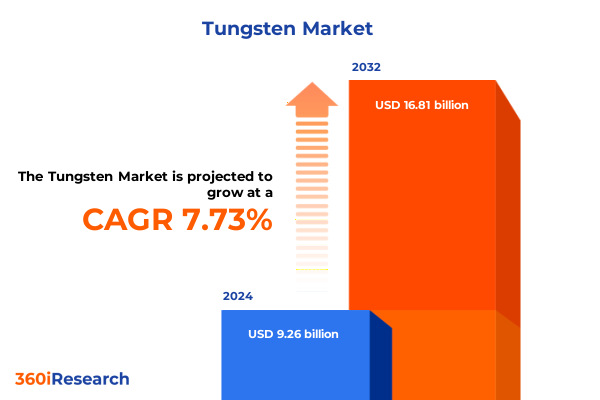

The Tungsten Market size was estimated at USD 9.26 billion in 2024 and expected to reach USD 9.93 billion in 2025, at a CAGR of 7.73% to reach USD 16.81 billion by 2032.

Unveiling the Critical Role of Tungsten in Modern Industry and Strategic Imperatives Shaping Its Global Value Chain Insights

Tungsten, renowned for its remarkable hardness, high melting point, and exceptional conductivity, occupies a pivotal place among critical minerals. These characteristics underpin its indispensable role in applications ranging from wear-resistant cemented carbides to high-temperature superalloys and precision lighting components. Because it stands out as the densest naturally occurring metal at room temperature, tungsten’s physical resilience ensures performance consistency in the most demanding industrial contexts.

Global reliance on tungsten centers on a narrow supply base, with China accounting for nearly 83 percent of world mine production in 2024, a figure that underscores the fragility of existing supply chains. Recent analyses indicate that even modest new sources, such as deposits in Uzbekistan, could shift global output by nearly 2.7 percent-highlighting both the opportunity and urgency of diversifying production outside dominant jurisdictions.

Robust demand trends across multiple sectors continue to fuel analytical focus on tungsten’s strategic importance. In automotive manufacturing, especially electric vehicles, tungsten alloys serve as key components in motor assemblies and brake systems, driven by surging EV output. Similarly, aerospace and defense applications leverage tungsten’s thermal and mechanical stability for turbine blades and armament systems. In the electronics sector, tungsten sputtering targets and electrodes play a critical role in semiconductor fabrication and next-generation quantum computing hardware. These converging forces underscore tungsten’s evolving role at the intersection of industrial innovation and geopolitical strategy.

How Geopolitical Tensions Renewable Energy Advances and Technological Innovations Are Dramatically Transforming the Tungsten Landscape

Global geopolitics and energy transitions have converged to remake the traditional contours of the tungsten market, demanding new approaches to supply chain resilience and strategic sourcing. Heightened trade tensions between major economies have led to tariff escalations on tungsten products, reinforcing the need for diversified supply networks beyond established regional actors. Meanwhile, clean energy policies and shifting consumer preferences are catalyzing investments in advanced technologies that rely on tungsten’s unique properties, including high-performance wind turbine components and precision drilling solutions for geothermal projects. These intersecting trends are rewriting the rules for both upstream miners and downstream manufacturers.

Amid these shifts, export controls imposed by key producers have emerged as a transformative force. When China announced export restrictions on tungsten in early 2025, it signaled a strategic use of critical metal leverage that reverberated through global pricing and procurement strategies. This move has prompted major consumers in North America and Europe to accelerate the development of alternative sources and recycling initiatives to mitigate exposure to supply disruptions. As a result, new partnerships have formed between mining firms and manufacturers, aimed at securing long-term offtake agreements tied to emerging deposits outside China’s sphere.

Technological innovation is further redefining market dynamics by unlocking new uses for tungsten and enhancing production efficiency. Advances in powder metallurgy are enabling the creation of fine and ultra-fine tungsten powders with tailored morphologies, improving the performance of cutting tools and thermal management systems. Concurrently, progress in additive manufacturing techniques has opened pathways for intricate tungsten-based components that were previously impossible to produce at scale. Together, these developments are fostering a more agile and resilient tungsten ecosystem, where product versatility and supply chain adaptability go hand in hand.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Tungsten Supply Chains and Industry Resilience

Beginning January 1, 2025, the United States Trade Representative implemented a 25 percent tariff on select tungsten products imported from China under Section 301, reflecting broader efforts to enhance domestic supply chain security. By aligning protective measures with parallel investments in domestic recycling and processing, policymakers aim to diminish dependency on a single external source while supporting emerging North American operations. This policy shift has driven strategic planners to reassess sourcing networks and engage with alternative suppliers.

In parallel, a U.S. Executive Order issued on April 2, 2025 introduced reciprocal tariff measures targeting certain Harmonized Tariff Schedule codes. After thorough review, leading producers of tungsten concentrates and related materials confirmed that core products-including ore and oxide-were excluded from the latest duties. This exemption ensures continuity for key supply chain participants, even as overall trade policy becomes more complex and dynamic.

Meanwhile, countervailing duty and antidumping investigations have entered their final phase for tungsten shot imports from China, spotlighting unfair trade practices and potential market distortions. At the same time, leading North American-focused firms, such as American Tungsten Corp., have publicly reaffirmed their commitment to onshoring tungsten supply and strengthening domestic resilience against prospective duties on imports from Canada and Mexico. Collectively, these measures are reshaping procurement strategies and reinforcing the case for localized value chains in critical minerals.

Deep-Dive Into Tungsten Market Segmentation Revealing Insights Across Type Product Type Application and End-Use Industry Dynamics

The tungsten market is fundamentally structured around the distinction between tungsten carbide and tungsten ore, each serving unique segments of the value chain. Tungsten carbide, prized for its extreme hardness and wear resistance, predominantly feeds the cemented carbide industry, supplying metalworking tools and mining components. Conversely, tungsten ore provides the raw feedstock for chemical processing, powder production, and melting operations, underpinning broader industrial applications across multiple sectors. Transitioning between these forms requires specialized processing capacity and technological know-how, which in turn shapes competitive positioning among leading refiners.

Within product type segmentation, the market divides further into chemicals, powder, and wire and rod formats. Tungsten chemicals, such as ammonium paratungstate, are foundational for catalyst and pigment applications, whereas powders-available as coarse and fine granules-drive advancements in powder metallurgy, thermal spray coatings, and additive manufacturing. Wire and rod products serve the electrical and heating sectors, enabling the fabrication of precision electrodes and high-temperature contacts. Each product stream demands distinct supply chain arrangements, investment profiles, and quality standards to meet specific end-use requirements.

Application-based segmentation highlights cutting tools, electrodes, heating elements, and lighting as primary categories. Cutting tool manufacturers rely on tungsten carbide grades tailored for endurance and machinability, while tungsten electrodes support industrial welding processes that demand consistent arc stability. Heating elements in furnaces and boilers exploit tungsten’s refractory nature, and specialized lighting filaments depend on its resistance to high-temperature oxidation. Across these applications, performance benchmarks-such as hardness, thermal conductivity, and purity-dictate sourcing decisions and value differentiation among suppliers.

End-use industries further refine market dynamics by channeling tungsten into aerospace, automotive, construction, defense, electronics, energy, manufacturing and machinery, medical, and mining and drilling segments. Aerospace components exploit tungsten’s density for balance weights and superalloys, while automotive OEMs integrate tungsten alloys into safety systems and EV motors. Construction and mining equipment rely on wear-resistant parts, and medical devices leverage tungsten’s biocompatibility in radiation shields. Energy infrastructure projects use tungsten-lined drill bits for geothermal and oil exploration, underlining the metal’s versatility. These cross-industry intersections shape demand patterns and inform strategic investment priorities.

This comprehensive research report categorizes the Tungsten market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ore Type

- Form

- Application

- End Use Industry

- Sales Channel

Uncovering Regional Dynamics Influencing Tungsten Demand and Supply Across Americas Europe Middle East Africa and Asia-Pacific Markets

In the Americas, market participants are accelerating efforts to onshore tungsten supply in response to evolving trade policies and critical mineral strategies. While domestic mine production remains limited, substantial investments are targeting processing and recycling facilities in the United States and Canada. Collaborative initiatives with Canadian and Mexican partners aim to secure reliable feedstock, mitigate tariff volatility, and support defense-oriented elements of the supply chain. These developments are redefining North American sourcing networks and fostering new public-private partnerships to bolster resilience and meet strategic demand.

Europe, the Middle East, and Africa exhibit a multifaceted landscape shaped by a diverse mix of upstream and downstream capabilities. Portugal, Rwanda, and other emerging producers contribute non-Chinese tungsten supply, while the European Union’s critical raw materials initiatives are streamlining regulatory frameworks and funding processing technologies. At the same time, defense modernization programs across Europe and the Middle East are driving demand for tungsten alloys in munitions and armor systems. These regional dynamics underscore the importance of integrated logistics and strategic stockpiling to navigate complex geopolitical and regulatory environments.

Asia-Pacific remains the epicenter of global tungsten production, led by China’s dominance with over 80 percent of output. In response to supply restrictions and export controls, major economies such as South Korea and Japan are investing in alternative sources and strategic stockpiles. Notably, the Sangdong mine in South Korea has resumed operations in partnership with Canadian and U.S. stakeholders, exemplifying efforts to reduce reliance on a single market. Simultaneously, countries like Vietnam and Russia maintain niche production roles, contributing to a gradually diversifying regional supply base.

This comprehensive research report examines key regions that drive the evolution of the Tungsten market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovations from Leading Global Tungsten Producers Shaping the Industry’s Future

Almonty Industries has emerged as a pivotal player by advancing the Sangdong mine project and fostering partnerships that secure offtake agreements with strategic consumers. Its focus on world-class processing infrastructure and transparency in sourcing has positioned Almonty as a trusted supplier to defense and semiconductor sectors seeking non-Chinese feedstock.

American Tungsten Corp. is reinforcing its commitment to domestic resilience by expanding recycling and processing capabilities in North America. By emphasizing the conversion of secondary tungsten materials into high-purity feedstocks, the company aims to insulate customers from tariff fluctuations and strengthen the United States’ strategic supply posture for critical minerals.

Kennametal, a leader in engineered cutting tools and wear solutions, is leveraging advanced manufacturing technologies and an AI-powered software partnership to optimize product performance and mitigate raw material cost pressures. Its strategic investment in CAM software underscores a broader shift toward digitalized supply chain management and precision engineering.

H.C. Starck and Sandvik continue to drive innovation in powder metallurgy and additive manufacturing for tungsten applications. By integrating process analytics and refining production workflows, these suppliers are elevating consistency and reducing lead times, addressing the growing demands of aerospace and electronics customers for high-value, customizable solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tungsten market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Almonty Industries Inc.

- American Elements Corporation

- Buffalo Tungsten Inc.

- China Minmetals Corporation

- Chongyi ZhangYuan Tungsten Co., Ltd.

- CMOC Group Limited

- Elmet Technologies LLC

- Ganzhou Grand Sea Tungsten Co., Ltd.

- Guangdong Xianglu Tungsten Industry Co., Ltd.

- INDUS Holding AG

- Kennametal Inc.

- Lianyou Metals CO., LTD.

- Luoyang Combat Tungsten & Molybdenum Materials Co., Ltd.

- M&I Materials Ltd.

- Merck KGaA

- Mitsubishi Materials Corporation

- Otto Chemie Pvt. Ltd.

- Plansee SE

- ProChem, Inc.

- Specialty Metals Resources Limited

- Stanford Advanced Materials by Oceania International LLC

- Sumitomo Electric Group

- TaeguTec LTD by IMC International Metalworking Companies Inc.

- Thermo Fisher Scientific Inc.

- Tungsten Vietnam Joint Stock Company

- Umicore NV

- Xiamen Zhongwu Online Technology Co., Ltd.

Strategic Recommendations for Industry Leaders to Enhance Tungsten Supply Chain Resilience and Capitalize on Emerging Market Opportunities

Industry leaders should prioritize diversification of sourcing by establishing long-term agreements with multiple upstream partners, including emerging producers in non-Chinese jurisdictions. This approach will reduce exposure to unilateral export controls and safeguard against sudden supply disruptions caused by geopolitical actions.

Companies are advised to invest in localized processing and recycling infrastructure, which not only mitigates tariff impacts but also enhances sustainability credentials and aligns with evolving regulatory requirements governing critical minerals. Undertaking joint ventures with regional stakeholders can accelerate facility development and facilitate knowledge transfer in advanced refining techniques.

A strategic focus on digital supply chain transparency, utilizing AI and blockchain technologies, can enable real-time risk monitoring and facilitate rapid response to policy changes or market fluctuations. Integrating these tools within procurement and inventory management systems will empower decision-makers to optimize safety stocks and adapt dynamically to evolving conditions.

Comprehensive Research Methodology Detailing Data Collection Analytical Frameworks and Validation Processes Underpinning Tungsten Market Analysis

This report combines comprehensive secondary research, including analysis of United States Trade Representative announcements, Federal Register publications, and United States Geological Survey data. Primary insights were obtained through interviews with industry practitioners, material scientists, and supply chain experts to validate market developments and strategic trajectories. Quantitative data were triangulated across regulatory filings, trade statistics, and company disclosures to ensure robustness and accuracy. The analytical framework integrates supply-demand dynamics, policy impact assessment, and technological innovation mapping to provide a holistic perspective on the tungsten market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tungsten market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tungsten Market, by Product Type

- Tungsten Market, by Ore Type

- Tungsten Market, by Form

- Tungsten Market, by Application

- Tungsten Market, by End Use Industry

- Tungsten Market, by Sales Channel

- Tungsten Market, by Region

- Tungsten Market, by Group

- Tungsten Market, by Country

- United States Tungsten Market

- China Tungsten Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Concluding Perspectives on Tungsten Market Dynamics and Strategic Imperatives for Navigating Future Industry Evolutions Insights

In summary, the tungsten market is undergoing a period of profound transformation driven by converging geopolitical, technological, and regulatory forces. As critical mineral strategies become integral to national security and clean energy objectives, tungsten’s strategic importance will only intensify. Market participants that proactively diversify sourcing, invest in advanced processing capabilities, and leverage digital tools for risk management will be best positioned to navigate volatility and capitalize on growth opportunities. Looking ahead, continued collaboration between governments, producers, and end users will be essential to fortify resilient supply chains and unlock the full potential of tungsten across diverse industrial applications.

Speak Directly With Ketan Rohom to Secure Your Comprehensive Tungsten Market Research Report and Empower Your Strategic Decision-Making Today

Ready to take the next step in unlocking strategic insights for your organization? Reach out directly to Ketan Rohom (Associate Director, Sales & Marketing) to secure a comprehensive Tungsten Market Research Report. By partnering with Ketan, you gain tailored guidance that aligns with your specific growth objectives and supply chain priorities. Initiate a conversation today to ensure your company stays ahead in an evolving landscape where strategic decisions are driven by deep market intelligence. Let Ketan facilitate your access to the critical data and expert analysis needed to empower confident decision-making and accelerate your competitive advantage.

- How big is the Tungsten Market?

- What is the Tungsten Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?