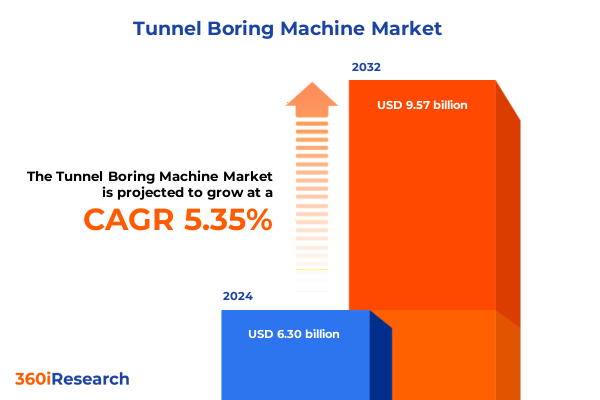

The Tunnel Boring Machine Market size was estimated at USD 6.62 billion in 2025 and expected to reach USD 6.96 billion in 2026, at a CAGR of 5.39% to reach USD 9.57 billion by 2032.

Unveiling the Critical Role of Tunnel Boring Machines in Shaping the Next Generation of Global Infrastructure Projects and Unlocking Future Urban Connectivity

In recent years, the role of tunnel boring machines has expanded far beyond simple excavation tools to become pivotal enablers of complex, large-scale infrastructure endeavors. As urban centers grapple with growing populations and aging transit networks, these sophisticated machines have emerged as essential assets for projects ranging from metro expansions to utility conduits and cross-border rail links.

Driven by continuous innovation, modern tunnel boring machines boast advanced automation, real-time monitoring, and modular configurations that can adapt to diverse geological conditions. This evolution has not only reduced project timelines and enhanced safety but also opened new possibilities for subterranean construction in environments once deemed too challenging or cost-prohibitive. As a result, stakeholders are increasingly relying on collaborative models that integrate OEM expertise, contractor experience, and digital solutions to deliver timely, resilient infrastructure.

Moreover, sustainability considerations have come to the forefront, with project owners and contractors prioritizing low-emission drives, noise minimization, and spoil management strategies. Such shifts underscore the growing importance of tunnel boring machines in addressing both urban congestion and environmental stewardship. Consequently, a holistic understanding of technological, regulatory, and economic trends is critical for decision-makers seeking to invest with confidence in this rapidly evolving sector.

How Technological and Environmental Imperatives Are Driving a Paradigm Shift in Tunnel Boring Machine Innovation and Deployment

Over the past decade, the tunnel boring landscape has undergone transformative shifts underpinned by both technological breakthroughs and heightened environmental mandates. Automation and the integration of Internet of Things sensors now allow operators to optimize cutterhead performance, predict maintenance needs, and adjust parameters on-the-fly, significantly reducing unplanned downtime and cost overruns. At the same time, digital twins and machine learning algorithms enable simultaneous simulation of complex tunneling scenarios, empowering project teams to refine alignment and reinforce safety protocols.

Concurrently, sustainability imperatives have driven the adoption of electric and hybrid drive systems, which not only lower carbon footprints but also mitigate noise and vibration in sensitive urban corridors. Regulatory bodies across mature markets are increasingly mandating stringent emission and spoil disposal standards, prompting OEMs and contractors to collaborate on closed-loop systems that recycle bentonite and treat slurry effluent. This confluence of innovation and regulation has raised the bar for project approvals, reinforcing the strategic value of eco-friendly tunneling solutions.

As a result, infrastructure developers are prioritizing turnkey offerings that bundle machine supply with digital services, performance guarantees, and aftermarket support. This shift toward outcome-based contracting underscores a broader industry move from transactional equipment sales to long-term partnerships focused on lifecycle optimization and risk sharing.

Assessing the Cumulative Impact of United States 2025 Tariff Measures on Tunnel Boring Machine Supply Chains and Cost Structures

The introduction of United States tariff measures in early 2025 has exerted significant pressure on the tunnel boring machine market’s supply chain and cost structures. Imposed tariffs on steel inputs, cutterhead components, and specialized electrical systems have driven up procurement expenses, compelling OEMs to reassess global sourcing strategies. In particular, components manufactured in tariff-affected regions now face higher landed costs, prompting a renewed focus on alternative suppliers in tariff-exempt jurisdictions.

As raw material costs climb, manufacturers and contractors alike are exploring nearshoring options to mitigate exposure and maintain project budgets. Collaborative agreements have emerged between equipment producers and regional fabricators to localize key assembly operations, thereby reducing lead times and tariff liabilities. Moreover, strategic stockpiling of critical spares has become a common risk-management tactic to safeguard project schedules against potential supply disruptions.

Despite these headwinds, the industry has also identified opportunities to innovate around localized production. Investments in modular machine architectures have enabled on-site assembly, which not only circumvents certain tariff barriers but also accelerates deployment in remote project environments. Consequently, stakeholders navigating the 2025 tariff regime must balance short-term cost pressures with long-term resilience strategies to sustain project momentum in an increasingly protectionist trade landscape.

Key Segmentation Insights Revealing How Machine Type Application Diameter Range and End User Dynamics Are Shaping Market Evolution

A nuanced examination of machine type reveals that Earth Pressure Balance units designed for both hard and soft ground conditions continue to secure a significant share of contract awards, owing to their versatility and reliability in urban tunneling. In contrast, Slurry Shield machines-whether utilizing bentonite or sand slurries-are increasingly favored for high-water-table environments and deep-sea projects, where their robust sealing capabilities are indispensable. Elsewhere, Double Shield and Single Shield configurations maintain relevance for long-distance drives through mixed geology, while Open TBMs retain niche applications in rock-dominated strata.

Turning to application dynamics, metro construction remains a primary growth driver, with densely populated cities pursuing network expansions to alleviate congestion and enhance mobility. Hydropower tunnels, conversely, demand specialized machine designs to navigate mountainous terrains and channel water flow for energy generation. Railway and roadway tunnels are advancing in parallel, each requiring distinct cutterhead profiles and thrust systems to meet alignment precision and gradient specifications. Utility conduits-covering water, sewage, and telecommunications-often rely on compact TBM variants for tight urban right-of-way conditions.

Diameter considerations further stratify equipment selection: smaller machines below four meters excel in urban utility retrofits, while the four to six-meter range serves as a flexible workhorse for metro and light rail. Machines spanning six to nine meters accommodate wider vehicular tunnels and combined transport corridors. Above nine meters, specialized units undertake monumental mega-projects such as multi-tube highway tunnels and high-capacity rail links. Ultimately, end users-spanning construction companies, government agencies, and private developers-tailor procurement strategies to align machine capabilities with project specifications, risk tolerance, and long-term maintenance objectives.

This comprehensive research report categorizes the Tunnel Boring Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tbm Type

- Diameter Range

- Application

- End User

Strategic Regional Insights Highlighting the Divergent Growth Patterns in the Americas Europe Middle East Africa and Asia Pacific

In the Americas, infrastructure renewal programs and urban transit expansions are driving strong demand for tunnel boring machines. Public-private partnerships in major metropolitan areas prioritize rapid delivery of commuter tunnels, while oil and gas pipeline projects in remote regions call for robust slurry systems capable of handling variable geology. Local fabrication hubs in the United States and Canada facilitate streamlined deliveries, offsetting the impact of import tariffs and fostering agile manufacturing ecosystems.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of opportunities. In Western Europe, ambitious projects like urban metro extensions and trans-Alpine rail links hinge on Earth Pressure Balance and Double Shield machines that can navigate mixed rock and soil strata. Regulatory requirements on noise and emissions spur innovation in electric drive systems. Gulf countries, flush with investment capital, are advancing water conveyance tunnels and utility passages, often contracting European OEMs for turnkey solutions. In contrast, several African nations are initiating their inaugural metro and water tunnels, prompting OEMs to establish local partnerships and training initiatives to develop regional expertise.

In Asia-Pacific, the pace of tunneling activity remains unparalleled. China continues to break ground on high-speed rail, urban metro, and inter-city links, deploying large-diameter machines to forge underwater and mountain tunnels. Japan’s seismic considerations drive demand for advanced EPB machines with precise balance control, while India’s urbanization wave fuels metro launches in tier-two cities. Across Southeast Asia and Australia, infrastructure gambits-from flood control tunnels to express rail corridors-underscore a sustained appetite for tailored TBM solutions.

This comprehensive research report examines key regions that drive the evolution of the Tunnel Boring Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Tunnel Boring Machine Manufacturers to Uncover Strategic Competencies Innovations and Competitive Differentiators

Herrenknecht remains a benchmark for large-diameter tunnel boring machines, excelling in mega-project executions across demanding environments. Their modular designs and comprehensive service agreements have set industry standards for reliability and performance. Caterpillar has deepened its presence through joint ventures and aftermarket service partnerships, leveraging its global supply chain to reduce downtime and cost volatility.

The Robbins Company continues to distinguish itself with bespoke machine designs for extreme ground conditions, offering innovative cutterhead geometries and segment erector systems tailored to customer specifications. Mitsubishi Heavy Industries has cemented its strength in EPB technology, integrating proprietary control systems that fine-tune face pressure and muck removal in complex tunnels. Hitachi Zosen exemplifies specialized slurry shield expertise, with robust slurry treatment plants that ensure environmental compliance in high-water tables.

Emerging players from China, led by major infrastructure conglomerates, are aggressively pursuing international projects, often under diplomatic initiatives that bundle financing with machine supply. These entrants emphasize cost-competitive offerings and rapid delivery schedules. Across the board, leading companies are intensifying R&D investments in digital solutions, eco-friendly drive systems, and automated maintenance platforms to differentiate themselves and meet evolving project requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tunnel Boring Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- China Railway Construction Heavy Industry Co., Ltd.

- China Railway Engineering Equipment Group Co., Ltd.

- Herrenknecht AG

- Hitachi Zosen Corporation

- Komatsu Ltd.

- Lovat S.p.A.

- Mitsubishi Heavy Industries, Ltd.

- Sandvik AB

- SELI Overseas S.p.A.

- TERRATEC Pty Ltd

- The Robbins Company

Actionable Recommendations for Industry Leaders to Optimize Tunnel Boring Machine Strategies Enhance Operational Efficiency and Drive Sustainable Growth

Industry leaders should prioritize the integration of digital twin platforms to simulate tunnel drives, analyze machine behavior under varied geological conditions, and forecast maintenance cycles. By harnessing real-time data streams from onboard sensors, operators can implement predictive maintenance regimes, reducing unplanned stoppages and extending cutterhead lifespan. In parallel, establishing nearshore fabrication and assembly centers will mitigate tariff exposure and compress lead times, enabling more agile responses to project demands.

Furthermore, aligning machine development with sustainability targets-such as zero-emission drive systems and slurry recycling-can unlock green financing opportunities and enhance community acceptance. Cultivating collaborative partnerships between OEMs, construction firms, and academic institutions will accelerate the adoption of advanced materials and automation technologies. Investing in workforce training programs that blend digital skills with traditional tunneling expertise will ensure a pool of qualified operators capable of managing increasingly complex equipment.

Finally, instituting cross-functional governance structures that bring procurement, engineering, and project management under unified oversight can streamline decision-making and foster accountability. By embedding risk management frameworks early in project planning, stakeholders can anticipate regulatory shifts, supply chain disruptions, and cost escalations-transforming challenges into competitive advantages.

Rigorous Research Methodology Detailing Qualitative and Quantitative Approaches Data Collection and Analytical Frameworks Underpinning the Study

This study employed a rigorous methodology combining qualitative and quantitative approaches to ensure comprehensive coverage of the tunnel boring machine landscape. Primary research involved structured interviews with industry executives, project managers, and technical experts, capturing firsthand insights into machine performance, procurement dynamics, and regulatory challenges. These discussions were complemented by in-depth case studies of landmark projects across diverse geographies.

Secondary data were sourced from peer-reviewed journals, technical whitepapers, patent filings, and trade association publications, providing a robust foundation for analytical triangulation. The research team conducted a systematic review of machine specifications, maintenance logs, and cost analyses to identify recurring patterns and best practices. A proprietary scoring framework evaluated technology readiness, environmental alignment, and market positioning to highlight leading companies and emerging disruptors.

Throughout the process, data validation protocols-such as cross-referencing interview findings with documented project outcomes-ensured accuracy and reliability. The analytical framework integrated qualitative narratives with quantitative breakdowns of project pipelines and tariff impacts, offering stakeholders a balanced perspective that informs strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tunnel Boring Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tunnel Boring Machine Market, by Tbm Type

- Tunnel Boring Machine Market, by Diameter Range

- Tunnel Boring Machine Market, by Application

- Tunnel Boring Machine Market, by End User

- Tunnel Boring Machine Market, by Region

- Tunnel Boring Machine Market, by Group

- Tunnel Boring Machine Market, by Country

- United States Tunnel Boring Machine Market

- China Tunnel Boring Machine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusion Emphasizing the Strategic Imperative of Advanced Tunnel Boring Technologies for Future Infrastructure Resilience and Project Success

The strategic imperative of advanced tunnel boring technologies has never been more pronounced. As infrastructure demands intensify and regulatory landscapes evolve, stakeholders must adopt innovative machine designs, data-driven workflows, and sustainable practices to remain competitive. Future projects will demand machines capable of adaptive control, predictive maintenance, and minimal environmental footprint, underscoring the critical role of continuous R&D and collaborative ecosystems.

Moreover, resilience in supply chains-fortified through nearshore production, flexible sourcing, and proactive tariff mitigation-will determine project viability in a volatile trade environment. By aligning procurement strategies with long-term infrastructure objectives, construction leaders can secure reliable equipment access while adhering to budgetary constraints.

Ultimately, the confluence of digital transformation, sustainability expectations, and evolving geotechnical challenges mandates a holistic approach to tunnel boring. Organizations that integrate advanced technologies, cultivate strategic partnerships, and embed risk management will not only drive project success but also chart the future course of subterranean infrastructure development worldwide.

Connect with Ketan Rohom to Acquire In-Depth Tunnel Boring Machine Market Research Insights and Drive Your Competitive Edge Today

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can empower your strategic initiatives and secure a sustainable competitive advantage. By leveraging exclusive insights into machine types, applications, regional dynamics, and tariff impacts, you can anticipate emerging challenges and capitalize on growth opportunities ahead of your peers.

Reach out today to schedule a personalized briefing with Ketan and discover how this in-depth analysis will inform your decision-making, streamline your project planning, and optimize your procurement strategies. Don’t miss the opportunity to align your organization with the next wave of tunnel boring innovation and ensure lasting project success.

- How big is the Tunnel Boring Machine Market?

- What is the Tunnel Boring Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?