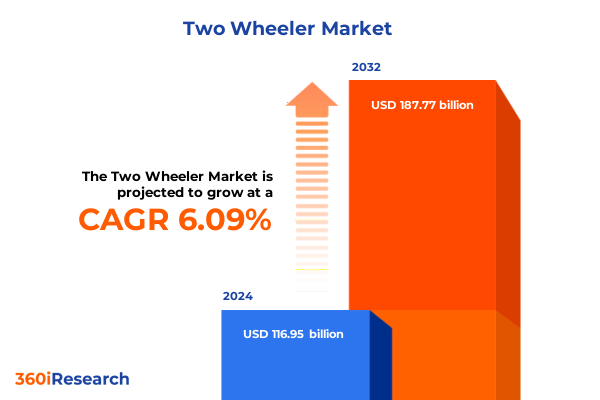

The Two Wheeler Market size was estimated at USD 123.81 billion in 2025 and expected to reach USD 131.17 billion in 2026, at a CAGR of 6.12% to reach USD 187.77 billion by 2032.

Pioneering a New Era of Urban Mobility Where Agility, Sustainability, and Advanced Connectivity Seamlessly Converge to Redefine the Two-Wheeler Experience

The two-wheeler segment has swiftly emerged as a linchpin of urban mobility, offering agile navigation through congested streets and delivering significant savings in time and operating costs. As metropolitan centers grapple with persistent traffic bottlenecks and escalating fuel prices, many commuters are rediscovering two-wheelers-both motorcycles and scooters-as nimble alternatives that blend efficiency and practicality in their daily journeys. Beyond their inherent convenience, these vehicles resonate with a growing environmental ethos, reducing per-passenger emissions and easing demands on parking infrastructure in densely populated locales.

Uncovering the Transformative Shifts Reshaping Two-Wheeler Market Dynamics from Electrification and Connectivity to Evolving Consumer Expectations

Electrification has precipitated one of the most profound paradigm shifts in the two-wheeler landscape. Accelerated advances in battery chemistries, including emerging solid-state technologies and modular battery-as-a-service models, are surmounting traditional range limitations and dramatically reducing charging times. Governments and private stakeholders alike have launched incentive programs and infrastructure expansions, catalyzing consumer confidence and supporting a widening network of fast-charging stations across urban and suburban corridors.

Examining the Far-Reaching Implications of 2025 U.S. Trade Tariffs on Two-Wheeler Import Economics, Supply Chains, and Strategic Manufacturing Responses

In early 2025, the imposition of sweeping 25% tariffs on imported motorcycles, off-road vehicles, and critical components brought supply chains under intense strain. Manufacturers reliant on global sourcing have confronted sharp cost escalations, compelling many to absorb additional duties or pass increases along to dealers and end consumers. Dealers specializing in premium European and Japanese brands have reported constrained inventory flows and are recalibrating order volumes amid pervasive price uncertainty.

Illuminating Key Insights from Multifaceted Segmentation of Vehicle Types, Propulsion Systems, Engine Capacities, Categories, Price Tiers, and Applications

A nuanced segmentation framework is essential for capturing the full spectrum of market demands, beginning with distinctions between motorcycles and scooters, each catering to unique use cases from highway cruising to urban errands. Propulsion choices span traditional internal combustion engines and a burgeoning electric cohort, the latter bifurcated into battery-swappable solutions and plug-in charging models that optimize convenience and operational uptime. Engine capacities are stratified from sub-125cc commuters to high-capacity machines exceeding 500cc, addressing the varied expectations of novice riders, everyday commuters, and performance enthusiasts. Categorization into mini, standard, and large platforms informs ergonomic design and feature packages, while price tiers ranging from budget to premium guide positioning strategies across consumer segments. Application-based targeting further refines market approaches, encompassing commercial deployments-such as courier fleets, delivery services, and rental operations-alongside personal commuting and competitive racing.

This comprehensive research report categorizes the Two Wheeler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion Type

- Performance Type

- Category

- Transmission Type

- Price Range

- Application

- End User

Exploring the Distinctive Regional Nuances Influencing Two-Wheeler Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics underscore how cultural preferences, regulatory frameworks, and infrastructure maturity shape two-wheeler adoption. In the Americas, lifestyle brands have long dominated, but recent enthusiasm for electric scooters and commuter motorcycles is buoyed by city-wide sharing initiatives and municipally funded charging networks. Europe, the Middle East, and Africa (EMEA) exhibit a premium-driven market, where stringent emissions standards and robust urban planning foster rapid uptake of high-performance electric models alongside traditional roadsters. The Asia-Pacific region remains the volume leader, propelled by expansive shared-mobility ecosystems, targeted government subsidies, and a diverse vendor landscape catering to both entry-level commuters and adventure touring aficionados.

This comprehensive research report examines key regions that drive the evolution of the Two Wheeler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Market Penetration, and Competitive Strategies in the Two-Wheeler Sector

Leading incumbents and disruptors alike are charting distinct strategic paths to capture evolving demand. Harley-Davidson has recalibrated its portfolio to include sub-500cc models through strategic alliances, while its LiveWire division pursues federal support to scale electric production. Honda’s heritage in reliability underpins its expansion of fuel-efficient mid-capacity motorcycles, even as it invests substantially in electric platforms and connectivity services. Yamaha’s ambitious electrification targets and BMW’s emphasis on U.S. assembly illustrate how global players are diversifying production geographies to mitigate trade risk. Pure-play electric marques such as Zero Motorcycles are leveraging flexible pricing and supply guarantees to shepherd early adopters through tariff-driven volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Two Wheeler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIMA TECHNOLOGY GROUP CO.,LTD.

- ARCH Motorcycle Company LLC

- Ather Energy Limited

- Bajaj Auto Limited

- BMW Group

- Boss Hoss Cycles, Inc.

- Ducati Motor Holding S.p.A. by Audi AG

- Harley-Davidson, Inc.

- Hero MotoCorp Limited

- Honda Motor Co., Ltd.

- Indian Motorcycle International, LLC by Polaris Industries Inc.

- Italika

- JAWA Moto spol s r. o.

- Jiangmen Dachangjiang Group Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kwang Yang Motor Co., Ltd.

- Mahindra & Mahindra Limited

- Niu International

- Ola Electric Mobility Limited

- Piaggio Group

- Pierer Mobility AG

- Qianjiang Motorcycle Co., Ltd.

- Royal Enfield by Eicher Motors Limited

- Sanyang Motor Co., Ltd.

- Suzuki Motor Corporation

- Triumph Motorcycles Limited

- TVS Motor Company Limited

- Wardwizard Innovations & Mobility Limited

- Yadea Group Holdings Ltd.

- Yamaha Motor Co., Ltd.

- Zero Motorcycles, Inc.

Strategies for Industry Leaders to Seize Emerging Opportunities, Mitigate Risks, and Accelerate Growth in the Evolving Two-Wheeler Landscape

Industry leaders must prioritize supply-chain resilience through diversified sourcing and near-shoring initiatives, mitigating exposure to fluctuating trade policies. Accelerating integration of modular battery services can enhance customer convenience, while strategic partnerships with urban mobility platforms can extend brand reach into emerging shared-transport segments. Leveraging over-the-air software updates and data-driven rider analytics will unlock new revenue streams and foster stronger customer loyalty. Moreover, tailored financing and subscription offerings can lower adoption barriers for both individual consumers and commercial fleet operators, positioning stakeholders at the forefront of sustainable mobility transformation.

Outlining Rigorous Research Methodologies, Data Collection Techniques, and Analytical Frameworks Underpinning the Two-Wheeler Market Analysis

This analysis synthesizes extensive primary research comprising in-depth interviews with manufacturer executives, dealership networks, and fleet operators, complemented by dealer-level surveys capturing real-world implications of recent tariff adjustments. Secondary research sources include regulatory filings, trade association reports, proprietary customs data, and leading industry publications. Data triangulation ensures consistency across multiple channels, while rigorous validation protocols refine insights. Quantitative inputs are juxtaposed with qualitative stakeholder perspectives to construct a holistic view of market dynamics and actionable strategic levers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Two Wheeler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Two Wheeler Market, by Vehicle Type

- Two Wheeler Market, by Propulsion Type

- Two Wheeler Market, by Performance Type

- Two Wheeler Market, by Category

- Two Wheeler Market, by Transmission Type

- Two Wheeler Market, by Price Range

- Two Wheeler Market, by Application

- Two Wheeler Market, by End User

- Two Wheeler Market, by Region

- Two Wheeler Market, by Group

- Two Wheeler Market, by Country

- United States Two Wheeler Market

- China Two Wheeler Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Consolidating Core Insights and Future Outlook to Empower Stakeholders in the Two-Wheeler Market to Navigate Emerging Challenges and Opportunities

The confluence of regulatory shifts, technological breakthroughs, and shifting consumer priorities has catalyzed a redefinition of the two-wheeler market. Stakeholders equipped with a deep understanding of tariff impacts, segmentation nuances, and regional intricacies are best positioned to navigate uncertainty and capitalize on emerging growth vectors. As electrification, connectivity, and innovative business models reshape conventional paradigms, continuous monitoring of policy developments and agile recalibration of product and go-to-market strategies will distinguish market leaders from followers.

Partner with Ketan Rohom for Tailored Two-Wheeler Market Intelligence to Elevate Strategic Decisions and Drive Competitive Advantage

To obtain the comprehensive market research report and leverage these in-depth insights for your strategic initiatives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Discuss customized data packages, receive a tailored demonstration of key findings, and secure your access to the definitive analysis of the Two-Wheeler market. Engage now to transform intelligence into action and stay ahead in this rapidly evolving industry.

- How big is the Two Wheeler Market?

- What is the Two Wheeler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?