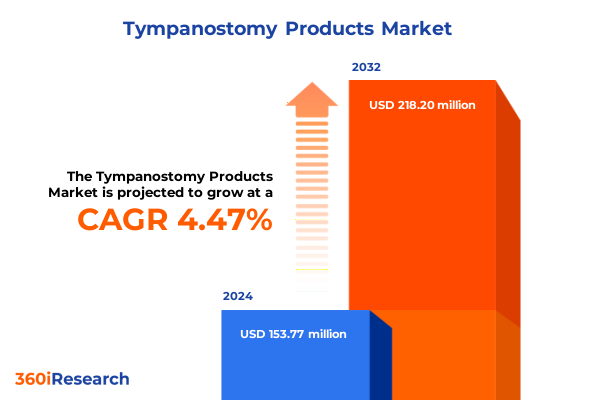

The Tympanostomy Products Market size was estimated at USD 160.10 million in 2025 and expected to reach USD 169.81 million in 2026, at a CAGR of 4.52% to reach USD 218.20 million by 2032.

A concise, clinically anchored introduction that frames tympanostomy products through clinical indications, materials differentiation, and commercial forces shaping provider adoption

Tympanostomy products sit at the intersection of pediatric otology, adult Eustachian tube care, and procedural site-of-care optimization. This introduction frames the category through three compact lenses: clinical utility, materials and design differentiation, and the shifting commercial environment that providers and manufacturers must navigate today. Clinically, tympanostomy tubes remain a cornerstone intervention for persistent middle ear effusion, recurrent acute otitis media, and selected cases of Eustachian tube dysfunction; contemporary practice is guided by updated specialty recommendations that emphasize careful patient selection, objective hearing evaluation when effusion persists, and shared decision-making with families. These clinical anchors continue to determine when and how devices are used across care settings and patient ages, and they reinforce the need for device designs that balance function, extrusion profile, and complication rates. The materials and design axis ranges from traditional fluoroplastic and silicone options to higher-cost metallic solutions such as stainless steel and titanium; each material set introduces trade-offs in extrusion time, biofilm propensity, and clinician familiarity, which in turn shapes hospital purchasing committees and ENT clinic formularies. Finally, commercial context has tightened: providers are operating in an environment where ambulatory care expansion, supply-chain stressors, digital engagement for procurement, and tariff-driven cost pressures converge to reshape purchasing priorities and vendor strategies. Taken together, this introduction establishes the practical framing for deeper analysis: clinicians and commercial teams must align on evidence-based indications, prioritize material and design choices that match patient needs and operational settings, and plan for near- and medium-term commercial disruptions driven by policy and supply dynamics

An urgent overview of the transformative clinical, operational, and commercial shifts reshaping how tympanostomy devices are designed, purchased, and used in practice

The tympanostomy category is experiencing a set of transformative shifts that are simultaneously clinical, operational, and commercial in nature. On the clinical front, updated practice guidance has sharpened indications for tube insertion and reinforced the importance of objective hearing assessment and conservative management pathways before surgery; these refinements influence case selection and encourage more deliberate use of longer-term tubes only where clinical benefit is clear. As a result, manufacturers must position differentiated value propositions-such as antimicrobial surface treatments or optimized extrusion profiles-against a backdrop of heightened guideline-driven scrutiny. Operationally, the most visible shift is the steady migration of ENT procedures into lower-cost, higher-throughput ambulatory settings. Ambulatory surgery centers and office-based hybrid models are increasingly preferred for routine tube insertions because they reduce overhead, enhance scheduling flexibility, and align with payer incentives to move appropriate procedures out of hospital outpatient departments. This site-of-care evolution rewards devices and disposables that simplify room turnover, reduce anesthesia time, and enable standardization across ASC workflows. Commercially, the industry faces new price and supply pressures driven by tariff policy and by manufacturers’ strategic responses-near-shoring, realignment of supplier portfolios, and tactical inventory buffering. These pressures are creating both short-term margin erosion for manufacturers and procurement complexity for health systems. In parallel, digital commercialization is accelerating: manufacturers are investing in digital engagement platforms and data-driven sales models to reach clinicians and supply chain buyers more efficiently, while procurement teams increasingly demand transparency in origin, traceability, and cost breakdowns across component inputs. Taken together, these shifts compel a different go-to-market playbook-one that blends clinical evidence, operational simplicity, and supply-chain resilience to win durable adoption in a rapidly evolving care landscape

A strategic analysis of how new 2025 United States tariff measures and trade-policy shifts are materially altering sourcing, costing, and contracting across the tympanostomy device supply chain

A defining force in 2025 for device manufacturers and provider purchasing teams has been the cumulative impact of United States tariff actions and related trade-policy shifts. Recent administration proclamations and tariff modifications have expanded duties on steel and aluminum, adjusted Section 301 measures affecting certain medical products, and prompted rapid responses from major medtech trade associations and leading hospital groups. The practical consequences for tympanostomy product stakeholders are multi-layered. First, tariffs on upstream metals like stainless steel and on certain medical product HTS codes raise input costs for metallic tube variants and for instrument components used in insertion kits, which compresses manufacturer gross margins or forces price increases to purchasers. Second, uncertainty about tariff scope and potential exemptions is incentivizing manufacturers to re-evaluate sourcing strategies-favoring geographically diversified suppliers, more contract manufacturing in lower-tariff jurisdictions, or incremental domestic finishing operations to qualify for carve-outs based on local processing rules. Third, hospitals and ASCs are now more likely to request greater traceability of origin, itemized cost inputs, and contractual protections (such as longer fixed-price terms) when negotiating supply agreements for reusable instruments and single-use consumables. Industry associations and system purchasers have been vocally engaged with policy makers to seek exemptions or mitigation mechanisms for medical products, arguing that broad-based duties can distort access and drive care cost inflation. Finally, the combined effect of tariffs and supply-chain responses has accelerated selective reshoring investments among larger medtech OEMs while leaving smaller specialty suppliers weighing relocation economics against regulatory timelines and capital availability. Ultimately, the tariff environment in 2025 is not a single event but a catalytic policy environment that alters margin structures, procurement behaviors, and strategic location decisions across the supply chain, and it requires manufacturers and provider procurement teams to model scenario-based cost paths and to update contracting playbooks accordingly

Integrated segmentation insights showing how product type, end-user setting, distribution channel, clinical application, and material choices interact to determine adoption and value realization

Segmentation insights for tympanostomy products reveal discrete, actionable implications when product type, end-user setting, distribution channel, application, and material are considered together rather than in isolation. When product type varies between pressure equalization tubes and ventilation tubes-with pressure equalization options further segmented into silastic, stainless steel, and titanium and ventilation designs described as intermediate-term, long-term, and short-term-clinical preference and procurement inertia both influence selection. For short-term cases where natural extrusion and minimal follow-up are prioritized, silicone or fluoroplastic grommets typically align with clinician expectations for lower complication rates and straightforward supply-chain sourcing. In contrast, when long-term ventilation is clinically indicated, specialty metallic options that offer extended retention and predictable extrusion behavior become more attractive despite higher unit costs, because they reduce the likelihood of repeat procedures and prolonged management. Shifts in end-user demand-across ambulatory surgery centers, home care pathways for post-operative monitoring, hospitals, and specialty clinics-mean that product packaging, sterilization workflows, and clinician training programs must be adapted to the operational norms of each setting; ASCs value kits that streamline turnover and minimize instrument sets, while specialty clinics prize small-format, just-in-time consumables that reduce storage burdens. Distribution channel dynamics add another layer: direct sales models enable manufacturers to bundle clinical training, data reporting, and inventory management services, distributors extend geographic coverage and managed inventory for heterogeneous buyer bases, and online sales increasingly serve niche or replacement-parts demand where speed and convenience trump traditional sales relationships. Application segmentation-chronic otitis media, effusion management, and Eustachian tube dysfunction-further shapes clinical decision-making and post-procedural pathways; devices for effusion management are optimized for short-term restoration of hearing and rapid extrusion profiles, whereas devices intended for persistent Eustachian tube dysfunction may be paired with complementary interventions and require evidence of longer-term patency. Material selection, spanning polyethylene, silicone, stainless steel, and titanium, must be positioned against both clinical outcome data and procurement realities: polymeric materials typically offer cost and manufacturing flexibility, while metallic materials provide mechanical durability and potential differences in infection dynamics that matter to select patient cohorts. Taken holistically, these segmentation intersections suggest that winning strategies will be those that align product design with site-of-care workflows, offer differentiated clinical value for particular applications, and deploy flexible distribution models that match buyer preferences and supply-chain constraints

This comprehensive research report categorizes the Tympanostomy Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

- Application

A nuanced regional analysis explaining how Americas, Europe Middle East & Africa, and Asia-Pacific markets differ in procurement behavior, regulatory expectations, and site-of-care economics

Regional dynamics continue to shape competitive priorities for manufacturers and distributors across the Americas, Europe Middle East & Africa, and Asia-Pacific, with each geography exhibiting distinct care-delivery models, procurement norms, and regulatory expectations. In the Americas, the United States’ site-of-care migration toward ambulatory settings, coupled with concentrated purchasing by integrated delivery networks and group purchasing organizations, favors device solutions that reduce total procedural cost and improve throughput while meeting strict regulatory and traceability requirements. Consequently, suppliers must navigate complex GPO contracts and demonstrate evidence of operational savings alongside clinical effectiveness. Moving to Europe Middle East & Africa, fragmented national reimbursement frameworks and variable hospital procurement practices create both barriers and opportunities for differentiated device introductions; in many EMEA markets, clinical guidelines and national procurement policies exert outsized influence, so manufacturers benefit from rigorous health economic dossiers and early engagement with key opinion leaders and national procurement bodies. The Asia-Pacific region presents a different set of dynamics: rapid expansion of hospital infrastructure and growing ENT specialization in urban centers drives demand for both low-cost polymeric solutions and higher-end metallic offerings in select tertiary centers. Additionally, local manufacturing hubs in Asia-Pacific and regional trade agreements can influence sourcing strategies and pricing, particularly in markets where tariff and non-tariff barriers are active. Across regions, regulatory timelines, sterilization standards, and local procurement timelines vary, and successful market entrants couple regional regulatory intelligence with tailored commercial models-leveraging local distributors where market access is complex and deploying direct clinician engagement where reimbursement and practice patterns reward clinical differentiation

This comprehensive research report examines key regions that drive the evolution of the Tympanostomy Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company archetypes and strategic behaviors that determine which manufacturers and suppliers will capture long-term value in the evolving tympanostomy products ecosystem

Companies operating in the tympanostomy ecosystem currently span established global medtech OEMs, specialized ENT-focused device firms, contract manufacturers, and a growing set of technology-focused newcomers developing antimicrobial coatings, resorbable polymers, and digital-enabled inventory services. Larger diversified medtech firms bring scale in regulatory expertise, manufacturing capacity, and contracting, which allows them to absorb short-term cost shocks or to invest in near-shoring initiatives that mitigate tariff exposure. In parallel, specialty ENT firms differentiate through focused clinical relationships, rapid product iteration, and the ability to pilot novel materials or antimicrobial surface technologies in partnership with high-volume clinics. Contract manufacturers and precision component suppliers play an increasingly strategic role because they can offer flexibility in material sourcing and finishing operations-an advantage when tariff and input-cost volatility requires rapid supplier substitution. Meanwhile, newer entrants are experimenting with value-added commercial models, such as bundled procedural kits, clinician training-as-a-service, and digital inventory replenishment programs that reduce hospital stocking burden while capturing recurring consumable revenue. Across these company archetypes, strategic winners make disciplined choices about where to own capability-maintaining in-house sterile packaging and critical finishing where regulatory control matters, while outsourcing commodity molding or raw-material procurement to specialized partners. In short, the competitive landscape rewards entities that combine clinical trust, manufacturing agility, and commercial innovation to deliver predictable supply, transparent cost structures, and demonstrable clinical value

This comprehensive research report delivers an in-depth overview of the principal market players in the Tympanostomy Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atos Medical AB

- Baxter International Inc.

- Cook Medical LLC

- Grace Medical, Inc.

- KARL STORZ SE & Co. KG

- Medtronic plc

- Meril Life Sciences Private Limited

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Spiggle & Theis Medizintechnik GmbH

- Stryker Corporation

- Teleflex Incorporated

High-impact, execution-focused recommendations for manufacturers and providers to protect margins, improve access, and accelerate clinically meaningful adoption in the tympanostomy category

Actionable recommendations for industry leaders coalesce around five practical priorities: align product development with guideline-driven indications and generate targeted clinical evidence showing meaningful benefits in those use-cases; design product portfolios that reflect site-of-care realities so that ENT clinics, ambulatory surgery centers, and hospitals each receive tailored offerings that simplify workflows; adopt flexible sourcing strategies, including qualified second-source suppliers and localized finishing, to mitigate tariff-driven cost volatility and reduce single-source risk; invest in digital commercialization and service bundles that shorten the sales cycle, provide inventory transparency, and demonstrate measurable operational improvements to purchasers; and engage proactively with policy makers, trade groups, and large provider systems to advocate for medically appropriate tariff exemptions or mitigation measures. Implementation of these priorities requires cross-functional coordination: clinical affairs teams should prioritize prospective registry or real-world evidence projects that demonstrate outcomes differences by material or design; supply-chain leaders must create scenario-based costing models that include tariff sensitivity analyses; commercial leaders should pilot hybrid distribution models-combining direct sales in high-value accounts with distributor partnerships and targeted online channels for aftermarket demand; and legal and regulatory functions must be prepared to support rapid label or supplier-change filings. By acting on these recommendations, manufacturers and provider partners can reduce execution risk, improve procurement resilience, and convert clinical differentiation into sustainable adoption

A transparent, evidence-first research methodology combining clinical guidelines, peer-reviewed comparisons, policy analysis, and scenario testing to validate practical recommendations

The research methodology underpinning this executive summary integrates multi-source evidence to build a practical, action-oriented view of the category. Primary inputs included a structured review of clinical practice guidance and peer-reviewed otology literature to ground recommendations in accepted standards of care and device performance characteristics. Secondary inputs drew on authoritative policy announcements, trade association statements, and industry reporting to map the macroeconomic and supply-chain forces that materially affect sourcing and pricing. Comparative device-material performance was assessed through targeted literature synthesis of randomized trials, retrospective comparative studies, and regulatory device listings to identify differences in extrusion time, infection profiles, and clinician preferences across polymers and metals. Commercial-channel insights came from a combination of industry consultancy analyses on digital transformation and ASC adoption, trade press coverage of manufacturing and tariff developments, and voice-of-customer interviews with procurement and ENT clinician stakeholders to flesh out cutting-points of friction in adoption. Finally, scenario analysis was used to stress-test sourcing and pricing strategies against plausible tariff and supply-disruption paths; this step included sensitivity checks on input metal-cost changes and lead-time shifts. Together, these methods deliver a balanced blend of clinical validity, commercial realism, and policy awareness designed to inform decision-making for product, commercial, and supply-chain leaders

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tympanostomy Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tympanostomy Products Market, by Product Type

- Tympanostomy Products Market, by Material

- Tympanostomy Products Market, by End User

- Tympanostomy Products Market, by Distribution Channel

- Tympanostomy Products Market, by Application

- Tympanostomy Products Market, by Region

- Tympanostomy Products Market, by Group

- Tympanostomy Products Market, by Country

- United States Tympanostomy Products Market

- China Tympanostomy Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

A conclusive synthesis that ties clinical best practices, supply-chain realities, and commercial strategy into a pragmatic path forward for manufacturers and provider partners

The current convergence of guideline refinement, ambulatory care expansion, digital commercialization, and trade-policy disruption has created both risk and opportunity for stakeholders in the tympanostomy products space. Clinicians are equipped with clearer guidance that supports more selective use of tubes, and ASCs and specialty clinics offer scalable sites of care that reward devices designed for throughput and consistency. At the same time, tariffs and supply-chain realignments introduce cost and sourcing complexity that cannot be ignored; procurement teams and manufacturers that fail to address these pressures will face margin compression and contract vulnerability. Yet for manufacturers who align development with guideline-directed indications, invest in material and design evidence, and modernize commercial approaches to match buyer workflows, the path to differentiated adoption is well defined. In short, the market is not static: strategic clarity, supply-chain agility, and disciplined evidence generation will determine who realizes lasting value as clinical practice and policy evolve

High-conversion call to action inviting clinical, commercial, and supply chain leaders to purchase the full tympanostomy products research report from the Associate Director of Sales & Marketing

Ready to access the most detailed, actionable intelligence on the tympanostomy products landscape and translate it into sales, product, and market strategies? Contact Ketan Rohom, Associate Director, Sales & Marketing, to request the full market research report and purchasing details. The report provides a comprehensive, practice-focused compass for commercial teams, medical affairs leaders, supply chain executives, and clinical champions seeking to align product roadmaps with regulatory, reimbursement, and site-of-care realities. Reach out to arrange a tailored briefing, demo, or enterprise license and accelerate decision-making with primary research, clinical guidance linkage, and strategic scenarios built for executives and program leads

- How big is the Tympanostomy Products Market?

- What is the Tympanostomy Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?