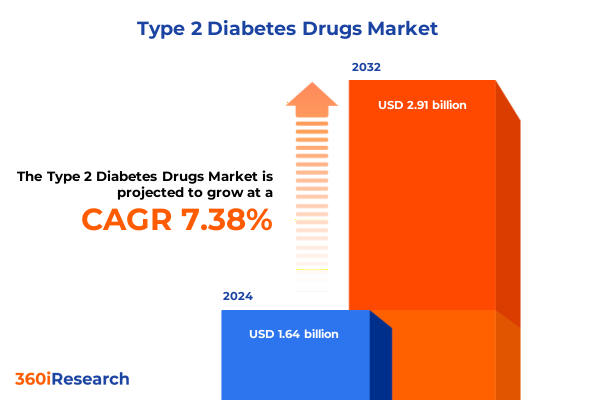

The Type 2 Diabetes Drugs Market size was estimated at USD 1.76 billion in 2025 and expected to reach USD 1.89 billion in 2026, at a CAGR of 7.41% to reach USD 2.91 billion by 2032.

Comprehensive Introduction to the Diverse Type 2 Diabetes Treatment Space Highlighting Key Therapeutic Advances, Patient Needs, and Market Dynamics

Type 2 Diabetes has evolved into one of the most intricate and rapidly shifting therapeutic areas, driven by rising prevalence, comorbidities, and the urgent need for personalized patient care. This introduction offers a panoramic view of the current treatment environment, spotlighting the critical intersections of patient needs, therapeutic innovation, and market drivers. Stakeholders ranging from pharmaceutical manufacturers to healthcare providers and payers must navigate a complex web of drug classes, administration routes, and evolving guidelines to deliver optimal outcomes.

Over the last decade, the proliferation of novel agents has reshaped standard protocols, extending beyond traditional insulin therapies toward non-insulin modalities such as GLP-1 receptor agonists and SGLT2 inhibitors. At the same time, global health authorities have intensified focus on real-world evidence generation, patient adherence programs, and digital interventions to improve glycemic control. As payers recalibrate reimbursement frameworks to reward value-based outcomes, understanding the full spectrum of treatment options and emerging trends has become indispensable for informed decision-making. This introduction lays the groundwork for a deeper exploration into transformative shifts, policy influences, segmentation nuances, and regional dynamics that will define the future of Type 2 Diabetes therapeutics.

Unprecedented Transformations in the Type 2 Diabetes Treatment Paradigm Fueled by Novel Formulations, Digital Therapeutics, and Evolving Regulatory Frameworks

The Type 2 Diabetes arena is undergoing a paradigm shift fueled by breakthroughs in molecular design, digital health integration, and regulatory agility. The advent of next-generation GLP-1 receptor agonists with extended dosing intervals has dramatically enhanced patient compliance, while SGLT2 inhibitors continue to demonstrate cardiovascular and renal benefits beyond glycemic control. Concurrently, the emergence of novel dual- and tri-agonists targeting multiple metabolic pathways underscores an era of precision pharmacotherapy that tailors interventions to individual risk profiles.

Moreover, digital therapeutics platforms and remote monitoring tools are seamlessly blending with pharmacological management, empowering patients with real-time insights and personalized coaching. This intersection of drug innovation and health technology is catalyzing new care models that prioritize holistic metabolic management over simple glucose lowering. On the regulatory front, expedited review pathways and adaptive trial designs are accelerating the launch of breakthrough therapies, reinforcing the transformative nature of this landscape. Against this backdrop, industry participants must adapt to fast-moving scientific advances, shifting payer expectations, and an increasingly patient-centric ethos to maintain strategic relevance.

Analyzing How 2025 United States Tariff Policy Adjustments Are Reshaping Import Dynamics and Strategic Sourcing for Type 2 Diabetes Therapeutics

The implementation of revised United States tariff policies in 2025 has introduced a new layer of complexity to the Type 2 Diabetes supply chain, particularly affecting the importation of active pharmaceutical ingredients and finished dosage forms. Under the new regime, select APIs originating outside of North America have become subject to elevated duties, prompting manufacturers to reconfigure sourcing strategies to mitigate cost escalation. This shift has reinforced the urgency of building resilient, diversified supplier networks and exploring nearshoring opportunities to safeguard continuity of supply.

In addition to direct cost implications, higher tariff burdens have influenced contract negotiations between drug developers and large-scale distributors, leading to tighter price corridors and renegotiated service agreements. Healthcare systems and payers are also feeling the ripple effects, as formulary committees assess the financial viability of imported therapies versus domestically produced alternatives. Consequently, some biopharma players have accelerated investments in local manufacturing facilities, both to comply with regulatory preferences and to insulate their portfolios from future trade policy volatility. Collectively, these dynamics underscore the cumulative impact of tariff adjustments on strategic planning, cost management, and market access for Type 2 Diabetes therapeutics.

Comprehensive Segmentation Deep Dive Reveals Distinct Patient Cohorts, Treatment Modalities, Administration Routes, and Commercial Channels Driving Market Complexity

Rigorous segmentation analysis unveils distinct patterns of clinical adoption and commercialization across drug classes, administration routes, treatment lines, distribution channels, brand types, and patient demographics. When evaluating by drug class, biguanides remain foundational with their immediate-release, extended-release, and combination formulations, yet it is the rapid uptake of GLP-1 receptor agonists such as dulaglutide, exenatide, liraglutide, and semaglutide that has redefined treatment algorithms. In parallel, DPP-4 inhibitors featuring alogliptin, linagliptin, saxagliptin, and sitagliptin continue to offer favorable tolerability, while SGLT2 inhibitors like canagliflozin, dapagliflozin, empagliflozin, and ertugliflozin broaden therapeutic choices through organ-protective benefits.

Turning to routes of administration, the growing preference for injectables delivered via patient-friendly pens or prefilled syringes highlights the emphasis on ease of use and adherence. Oral therapies in capsule and tablet forms maintain their appeal for early-line monotherapy and combination regimens. Within treatment lines, first-line interventions span monotherapy and combination regimens-dual or triple therapies-while second- and third-line options increasingly feature advanced biologics and insulins, categorized into basal, prandial, and premixed formulations such as degludec, detemir, glargine, aspart, glulisine, lispro, and various premixed ratios. Commercial channels reveal that hospital pharmacies play a pivotal role in initiating advanced therapies, whereas online pharmacies accelerate refill cycles and retail pharmacies anchor long-term maintenance. Brand differentiation remains pronounced between branded innovators and generic competitors, and patient profiles segmented by age groups 18-to-65 and above-65, as well as gender-specific considerations, illuminate varying adherence challenges and risk-benefit assessments.

This comprehensive research report categorizes the Type 2 Diabetes Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Treatment Line

- Brand Type

- Patient Age Group

- Patient Gender

- Distribution Channel

Regional Dynamics Spotlighting Variations in Type 2 Diabetes Treatment Preferences and Access Patterns Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on Type 2 Diabetes treatment paradigms, as variations in epidemiology, reimbursement structures, and healthcare infrastructure dictate therapeutic pathways. In the Americas, high levels of healthcare expenditure and robust reimbursement frameworks have facilitated rapid penetration of premium biologics, particularly GLP-1 receptor agonists, while emerging patient support programs and digital engagement initiatives drive adherence and outcomes.

Moving into Europe, Middle East & Africa, the availability of harmonized regulatory pathways across the European Union contrasts with heterogeneous market access policies, creating a nuanced environment where pricing pressures and health technology assessments shape launch strategies. In many Middle Eastern and African countries, limited infrastructure and budgetary constraints elevate the importance of cost-effective generics and fixed-dose combinations.

Across Asia-Pacific, soaring prevalence rates driven by urbanization and lifestyle changes have spurred government-led screening campaigns and expanded public-private partnerships. This region’s diverse economies showcase a dual narrative: in developed markets such as Japan and Australia, advanced insulin analogs and dual-agonists gain traction, whereas in emerging markets, the focus remains on accessible oral therapies and the expansion of retail pharmacy networks to meet growing demand.

This comprehensive research report examines key regions that drive the evolution of the Type 2 Diabetes Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Analysis Illuminates How Leading Pharmaceutical Players Are Innovating, Collaborating, and Positioning Themselves in Type 2 Diabetes

The competitive landscape in Type 2 Diabetes therapeutics is being redefined by both legacy innovators and agile newcomers. Novo Nordisk maintains its leadership through continuous enhancements of semaglutide formulations and a strong pipeline of obesity and dual-agonist candidates, while Eli Lilly’s tirzepatide has rapidly gained share thanks to compelling efficacy data and broad label expansion. Sanofi upholds its insulin heritage with next-generation basal insulins and strategic alliances aimed at biosimilar development, whereas AstraZeneca and Boehringer Ingelheim leverage their partnership to strengthen the SGLT2 inhibitor franchise.

Meanwhile, Merck underscores its expertise in DPP-4 inhibitors and is exploring cardio-renal benefits through combination therapies. Smaller biotechs and specialized pharma companies are carving niches by focusing on patient-centric digital solutions, novel delivery mechanisms, and precision medicine approaches. Partnerships between established manufacturers and digital health startups are proliferating, enabling seamless integration of adherence tracking, remote monitoring, and data-driven patient engagement programs. This dynamic interplay among market leaders, emerging players, and cross-industry collaborators shapes an intensely competitive yet highly innovative ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Type 2 Diabetes Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bayer AG

- Biocon Limited

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Chong Kun Dang Pharmaceutical Corp.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Hanmi Pharmaceutical Co., Ltd.

- Innovent Biologics Co., Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Novo Nordisk A/S

- Oramed Pharmaceuticals, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Proven Strategic Imperatives and Tactical Recommendations for Industry Leaders to Enhance Market Penetration, Patient Engagement, and Supply Chain Resilience

To navigate the complexities of the Type 2 Diabetes market and achieve sustainable growth, industry leaders must implement a multifaceted strategy that emphasizes both agility and patient-centricity. Prioritizing portfolio diversification across drug classes and administration routes will mitigate dependency on single therapeutic segments and capture evolving treatment preferences. Concurrently, investment in localized manufacturing capacities will enhance supply chain resilience in light of shifting tariff landscapes.

Strengthening partnerships with digital health providers and payers can facilitate the deployment of outcome-based contracts, real-world evidence programs, and value-added services that enhance patient adherence and demonstrate cost-effectiveness. Engaging key opinion leaders and patient advocacy groups early in development can inform effective trial design and accelerate market acceptance. Finally, proactive alignment with regulatory agencies through adaptive clinical strategies and accelerated filings will position organizations to capitalize on expedited review pathways. By executing these recommendations, companies can consolidate competitive advantages, deliver demonstrable patient value, and navigate future uncertainties with confidence.

Meticulous Research Design Outline Highlighting Primary and Secondary Data Collection, Triangulation Techniques, and Analytical Frameworks for Robust Market Intelligence

This research adopts a rigorous methodology integrating both secondary and primary data sources to ensure robust and unbiased insights. Secondary analysis draws upon peer-reviewed publications, regulatory agency databases, clinical trial repositories, and publicly available corporate disclosures to map historical trends and validate therapeutic efficacy. This foundation is complemented by primary research comprising in-depth interviews with a cross-section of stakeholders, including endocrinologists, pharmacists, payers, patient advocates, and supply chain experts.

Data triangulation techniques harmonize quantitative metrics with qualitative feedback, while statistical modeling underpins segmentation analyses and regional comparisons. The research design incorporates an executive advisory board that reviews key findings and ensures interpretative accuracy. Moreover, ethical considerations and data privacy standards guide all primary interactions. Through this systematic framework, the study delivers a comprehensive and credible examination of the Type 2 Diabetes therapeutics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Type 2 Diabetes Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Type 2 Diabetes Drugs Market, by Drug Class

- Type 2 Diabetes Drugs Market, by Route Of Administration

- Type 2 Diabetes Drugs Market, by Treatment Line

- Type 2 Diabetes Drugs Market, by Brand Type

- Type 2 Diabetes Drugs Market, by Patient Age Group

- Type 2 Diabetes Drugs Market, by Patient Gender

- Type 2 Diabetes Drugs Market, by Distribution Channel

- Type 2 Diabetes Drugs Market, by Region

- Type 2 Diabetes Drugs Market, by Group

- Type 2 Diabetes Drugs Market, by Country

- United States Type 2 Diabetes Drugs Market

- China Type 2 Diabetes Drugs Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3498 ]

Executive Synthesis of Critical Findings Underscoring Therapeutic Trends, Policy Impacts, and Strategic Imperatives in the Type 2 Diabetes Ecosystem

In synthesizing the foregoing analyses, it is clear that the Type 2 Diabetes therapeutics landscape is characterized by relentless scientific innovation, shifting regulatory and policy backdrops, and nuanced patient and regional landscapes. The accelerated adoption of GLP-1 receptor agonists, the expanding role of SGLT2 inhibitors, and the resurgence of insulin analog innovation collectively underscore an era of unprecedented therapeutic depth. Simultaneously, 2025 tariff adjustments in the United States have accentuated the importance of resilient supply chains and localized production strategies.

Segmentation insights reveal heterogeneous preferences by drug class, administration route, and patient demographics, while regional evaluations highlight divergent market access dynamics across the Americas, EMEA, and Asia-Pacific. Competitive intelligence underscores the strategic thrusts of leading manufacturers, who are increasingly integrating digital health and partnership models to maintain differentiation. Finally, actionable recommendations offer a roadmap for enhancing portfolio agility, accelerating market access, and delivering measurable patient outcomes. This comprehensive executive summary equips decision-makers with the context and clarity needed to steer through the complexities of the modern Type 2 Diabetes treatment ecosystem.

Engaging Call to Action Inviting Stakeholders to Connect with Subject Matter Expert for Access to the Full Detailed Type 2 Diabetes Market Analysis Report

To access the complete and most detailed Type 2 Diabetes Therapeutics report, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in pharmaceutical market research and close collaboration with industry leaders ensure you receive tailored insights to guide strategic decisions. Engaging with Ketan will unlock comprehensive data, actionable recommendations, and scenario analyses designed to optimize your market positioning and growth strategies. Reach out to him to secure your copy of the full report and gain a competitive advantage through unparalleled clarity on emerging trends, competitive dynamics, and regulatory shifts shaping the Type 2 Diabetes treatment landscape.

- How big is the Type 2 Diabetes Drugs Market?

- What is the Type 2 Diabetes Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?