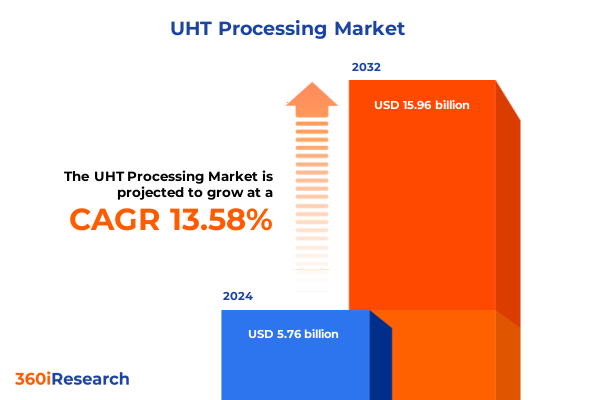

The UHT Processing Market size was estimated at USD 6.51 billion in 2025 and expected to reach USD 7.35 billion in 2026, at a CAGR of 13.67% to reach USD 15.96 billion by 2032.

Overview of the UHT Processing Market Spotlighting Key Drivers, Challenges, and Opportunities Shaping the Future of Long-Life Dairy Beverages

The Ultra-High Temperature Processing sector stands at the confluence of technological sophistication and evolving consumer demands, reshaping how dairy, plant-based, and specialty beverages maintain safety and nutritional integrity without refrigeration. Harnessing rapid heating and aseptic techniques, UHT processing extends shelf life while preserving key proteins and vitamins, enabling ambient distribution models that cut cold-chain dependence and expand market reach to regions lacking advanced infrastructure. Industry pioneers are now integrating advanced direct steam-injection heaters, high-barrier carton innovations, and regenerative heat exchangers to drive energy recovery rates of up to 92 percent, underscoring a commitment to both operational efficiency and sustainability.

Amidst these technological evolutions, the UHT landscape is being propelled by surging consumer interest in convenience, health, and sustainability. Market participants are responding by diversifying product portfolios to include enriched dairy variants, lactose-free formulations, and rapidly growing plant-based milks such as almond, oat, and soy, which capitalize on broad dietary trends. Automated production lines and IoT-enabled monitoring systems deliver unprecedented process control and predictive maintenance capabilities, reducing downtime and strengthening quality assurance. As the sector continues to innovate, stakeholders must remain vigilant to regulatory shifts and consumer preferences, positioning UHT processing as a cornerstone of modern beverage distribution strategies.

Exploring Major Technological Advancements, Consumer Preferences Evolution, and Sustainable Innovations Redefining the UHT Processing Landscape Worldwide

The technology underpinning UHT processing has undergone a profound transformation driven by demands for enhanced energy efficiency and product integrity. Once reliant on conventional indirect heating, processors are now adopting direct steam-injection systems that flash-heat products within seconds, maintaining nutritional and sensory characteristics. Parallel advancements in aseptic packaging have introduced aluminum-free, high-barrier cartons that extend shelf life beyond a year while reducing environmental footprints by nearly two-thirds in carbon emissions. These innovations not only optimize operational costs but also foster supply chain resilience by mitigating spoilage and cold-chain disruptions.

Concurrently, the rise of eco-friendly packaging solutions has accelerated, with leading firms unveiling prototypes of fully recyclable cartons composed of renewable materials. By leveraging forest-stewardship-board-certified paperboard and biodegradable bio-plastics, manufacturers are aligning with stringent sustainability mandates and consumer preference for green credentials. The transition toward circular economy principles is further evidenced by closed-loop water systems and industrial heat pumps that slash water usage by up to 50 percent and deliver two to four times the efficiency of traditional boilers, respectively. These holistic upgrades underscore the industry’s pivot from mere shelf-life extension toward minimizing environmental impact across the product lifecycle.

Automation and digitalization have emerged as pivotal enablers of productivity and quality control. Real-time sensor networks and AI-driven analytics facilitate continuous monitoring of temperature profiles, flow rates, and equipment health, empowering plant operators to anticipate maintenance needs and eliminate unplanned downtime. Manufacturers are integrating cloud-connected modules that deliver comprehensive dashboards on energy usage and process KPIs, fostering data-driven optimization and compliance with evolving food safety regulations. As the UHT processing landscape embraces Industry 4.0 paradigms, competitive differentiation will hinge on the seamless integration of smart processing with sustainable design principles.

Assessing the Ripple Effects of New United States Dairy Trade Tariffs on UHT Processors, Equipment Costs, Export Volumes, and Supply Chain Stability in 2025

In early March 2025, the United States government imposed reciprocal tariffs on imports from Canada, Mexico, China, and the European Union under emergency trade measures, triggering retaliatory levies on American dairy exports including UHT milk, cream, and related products. The new duties, ranging from 20 percent on North American goods to 34 percent on Chinese imports, have introduced immediate cost pressures across raw materials and machinery components used in UHT processing plants, challenging margin structures and prompting supply chain diversification.

Beyond import duties, even the specter of escalating trade conflicts has dampened export volumes of nonfat dry milk and skim milk powder, cascading impacts back into UHT processors that utilize these ingredients. Domestic buyers have exhibited greater price sensitivity, as seen in CME spot NDM pricing slipping to six-month lows, while processors have accelerated local sourcing strategies to hedge against tariff-driven volatility. This market contraction is further aggravated by equipment cost inflation, with manufacturers reporting up to 15 percent uplifts in spare parts and service rates due to higher import levies on steel, aluminum, and specialized components.

Despite these headwinds, the U.S. dairy sector remains anchored by robust export performance, having achieved a record $8.2 billion in dairy sales across 145 countries in 2024. Canada and Mexico alone constitute over 40 percent of this total, underscoring the critical nature of bilateral trade normalization to sustain growth. Industry groups are intensifying advocacy efforts for expedited resolution of tariff disputes, emphasizing that prolonged barriers risk undermining two decades of export gains and the substantial capital investments made in UHT processing capacity over the past five years.

Uncovering Insightful Trends Across Product Types, Packaging Formats, Distribution Channels, End Users, Sources, Price Tiers, and Applications Domain in UHT Processing

When segmenting by product type, market participants note that cream and flavored milk continue to satisfy premium and indulgence categories, while traditional milk retains volume leadership. Plant-based milks, encompassing almond, oat, and soy formulations, are carving accelerated growth trajectories by catering to lactose-intolerant and environmentally conscious consumers. Packaging strategies vary significantly, with bag-in-box formats favored for industrial ingredient bulk, bottles sustaining brand visibility in retail, cartons asserting dominance in aseptic retail channels, and flexible pouches capturing single-serve convenience trends. Distribution channels range from the ubiquity of supermarkets and hypermarkets to the agility of online retail platforms and the impulse‐driven nature of convenience stores, creating a mosaic of market touchpoints. Across end users, foodservice operators leverage UHT products for consistent supply, industrial processors prioritize shelf stability for value-added applications, and retail buyers demand on-the-go options that fit modern lifestyles. Further nuance emerges in source differentiation: cow milk underpins the core market, goat and sheep milks occupy specialty niches, and plant-based alternatives advance broader menu diversification. Price tier considerations split the market into economy segments focused on affordability, standard tiers balancing quality and cost, and premium brackets emphasizing organic, fortified, or value-added attributes. Finally, application insights highlight a bifurcation between ingredient uses-spanning bakery, confectionery, and culinary operations-and ready-to-drink offerings that serve convenience and nutrition needs directly to end consumers.

This comprehensive research report categorizes the UHT Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Source

- Price Tier

- Distribution Channel

- End User

- Application

Comparative Analysis of UHT Processing Growth Drivers, Regulatory Dynamics, Consumer Demand Patterns, and Competitive Landscapes Across Major Global Regions

In the Americas, the UHT Processing market is buoyed by strong consumer demand for shelf-stable milk across both North and Latin American regions, driven by expanding retail networks and an increasing preference for convenience. Manufacturers are rolling out innovative aseptic packaging tailored to local taste profiles, while investments in plant-based product lines reflect shifting dietary trends. Economic factors such as competitive pricing and evolving cold-chain dynamics continue to shape channel strategies across supermarkets, online platforms, and convenience stores, fostering a resilient ecosystem of regional players and global exporters.

Europe, the Middle East, and Africa collectively present a mature yet diverse landscape where regulatory frameworks and quality standards are highly harmonized, encouraging adoption of next-generation UHT technologies. European dairy processors lead in environmentally driven innovations, deploying advanced heat recovery systems and eco-certified packaging solutions. In the Middle East and Africa, rapid urbanization and rising per capita incomes fuel demand for long-life dairy and non-dairy beverages, while trade corridors connecting Europe and North Africa enhance cross-border distribution capacities.

Asia-Pacific stands out as the fastest-growing region, with burgeoning consumer bases and supportive policy environments catalyzing swift expansion of UHT processing infrastructure. Government incentives and joint ventures have spurred the deployment of automated aseptic lines, particularly to serve the plant-based segment where almond, oat, and soy drinks are competing head-to-head with dairy milks. The region’s scale and diversity-from the high-volume markets of China and India to niche specialist geographies-underscore its critical role in the future global supply matrix for shelf-stable beverages.

This comprehensive research report examines key regions that drive the evolution of the UHT Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Advancing UHT Processing Through Strategic Partnerships, Technological Investments, and Market Expansion Initiatives for Competitive Edge

Tetra Pak remains a frontline innovator in aseptic packaging, having introduced aluminum-free Prisma Edge cartons and high-barrier paperboard solutions that reduce carbon footprints by over 60 percent while sustaining year-long shelf life. Its global design installations underscore a commitment to circularity and ergonomic usability in retail channels.

SPX FLOW’s APV brand has earned multiple sustainability accolades for its Seamless Infusion Vessel, a gasket-free UHT module that minimizes fouling, extends run times by up to 100 hours annually, and cuts resource consumption. This proprietary innovation exemplifies the convergence of operational efficiency and environmental stewardship in UHT processing equipment.

GEA Group has further fortified its North American footprint with a $20 million New Food Application and Technology Center in Janesville, Wisconsin, which features pilot-scale thermal processing and aseptic filling capabilities under 100 percent renewable energy. By bridging R&D and industrial scale-up, GEA empowers producers to validate UHT and alternative protein processes with comprehensive analytical support and minimal carbon impact.

This comprehensive research report delivers an in-depth overview of the principal market players in the UHT Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Elopak AS

- GEA Group Aktiengesellschaft

- Glanbia plc

- JBT Corporation

- Krones AG

- Meiji Holdings Co., Ltd.

- MicroThermics, Inc.

- Proxes GmbH

- SIG Combibloc Group AG

- SPX Flow, Inc.

- Tetra Laval International S.A.

Strategic Roadmap for Industry Leaders to Leverage Innovation, Optimize Operations, Enhance Resilience, and Capitalize on Emerging Opportunities in UHT Processing

Industry leaders should prioritize the integration of sustainable packaging innovations, such as aluminum-free high-barrier cartons and biodegradable polymer alternatives, to meet tightening environmental regulations and resonate with eco-conscious consumers. Collaboration with material science partners can accelerate development cycles and expand circular economy credentials.

To optimize operational resilience, processing plants must embrace automation and IoT-driven analytics for real-time monitoring of equipment health and energy consumption. Early adopters of predictive maintenance platforms report up to a 30 percent reduction in unplanned downtime, underscoring the ROI of digital transformation in UHT processing.

Given the tariff-induced volatility in global dairy trade, manufacturers should diversify sourcing strategies for key ingredients and negotiate multi-regional supply contracts. Concurrently, pursuing free trade agreement benefits and engaging in proactive industry advocacy can mitigate tariff risk and safeguard export channels.

Lastly, expanding strategic partnerships with research institutions and commissioning localized pilot-scale technology centers will facilitate accelerated scale-up of novel UHT formulations, including fortified, lactose-free, and plant-based beverages, positioning companies to capture emerging market segments efficiently.

Detailed Examination of the Research Framework, Data Collection Techniques, Analytical Approaches, and Quality Assurance Measures Underpinning the UHT Processing Analysis

The research framework is grounded in a mixed-method approach, synthesizing qualitative insights from industry expert interviews with quantitative analysis of publicly available trade and regulatory data. Primary interviews encompassed equipment suppliers, processing facility managers, and trade association representatives to capture firsthand perspectives on technology adoption and market challenges.

Secondary research involved aggregating data from government trade reports, peer-reviewed journals, and financial disclosures of key market participants. Rigorous triangulation of multiple data sources ensured validity and reliability of findings, while advanced analytics tools were employed to identify trend inflection points and scenario variables.

Quality assurance protocols included peer review by subject matter specialists, cross-validation of citations, and iterative feedback loops with industry stakeholders. This methodological rigor underpins the robustness of the analysis and provides a transparent audit trail for all insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our UHT Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- UHT Processing Market, by Product Type

- UHT Processing Market, by Packaging Type

- UHT Processing Market, by Source

- UHT Processing Market, by Price Tier

- UHT Processing Market, by Distribution Channel

- UHT Processing Market, by End User

- UHT Processing Market, by Application

- UHT Processing Market, by Region

- UHT Processing Market, by Group

- UHT Processing Market, by Country

- United States UHT Processing Market

- China UHT Processing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings, Strategic Imperatives, and Future Outlook to Guide Stakeholder Decision-Making in the Rapidly Evolving UHT Processing Market Landscape

The UHT Processing market is at an inflection point where sustainability, digitalization, and product diversification converge to reshape long-life beverage manufacture and distribution. Stakeholders that align investments in eco-centric packaging, energy-efficient processing equipment, and advanced digital controls will unlock new operational efficiencies and brand differentiation.

Simultaneously, navigating trade dynamics-particularly the implications of 2025 tariff measures-necessitates proactive supply-chain strategies and robust advocacy to maintain export momentum. As plant-based milks continue to expand market share, and ready-to-drink formulations proliferate across channels, processors must remain agile in responding to consumer preferences and regulatory requirements.

Ultimately, the most successful companies will be those that marry technological innovation with strategic foresight, leveraging partnerships and research-driven pilot initiatives to anticipate market shifts and drive sustainable growth in the evolving UHT landscape.

Engaging with Ketan Rohom to Secure Exclusive Market Intelligence, Tailor Strategic Insights, and Maximize Value from the Comprehensive UHT Processing Research Report

To purchase the UHT Processing market research report and explore tailored strategic insights, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in guiding industry stakeholders through complex market landscapes and will work closely with you to ensure the report aligns perfectly with your business objectives. Reach out to arrange a personalized briefing, discuss volume licensing options, and access exclusive add-on modules on technology benchmarking and tariff impact assessments. Engage with Ketan today to secure your competitive advantage and drive informed decision-making with the most comprehensive UHT Processing intelligence available.

- How big is the UHT Processing Market?

- What is the UHT Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?