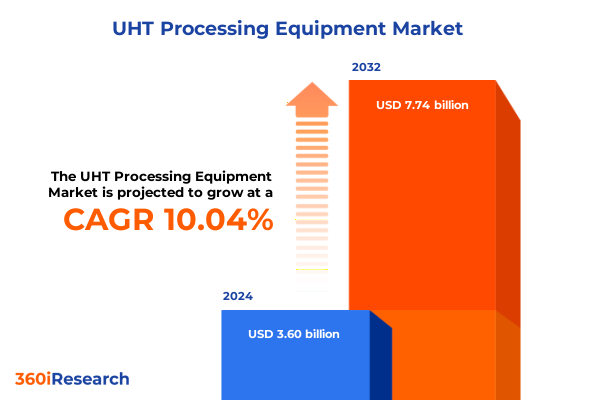

The UHT Processing Equipment Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.33 billion in 2026, at a CAGR of 10.10% to reach USD 7.74 billion by 2032.

Understanding the Role and Market Relevance of UHT Processing Equipment in Aseptic Food and Beverage Production amid Tech Innovation, Regulatory Changes

Ultra-high temperature processing equipment forms the foundation of modern aseptic manufacturing by rapidly heating beverages and liquid foods to eliminate harmful microorganisms, thereby achieving extended shelf life without compromising nutritional integrity or sensory quality. These systems integrate advanced heat exchangers, precise temperature controls, and sterile filling modules to maintain product safety while meeting stringent regulatory standards. As consumer demand for clean-label, minimally processed products continues to rise, the capability of UHT technology to deliver long-lasting, stable goods becomes increasingly critical for manufacturers pursuing global distribution and retail penetration.

This executive summary offers a concise overview of the key factors driving UHT processing equipment adoption, including emerging technological breakthroughs, evolving regulatory and trade dynamics, in-depth segmentation analyses, and regional market distinctions. By unpacking strategic initiatives undertaken by leading suppliers, examining the cumulative effects of recent tariff measures, and presenting tailored recommendations for operational excellence, this document equips decision makers with a clear roadmap for navigating the challenges and capitalizing on growth opportunities within the UHT processing landscape.

Navigating the Most Impactful Technological, Operational, and Regulatory Transformations Reshaping the UHT Processing Equipment Market Today

The UHT processing equipment industry is undergoing a digital revolution as manufacturers adopt smart sensors, real-time analytics, and industrial Internet of Things platforms to enhance process control and predictive maintenance. By integrating machine learning algorithms with historical performance data, operators can anticipate equipment wear, optimize cleaning-in-place cycles, and minimize unscheduled downtime. Consequently, maintenance budgets can be reallocated toward continuous improvement initiatives, driving productivity gains across production lines.

Sustainability has emerged as a paramount concern, prompting suppliers to engineer energy-efficient heat exchanger designs and closed‐loop water recovery systems. Innovations such as advanced plate materials and novel flow channel geometries enable significant reductions in thermal energy consumption and water usage. As environmental regulations tighten and corporate ESG commitments become more stringent, the ability to demonstrate measurable reductions in carbon footprint and resource utilization will increasingly differentiate market leaders from cost-focused competitors.

Moreover, the shift toward modular, skid‐mounted UHT systems accelerates deployment cycles and enhances scalability. Modular architectures allow processors to expand capacity in stages, aligning capital expenditures with market demand fluctuations. Coupled with advancements in aseptic filling technology-such as single‐use aseptic connectors and in‐line sterilization modules-these modular solutions empower manufacturers to launch new product variants with minimal line changeover time, improving agility in responding to consumer trends.

Assessing the Compounded Effects of Recent United States Tariffs and Trade Measures on UHT Processing Equipment Supply Chains and Costs

Since the imposition of Section 232 steel and aluminum tariffs in 2018 and subsequent trade actions under Section 301 targeting specialized machinery imports, UHT processing equipment suppliers have faced escalating input costs and supply chain uncertainties. The additional duties on imported stainless steel components, heat exchanger plates, and pressure‐rated tubing have resulted in upstream cost increases that cascade across the value chain. Furthermore, new 2025 adjustments to Harmonized Tariff Schedule classifications have extended levies to certain tube heat exchanger assemblies, compounding the financial pressures on both OEMs and end users.

These cumulative trade measures have prompted a strategic reevaluation of procurement strategies, with many manufacturers exploring domestic sourcing partnerships and nearshoring arrangements to mitigate duty exposures. Equipment delivery lead times have also lengthened due to rerouted shipping lanes and increased customs inspections. To preserve profit margins, many processors are negotiating longer‐term supply agreements and engaging in collaborative cost‐reduction programs with vendors, while some are passing incremental expense burdens onto contract packagers or end‐customers. In response, a growing number of stakeholders are investing in process optimization and energy savings to offset higher capital and operating expenditures.

Unveiling Critical Insights Across Diverse Technology, Distribution, Equipment, Application, Industry, and Capacity Segments Shaping UHT Processing Equipment Adoption

Analysis of technology segmentation reveals that direct UHT systems dominate applications requiring high-precision temperature control, while indirect configurations-comprising both plate heat exchangers and tube heat exchangers-offer flexible options for processors balancing capital intensity with sanitation demands. Within the indirect category, plate heat exchangers are favored for rapid heat transfer and ease of maintenance, whereas tube heat exchangers provide robustness for viscous products and high‐pressure sterilization requirements.

In examining distribution channels, a bifurcation emerges between direct sales models, where OEMs engage end users through dedicated sales teams and engineering consultative services, and distributor networks that extend geographic reach, offer localized technical support, and manage inventory buffers. Equipment-type segmentation further delineates product offerings into plate heat exchangers-available in brazed, gasketed, and welded formats to suit volume and maintenance preferences-and tube heat exchangers, which are engineered as either shell and tube designs or spiral configurations for enhanced flow dynamics in niche applications.

Applications span from dairy beverages and juice products to soy-based formulations, each presenting distinct thermal sensitivity profiles and process sanitation challenges. End user industries include beverage manufacturers seeking continuous flow capabilities, dairy producers focused on spoilage prevention, and pharmaceutical companies requiring aseptic grade processing for specialized liquid formulations. Capacity segmentation classifies installations into small, medium, and large capacity footprints, enabling companies of all scales to implement UHT technology aligned with their production throughput objectives.

This comprehensive research report categorizes the UHT Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component Type

- Capacity

- Integration Types

- End Product Form

- Application

- Distribution Channel

- End User Industry

Illuminating Pivotal Regional Trends and Dynamics Influencing UHT Processing Equipment Market Growth in the Americas, EMEA, and Asia-Pacific Zones

Within the Americas, demand for UHT processing equipment remains strong in North America and Brazil, driven by rising consumption of shelf-stable dairy alternatives and innovative beverage blends. The United States in particular has witnessed growth in niche product lines such as plant-based milks and functional beverages, prompting producers to upgrade to high-efficiency heat exchanger modules and invest in advanced process control systems. In South America, Brazil’s large-scale dairy sector and expanding juice export market continue to support investments in modular, scalable solutions.

In Europe, the Middle East, and Africa, regulatory harmonization under the European Union’s food safety framework drives adoption of sterile processing equipment that can comply with stringent HACCP and GMP requirements. Key markets such as Germany, Italy, and the United Kingdom lead in equipment modernization initiatives, while emerging economies in Eastern Europe and North Africa are investing in smaller‐scale UHT units to service local consumption patterns. Sustainability regulations across EMEA are accelerating demand for energy recovery options and water‐efficient designs.

The Asia-Pacific region exhibits dynamic growth, with China and India at the forefront of capacity expansion in dairy and beverage production. Rapid urbanization and increased disposable incomes are fueling demand for aseptic packaging formats, encouraging local OEMs and global suppliers to form strategic partnerships. Southeast Asian nations are also upgrading existing lines to meet evolving quality standards, with a notable emphasis on reducing thermal energy consumption and integrating digital monitoring solutions for process validation.

This comprehensive research report examines key regions that drive the evolution of the UHT Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positions, Innovations, and Collaborative Initiatives of Leading UHT Processing Equipment Manufacturers in a Competitive Landscape

Leading suppliers are differentiating through a combination of product innovation, strategic collaborations, and expansion of service portfolios. GEA Group has focused on modular skid-based systems that integrate UHT heating, holding tubes, and aseptic filler interfaces, enabling rapid line extensions and pilot-scale testing. Meanwhile, Alfa Laval continues to push the envelope in plate heat exchanger design, leveraging proprietary gasket materials and optimized channel geometries to deliver superior thermal performance and reduced maintenance cycles.

Other key players such as SPX Flow and Tetra Pak invest heavily in digital platforms that provide real-time equipment diagnostics and remote service capabilities, facilitating predictive maintenance and minimizing unscheduled downtime. JBT Corporation has entered joint development agreements to co-create turnkey solutions tailored to specialized applications in dairy and alternative protein processing. Across the board, these manufacturers are building ecosystems of after‐sales support, including training programs, spare part fulfillment networks, and remote troubleshooting services, to strengthen customer loyalty and drive lifecycle value.

This comprehensive research report delivers an in-depth overview of the principal market players in the UHT Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Asepto GmbH

- CFT S.p.A by ATS Corporation

- China Joylong Group Co.,Ltd.

- Coldtech Engineering Pvt. Ltd.

- Elecster Oyj

- GEA Group Aktiengesellschaft

- Goma Engineering Pvt. Ltd.

- I.M.A. Industria Macchine Automatiche S.p.A.

- IDMC Limited

- INOXPA S.A.U.

- Iwai Kikai Kogyo Co., Ltd.

- JBT Corporation

- Krones AG

- MicroThermics, Inc.

- Milkman Dairy Equipment

- Naugra Export

- Neologic Engineers Private Limited

- NK Dairy Equipments

- OMVE Netherlands B.V.

- ProXES GmbH

- Reda SpA

- Repute Engineers Private Limited

- Shanghai Triowin Intelligent Machinery Co., Ltd.

- SPX FLOW, Inc.

- Tessa Dairy Machinery

- Tetra Pak International S.A.

Delivering Pragmatic Strategies to Enhance Operational Efficiency, Sustainability, and Innovation for Stakeholders in the UHT Processing Equipment Sector

To harness the full potential of UHT processing, stakeholders must prioritize digital transformation by adopting advanced process control platforms and predictive analytics. Establishing data collection protocols at each critical control point enables continuous performance benchmarking and early detection of inefficiencies. Furthermore, investing in connectivity standards and cybersecurity safeguards ensures that remote monitoring capabilities are both reliable and resilient against evolving digital threats.

Sustainability efforts should focus on optimizing energy consumption and water usage through retrofits and equipment upgrades. Retrofitting existing heat exchanger circuits with high-efficiency plates, integrating heat recovery systems into CIP loops, and deploying variable-frequency drives on pumps can collectively reduce operational footprint. By quantifying resource savings and aligning upgrades with corporate ESG objectives, companies can secure regulatory approvals and benefit from potential incentive programs.

Finally, fostering strategic partnerships between OEMs, material suppliers, and end users accelerates innovation cycles. Collaborative initiatives such as co-development agreements for novel plate alloys, pilot testing of alternative refrigerants, and joint workshops on aseptic processing protocols can generate proprietary insights and reduce time-to-market. Leaders should also explore consortium models to share best practices and collectively address supply chain vulnerabilities, ensuring continuity and competitiveness across the UHT equipment ecosystem.

Outlining a Methodological Framework Employing Primary and Secondary Research Techniques to Ensure Thorough Evaluation of the UHT Processing Equipment Market

The research methodology underpinning this analysis combined qualitative interviews with senior executives, process engineers, and technical experts across leading equipment manufacturers, end user facilities, and industry associations. These primary engagements provided firsthand insights into emerging technology adoption patterns, operational pain points, and strategic sourcing decisions. In parallel, a comprehensive review of secondary sources-including regulatory filings, technical white papers, and industry periodicals-supplemented our understanding of market dynamics and competitive benchmarks.

Data triangulation was achieved by cross‐referencing quantitative input parameters, such as equipment lead times and component cost indices, with expert-validated anecdotal feedback. A structured segmentation framework guided data collection across technology, distribution channel, equipment type, application, end user industry, and capacity categories. Each segment was analyzed through a combination of supplier catalogs, customer case studies, and trade association surveys to ensure a balanced perspective.

To maintain analytical rigor, all findings underwent multiple rounds of quality validation, including peer review by subject matter experts and consistency checks against publicly disclosed financial disclosures and trade data. This layered approach ensures that conclusions drawn within the report are robust, transparent, and actionable for executives seeking to make informed decisions in the ever-evolving UHT processing equipment market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our UHT Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- UHT Processing Equipment Market, by Technology

- UHT Processing Equipment Market, by Component Type

- UHT Processing Equipment Market, by Capacity

- UHT Processing Equipment Market, by Integration Types

- UHT Processing Equipment Market, by End Product Form

- UHT Processing Equipment Market, by Application

- UHT Processing Equipment Market, by Distribution Channel

- UHT Processing Equipment Market, by End User Industry

- UHT Processing Equipment Market, by Region

- UHT Processing Equipment Market, by Group

- UHT Processing Equipment Market, by Country

- United States UHT Processing Equipment Market

- China UHT Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Illuminate Future Opportunities and Strategic Imperatives for Participants in the UHT Processing Equipment Arena

In synthesizing the core findings, it is evident that digital integration, sustainability imperatives, and tariff-related cost pressures are converging to reshape strategic priorities across the UHT processing equipment landscape. Manufacturers are increasingly pursuing modular solutions that enable agile capacity scaling and faster time to market, while also embedding advanced monitoring capabilities for predictive performance management.

As trade policies continue to influence capital expenditures and supply chain configurations, industry participants must remain vigilant in cultivating diversified sourcing strategies and building collaborative relationships. By aligning technology roadmaps with evolving regulatory requirements and environmental objectives, organizations can position themselves to capture new market segments and reinforce competitive advantage. The insights contained in this executive summary offer a clear blueprint for navigating these complex dynamics and fostering sustained growth in the UHT processing equipment arena.

Encouraging Industry Stakeholders to Secure Exclusive Market Insights by Engaging Directly with Ketan Rohom to Unlock the Full UHT Processing Equipment Report

To explore comprehensive analyses, detailed case studies, and custom insights that delve into the nuances of equipment performance metrics, cost drivers, and strategic entry points, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will provide you exclusive access to the full report, including enhanced data tables, expert commentary, and actionable intelligence tailored to your organization’s priorities. Don’t miss the opportunity to leverage these findings to shape competitive strategies, optimize procurement decisions, and accelerate innovation cycles in your operations. Reach out today to secure your copy and position your team at the forefront of UHT processing equipment excellence.

- How big is the UHT Processing Equipment Market?

- What is the UHT Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?