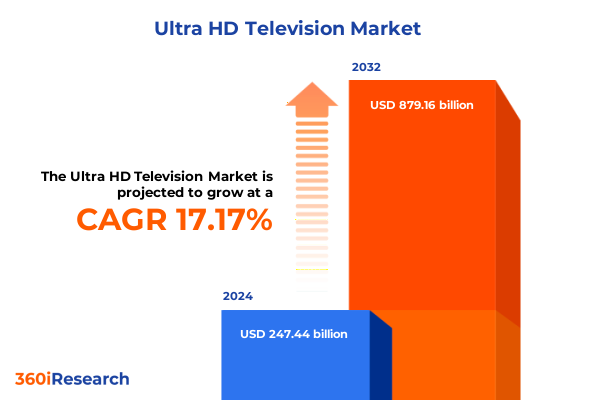

The Ultra HD Television Market size was estimated at USD 289.21 billion in 2025 and expected to reach USD 338.03 billion in 2026, at a CAGR of 17.21% to reach USD 879.16 billion by 2032.

Exploring the Unprecedented Evolution and Consumer Adoption Patterns Driving the Ultra HD Television Market Toward a Transformative Future

Ultra High Definition Television, encompassing both 4K Ultra HD and emerging 8K formats, represents a paradigm shift in visual entertainment by offering dramatically higher pixel densities and richer color depth than standard high-definition models. A 4K display delivers approximately four times the pixel count of a 1080p HDTV, providing enhanced clarity and detail that have become essential for immersive viewing experiences in both residential and commercial environments. 8K resolution, measuring 7,680 by 4,320 pixels, quadruples the resolution of 4K screens and leverages advanced upscaling processors to transform lower-resolution content into sharper images, although native 8K content remains scarce in current broadcasting and streaming services.

Consumer adoption of Ultra HD Television has accelerated rapidly over the past several years, propelled by the proliferation of streaming platforms and declining hardware costs. In North America, more than 60 percent of households now own a 4K-capable television, underscoring the mainstream acceptance of Ultra HD technology and the growing demand for higher-quality content. Simultaneously, global revenue for 4K Ultra HD screens reached over USD 101 billion in 2024, reflecting strong investment by manufacturers and retailers in catering to evolving consumer preferences.

Building on these advancements, television makers have embraced innovative panel technologies such as OLED, QLED, MiniLED, and the nascent MicroLED to deliver deeper contrast, wider color gamuts, and higher peak brightness levels. As UHD standards continue to evolve, the market is poised for further transformation driven by next-generation technologies, premium content offerings, and the integration of artificial intelligence to optimize display performance. This introduction sets the stage for a deeper exploration of the dynamic shifts, regulatory impacts, and strategic imperatives shaping the Ultra HD Television market today.

Revealing the Pivotal Technological and Consumer Behavior Transformations Reshaping the Ultra HD Television Landscape Worldwide

The Ultra HD Television landscape is undergoing a profound metamorphosis as emerging technologies and shifting consumer behaviors converge to redefine the home entertainment ecosystem. Streaming services have spearheaded this transformation by expanding their 4K content libraries, with over half of leading platforms now offering Ultra HD titles, thereby incentivizing viewers to upgrade older displays and fueling demand for cutting-edge panels. Concurrently, the gaming industry has embraced 4K and 8K resolutions, with next-generation consoles and high-end graphics cards supporting Ultra HD output to deliver hyper-realistic gameplay experiences on large-format screens.

On the hardware front, OLED technology has continued to gain traction in premium segments due to its superior contrast ratios and perfect black levels. LG Electronics has maintained its position as the global leader in OLED TV shipments for twelve consecutive years, commanding over 52 percent market share in the segment by shipping more than 3.18 million units in 2024. At the same time, advancements in MiniLED backlighting and quantum dot materials have bolstered the growth of high-end LCD displays, with global shipments of MiniLED-backlit units surpassing two million in Q4 2024 and expected to outpace OLED volumes by mid-2025.

Looking ahead, MicroLED panels are moving from concept to commercialization, delivering unrivaled brightness, energy efficiency, and durability without burn-in concerns. Samsung’s roadmap includes smaller, more affordable MicroLED models slated for demonstration at IFA Berlin in September 2025 and potential consumer availability at CES 2026, signaling the approach of a new era in ultra-premium displays. These technological leaps, combined with the proliferation of smart platform capabilities such as integrated AI upscaling and voice interfaces, underscore a market in flux and poised for continued innovation.

Assessing How the 2025 United States Tariffs on Imported Televisions Are Altering Pricing Structures and Supply Chains Across the Industry

In early 2025, the United States government enacted a series of reciprocal tariffs targeting imported televisions, significantly influencing pricing strategies, supply chains, and market dynamics for Ultra HD displays. The new tariff framework imposes a 34 percent levy on Chinese-made TVs-stacked upon an existing 20 percent baseline-while sparing products manufactured in Mexico under USMCA provisions. This divergence in treatment prompted major brands to accelerate shipments from Mexican facilities, thereby preserving competitive pricing for North American consumers in the first half of the year.

Despite these mitigations, retailers and brands have begun transferring tariff burdens to end users, with projections indicating retail price increases of up to 23 percent on Chinese-made models. According to a study by the National Retail Federation and the Consumer Technology Association, implementing a 25 percent tariff on imports from China would add an estimated $711 million to consumer expenditures over a twelve-month period, forcing a $250 television to potentially cost $308 post-tariff and elevating a $500 model to $615. As a result, demand for last-generation inventory surged, with savvy buyers rushing to secure deals before anticipated price hikes.

Beyond immediate price effects, the tariff-driven shift in manufacturing geographies has long-term implications for supply chain resilience and production localization. Industry analysts caution that while Mexican manufacturing has absorbed initial demand, scaling capacity to meet Ultra HD TV volumes remains a formidable challenge, particularly for smaller players lacking established local infrastructure. Consequently, forward-looking brands are exploring hybrid sourcing strategies, diversifying production footprints across Southeast Asia and Latin America to hedge against future trade volatility.

Unlocking Critical Market Segmentation Perspectives Across Panel Types, Smart Platforms, Screen Sizes, Distribution Channels, and End Users

The Ultra HD Television market’s complexity is best understood through its multifaceted segmentation, which captures distinct consumer preferences and purchase behaviors across panel types, smart platforms, screen sizes, distribution channels, and end uses. Each panel technology-ranging from traditional LED and QLED to OLED and the nascent MicroLED-caters to unique value propositions, with LED maintaining mass-market affordability while OLED commands premium pricing for perfect blacks and infinite contrast ratios. MicroLED, still early in commercialization, offers unmatched brightness and longevity, positioning it for future flagship deployments under ultra-premium branding.

Smart platform choices further shape consumer experiences by determining app ecosystems, voice assistant integrations, and user interfaces. Android TV leads global shipments with over 24 percent share thanks to broad licensing across multiple manufacturers, while Samsung’s Tizen and LG’s WebOS follow, each offering proprietary features, optimized performance, and exclusive content partnerships. These platforms drive software differentiation even as hardware innovations compete for attention.

Display size remains a critical factor, with screens above 55 inches accounting for nearly half of all Ultra HD TV sales-a trend reflecting a growing appetite for immersive, cinema-like viewing. Within this category, models between 65 and 75 inches are capturing significant share due to balanced price-to-value ratios, while ultra-large segments beyond 75 inches serve luxury environments and dedicated home theaters. Conversely, under-55-inch models continue to serve budget-conscious buyers and secondary room installations, with subcategories from 50 to 55 inches and below 50 inches addressing distinct space constraints.

Distribution channels illustrate the evolving retail landscape. Online commerce now commands nearly half of all television purchases in the United States, as digital marketplaces offer expansive product assortments and flexible delivery options. Traditional store retail remains influential for in-person demonstrations and instant gratification, particularly for premium and large-format models. Finally, the end-user segmentation bifurcates into residential viewers seeking entertainment and immersive experiences, and commercial adopters deploying digital signage, video walls, and professional displays in corporate, hospitality, and public venues, where durability and around-the-clock operation drive procurement decisions.

This comprehensive research report categorizes the Ultra HD Television market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Panel Type

- Smart Platform

- Screen Size

- Distribution Channel

- End User

Comparative Regional Dynamics Highlighting Market Opportunities and Consumer Preferences Across the Americas, EMEA, and Asia-Pacific Territories

The Ultra HD Television market exhibits pronounced regional distinctions driven by economic development, consumer income levels, and cultural viewing preferences. In the Americas, the United States remains the global leader for 4K penetration, with over 60 percent household adoption and a thriving e-commerce ecosystem where nearly half of all TVs transact online. Streaming platforms are deeply ingrained, with 41 percent of U.S. TV consumption attributed to digital services as of Q3 2024, reflecting continuing cord-cutting trends and demand for high-resolution content. Canada and Latin American markets follow similar trajectories, though affordability constraints temper large-screen prevalence and premium panel uptake.

Europe, Middle East & Africa (EMEA) markets exhibit a mosaic of adoption rates, underpinned by strong broadband infrastructure in Western Europe and rising digital investments in the Gulf States. Western European households report a 65 percent UHD adoption rate, with demand for OLED displays especially robust in Germany and the U.K., where premium content offerings and consumer spending power support lofty price points. Meanwhile, Middle Eastern and African markets show double-digit year-over-year UHD growth, buoyed by smart city initiatives and hospitality sector investments in experiential digital signage, with regional adoption growing by 18 percent annually.

Asia-Pacific maintains the fastest expansion, driven by China’s massive manufacturing capacities and domestic consumption, where over 60 million 4K units were sold in 2023. Japan and South Korea lead in early 8K trials and broadcasting, fueled by public and private sector R&D investments, while Southeast Asia represents a high-growth frontier as rising incomes accelerate consumer upgrades. These regional dynamics underscore tailored market strategies for manufacturers and retailers seeking to align product portfolios, pricing frameworks, and distribution models with localized demand.

This comprehensive research report examines key regions that drive the evolution of the Ultra HD Television market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Global Players and Their Strategic Innovations Driving Competition and Growth in the Ultra HD Television Market

Leading manufacturers are steering the Ultra HD Television market through differentiated strategies centered on innovation, production flexibility, and ecosystem partnerships. Samsung Electronics has secured its nineteenth consecutive global TV market lead, capturing 28.3 percent share in 2024 by prioritizing premium QLED portfolios and ultra-large screen innovation while leveraging Mexican manufacturing to mitigate tariff impacts. Strategic investments in AI-powered display enhancements and content alliances with major streaming services have further cemented its leadership position.

LG Electronics continues to dominate the OLED segment, shipping over 3.1 million units in 2024 and holding more than 52 percent OLED market share. Its relentless focus on perfect black levels, AI-enhanced upscaling, and ultra-slim form factors positions LG at the forefront of premium display differentiation, while collaborations with home theater brands amplify its appeal in luxury segments.

Chinese manufacturers TCL and Hisense have emerged as formidable competitors, capitalizing on cost advantages and rapid product rollouts. TrendForce data indicates TCL is set to grow its shipments by 15 percent and Hisense by 7 percent in 2025, driven by aggressive MiniLED backlight adoption and robust trade-in subsidy programs in key markets. VIZIO, with a projected 20 percent year-on-year shipment surge, underscores the potency of hybrid manufacturing strategies and value-oriented smart platform integrations.

Complementing these giants, Sony continues to invest in premium Bravia models and next-generation panel research, while emerging players such as Xiaomi and Konka explore RGB LED and QDEL technologies to carve niche positions. This competitive tapestry illustrates a market where scale, technological leadership, and agile supply chain execution define winning formulas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra HD Television market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Hisense Company Limited

- Koninklijke Philips N.V.

- KONKA North America

- LG Electronics Inc.

- Micromax Company

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sichuan Changhong Electric Co., Ltd.

- Skyworth Group Co., Ltd.

- Sony Group Corporation

- TCL Technology Group Corporation

- TPV Technology Limited

- Xiaomi Corporation

Strategic Pillars and Actionable Recommendations for Industry Leaders to Capitalize on Ultra HD Television Market Opportunities and Mitigate Risks

To navigate the evolving Ultra HD Television landscape effectively, industry leaders must adopt a multi-pronged strategic framework that balances immediate tactical responses with long-term innovation roadmaps. First, diversifying manufacturing footprints beyond single-source geographies is imperative to insulate against trade policy shifts; investing in modular assembly capabilities in Mexico, Vietnam, and other compliant jurisdictions will curtail tariff exposures and maintain agile production pipelines.

Second, doubling down on emerging panel technologies such as MiniLED and MicroLED will be critical to capturing premium segments and commanding higher margins. Companies should ramp R&D collaborations with material suppliers, semiconductor foundries, and academic institutions to streamline mass-production techniques and drive down cost-per-unit metrics. Pilot deployments of MicroLED in flagship retail and hospitality environments will serve both as proof-of-concept and a marketing differentiator.

Third, forging deeper integrations with streaming platforms, game publishers, and smart home ecosystems can extend the value proposition beyond hardware. Partnerships that bundle content subscriptions, exclusive features, and voice assistant compatibilities will strengthen brand loyalty and generate recurring software revenue streams.

Fourth, optimizing omnichannel distribution strategies to balance online convenience with in-store experiential touchpoints is essential. Retail-in-a-box solutions utilizing virtual reality or holographic demos can invigorate physical showrooms, while AI-driven recommendation engines on e-commerce platforms can personalize product discovery and drive upsell conversions.

Finally, embedding circular economy principles-through take-back programs, modular repairability, and certified refurbishment initiatives-will align brands with sustainability mandates, reduce end-of-life waste, and resonate with environmentally conscious consumers. Implementing these action plans will enable stakeholders to seize growth opportunities, differentiate effectively, and fortify market resilience.

Transparency in Methodology Explaining the Research Framework, Data Collection Techniques, and Analytical Approaches Underpinning This Report

This market research report synthesizes primary and secondary data through a rigorous, multi-step methodology designed to ensure comprehensive accuracy and actionable insights. Initially, a thorough review of publicly available industry literature, trade publications, government tariff filings, and credible news sources established foundational market parameters and contextualized recent regulatory developments.

Subsequently, primary research was conducted via structured interviews with key stakeholders, including senior executives at major OEMs, supply chain managers, distributors, and leading content platform representatives. These discussions provided qualitative validation of strategic priorities, technology adoption timelines, and distribution challenges.

Quantitative data collection employed a bottom-up approach, aggregating company-reported shipment figures, manufacturing capacity statistics, and customs import volumes to construct reliable unit and revenue estimates. Data triangulation techniques reconciled disparities across multiple sources, utilizing statistical normalization to ensure consistency.

Advanced analytical modeling, encompassing scenario analysis and sensitivity testing, evaluated the implications of potential tariff adjustments and technology cost reductions on pricing and profitability trajectories. Competitive benchmarking assessed relative performance across key players, while trend extrapolation forecasted adoption curves for emerging panel technologies.

All findings underwent a thorough peer review process involving cross-functional experts in market intelligence, economic policy analysis, and display engineering. This layered validation framework ensures that the report’s conclusions are robust, transparent, and aligned with the latest industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra HD Television market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra HD Television Market, by Panel Type

- Ultra HD Television Market, by Smart Platform

- Ultra HD Television Market, by Screen Size

- Ultra HD Television Market, by Distribution Channel

- Ultra HD Television Market, by End User

- Ultra HD Television Market, by Region

- Ultra HD Television Market, by Group

- Ultra HD Television Market, by Country

- United States Ultra HD Television Market

- China Ultra HD Television Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways and Forward-Looking Perspectives on the Ultra HD Television Market’s Trajectory and Strategic Implications

As Ultra High Definition Television continues its ascendancy as the cornerstone of home and commercial viewing experiences, market stakeholders face a landscape characterized by rapid technological advances, geopolitical headwinds, and evolving consumer expectations. The confluence of dynamic panel innovations-from OLED’s perfect blacks to MicroLED’s impending mainstream debut-with resilient consumer demand for larger, smarter displays underscores the enduring growth potential of this sector.

Yet, regulatory shifts, particularly the 2025 U.S. tariffs on imported panels, spotlight the necessity for agile manufacturing and supply chain strategies that transcend traditional boundaries. Market leaders have demonstrated the capacity to pivot, leveraging USMCA-compliant production and diversified sourcing to mitigate cost pressures, yet the broader ecosystem must remain vigilant to future trade fluctuations.

Regional disparities in UHD adoption emphasize the importance of tailored go-to-market approaches, balancing premium-centric offerings in mature markets with value-driven models in emerging economies. Meanwhile, integration with streaming services, gaming platforms, and smart home infrastructures will continue to differentiate brands and unlock recurring revenue models beyond pure hardware sales.

Ultimately, the Ultra HD Television market’s trajectory will be defined by those who can harmonize technical innovation, supply chain resilience, strategic partnerships, and consumer-centric experiences. As new technologies emerge and content ecosystems expand, stakeholders who adopt a forward-looking mindset and embrace collaborative pathways will be best positioned to capture the sector’s rich opportunities and sustain leadership in an increasingly competitive arena.

Connect with Ketan Rohom to Secure Comprehensive Ultra HD Television Market Research and Drive Informed Strategic Decisions

Ready to transform your business strategies with cutting-edge insights on the Ultra HD Television market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke research solutions tailored to your organization’s needs. Gain exclusive access to in-depth data, strategic analysis, and market intelligence that will empower you to make informed decisions, drive growth, and stay ahead of the competition. Reach out today to secure your comprehensive market research report and unlock unparalleled opportunities in the evolving world of Ultra HD Television.

- How big is the Ultra HD Television Market?

- What is the Ultra HD Television Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?