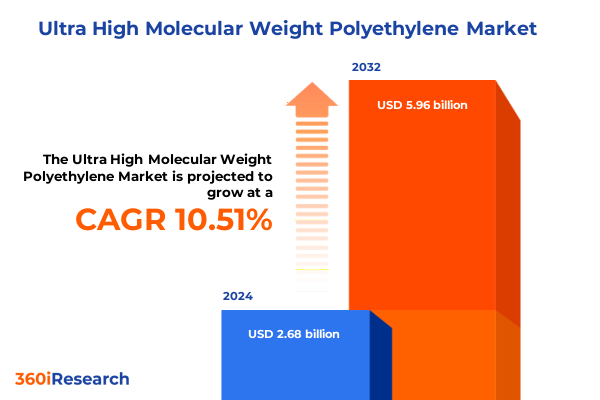

The Ultra High Molecular Weight Polyethylene Market size was estimated at USD 2.93 billion in 2025 and expected to reach USD 3.22 billion in 2026, at a CAGR of 10.65% to reach USD 5.96 billion by 2032.

Emerging Applications and Strategic Imperatives for Ultra High Molecular Weight Polyethylene in a Rapidly Evolving Polymer Landscape

Ultra high molecular weight polyethylene (UHMWPE) has emerged as a cornerstone material for industries demanding exceptional durability, impact resistance, and wear performance. Distinguished by its extremely long polymer chains and high molecular mass, this class of polyethylene exhibits unrivaled tensile strength and abrasion resistance, setting it apart from conventional polymer grades. As global demand for high-performance materials intensifies, stakeholders across transportation, healthcare, defense, and manufacturing sectors are turning to UHMWPE to fulfill increasingly stringent specifications for weight reduction, reliability, and lifecycle cost savings. Consequently, understanding the broader context of market drivers, technological advancements, and supply chain dynamics has become pivotal for organizations seeking to harness the benefits of this material.

In this report, we delve into the complexities of the UHMWPE landscape, exploring the transformative shifts that define current market trajectories. Through an integrated analysis of production techniques, tariff influences, segmentation strategies, and regional patterns, we provide a holistic view that empowers decision-makers to align investments with emerging opportunities. Supported by interviews with industry leaders, cross-border trade records, and technology adoption case studies, the following sections chart the strategic imperatives you need to navigate an environment characterized by intensifying competition, geopolitical realignments, and rapid innovation cycles.

Breakthrough Innovations and Competitive Dynamics Reshaping the Ultra High Molecular Weight Polyethylene Market Ecosystem Globally

Recent breakthroughs in polymerization catalysts and processing technologies have redefined the performance envelope of ultra high molecular weight polyethylene. Advanced metallocene-based catalysts now enable manufacturers to achieve tighter molecular weight distributions, driving uniformity in mechanical properties that was previously unattainable. Additionally, novel extrusion and ram processing techniques have significantly boosted production throughput, while additive integration approaches are unlocking multifunctional composites tailored to specific end-use requirements. These technological evolutions are converging to elevate UHMWPE from a niche specialty material to a mainstream solution across diverse market segments.

At the same time, competitive dynamics have intensified as legacy producers collaborate with material science startups, forging strategic alliances to accelerate time-to-market for next-generation UHMWPE formulations. Mergers and joint ventures are reshaping the value chain, while contract manufacturers expand capacity to meet burgeoning demand. Moreover, investments in digital manufacturing and predictive analytics are enhancing operational resilience and driving product quality improvements. Collectively, these transformative shifts are recalibrating industry benchmarks and creating fresh avenues for differentiation in an increasingly saturated market.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Ultra High Molecular Weight Polyethylene Supply Chains and Costs

In early 2025, sweeping tariff measures introduced under broad import regulation authorities imposed a baseline duty on a wide array of polymer imports, including ultra high molecular weight polyethylene. By establishing a universal levy on incoming shipments and layered country-specific surcharges, these policies elevated cost pressures on downstream fabricators and end-users alike. Organizations reliant on international supply channels have responded by reassessing supplier footprints and accelerating qualification programs for domestic resin producers to mitigate exposure and secure uninterrupted production flows.

The cumulative impact has prompted a strategic pivot from singular sourcing toward diversified procurement models, combining imports routed through free-trade zones with locally produced resin. While this shift has provided cost relief in certain applications, it has also introduced complexity in logistics planning, extended lead times, and inventory management challenges. High value sectors such as aerospace and defense have strategically absorbed incremental cost burdens to ensure material availability, whereas more price-sensitive industries have sought long-term supply agreements and leveraged recycled UHMWPE grades to balance performance demands against tighter budget constraints. These supply chain realignments underscore the criticality of agile contracting and robust risk mitigation frameworks in a tariff-volatile environment.

Uncovering Strategic Opportunities Across Diverse Product, Grade, Industry and Channel Segments in the Ultra High Molecular Weight Polyethylene Sphere

Analyzing the market through multiple lenses reveals how distinct product forms, resin grades, end-user applications, and distribution pathways drive opportunity. The fibers segment has continued to grow, buoyed by demand for ultra-high strength ropes and ballistic textiles, while films benefit from enhanced barrier properties and low friction in packaging and liner applications. At the same time, rods and tubes serve as essential components in high-wear bearing systems and medical catheters, whereas sheets and tapes deliver versatile solutions for wear liners, medical implants, and precision gaskets. Shifts in grade preference also warrant attention: while virgin UHMWPE maintains its dominance in critical applications requiring uncompromised performance, reprocessed grades are gaining traction where sustainability and cost optimization align with technical requirements.

Diverse industry segments further underscore the strategic importance of tailoring offerings to unique performance profiles. Aerospace and automotive sectors prioritize weight savings and fatigue resistance, contrasted with construction and electronics industries that emphasize durability and dielectric properties. In the food and beverage and medical arenas, hygienic compliance and chemical inertness remain paramount. Meanwhile, the oil and gas sector demands resilience under abrasive conditions, and textile applications seek enhanced tensile strength and flexibility. Distribution channels have adapted accordingly, with traditional offline partnerships retaining strength in industrial markets, even as digital platforms expand reach into specialized end-user communities. This integrated segmentation framework illuminates where targeted investments and product innovations can yield the greatest returns.

This comprehensive research report categorizes the Ultra High Molecular Weight Polyethylene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Grade

- Process

- Functionality

- End-User Industries

- Distribution Channel

Regional Dynamics Shaping Demand and Innovation Trajectories for Ultra High Molecular Weight Polyethylene Across Key Global Territories

Geographic markets exhibit pronounced differences in demand drivers, regulatory frameworks, and technology adoption cycles, offering nuanced insights for strategic deployment. In the Americas, robust infrastructure investment and strong defense procurement have created stable consumption patterns for UHMWPE materials, complemented by growth in healthcare applications and sustainable packaging solutions. Regulatory emphasis on domestic sourcing has further catalyzed local capacity expansions, fostering closer partnerships between resin producers and end-users.

Across Europe, the Middle East, and Africa, stringent environmental standards and a premium on lightweight construction materials have propelled UHMWPE into applications such as renewable energy components and high-performance marine outfittings. Collaborative research hubs and industry consortiums support rapid technology transfer, while distribution networks balance centralized warehousing with responsive local servicing. In the Asia-Pacific region, the sheer scale of manufacturing ecosystems and the rapid pace of infrastructure development have driven broad-based adoption of UHMWPE in sectors ranging from automotive friction materials to advanced sports equipment. Investments in regional R&D centers and government incentives for high-performance polymers underscore a clear commitment to material innovation within these markets.

This comprehensive research report examines key regions that drive the evolution of the Ultra High Molecular Weight Polyethylene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Growth Models and Collaborative Partnerships Defining Key Competitive Positions in the Global Ultra High Molecular Weight Polyethylene Arena

The competitive landscape remains both diverse and dynamic, with several leading resin manufacturers pursuing complementary growth strategies. Major incumbents have expanded production footprints through capacity additions at existing facilities and new greenfield plants to serve proximate demand centers. Concurrently, emerging entrants with specialized process technologies are carving out niche positions by addressing high-margin segments like medical implants and ballistic fabrics. This dual-track approach has intensified technology differentiation and accelerated the pace of new product launches.

Strategic partnerships have also emerged as a critical enabler of growth, with resin producers collaborating with end-users to co-develop tailored formulations that meet stringent application-specific requirements. In addition, contract manufacturers and toll processors are enhancing competitive positioning by offering turnkey solutions across complex value chains, from resin compounding to finished component fabrication. These collaborative models underscore a wider trend toward integrated service offerings, where responsiveness and technical support drive customer loyalty and foster deeper ecosystem engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra High Molecular Weight Polyethylene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Avient Corporation

- Braskem S.A.

- Celanese Corporation

- China Petrochemical Corporation

- Crown Plastics, Inc.

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Garland Manufacturing Company

- Honeywell International Inc.

- INEOS GROUP HOLDINGS S.A.

- Korea Petrochemical Ind. Co., LTD.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Group Corporation

- Mitsuboshi Belting Ltd.

- Mitsui Chemicals, Inc.

- Nitto Denko Corporation

- Parshwa Polymer Industries

- Polymer Industries

- Repsol, S.A.

- Röchling Group

- Saudi Basic Industries Corporation

- Shandong Matrox Plastics Co., Ltd

- Shanxi BuMtresD Mechanical Equipment Co., Ltd.

- Swami Plast Industries

- Teijin Limited

- Toray Industries, Inc.

- Toyobo Co., Ltd.

Proactive Strategic Levers and Partnership Models to Drive Leadership in the Ultra High Molecular Weight Polyethylene Industry Amid Market Complexity

To navigate the evolving UHMWPE landscape effectively, industry leaders should prioritize investment in advanced catalyst and processing platforms that deliver differentiated performance attributes. Cultivating partnerships between resin producers, fabricators, and end-users can accelerate the commercialization of proprietary grades and expand addressable application spaces. Equally important is the diversification of supply chain footprints through strategic alliances with regional manufacturers and recycled resin suppliers to bolster resilience against tariff fluctuations and logistical disruptions.

Moreover, leveraging digital solutions such as predictive maintenance analytics and supply chain visibility tools can optimize operational efficiencies and reduce waste. Firms that integrate sustainability frameworks-emphasizing circularity through reprocessed resins and energy-efficient production processes-will strengthen their market position amid tightening environmental regulations. Finally, aligning product roadmaps with evolving end-user demands, particularly in high-growth sectors like medical devices and defense, will position organizations at the forefront of value creation in what remains a highly competitive and innovation-driven industry.

Rigorous Analytical Framework and Multi-Dimensional Data Collection Approaches Employed to Deliver Comprehensive Ultra High Molecular Weight Polyethylene Market Insights

Our research methodology combined primary interviews with leading resin manufacturers, end-user executives, and supply chain experts to capture real-time perspectives on market dynamics and future priorities. We supplemented these insights with an extensive review of technical literature, industry publications, and regulatory filings to ensure a comprehensive understanding of processing innovations, performance standards, and policy developments. Data triangulation techniques were applied to reconcile differing viewpoints and validate trends across various geographies and application segments.

Quantitative inputs were collected through anonymous surveys targeting key decision-makers in aerospace, automotive, medical, and packaging industries to gauge material preferences and procurement strategies. Qualitative analysis relied on case studies of successful UHMWPE deployments, highlighting factors that drive superior material performance and cost efficiencies. Finally, our integrated assessment framework synthesized supply chain structures, competitive dynamics, and macroeconomic indicators to provide a balanced and forward-looking perspective on opportunities and risks within the UHMWPE space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra High Molecular Weight Polyethylene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra High Molecular Weight Polyethylene Market, by Product

- Ultra High Molecular Weight Polyethylene Market, by Grade

- Ultra High Molecular Weight Polyethylene Market, by Process

- Ultra High Molecular Weight Polyethylene Market, by Functionality

- Ultra High Molecular Weight Polyethylene Market, by End-User Industries

- Ultra High Molecular Weight Polyethylene Market, by Distribution Channel

- Ultra High Molecular Weight Polyethylene Market, by Region

- Ultra High Molecular Weight Polyethylene Market, by Group

- Ultra High Molecular Weight Polyethylene Market, by Country

- United States Ultra High Molecular Weight Polyethylene Market

- China Ultra High Molecular Weight Polyethylene Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Market Dynamics and Strategic Imperatives Charting the Future Course of the Ultra High Molecular Weight Polyethylene Sector

As the ultra high molecular weight polyethylene sector continues to advance, the convergence of process innovations, supply chain realignments, and evolving end-user requirements will define its next chapter. Organizations that proactively adapt to shifting tariff landscapes, invest in differentiated resin formulations, and cultivate collaborative partnerships stand to capture significant value. Segment-focused strategies that align product features with precise industry needs will unlock new application frontiers and reinforce competitive advantage.

Looking ahead, sustainability imperatives and regulatory pressures will drive greater adoption of reprocessed grades and water-efficient manufacturing techniques. At the same time, the pursuit of lighter, stronger, and multifunctional materials will propel UHMWPE into emerging domains such as additive manufacturing and next-generation composite systems. By aligning governance structures, investment priorities, and innovation roadmaps with these macro trends, companies can chart a resilient and growth-oriented trajectory in an increasingly sophisticated polymer landscape.

Take the Next Step Towards Informed Decision Making by Securing Your Comprehensive Ultra High Molecular Weight Polyethylene Research Report Today

If you’re ready to gain a competitive edge and leverage deep market understanding to inform your strategic decisions, we invite you to secure a copy of our comprehensive Ultra High Molecular Weight Polyethylene market research report. Ketan Rohom, Associate Director, Sales & Marketing, stands ready to guide you through the key findings, customized insights, and proprietary analyses that can transform your planning and investment priorities. Drawing on rigorous primary interviews, cross-validated secondary sources, and advanced advisory frameworks, this report delivers the clarity and foresight you need to navigate evolving trade environments, shifting end-user demands, and accelerating technological breakthroughs. Don’t leave critical decisions to chance-reach out today and partner with Ketan Rohom to unlock the definitive resource on material performance, strategic segmentation, and regional outlooks that will sharpen your path to market leadership. Your next milestone in innovation and growth starts here; take action now to secure your copy and empower your organization with unparalleled market intelligence.

- How big is the Ultra High Molecular Weight Polyethylene Market?

- What is the Ultra High Molecular Weight Polyethylene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?