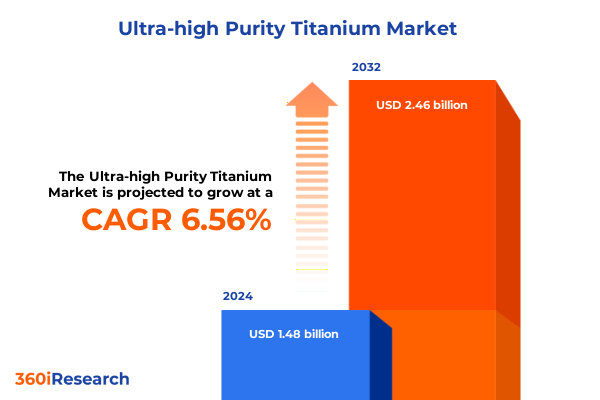

The Ultra-high Purity Titanium Market size was estimated at USD 1.56 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 6.70% to reach USD 2.46 billion by 2032.

An In-Depth Exploration of Ultra-High Purity Titanium and Its Strategic Importance Across Transformative Industry Applications and Supply Chains

In an era where material performance can make or break next-generation technologies, Ultra-High Purity Titanium has emerged as a cornerstone for innovation across critical industries. This introduction sets the stage by outlining the fundamental attributes that distinguish this exceptional grade of titanium, notably its extraordinarily low impurity profile and unparalleled mechanical properties. Within manufacturing environments that span from aerospace to medical devices, the consistency and reliability of ultra-high purity specifications underpin advancements in safety, efficiency, and product lifespan.

Moreover, the evolving needs of high-stress, high-corrosion, and high-temperature applications have propelled the demand for titanium grades that exceed traditional standards. As industries pursue lighter, stronger, and more durable materials, Ultra-High Purity Titanium offers a transformative solution that addresses both performance and regulatory compliance. This section offers a clear overview of how purity levels translate into tangible benefits such as enhanced fatigue resistance, superior biocompatibility, and improved heat tolerance, establishing the framework for deeper exploration in subsequent sections.

An Analytical Overview of How Emerging Processes and Technological Milestones Have Transformed Ultra-High Purity Titanium Production and Applications Globally

Over the past decade, Ultra-High Purity Titanium production has undergone significant metamorphosis, driven by breakthroughs in electron beam melting, plasma arc refining, and advanced electrochemical processes. These innovative techniques have not only elevated achievable purity thresholds but have also optimized process yields and reduced energy consumption. Consequently, manufacturers can now reliably produce titanium with impurity levels measured in mere parts per million, opening doors to applications that were previously constrained by material limitations.

In parallel, digital process controls and real-time monitoring systems have transformed quality assurance protocols, ensuring that each batch adheres to rigorous purity benchmarks. Advanced spectrometric analysis and machine learning–driven defect detection are redefining standards for trace element quantification and structural integrity verification. As a result, customers in critical sectors gain greater confidence in material performance while producers benefit from reduced rework and improved throughput. This transformation underscores a broader shift toward precision-enabled manufacturing, wherein data-driven insights guide end-to-end supply chain optimization and material innovation.

An Insightful Examination of the Multi-Faceted Impact of Recent United States Tariff Implementations on Ultra-High Purity Titanium Supply Chains and Pricing Structures

The introduction of new tariff measures by the United States in early 2025 has reverberated throughout the Ultra-High Purity Titanium supply chain, prompting stakeholders to reassess sourcing strategies and cost models. Heightened duties on imported feedstock have influenced raw material prices, compelling domestic producers to ramp up internal capacity expansions or seek alternative international partnerships. Simultaneously, downstream manufacturers are recalibrating their procurement timelines to hedge against potential disruptions and budgetary pressures.

As tariffs drive import substitution efforts, logistical efficiencies and nearshoring initiatives have gained renewed focus. Industry participants are investing in closer collaboration with regional suppliers to mitigate exposure to fluctuating duties while preserving the integrity of ultra-high purity requirements. Furthermore, vertical integration-particularly among large-scale producers-has emerged as a viable approach to internalize refining processes, reduce landed costs, and maintain consistent supply. These strategic shifts reflect a broader realignment of trade flows and production ecosystems, underscoring the long-term implications of trade policy on material affordability and availability.

Deep Dive into Market Segmentation Revealing Critical Insights on Grades, Forms, Applications, End-Use Industries and Distribution Channels

A nuanced understanding of market segmentation illuminates the diverse demand drivers shaping Ultra-High Purity Titanium adoption. Based on grade, clarity is found in the performance distinctions among Grade 23, Grade 5, and Grade 9, each offering specific advantages in strength-to-weight ratio and corrosion resistance. When analyzing form, it is evident that plate, powder, rod, sheet, tube, and wire serve different production pathways, with powders split between gas atomized and hydride delithiated variants, and tubes differentiated as seamless versus welded based on structural requirements.

Examining application reveals that processes such as additive manufacturing, extrusion, forging, machining, and welding leverage the material’s purity in unique ways, with additive manufacturing further detailed through electron beam melting and laser powder bed fusion techniques. In terms of end use industry, the market’s reach spans aerospace and defense, automotive, chemical processing, electronics and semiconductors, medical, and oil and gas, reflecting the material’s versatility and critical role in high-performance environments. Lastly, distribution channels demonstrate varying degrees of direct engagement, as direct sales, distributor partnerships, and online channels-including merchant and value added distribution networks-each contribute to how titanium moves from producers to end users. These segmentation dimensions collectively reveal the intricate interplay between material characteristics and market demands.

This comprehensive research report categorizes the Ultra-high Purity Titanium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Application

- End Use Industry

- Distribution Channel

Detailed Regional Analysis Uncovering Key Drivers, Opportunities and Challenges Shaping Ultra-High Purity Titanium Adoption in Major Global Territories

Ultra-High Purity Titanium’s global footprint is shaped by regional strengths and distinct industrial priorities. In the Americas, advanced manufacturing clusters and aerospace hubs drive a need for high-performance alloys, while domestic supply chains leverage established refining infrastructure to meet strict regulatory and quality standards. Across Europe, Middle East & Africa, rigorous environmental policies and the resurgence of defense modernization programs fuel demand, prompting strategic partnerships between local producers and research institutions focused on sustainable refining techniques.

Meanwhile, in the Asia-Pacific region, rapid adoption of additive manufacturing and increasing investment in semiconductors have spurred regional producers to expand capacity and innovate in alloy customization. Cross-border collaborations and government-led initiatives aimed at supply chain resilience underscore the strategic importance of securing access to ultra-high purity materials. As these regions navigate their unique macroeconomic and policy landscapes, stakeholders must align regional capabilities with global market dynamics, ensuring that production, distribution, and end-use deployments remain synchronized with evolving technological and regulatory imperatives.

This comprehensive research report examines key regions that drive the evolution of the Ultra-high Purity Titanium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Profile of Leading Industry Participants Driving Innovation and Competitive Dynamics in the Ultra-High Purity Titanium Marketplace

Leading companies in the Ultra-High Purity Titanium market are distinguished by their investments in refined production technologies and robust quality assurance frameworks. These industry participants prioritize continuous innovation to achieve tighter impurity tolerances and to develop proprietary alloys tailored for specific applications. Their approaches often involve strategic alliances with research institutions and technology providers to accelerate the commercialization of next-generation processing methods.

Competitive dynamics are intensifying as new entrants leverage niche capabilities-such as precision gas atomization or advanced hydride processing-to capture segments of the market that demand ultra-low contamination levels. At the same time, established players deploy capital toward scaling high-vacuum melting facilities and adopting digital twins for predictive process control. This convergence of scale and specialization creates an environment in which collaborative ventures, joint R&D projects, and targeted acquisitions become key levers for sustaining growth, diversifying product portfolios, and reinforcing barriers to entry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra-high Purity Titanium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Metallurgical Group N.V.

- Allegheny Technologies Incorporated

- Allegheny Technologies Incorporated

- Baoji Titanium Industry Co., Ltd.

- Baoji Titanium Industry Co., Ltd.

- Carpenter Technology Corporation

- Hitachi Metals, Ltd.

- Honeywell International Inc.

- Kobe Steel, Ltd.

- Kobe Steel, Ltd.

- Mitsui Mining & Smelting Co., Ltd.

- Nippon Steel Corporation

- Osaka Titanium Technologies Co., Ltd.

- RTI International Metals, Inc.

- RTI International Metals, Inc.

- Titanium Industries, Inc.

- Titanium Metals Corporation

- Toho Titanium Co., Ltd.

- Tosoh Corporation

- VSMPO-AVISMA Corporation

- Western Superconducting Technologies Co., Ltd.

- Western Superconducting Technologies Co., Ltd.

- Wuxi Baoqi Titanium Industry Co., Ltd.

Strategic and Actionable Recommendations Empowering Industry Leaders to Optimize Ultra-High Purity Titanium Supply Chains and Maximize Competitive Advantage

To navigate the evolving landscape of Ultra-High Purity Titanium, industry leaders must adopt a multifaceted strategy that balances supply chain resilience with technological advancement. First, diversifying feedstock sources through strategic partnerships and long-term supply agreements can buffer against tariff volatility and geopolitical uncertainties. Coupled with this, investing in modular refining units allows for rapid capacity adjustments to meet surges in specialized demand.

Simultaneously, allocating resources toward automation and digital process controls will enhance yield consistency and reduce operational variability. Companies should also foster collaborative R&D ecosystems-whether through public-private partnerships or cross-industry consortia-to accelerate the maturation of high-throughput purification techniques. Lastly, embedding robust sustainability metrics into strategic planning not only aligns with tightening environmental regulations but also resonates with customers seeking ethically sourced, low-impact materials. By executing on these actionable initiatives, leaders can fortify their competitive positioning while capitalizing on new avenues for market growth.

Rigorous Research Methodology and Framework Employed to Ensure Reliability and Validity of Ultra-High Purity Titanium Market Insights

This research is underpinned by a rigorous methodology that integrates qualitative and quantitative approaches to ensure data integrity and analytical depth. Primary interviews with material scientists, procurement executives, and process engineers provide firsthand insights into emerging challenges and innovation drivers. Complementing this, secondary research encompasses technical journals, patent filings, regulatory documents, and public filings to map the developmental trajectory of Ultra-High Purity Titanium technologies.

Furthermore, cross-validation of findings through triangulation techniques ensures that discrepancies are identified and reconciled. Advanced data modeling, including scenario analysis and sensitivity testing, enhances the robustness of key insights without relying on speculative projections. Ethical research protocols, transparency in source attribution, and adherence to industry best practices collectively uphold the credibility of the study and deliver stakeholders a clear window into market mechanics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra-high Purity Titanium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra-high Purity Titanium Market, by Grade

- Ultra-high Purity Titanium Market, by Form

- Ultra-high Purity Titanium Market, by Application

- Ultra-high Purity Titanium Market, by End Use Industry

- Ultra-high Purity Titanium Market, by Distribution Channel

- Ultra-high Purity Titanium Market, by Region

- Ultra-high Purity Titanium Market, by Group

- Ultra-high Purity Titanium Market, by Country

- United States Ultra-high Purity Titanium Market

- China Ultra-high Purity Titanium Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concise Conclusions Synthesizing Critical Findings and Strategic Implications for Stakeholders in the Ultra-High Purity Titanium Ecosystem

This executive summary distills the critical learnings from each analytical dimension-from technological advancements and tariff implications to segmentation intricacies and regional dynamics. Collectively, these insights underscore the strategic imperative for stakeholders to invest in purification innovations, supply chain diversification, and collaborative R&D. The intersection of rising performance requirements and evolving trade landscapes reaffirms that Ultra-High Purity Titanium will remain central to advancements in aerospace, medical devices, semiconductors, and beyond.

Stakeholders poised to capitalize on this momentum will be those who integrate advanced manufacturing controls, leverage data-driven process optimization, and establish resilient partnerships across the value chain. As market complexities intensify, this comprehensive understanding equips decision-makers with the clarity needed to navigate risk, harness opportunities, and drive sustainable growth.

Engage Directly with Senior Sales and Marketing Leadership to Obtain the Definitive Ultra-High Purity Titanium Market Research Report

For a comprehensive understanding of the Ultra-High Purity Titanium market dynamics and to empower your organization’s strategic planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Accessing the full market research report will provide you with in-depth analysis, actionable intelligence, and tailored recommendations. Engage directly to discuss customized data needs, secure early insights into emerging trends, and unlock competitive advantages. Connect today to elevate your decision-making with precise, reliable intelligence that drives growth and innovation in Ultra-High Purity Titanium applications.

- How big is the Ultra-high Purity Titanium Market?

- What is the Ultra-high Purity Titanium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?