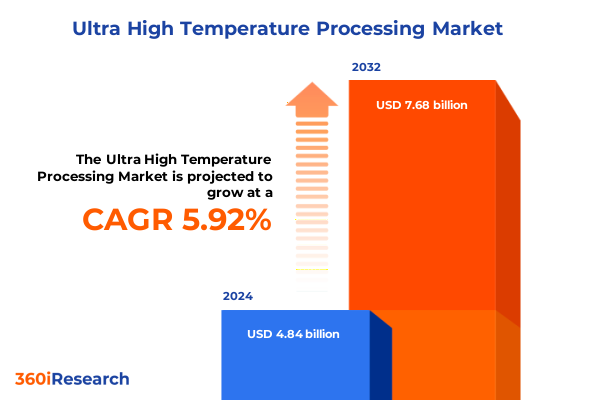

The Ultra High Temperature Processing Market size was estimated at USD 5.10 billion in 2025 and expected to reach USD 5.38 billion in 2026, at a CAGR of 6.01% to reach USD 7.68 billion by 2032.

Explore the Crucial Role of Ultra High Temperature Processing in Ensuring Food Safety, Shelf Stability, and Nutrient Retention Across Global Supply Chains

The application of ultra high temperature processing has transformed the way liquid foods are sterilized, offering a continuous sterilization method where products are heated above the temperature required to eliminate bacterial endospores-typically exceeding 135 °C for two to five seconds-before rapid cooling and aseptic packaging. This high-temperature, short-time treatment ensures commercial sterility, delivering products that can remain shelf-stable at ambient temperatures for six to nine months while preserving more nutritional and sensory attributes than conventional pasteurization approaches.

In response to evolving consumer demands for convenience, safety, and sustainability, ultra high temperature processing has become integral to the production of ready-to-consume milk, cream, juices, and plant-based beverages. By eliminating the need for continuous refrigeration, this technology reduces cold-chain energy requirements and associated greenhouse gas emissions, thereby aligning with corporate sustainability goals. As manufacturers strive to meet strict food safety regulations and deliver consistent quality across diverse product lines, UHT processing has emerged as a cornerstone in modern dairy and non-dairy supply chains, bridging the gap between food safety imperatives and consumer lifestyle trends.

Understand How Technological Innovation and Consumer Demand Are Driving Transformational Shifts in the Ultra High Temperature Processing Landscape Worldwide

Recent years have witnessed profound technological advancements reshaping the ultra high temperature processing landscape. Continuous UHT systems now offer uninterrupted sterilization with minimal downtime, enabling manufacturers to sustain high throughput without compromising product integrity. Simultaneously, sophisticated heat recovery units have been integrated into processing lines to capture and reutilize thermal energy, driving operational cost reductions of up to 20% and supporting environmental sustainability targets. The convergence of these innovations with IoT-driven process control and predictive maintenance tools ensures real-time monitoring of temperature profiles and flow conditions, thereby safeguarding product consistency and reducing unplanned downtime through data-driven insights.

Concurrently, advancements in aseptic packaging have led to the adoption of high-barrier materials with up to 80% paper content, reducing reliance on fossil-based plastics while preserving extended shelf life. Smart packaging innovations, including QR codes and RFID tags, now enable brands to offer transparency by providing dynamic information on product freshness, nutritional content, and supply chain origin. These strides in packaging align with consumer expectations for traceability and eco-friendly solutions, further cementing UHT processing as a transformative force within food and beverage manufacturing.

Assess the Comprehensive Cumulative Impact of United States 2025 Tariffs on UHT Processing Inputs, Supply Chains, and Export Strategies for Food Manufacturers

In April 2025, the United States invoked its International Emergency Economic Powers Act to impose a baseline 10% tariff on imports from all countries, followed by tiered reciprocal levies reaching upwards of 34% on select trading partners with significant trade deficits. This sweeping tariff action prompted the International Dairy Foods Association to warn of elevated costs for dairy processors and to urge prompt negotiation to alleviate prospective disruptions to over 3.2 million U.S. dairy sector jobs.

These tariff measures have significantly impacted the UHT processing value chain, as import duties on critical components-such as plate heat exchangers, specialized homogenizers, and insulated tubing assemblies-have increased landed costs by up to 25%. To mitigate margin pressures, many UHT equipment users are realigning their procurement strategies toward European and Asia-Pacific suppliers, boosting domestic fabrication capabilities, and extending equipment lifespans through targeted retrofitting and enhanced maintenance protocols. Such strategic adaptations underscore the imperative for flexibility and resilience in navigating an increasingly complex trade policy environment.

Uncover Key Market Segmentation Insights Revealing How Equipment, Product Lines, Technologies, and End Users Shape the Ultra High Temperature Processing Ecosystem

Effective market segmentation in the UHT processing sector empowers manufacturers to align their technological and operational investments with distinct user requirements and product specifications. By subdividing the market across core equipment categories-including aseptic filling lines, plate and tubular heat exchangers, high-pressure and ultra-high-pressure homogenizers, and integrated UHT sterilization modules-stakeholders can optimize asset utilization and ensure process scalability. Coupled with direct and indirect heating technologies, these configurations facilitate tailored thermal profiles that meet the stringent quality and safety criteria of dairy and non-dairy applications alike.

In parallel, segmentation by product portfolio spans conventional and organic milk, cream variants for coffee and whipping, fruit and vegetable juices, and plant-based alternatives such as almond, oat, and soy beverages. End user segmentation further delineates beverage manufacturers, large- and small-scale dairy processing plants, and diversified food processing facilities, enabling precise alignment of equipment capabilities with operational scale and formulation complexity. This multidimensional segmentation framework provides a robust foundation for strategic planning and targeted innovation across the UHT processing ecosystem.

This comprehensive research report categorizes the Ultra High Temperature Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment

- Product

- Technology

- End User

Delve Into Regional Dynamics and Emerging Opportunities Across the Americas, EMEA, and Asia-Pacific Within the Ultra High Temperature Processing Market Landscape

In the Americas, North America leads global UHT processing adoption due to advanced processing infrastructure and high consumption of shelf-stable dairy and plant-based beverages. The United States alone accounted for over 40% of North American UHT sector revenue in 2024, driven by consumer demand for convenient, long-lasting products and supportive regulatory frameworks that encourage food safety innovation. Meanwhile, Latin American markets are expanding rapidly, as UHT products address cold-chain limitations in remote regions and rising disposable incomes heighten demand for ambient-stable dairy substitutes.

Across Europe, Middle East, and Africa, UHT processing is deeply entrenched within mature dairy value chains, with over 70% of non-refrigerated milk consumption relying on UHT technology in Western Europe. Stringent food safety regulations and a focus on sustainable packaging have accelerated the uptake of eco-friendly cartons with high renewable content. In the Middle East and Africa, ambient distribution models mitigate inconsistent electricity supply, enabling manufacturers to deliver nutritionally fortified dairy and beverage products to underserved communities while reducing spoilage and waste.

Asia-Pacific stands out as the fastest-growing regional market, propelled by urbanization, rising incomes, and an expanding middle class seeking functional and fortified beverages. In markets such as China, India, and Southeast Asia, UHT high-protein drinks and dairy substitutes have captured consumer interest, blending extended shelf life with targeted nutrition for on-the-go lifestyles in regions with limited cold-chain capacity.

This comprehensive research report examines key regions that drive the evolution of the Ultra High Temperature Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine How Leading Industry Players Are Innovating, Collaborating, and Competing to Define the Ultra High Temperature Processing Market’s Competitive Edge

The competitive landscape of UHT processing is moderately consolidated, with leading players such as Tetra Pak International, GEA Group, Alfa Laval, SPX FLOW, JBT Corporation, MicroThermics, and Shanghai Triowin driving innovation in equipment design, automation, and sustainability. These incumbents are broadly investing in R&D to refine continuous UHT systems, enhance equipment modularity, and expand digital control capabilities that facilitate remote monitoring and predictive maintenance.

In response to supply chain volatility and sustainability mandates, many manufacturers are forging strategic partnerships with packaging specialists to develop eco-optimized aseptic cartons and exploring collaborations with plant-based ingredient suppliers to broaden their application portfolio. Additionally, regional equipment providers are establishing localized production facilities to mitigate tariff exposure and improve service responsiveness, underscoring the strategic importance of proximity to end users in an increasingly dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra High Temperature Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval Corporate AB

- GEA Group Aktiengesellschaft

- GEA Procomac S.r.l.

- IMA S.p.A.

- John Bean Technologies Corporation

- KHS GmbH

- Krones Aktiengesellschaft

- Serac Group SAS

- SPX Flow, Inc.

- Stephan Machinery GmbH

- Tetra Pak International S.A.

Identify Actionable Strategic Recommendations for Industry Leaders to Drive Growth, Enhance Resilience, and Leverage Emerging Trends in UHT Processing Operations

Industry leaders should prioritize investments in energy-efficient heat exchangers and heat recovery systems to reduce operational expenses and advance corporate sustainability goals. By integrating advanced process control platforms and IoT-enabled sensor networks, manufacturers can leverage real-time data analytics and predictive models to optimize thermal profiles, minimize product rejects, and streamline maintenance cycles.

Simultaneously, diversifying procurement channels for critical UHT components will help mitigate risks associated with tariff fluctuations, while building robust relationships with packaging innovators can support the rapid deployment of high-barrier, recyclable aseptic cartons. To capture emerging opportunities, companies should develop tailored product formats-such as probiotic-enhanced milks and functional plant-based beverages-and align them with regional taste preferences and distribution strategies, thus strengthening market resilience and driving long-term growth.

Review the Rigorous Research Methodology Underpinning This Analysis to Ensure Transparency, Data Integrity, and Comprehensive Coverage of the UHT Processing Sector

This analysis synthesizes insights from peer-reviewed journals, industry publications, and regulatory databases, augmented by structured interviews with equipment manufacturers, beverage producers, and packaging experts to ensure comprehensive coverage of technological, operational, and trade dynamics. Data triangulation across multiple sources, including academic research on process control and sensory impacts, was employed to validate key findings and minimize bias.

Primary research was complemented by secondary data gathering from public financial disclosures, trade association statements, and government tariff notifications, while an expert panel review provided an additional layer of quality assurance. This multi-tiered methodology ensures transparency, consistency, and robustness, facilitating actionable insights that cater to both strategic decision-makers and technical stakeholders within the UHT processing domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra High Temperature Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra High Temperature Processing Market, by Equipment

- Ultra High Temperature Processing Market, by Product

- Ultra High Temperature Processing Market, by Technology

- Ultra High Temperature Processing Market, by End User

- Ultra High Temperature Processing Market, by Region

- Ultra High Temperature Processing Market, by Group

- Ultra High Temperature Processing Market, by Country

- United States Ultra High Temperature Processing Market

- China Ultra High Temperature Processing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesize Key Findings and Strategic Implications Highlighting How Ultra High Temperature Processing Continues to Transform Food and Beverage Industries

Ultra high temperature processing continues to redefine food preservation by delivering commercially sterile products with extended shelf life, robust safety profiles, and minimal nutrient degradation. Its integration with advanced automation, energy recovery systems, and sustainable packaging initiatives underscores the technology’s adaptability to evolving consumer demands and environmental mandates. Moreover, strategic navigation of trade policy shifts-such as the US 2025 tariff adjustments-has illuminated the sector’s need for agile supply chain configurations and diversified sourcing strategies to maintain cost competitiveness and market access.

Connect with Ketan Rohom to Secure Your Comprehensive UHT Processing Market Intelligence Report and Empower Decisions With Expert Insights and Data

For tailored insights and exhaustive coverage of the ultra high temperature processing market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise and personalized guidance will ensure you secure the definitive report packed with actionable data, market segmentation analysis, and strategic recommendations crucial for your organization’s success. Contact Ketan today to explore subscription options and gain immediate access to a comprehensive intelligence package that will empower your decision-making with real-time industry knowledge and bespoke solutions

- How big is the Ultra High Temperature Processing Market?

- What is the Ultra High Temperature Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?