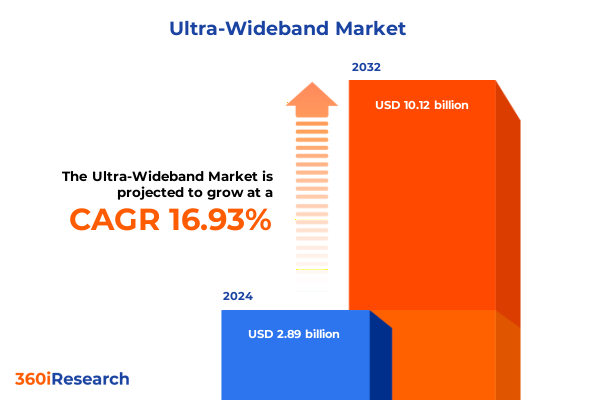

The Ultra-Wideband Market size was estimated at USD 3.37 billion in 2025 and expected to reach USD 3.90 billion in 2026, at a CAGR of 16.97% to reach USD 10.12 billion by 2032.

Exploring the Foundations and Future of Ultra-Wideband Technology in the Era of Seamless Connectivity and Precise Spatial Awareness

Ultra-Wideband (UWB) technology has emerged as a transformative force in wireless communications, delivering unprecedented spatial precision and low-power connectivity. Initially conceived for military radar and secure communications, UWB’s sub-nanosecond pulse transmissions enable centimeter-level ranging accuracy, setting it apart from traditional wireless standards. Beyond its technical virtues, UWB has been propelled by a confluence of innovations in semiconductor design, advanced antenna architectures, and sophisticated signal processing techniques.

In recent years, major technology vendors and industry consortia have galvanized efforts to integrate UWB into consumer devices, automotive systems, healthcare instruments, and industrial automation platforms. This transition reflects a broader trend toward seamless contextual awareness, where devices not only exchange data but also precisely locate and authenticate one another in real time. As IoT deployments scale and interoperability frameworks mature, UWB is positioned to become a linchpin for next-generation proximity services and secure access solutions.

With its unique combination of high bandwidth, low interference susceptibility, and robust multipath resilience, Ultra-Wideband stands at the intersection of emerging use cases that demand both security and accuracy. As enterprises and developers explore its potential, understanding the foundational technologies, ecosystem dynamics, and evolving standards becomes critical. This introduction lays the groundwork for a comprehensive exploration of UWB’s capabilities, market drivers, and strategic trajectories.

Unveiling the Key Technological and Market Shifts Driving Ultra-Wideband Toward Mainstream Adoption and Innovative Applications

The Ultra-Wideband landscape is undergoing rapid transformation driven by breakthroughs in integrated circuit design, regulatory harmonization, and burgeoning application demands. Breakthroughs in low-power, high-precision UWB transceivers have unlocked new dimensions of miniaturization, enabling the technology to migrate from specialized industrial equipment into everyday consumer gadgets. These advancements are complemented by enhanced antenna arrays and software-defined radio platforms that optimize spectral efficiency and adaptive ranging algorithms.

Regulatory bodies across key regions have aligned on unified frequency allocations and emission limits, fostering greater interoperability and reducing barriers to global deployment. This harmonization effort has been instrumental in catalyzing cross-industry partnerships, where automotive OEMs collaborate with semiconductor manufacturers to integrate UWB into advanced driver assistance and secure car entry systems. Concurrently, the development of open-source protocol stacks and certification frameworks has accelerated time to market and bolstered confidence among end users.

From an ecosystem perspective, the aggregation of hardware, middleware, and cloud-based analytics is reshaping how UWB is engineered and delivered. Startups and established players alike are forging alliances to co-create modular solutions that span asset tracking, indoor positioning, and contactless authentication. As these collaborative models proliferate, they promise to drive economies of scale, diversify product portfolios, and ultimately expand UWB’s addressable market across verticals.

Assessing the Pervasive Effects of 2025 United States Trade Tariffs on the Ultra-Wideband Ecosystem and Supply Chain Resilience

The announcement of potential 25% tariffs on semiconductor imports in 2025 has introduced significant cost pressure on manufacturers reliant on chips, including those producing Ultra-Wideband transceivers and modules. Modeling by the Information Technology and Innovation Foundation indicates that a sustained 25 percent levy could cumulatively reduce U.S. GDP growth by as much as 0.76 percent over ten years, amplifying production costs for advanced semiconductor devices integral to UWB solutions

Beyond headline rates, policymakers have signaled escalating duties that could start at 10 percent on a broad range of electronic imports before climbing further. The broad imposition of a baseline 10 percent tariff on all U.S. imports in early 2025, with targeted hikes for strategic partners and critical technology components, risks inflating the cost of UWB chipsets assembled overseas and driving lead-time extensions as vendors recalibrate their global supply chains

Market signals have already begun to reflect these cumulative pressures. In July 2025, Texas Instruments-an analog and mixed-signal chip leader whose components underpin many UWB modules-reported a trimmed outlook and share price contraction amid growing uncertainty over tariff-driven cost increases and customer order timing adjustments. This development underscores the vulnerability of precision radio-frequency solutions to abrupt duties on semiconductor inputs

Compounding the impact, industry respondents highlight that reengineering supply networks to sidestep tariff-hit regions entails protracted timelines and substantial capital outlay. Shifting chip sourcing or ramping domestic fabrication capacity can require years of investment in facilities, workforce development, and regulatory compliance, a reality that could stall the deployment of UWB-enabled systems in high-growth sectors such as industrial automation and asset tracking

Revealing Critical Market Segments That Define Ultra-Wideband Growth Paths Across Components, Technologies, End Users, and Applications

A granular examination of Ultra-Wideband’s market architecture reveals distinct layers of value creation and adoption. At the hardware foundation, antenna assemblies, semiconductor chips, pre-validated modules, and enabling software converge to define product differentiation. Each component tier demands specialized engineering acumen, from high-frequency PCB layouts for antennas to power-optimized baseband chips that sustain centimeter-level accuracy under constrained energy budgets.

Diving deeper, the landscape differentiates along technology modalities such as impulse radio UWB, multiband OFDM UWB, and time-hopping UWB. Impulse radio variants excel in low-power, narrow-pulse transmission suited to consumer electronics and battery-driven sensors, whereas multiband OFDM architectures deliver enhanced data throughput for high-performance applications. Time-hopping schemes, with their resilience to narrowband interference, support critical communications in industrial and defense contexts.

The end-user segment further stratifies into aerospace and defense, automotive, consumer electronics, healthcare, and industrial verticals. Within aerospace and defense, UWB’s precision ranging underpins positioning systems, radar sensing, and secure communications for mission-critical operations. Automotive stakeholders leverage the technology for advanced driver assistance, digital key entry, and proximity-based infotainment, pioneering novel user experiences. In consumer electronics, smartphones, laptops, tablets, and wearables integrate UWB for seamless device discovery and secure payment protocols. The healthcare domain exploits asset tracking, medical imaging, and patient monitoring to enhance operational efficiency and care quality. Meanwhile, industrial adopters deploy UWB for asset management, factory automation, and logistics tracking to streamline production workflows.

Applications carve another layer of specialization. Asset tracking spans inventory management and logistics orchestration, ensuring real-time visibility across supply chains. Communication use cases range from secure peer-to-peer exchange to multi-node mesh networks. In imaging, ground-penetrating radar systems penetrate sub-surface environments, while through-wall imaging affords critical situational awareness in security operations. Location services offer indoor positioning and navigation assistance, delivering new paradigms of spatial intelligence across enterprise and consumer contexts.

This comprehensive research report categorizes the Ultra-Wideband market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Technology Type

- End User Industry

- Application

Mapping Regional Dynamics That Shape Ultra-Wideband Adoption and Innovation Trends Across Americas EMEA and Asia-Pacific Markets

Regional contours of the Ultra-Wideband market reflect varied technological priorities and ecosystem maturity levels. In the Americas, early investments in R&D and strong alignment between industry consortia and regulatory agencies have positioned the United States as a frontrunner in UWB innovation. This leadership has fostered robust partnerships between chipset manufacturers, device OEMs, and system integrators, although ongoing trade policy shifts continue to introduce elements of supply chain uncertainty.

Across Europe, Middle East, and Africa, the UWB narrative is shaped by stringent regulatory frameworks and a focus on automotive and defense applications. European automakers are at the forefront of integrating UWB into next-generation vehicle architectures, leveraging secure proximity sensing to enhance passenger safety and user convenience. In defense and security sectors, UWB’s non-line-of-sight capabilities and interference resistance are particularly prized for radar sensing and tactical communications, driving bespoke deployments across allied nations.

Asia-Pacific stands out as both a manufacturing powerhouse and a fast-growing adoption market. Semiconductor foundries in East Asia supply a significant share of UWB chips, while consumer electronics leaders in the region rapidly embed the technology into smartphones, wearables, and smart home ecosystems. Government initiatives aimed at boosting domestic semiconductor production and standardizing IoT protocols further accelerate UWB proliferation. As regional stakeholders harmonize their approach to spectrum allocation and certification, the Asia-Pacific corridor is poised for sustained growth in industrial automation, asset management, and next-generation location services.

This comprehensive research report examines key regions that drive the evolution of the Ultra-Wideband market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprises and Emerging Innovators Powering Ultra-Wideband Advancements in a Competitive Global Arena

The Ultra-Wideband arena features a spectrum of incumbents and challengers, each deploying distinct strategies to capture market share. Leading semiconductor vendors have invested aggressively in specialized UWB chip portfolios that balance precision ranging with energy efficiency, aiming to secure long-term design wins across diverse end-use cases. Their roadmaps emphasize process node advancements, integration of radio-frequency front ends, and certification under unified global specifications.

Module providers have seized opportunities to simplify adoption by offering turnkey solutions that bundle chips, antennas, and protocol stacks into single form factors. These vendors partner closely with system integrators to accelerate proof-of-concept trials and minimize time to initial deployment. In parallel, software firms are developing cloud-native platforms that transform raw UWB measurements into actionable insights, leveraging machine learning to interpret location data and drive predictive analytics in real time.

Startups and emerging players are carving niches with specialized offerings, such as ultra-miniaturized tags for medical devices or ruggedized modules for harsh industrial environments. Their innovations in packaging, power management, and firmware optimization tackle segment-specific pain points, challenging larger incumbents to adapt. As strategic collaborations increase, the competitive field continues to reshape, with ecosystem alliances and cross-licensing agreements driving faster innovation cycles and expanding the global UWB footprint.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra-Wideband market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alereon, Inc.

- Apple Inc.

- BeSpoon SAS

- Infineon Technologies AG

- Johanson Technology, Inc.

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd.

- Nanotron Technologies GmbH

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Sewio Networks s.r.o.

- Sony Group Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Ubisense Ltd.

- Zebra Technologies Corporation

Strategic Guidance for Industry Leaders to Capitalize on Ultra-Wideband Opportunities and Mitigate Emerging Market Challenges

Industry leaders should prioritize the development of cohesive, end-to-end UWB ecosystems that bridge hardware, software, and service layers. By forging strategic partnerships across design houses, module assemblers, and cloud providers, organizations can accelerate solution rollouts and create differentiated value propositions. In parallel, investing in open interoperability testing and contributing to global standards bodies will reinforce system compatibility and reduce fragmentation risks.

Supply chain resilience is equally vital. Companies must evaluate multi-sourcing strategies for critical components, balancing cost optimization with geographic diversification to guard against policy-driven disruptions. Engaging in long-term procurement agreements and supporting regional fabrication initiatives can further stabilize input costs and shorten lead times.

Moreover, aligning UWB deployments with end-user workflows-whether in automotive diagnostics, asset management, or patient care-demands a customer-centric approach. Co-innovating with vertical specialists and piloting high-impact use cases will reinforce proof-of-value and catalyze broader adoption. Finally, embedding security and privacy considerations at the core of product development will address regulatory expectations and build trust among enterprise and consumer stakeholders alike.

A Comprehensive Overview of Rigorous Research Methods and Analytical Frameworks Applied to Uncover Ultra-Wideband Market Insights

The research underpinning this report combines extensive secondary analysis with targeted primary investigations to ensure robust, actionable insights. Initially, a comprehensive review of academic publications, industry white papers, regulatory filings, and patent landscapes established a technical and historical baseline for Ultra-Wideband evolution. Concurrently, data from technology consortia, standards organizations, and publicly available market intelligence informed a contextual understanding of adoption drivers and competitive positioning.

To validate and enrich these findings, a series of in-depth interviews was conducted with senior executives, product architects, and field engineers across semiconductor firms, module providers, system integrators, and end-user organizations. These conversations explored real-world deployments, pain points, and strategic priorities, offering qualitative depth to complement quantitative observations.

Finally, a systematic triangulation process cross-referenced insights from both primary and secondary sources, identifying convergent themes and isolating potential discrepancies. This methodological rigor ensures that the segmentation framework, regional analysis, and strategic recommendations presented herein reflect a balanced synthesis of expert perspectives and documented evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra-Wideband market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra-Wideband Market, by Components

- Ultra-Wideband Market, by Technology Type

- Ultra-Wideband Market, by End User Industry

- Ultra-Wideband Market, by Application

- Ultra-Wideband Market, by Region

- Ultra-Wideband Market, by Group

- Ultra-Wideband Market, by Country

- United States Ultra-Wideband Market

- China Ultra-Wideband Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Ultra-Wideband Market Intelligence to Illuminate Future Outlooks and Strategic Imperatives for Stakeholders

In conclusion, Ultra-Wideband technology represents a pivotal enabler for the next wave of precise, low-power wireless applications spanning consumer devices, automotive platforms, industrial systems, and secure communications. The convergence of advanced chipsets, modular integration, and cloud-based intelligence has elevated UWB from a specialized niche to a mainstream contender in the indoor positioning and proximity services arena.

Navigating this dynamic landscape requires a nuanced understanding of component interdependencies, regulatory environments, and geopolitical factors such as trade tariffs. By leveraging the strategic guidance and segmentation insights detailed in this report, stakeholders can make informed decisions about R&D investments, ecosystem partnerships, and go-to-market strategies.

Ultimately, those who embrace a holistic, customer-centric approach-balancing technological innovation with supply chain agility and security by design-will be best positioned to capture value and drive sustainable growth in the evolving Ultra-Wideband ecosystem.

Drive Your Business Forward with In-Depth Ultra-Wideband Insights and Expert Guidance from a Strategic Sales and Marketing Leader

Contact Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive market research report on Ultra-Wideband technology. With his expertise and personalized support, you can gain immediate access to in-depth analysis, strategic insights, and tailored recommendations designed to empower your organization’s decision-making. Reach out today to explore how the full report can inform your roadmap, guide your investment priorities, and strengthen your competitive positioning in the evolving Ultra-Wideband ecosystem.

- How big is the Ultra-Wideband Market?

- What is the Ultra-Wideband Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?