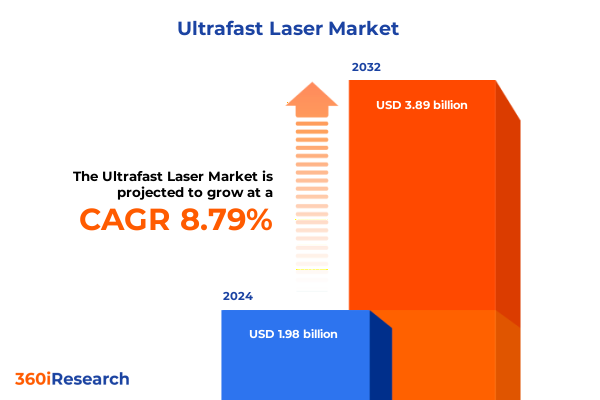

The Ultrafast Laser Market size was estimated at USD 2.12 billion in 2025 and expected to reach USD 2.27 billion in 2026, at a CAGR of 9.04% to reach USD 3.89 billion by 2032.

Unlocking the Pulse of Precision: A Comprehensive Exploration of Ultrafast Laser Technologies Shaping Tomorrow’s Industrial and Scientific Frontiers

In a world where speed and precision define the competitive edge, ultrafast lasers have emerged as a cornerstone of innovation across scientific research and advanced manufacturing. These lasers deliver pulses measured in femtoseconds and picoseconds, enabling interactions with matter that were once thought impossible. By harnessing such rapid bursts of energy, researchers and engineers can manipulate materials at molecular and atomic scales, unlocking new frontiers in material processing, medical procedures, and fundamental physics.

The evolution of ultrafast laser technology has been propelled by breakthroughs in laser design, including solid-state configurations and fiber-based architectures that deliver unparalleled stability and beam quality. Concurrently, integration with advanced control systems and feedback mechanisms has elevated performance, allowing for precise tailoring of pulse characteristics to specific applications. As a result, ultrafast lasers now perform tasks ranging from precision cutting of semiconductor wafers to probing ultrafast chemical reactions.

This executive summary offers a panoramic view of the ultrafast laser landscape, examining the transformative forces shaping this dynamic market. Readers will gain insight into the technological shifts, regulatory influences, and segmentation trends that define current developments. Through an exploration of regional dynamics, competitive strategies, and actionable recommendations, this report equips decision-makers with the intelligence needed to capitalize on emerging opportunities and mitigate growing challenges.

Navigating Paradigm Shifts in Industry Dynamics Driven by Breakthrough Advancements and Emerging Applications in Ultrafast Laser Landscapes

The ultrafast laser domain is undergoing a paradigm shift driven by breakthroughs in materials science and photonics engineering. Recent innovations in crystal doping techniques and waveguide fabrication have yielded devices with higher peak powers and improved thermal management. These advancements are accelerating the adoption of ultrafast lasers in sectors previously constrained by performance limitations.

Moreover, the integration of artificial intelligence and machine learning algorithms into laser control systems is revolutionizing beam optimization and process monitoring. Predictive maintenance solutions now leverage real-time diagnostics to anticipate component degradation before it impacts performance. As a result, uptime is maximized and operational costs are reduced, paving the way for broader industrial utilization.

Simultaneously, miniaturization efforts have produced compact, portable ultrafast laser modules that maintain high pulse fidelity. These form factors open new frontiers in field-deployable medical devices and on-site material analysis, while fueling demand for systems that can operate in austere environments. Continuously, ecosystem players are forging collaborations with end users to co-develop customized solutions, ensuring that next-generation platforms address precise application requirements.

Looking ahead, emerging applications in quantum computing and high-speed optical communications promise to further extend the reach of ultrafast lasers. As these systems transition from laboratory prototypes to commercial deployments, the landscape will continue to transform, presenting innovators with both challenges and unprecedented growth pathways.

Evaluating the Far-Reaching Ramifications of 2025 United States Tariff Measures on Ultrafast Laser Supply Chains Manufacturing and Market Strategies

In 2025, sweeping tariff measures implemented by the United States have reshaped the economics of ultrafast laser supply chains and manufacturing strategies. By levying additional duties on critical raw materials and finished laser components imported from key overseas producers, these policies have compelled end users and original equipment manufacturers to reevaluate sourcing strategies. As a result, companies are exploring partnerships with domestic suppliers and investing in local production capabilities to mitigate exposure to trade policy volatility.

Furthermore, the impact has extended to equipment costs and delivery timelines, prompting organizations to adopt dual-sourcing models and build redundancies into their supply networks. Manufacturers have accelerated qualification processes for alternative vendors, while engineering teams are redesigning modules to accommodate locally available materials without compromising performance. Consequently, product development cycles are gaining agility, enabling stakeholders to respond more swiftly to unforeseen policy shifts.

In parallel, the tariff environment has spurred heightened engagement with trade associations and government agencies to shape advocacy efforts. Industry leaders are collaborating to establish standardized testing protocols and certifications that streamline cross-border shipments, reducing friction at ports of entry. This collective action is fostering a more resilient ecosystem that balances geopolitical risk with the imperative for continuous innovation.

Ultimately, the cumulative ramifications of these tariffs extend beyond cost considerations. They are catalyzing a strategic realignment of global operations and supply chain configurations, driving the ultrafast laser community toward a more diversified and regionally balanced market structure.

Unveiling Core Market Stratifications and Performance Drivers Across Technology Types Component Architectures Application Verticals and End-User Sectors

A nuanced understanding of ultrafast laser market stratifications reveals where innovations and investments are most intense. By examining the technology types, it becomes clear that developments in diode-pumped lasers-particularly femtosecond variants-have accelerated adoption in precision machining, while fiber lasers continue to expand their role in telecommunications and metrology. Advancements in solid-state lasers, by contrast, are unlocking new possibilities in high-power industrial applications.

Looking at the internal architectures, the interplay between amplifiers, compressors, oscillators, and stretchers dictates system performance. High-efficiency amplifiers are being optimized to deliver greater peak powers, and improvements in compressor design are reducing pulse distortion. Oscillator technologies are evolving to provide more stable seed pulses, and innovations in stretcher configurations are enhancing temporal control, ultimately improving overall system coherence.

Application diversity further drives market dynamics, with cutting and welding processes benefiting from reduced thermal impact and material etching gaining precision at micro- and nano-scales. Microscopic passivation techniques protect delicate surfaces, precision marking delivers high-contrast features on challenging substrates, and scientific research applications leverage ultrafast pulses to explore fundamental phenomena in physics and chemistry.

End-user industries play a pivotal role in shaping demand trajectories. Automotive manufacturers are integrating ultrafast lasers for lightweight component fabrication, defense and aerospace sectors rely on them for advanced materials testing, electronics producers employ them in semiconductor wafer processing, and healthcare innovators utilize them for surgical instruments and diagnostic imaging enhancements.

This comprehensive research report categorizes the Ultrafast Laser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Application

- End-User Industry

Mapping Regional Nuances and Growth Enablers Across the Americas Europe Middle East Africa and Asia-Pacific Domains in the Ultrafast Laser Arena

Regional dynamics play a decisive role in ultrafast laser market maturation and adoption. The Americas region leads in research commercialization, supported by robust venture capital investments and close collaboration between universities and industry partners. Cutting-edge applications in biomedical research and precision manufacturing continue to flourish, propelled by favorable regulatory frameworks and government incentives.

In the Europe, Middle East & Africa region, established industrial ecosystems and coherent regulatory standards underpin steady growth. Germany’s precision engineering base catalyzes high-power system development, while France’s photonics clusters foster innovation in photonic integrated circuits. Meanwhile, emerging markets in the Middle East leverage government-backed initiatives to cultivate local production hubs, and select African nations are exploring partnerships with international technology providers to accelerate market entry.

Across the Asia-Pacific region, diverse trajectories reflect varying levels of technological maturity. China’s aggressive investment in domestic semiconductor capability is spurring demand for ultrafast laser-enabled wafer processing. Japan and South Korea maintain leadership in high-precision optics and materials science, underpinning new applications in display manufacturing. Meanwhile, Southeast Asian markets are gradually building capacity by licensing proven technologies and forming joint ventures with global incumbents.

Together, these regional narratives underscore the importance of tailored market approaches that align with local innovation ecosystems, regulatory climates, and infrastructure readiness levels, ensuring that stakeholders can effectively capture opportunities in each domain.

This comprehensive research report examines key regions that drive the evolution of the Ultrafast Laser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Trajectories and Innovation Imperatives Among Leading Industry Players Driving Disruption in Ultrafast Laser Development and Deployment

The ultrafast laser landscape is defined by a blend of established multinationals and dynamic emerging powerhouses. Leading firms are differentiating through vertical integration, bringing in-house capabilities for crystal growth, pump source development, and precision optics fabrication. Such strategies reduce dependency on external suppliers and enable tighter quality control, from initial design through final assembly.

Concurrently, a wave of mid-sized innovators is disrupting traditional value chains with modular system architectures that streamline customization. These organizations collaborate closely with end users to embed software-driven automation features, ensuring that laser platforms can adapt swiftly to new process requirements. Strategic alliances with technology providers specializing in AI and real-time analytics are further enhancing system intelligence and operational efficiency.

Mergers and acquisitions remain a critical avenue for growth, as companies aim to broaden their technology portfolios and gain access to complementary markets. Recent deals have clustered expertise in ultrafast pulse shaping and nonlinear optics, creating entities capable of addressing both industrial and scientific segments simultaneously. Investment in specialized start-ups is also on the rise, with venture funds targeting early-stage breakthroughs in novel gain media and fiber designs.

Ultimately, the competitive arena favors those players that can balance deep R&D investments with agile market deployment, fueling a virtuous cycle of innovation that cascades across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrafast Laser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amplitude Laser Group SAS

- APE GmbH

- Calmar Laser

- Coherent Corp.

- Epilog Corporation

- IMRA America, Inc.

- IPG Photonics Corporation

- Lumentum Holdings Inc.

- NKT Photonics A/S

- Resonetics, LLC

- TeraXion Inc.

Charting Strategic Imperatives and Actionable Pathways for Industry Leaders to Capitalize on Opportunities and Mitigate Disruptions in Ultrafast Laser Markets

Industry leaders can best position themselves by prioritizing strategic partnerships that bridge technology gaps and accelerate time to market. Collaborations with materials science experts, control systems integrators, and academic research institutions can provide early access to emerging breakthroughs, ensuring that product roadmaps align with evolving application requirements.

Furthermore, proactive engagement with regulatory bodies and standards organizations is essential. By contributing to the development of coherent guidelines for laser safety, performance testing, and export controls, companies can shape policies in ways that support responsible growth and reduce compliance costs. Such influence can also strengthen barriers to entry, preserving competitive advantage.

Investment in talent development represents another key lever. Organizations should foster cross-functional teams that combine expertise in photonics, software engineering, and process automation. Structured training programs and rotational assignments can cultivate versatile professionals capable of driving integrated solution design and deployment.

Finally, firms must remain vigilant of supply chain risks and diversify procurement channels. Establishing redundant sourcing agreements and qualifying alternative materials can safeguard operations against geopolitical disruptions and raw material shortages, allowing for uninterrupted progression of research and production initiatives.

Detailing Rigorous Analytical Frameworks and Data Validation Approaches Employed to Derive Robust Insights in the Ultrafast Laser Research Process

To ensure the robustness of insights, this analysis leveraged a combination of primary and secondary research methods. In-depth interviews with industry executives, system integrators, and end users provided qualitative perspectives on emerging needs and innovation drivers. These conversations were complemented by site visits to manufacturing facilities and academic laboratories, where firsthand observations informed assessments of technological readiness.

Secondary research encompassed a comprehensive review of patents, peer-reviewed journals, and white papers, enabling triangulation of technical data and market developments. Proprietary databases were mined for historical supply chain interactions and M&A trends, while regulatory filings and government trade records illuminated the impacts of policy shifts.

Data validation was conducted through cross-referencing multiple independent sources and subjecting key findings to peer review by external experts in photonics and laser engineering. Statistical consistency checks and trend analyses were performed to confirm the reliability of thematic patterns identified across disparate data sets.

This rigorous methodology underpins the strategic recommendations and ensures that decision-makers can proceed with confidence, armed with a clear view of the opportunities and challenges shaping the ultrafast laser sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrafast Laser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrafast Laser Market, by Type

- Ultrafast Laser Market, by Component

- Ultrafast Laser Market, by Application

- Ultrafast Laser Market, by End-User Industry

- Ultrafast Laser Market, by Region

- Ultrafast Laser Market, by Group

- Ultrafast Laser Market, by Country

- United States Ultrafast Laser Market

- China Ultrafast Laser Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward in Harnessing Ultrafast Laser Technologies for Competitive Advantage

The synthesis of technological breakthroughs, policy realignments, and regional variations paints a compelling portrait of an industry on the cusp of transformative growth. Ultrafast lasers stand poised to redefine precision manufacturing, advance biomedical interventions, and enable fundamental scientific discovery at unprecedented time scales.

Key drivers-including AI-enabled controls, miniaturized architectures, and resilient supply chains-will continue to shape competitive dynamics. As companies adapt to the implications of 2025 tariff measures, strategic alliances and localized production strategies will safeguard performance benchmarks while facilitating market expansion.

Segment and regional insights underscore the value of targeted, data-driven approaches to product development and go-to-market execution. Whether addressing the unique requirements of automotive component fabrication or pioneering applications in quantum information science, stakeholders must tailor solutions that resonate with specific end-user challenges.

By embracing the recommendations outlined in this report, industry participants can navigate the evolving landscape with agility and foresight. The integration of robust research methodologies and actionable intelligence will serve as a foundation for sustained innovation and long-term success in this dynamic field.

Engage with Ketan Rohom to Secure Your Customized Market Intelligence Report and Propel Strategic Decision-Making in Ultrafast Laser Innovations

Ready to harness the full potential of ultrafast laser innovations and stay ahead of evolving industry dynamics? Reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to discuss how our comprehensive market intelligence report can address your specific strategic objectives and guide your next steps in product development, partnerships, and market expansion. Engage with tailored insights, in-depth analysis, and actionable guidance to accelerate your decision-making process and secure a competitive advantage in this transformative technology arena.

- How big is the Ultrafast Laser Market?

- What is the Ultrafast Laser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?