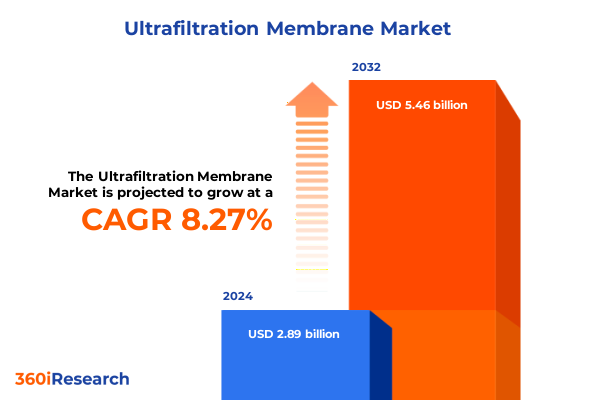

The Ultrafiltration Membrane Market size was estimated at USD 3.08 billion in 2025 and expected to reach USD 3.35 billion in 2026, at a CAGR of 8.50% to reach USD 5.46 billion by 2032.

A comprehensive introduction to the evolving ultrafiltration membrane landscape and its strategic relevance for modern separation applications

Ultrafiltration membranes have emerged as a cornerstone in modern separation science, offering unparalleled precision in removing colloids, macromolecules, and pathogens from diverse fluid streams. As global industries grapple with increasingly stringent environmental regulations and heightened demands for product purity, these membranes are playing a transformative role across chemical processing, food and beverage production, pharmaceutical and biotech manufacturing, and water treatment sectors. The combination of high flux rates, tunable selectivity, and robust operational lifetimes makes ultrafiltration technology a versatile and cost-effective solution for both established applications and innovative processes.

Driven by advancements in polymer science and fabrication techniques, next-generation membranes now deliver enhanced fouling resistance, improved mechanical strength, and optimized pore structures. These improvements are enabling system designers to scale operations more efficiently while reducing energy consumption and chemical cleaning requirements. Equally significant, the integration of digital monitoring and control systems is ushering in an era of real-time process optimization, further elevating the value proposition of ultrafiltration solutions. As industries pivot to embrace circular economy principles, membranes that can recover valuable byproducts or enable water reuse are increasingly critical to sustainable operations.

In this executive summary, we provide a structured overview of the ultrafiltration membrane landscape, highlighting transformative market shifts, the cumulative impact of recent United States tariff measures, deep segmentation insights, regional nuances, leading company strategies, actionable recommendations for decision-makers, and a transparent view into the research methodology. By grounding this analysis in the latest industry data and technological trends, readers will be equipped to navigate competitive challenges and unlock growth opportunities in this dynamic field.

Key transformative shifts reshaping the ultrafiltration membrane sector driven by technological innovation regulatory evolution and market convergence

The ultrafiltration membrane market is undergoing a wave of transformative shifts propelled by a confluence of technological breakthroughs and evolving stakeholder expectations. Rapid advances in polymer synthesis and membrane casting techniques now allow for precise control over pore size distribution, enabling manufacturers to target specific molecular weight cut-off ranges with greater consistency. Concurrently, nanocomposite membranes incorporating inorganic fillers like graphene oxide and titanium dioxide are enhancing fouling resistance and mechanical durability, thus extending cleaning intervals and reducing total cost of ownership.

At the same time, regulatory bodies worldwide are tightening discharge limits for micropollutants, pathogens, and industrial effluents. In response, system integrators are bundling ultrafiltration stages with upstream pretreatment modules and downstream polishing steps, creating turnkey solutions that ensure compliance with the most stringent environmental standards. These integrated systems not only mitigate operational risks but also streamline permitting processes, accelerating project timelines and facilitating broader adoption in municipal and industrial wastewater treatment facilities.

Another critical shift has been the infusion of digital transformation into membrane operations. Advanced sensors and machine learning algorithms are now embedded within filtration units to continuously monitor parameters such as transmembrane pressure, permeate quality, and fouling indices. This enables predictive maintenance protocols and dynamic process adjustments, significantly improving uptime and resource efficiency. As data analytics platforms mature, operators can benchmark performance across multiple installations, unlocking new insights into lifetime performance and driving iterative design improvements.

Finally, sustainability considerations are reshaping procurement decisions. End users are increasingly evaluating membrane solutions not only on immediate performance metrics but also on life-cycle environmental impacts. Suppliers that transparently disclose carbon footprints, employ renewable raw materials, and demonstrate circular economy capabilities are gaining favor. This alignment with corporate sustainability goals is turning membrane selection into a strategic differentiator rather than a purely technical choice.

Analyzing the cumulative impact of United States tariff measures on ultrafiltration membrane supply chains manufacturing costs and competitive dynamics in 2025

United States tariff measures implemented in early 2025 have introduced a new level of complexity to global ultrafiltration membrane supply chains. By imposing additional duties on raw polymer imports and finished membrane modules from key manufacturing regions, these policies have affected pricing structures and sourcing strategies throughout the value chain. Membrane integrators that historically relied on low-cost polymer feedstocks have been compelled to explore alternative suppliers or negotiate optimized contracts to maintain cost competitiveness.

As tariffs elevated the landed cost of cellulose acetate and specialty polymers used in membrane fabrication, engineering teams have revisited material specifications to identify formulations that balance performance with affordability. In certain sectors, end users have accelerated the qualification of polyethersulfone and polyvinylidene fluoride membranes sourced from domestic producers to mitigate exposure to international duties. Though these substitutions occasionally necessitate minor adjustments to process parameters, they have proven effective in preserving separation efficiency while reducing the financial impact of trade policies.

Furthermore, membrane manufacturers have responded by consolidating production footprints closer to the United States market. Greenfield investments in North American fabrication facilities have gained momentum, supported by government incentives aimed at bolstering domestic manufacturing capabilities. These localized operations not only circumvent tariff barriers but also shorten lead times and lower logistics costs, enhancing responsiveness to fluctuating demand.

Despite these strategic pivots, market participants continue to contend with residual uncertainty around potential tariff escalations and regulatory reviews. Many companies are diversifying supply bases across multiple jurisdictions to distribute risk. At the same time, collaborative industry forums have emerged to advocate for harmonized trade standards and to engage policymakers in dialogue, underscoring the importance of stable cross-border flows for critical industrial technologies.

Unveiling critical segmentation insights across application material configuration pore size and end use industry dimensions to guide strategic decision making

The ultrafiltration membrane market exhibits intricate dynamics when examined through the lens of multiple segmentation dimensions. Within application segments, Chemical Processing, encompassing Oil & Gas and Petrochemicals, demands membranes capable of withstanding high temperatures and aggressive solvents. Food & Beverage, which includes Brewery & Distillery, Dairy Processing, and Juice Clarification, prioritizes membranes with exceptional cleanliness and flavor preservation characteristics. In the Pharmaceutical & Biotech field, Protein Separation and Vaccine Purification operations require ultra-high retention accuracy and stringent sterilizability. Water Treatment spans Drinking Water, with both Groundwater Treatment and Surface Water Treatment subsegments, in addition to Wastewater Treatment covering Industrial Wastewater and Municipal Wastewater, each with distinct contaminant profiles and regulatory requirements.

Material selection further differentiates market offerings. Cellulose Acetate membranes offer cost-effective performance for general-purpose separations, while Polyethersulfone variants deliver enhanced chemical compatibility and broad pH stability. Polyvinylidene Fluoride membranes stand out for their mechanical robustness and superior fouling resistance, making them a preferred option for harsh industrial environments.

Membrane Configuration also plays a pivotal role in system design. Hollow Fiber modules provide high surface area-to-volume ratios and are ideal for compact installations. Plate And Frame assemblies allow for easy maintenance and module interchangeability. Spiral Wound configurations deliver a compact footprint with high packing density, whereas Tubular membranes offer straightforward cleaning cycles and resilience to abrasive feed streams.

Pore Size segmentation spans less than 10 kDa, 10 to 30 kDa, and above 30 kDa, enabling a spectrum of separations from macromolecular concentration to particle removal. Finally, End-Use Industry distinctions among Industrial, Municipal, and Residential applications guide procurement decisions, as each category imposes unique performance thresholds and compliance criteria. By integrating insights across these five segmentation pillars, stakeholders can tailor membrane solutions to specific operational objectives and maximize return on investment.

This comprehensive research report categorizes the Ultrafiltration Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Membrane Configuration

- Pore Size

- Application

- End-Use Industry

Key regional insights revealing unique drivers challenges and growth prospects across the Americas Europe Middle East and Africa and the Asia Pacific markets

Regional markets for ultrafiltration membranes reflect a blend of regulatory pressures, infrastructure maturity, and evolving end-user requirements. In the Americas, robust investment in municipal water infrastructure and stringent environmental regulations are driving accelerated replacement of aging membrane systems. Furthermore, a resurgence in petrochemical projects across North America has fueled demand for specialized membranes capable of purifying process streams under challenging conditions. This dual push from both public and private sectors is creating fertile ground for innovative membrane solutions in the region.

Europe, the Middle East, and Africa collectively present a diverse demand profile. In Europe, comprehensive wastewater treatment directives and ambitious decarbonization targets are prompting utilities and industrial operators to deploy membranes for resource recovery and water reuse. Meanwhile, Middle Eastern markets are prioritizing desalination and brine concentration applications, leveraging ultrafiltration as a pretreatment step to protect reverse osmosis systems and extend their service life. In Africa, water scarcity challenges are sparking decentralized ultrafiltration projects that address community-level potable water needs, often supported by international development funds.

The Asia-Pacific region remains the fastest-growing market, propelled by rapid industrial expansion and escalating urban water demands. China and India have doubled down on pollution control measures, mandating advanced treatment technologies for both new and existing facilities. Southeast Asian economies are increasingly adopting membrane-based processes in food and beverage manufacturing to ensure international quality standards. Across the region, cross-border collaborations and technology licensing agreements are facilitating knowledge transfer and boosting local manufacturing capabilities.

As each region navigates unique regulatory landscapes and infrastructure priorities, suppliers that tailor their go-to-market strategies to align with local drivers will be best positioned to capture growth opportunities. Whether through strategic partnerships, joint ventures, or targeted R&D investments, regional alignment remains a critical success factor.

This comprehensive research report examines key regions that drive the evolution of the Ultrafiltration Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deep dive into leading industry players strategic approaches innovation portfolios and collaborative ventures shaping the competitive membrane ecosystem

Leading companies in the ultrafiltration membrane sector are differentiating themselves through technology leadership, strategic partnerships, and portfolio diversification. One prominent player has invested heavily in proprietary polymer modification techniques that enhance fouling resistance, allowing customers to achieve extended run times and lower cleaning frequencies. By coupling these materials with advanced module designs, the company has established a strong foothold in high-value applications such as pharmaceutical processing and critical beverage filtration.

Another major manufacturer has pursued an aggressive collaboration strategy, forging alliances with digital solutions providers to embed condition-monitoring sensors within its membrane modules. This integration enables predictive maintenance and remote troubleshooting, reducing unplanned downtime for end users. The combination of hardware and software has created a differentiated value proposition, particularly attractive to large-scale industrial operators seeking to optimize total cost of ownership.

A third competitor has focused on geographic expansion, establishing regional production facilities in emerging markets to better serve local customers. By localizing manufacturing, this firm has cut lead times and logistic costs, while also benefiting from regional incentives aimed at promoting sustainable water technologies. Its approach has resonated in markets with tight project timelines and limited capital expenditures, such as municipal water retrofits and decentralized treatment schemes.

Across the industry, smaller innovative enterprises are carving niches by developing specialty membranes for emerging applications. Examples include membranes tailored for high-temperature process streams in biofuels production and modules engineered for selective recovery of valuable biomolecules. These niche players often attract venture capital funding and enter licensing agreements with larger manufacturers to scale their technologies globally.

By examining these varied strategic approaches-material innovation, digital integration, local production footprints, and niche specialization-industry leaders can glean best practices for driving growth and sustaining competitive advantage in an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrafiltration Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Asahi Kasei Corporation

- Danaher Corporation

- DuPont de Nemours, Inc.

- GEA Group AG

- Koch Industries, Inc.

- Kovalus Separation Solutions, Inc.

- Kuraray Co., Ltd.

- MANN+HUMMEL International GmbH & Co. KG

- Merck KGaA

- Pentair plc

- SUEZ SA

- Toray Industries, Inc.

- Veolia Environnement S.A.

Actionable recommendations for industry leaders to capitalize on ultrafiltration membrane advancements optimize operations and foster sustainable growth

To capitalize on the evolving ultrafiltration membrane landscape, industry leaders must adopt a proactive stance that aligns with emerging market dynamics. First, organizations should prioritize strategic partnerships with technology innovators and digital solution providers. By co-developing sensor-integrated modules and data analytics platforms, companies can offer end users predictive maintenance capabilities that translate into reduced downtime and improved cost efficiencies.

Next, supply chain resilience must be fortified in light of changing trade policies and material availability. Establishing dual-source agreements for critical polymers and advancing localized production can mitigate tariff impacts and shorten delivery cycles. Furthermore, engaging in collaborative forums to advocate for harmonized trade standards will help stabilize cross-border flows and lower long-term procurement risks.

Sustainability should serve as a guiding principle across R&D and commercialization activities. Embedding circular economy concepts-such as membrane recycling programs and resource recovery applications-will resonate with corporate environmental targets and regulatory mandates. Transparent life-cycle assessments can demonstrate environmental credentials and differentiate offerings in a crowded marketplace.

Additionally, organizations must invest in talent development to bridge the gap between membrane science and digital engineering. Upskilling technical teams in data analytics, machine learning, and process control will be critical for harnessing the full potential of intelligent filtration systems. Finally, tailored go-to-market approaches that account for regional infrastructure maturity and regulatory nuances will enable companies to align product portfolios with specific customer needs, thereby accelerating market penetration and fostering long-term customer loyalty.

Robust research methodology detailing data collection analytical frameworks and validation processes underpinning the ultrafiltration membrane market study

This study was conducted through a rigorous blend of secondary and primary research methodologies to ensure comprehensive and unbiased insights. The initial research phase involved in-depth examination of industry white papers, peer-reviewed journals, patent filings, and regulatory publications to establish foundational understanding of material science developments, process innovations, and policy frameworks. This secondary analysis provided context for identifying critical market drivers and technological trends.

Subsequently, a series of structured interviews and surveys were carried out with key stakeholders across the ultrafiltration value chain. Participants included membrane manufacturers, system integrators, end-users in chemical, food and beverage, pharmaceutical, and water treatment sectors, as well as regulatory experts. These discussions yielded qualitative insights into application challenges, material preferences, and the strategic implications of recent tariff measures.

Data triangulation was employed to corroborate findings from diverse sources, ensuring that quantitative data aligned with anecdotal evidence. Where discrepancies arose, follow-up interviews were conducted to reconcile conflicting perspectives. Analytical frameworks such as Porter’s Five Forces and SWOT analyses were used to assess competitive dynamics and market positioning of leading players.

Finally, all data points and hypotheses were validated through peer review by independent experts in process engineering and environmental policy. This multi-stage validation process underpins the credibility of our conclusions and recommendations, providing stakeholders with a transparent view of the research foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrafiltration Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrafiltration Membrane Market, by Material

- Ultrafiltration Membrane Market, by Membrane Configuration

- Ultrafiltration Membrane Market, by Pore Size

- Ultrafiltration Membrane Market, by Application

- Ultrafiltration Membrane Market, by End-Use Industry

- Ultrafiltration Membrane Market, by Region

- Ultrafiltration Membrane Market, by Group

- Ultrafiltration Membrane Market, by Country

- United States Ultrafiltration Membrane Market

- China Ultrafiltration Membrane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Compelling conclusion synthesizing key findings strategic implications and future outlook for the ultrafiltration membrane industry

Through our comprehensive analysis, it is evident that the ultrafiltration membrane industry stands at the intersection of technological innovation, shifting regulatory landscapes, and evolving customer expectations. The rapid adoption of advanced polymers, coupled with digital integration and an intensified focus on sustainability, is reshaping traditional separation paradigms. Stakeholders who embrace these trends will be poised to capture emerging growth opportunities and deliver differentiated value propositions.

Despite headwinds such as tariff uncertainties and competitive pressures, the fundamental drivers of membrane adoption remain strong. Industrial processes continue to seek higher throughput and product purity, while municipal and decentralized water treatment projects aim to meet tightening discharge standards. The convergence of these drivers underscores the enduring relevance of ultrafiltration membranes across both established and nascent applications.

Looking ahead, collaboration between material scientists, digital technology providers, and end users will be paramount to unlocking the full potential of intelligent filtration systems. As global emphasis on resource efficiency and circularity intensifies, membranes that facilitate product recovery and water reuse will increasingly define the competitive frontier. By aligning R&D efforts with market needs and regional priorities, industry participants can chart a course toward sustainable growth and innovation.

Take decisive action and contact Ketan Rohom Associate Director Sales Marketing to secure ultrafiltration membrane market insights and a competitive edge

For organizations seeking to deepen their strategic understanding of ultrafiltration membrane dynamics and gain a competitive advantage, the time to act is now. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full market research report tailored specifically to your needs. By partnering directly, you will receive not only comprehensive insights into the latest technological advancements and regulatory developments but also personalized guidance on leveraging these findings to drive growth and innovation within your organization. Contact Ketan today to transform data into strategic success and ensure your firm stays at the forefront of the ultrafiltration membrane industry

- How big is the Ultrafiltration Membrane Market?

- What is the Ultrafiltration Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?