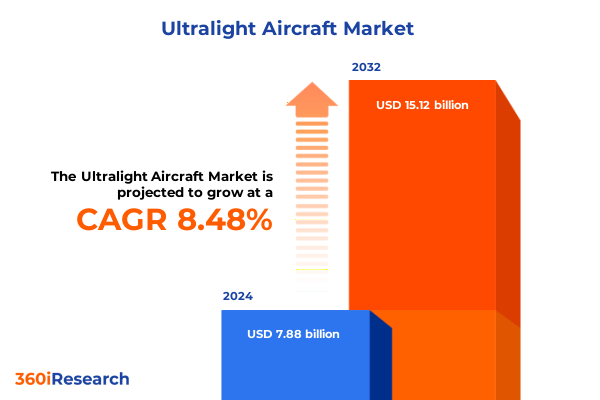

The Ultralight Aircraft Market size was estimated at USD 8.56 billion in 2025 and expected to reach USD 9.17 billion in 2026, at a CAGR of 8.45% to reach USD 15.12 billion by 2032.

Exploring the Evolution and Strategic Importance of Ultralight Aircraft as a Catalyst for Innovation in Personal and Commercial Aviation Markets Worldwide

Ultralight aircraft have undergone a remarkable journey from simple, homebuilt flying machines to sophisticated platforms that integrate advanced materials, avionics, and propulsion systems. This introduction explores the compelling story of how ultralight aviation has evolved to become a strategic focal point within both recreational and commercial domains. Initially championed by hobbyists seeking low-cost flight experiences, modern ultralight designs now address the growing demand for efficient air mobility solutions, showcasing the industry’s capacity for innovation and adaptation.

The narrative of ultralight aircraft is also shaped by broader trends in aerospace, such as the pursuit of sustainability and the integration of digital technologies. As manufacturers and stakeholders embrace electric and hybrid propulsion, lightweight composites, and real-time connectivity, ultralight platforms have emerged as test beds for cutting-edge developments. Consequently, this introduction positions ultralight aviation not merely as a niche sector, but as a vital ingredient in the trajectory of personal air transport and light utility operations, setting the stage for deeper insights into transformative shifts, policy dynamics, and market segmentation that will define the sector’s growth trajectory.

Identifying the Key Technological Advancements and Regulatory Transformations Reshaping the Ultralight Aircraft Landscape and Industry Dynamics Globally

The ultralight aircraft landscape is undergoing transformative shifts driven by technological breakthroughs and regulatory realignments. On the technological front, electric and hybrid propulsion architectures have matured in terms of energy density and thermal management, enabling lighter airframes and extended endurance. Meanwhile, advancements in composite materials and additive manufacturing are facilitating weight reduction and structural optimization. These innovations collectively enhance performance metrics, operational flexibility, and lifecycle costs, fundamentally redefining the capabilities of ultralight platforms.

Simultaneously, regulatory bodies are recalibrating frameworks to accommodate rapid innovation. Amendments to flight certification standards, such as expanding allowances for electric propulsion testing and streamlining import regulations for experimental designs, are lowering barriers to entry. Regulatory shifts also reflect a more proactive stance toward environmental sustainability and noise abatement, pressing industry players to adopt quieter, low-emission solutions. The convergence of these technological and policy dynamics is catalyzing a new era in ultralight aviation, where agility, eco-responsibility, and digital integration become the cornerstones of competitiveness.

Assessing the Comprehensive Impacts of Recent United States Tariffs on Ultralight Aircraft Industry Supply Chains Production Costs and Trade Flows in 2025

In 2025, the imposition of new United States tariffs on imported components crucial to ultralight aircraft has reverberated across supply chains and production strategies. These tariffs, targeting lightweight materials, advanced avionics modules, and propulsion subassemblies, have led to a notable increase in landed input costs. As a result, manufacturers have experienced margin compression and have begun recalibrating sourcing strategies, exploring alternate suppliers and investing in domestic production capabilities to mitigate exposure to import duties.

Beyond direct cost impacts, the tariffs have influenced broader trade flows and strategic partnerships. Several ultralight producers have accelerated nearshoring initiatives, relocating parts of the manufacturing footprint closer to end-markets to circumvent tariff barriers. At the same time, importers and distributors are negotiating longer lead times and volume-based pricing agreements to lock in favorable terms. While these adjustments introduce short-term operational complexity, they are also spurring investments in local supply chain resilience. Ultimately, the 2025 tariff landscape is reshaping competitive dynamics, compelling industry participants to balance cost structures with agility and supply security.

Uncovering Critical Market Segmentation Patterns in Ultralight Aircraft Demand Across Type Propulsion End Use and Distribution Channels

The ultralight aircraft market exhibits multifaceted segmentation across type, propulsion, end use, and distribution channels, each segment reflecting distinct demand drivers and product characteristics. Within the type dimension, fixed wing designs dominate due to established flight characteristics and widespread pilot familiarity, while powered parachutes and weight-shift models cater to enthusiasts valuing simple operation and low regulatory overhead. Rotary wing ultralights, offering vertical takeoff and landing capabilities, appeal to specialized training and observation missions, and the single-seat and two-seat subdivisions further differentiate user bases between solo recreational flights and tandem instructional or tour operations.

Propulsion segmentation reveals an accelerating shift toward electric powertrains, supported by enhanced battery technologies and charging infrastructure. Hybrid configurations provide a transitional solution, blending conventional piston engines with electric drives to optimize range and emissions. Traditional piston engine variants, including both two-stroke and four-stroke architectures, remain prevalent in remote areas lacking robust charging networks, while turbine-powered ultralights address high-performance niches demanding rapid climb rates and sustained cruise speeds.

End-use categories underscore diverse application scenarios. Commercial operations leverage ultralight platforms for aerial surveying, agriculture, and tourism, whereas recreational pilots prioritize affordable, low-complexity flying experiences. Military and defense units are progressively integrating ultralight vehicles for border surveillance and training flights, and academic institutions utilize these aircraft for pilot instruction and research projects. Finally, the distribution channel split between OEM sales and aftermarket services highlights the importance of direct manufacturer engagement in new aircraft deliveries, even as aftermarket providers drive maintenance, repair, and upgrade opportunities. This segmentation framework provides a holistic view of market dynamics, enabling stakeholders to align offerings with evolving customer requirements.

This comprehensive research report categorizes the Ultralight Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Propulsion

- End Use

- Distribution Channel

Evaluating the Strategic Growth Drivers and Market Potential of Ultralight Aircraft Across the Americas Europe Middle East Africa and Asia-Pacific Regions

Regional variations in ultralight aircraft adoption reveal divergent growth trajectories shaped by economic conditions, regulatory regimes, and infrastructure maturity. In the Americas, the United States leads through a well-established general aviation community, extensive flight training networks, and supportive state policies incentivizing recreational flying. Canada and Brazil contribute to market momentum by tapping into agricultural and tourism applications, with operators leveraging light aircraft for crop monitoring and eco-tourism initiatives across vast rural landscapes.

Across Europe, Middle East, and Africa, harmonization efforts by aviation authorities are fueling cross-border fleet movements and standardizing safety protocols. Europe’s recreational flying clubs drive steady demand for advanced ultralight models, while Gulf Cooperation Council nations explore light aviation roles in offshore logistics and aerial surveying. In Africa, the absence of extensive ground infrastructure positions ultralight platforms as cost-effective solutions for humanitarian missions and remote area connectivity.

The Asia-Pacific region stands out for its rapid market expansion propelled by rising disposable incomes, government support programs, and burgeoning tourism sectors. China and India are investing in pilot training academies and developing localized manufacturing hubs to reduce import dependencies. Southeast Asian nations, with their archipelagic geographies, utilize ultralight craft for inter-island transport and environmental monitoring, demonstrating the versatile applications that underscore regional growth potential.

This comprehensive research report examines key regions that drive the evolution of the Ultralight Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Ultralight Aircraft Manufacturers Innovators and Strategic Collaborators Driving Competitive Differentiation and Market Leadership

The competitive landscape of ultralight aircraft is defined by a mix of established manufacturers, innovative startups, and specialized component suppliers collaborating to enhance product portfolios and global reach. Leading firms such as Pipistrel and Tecnam have advanced their electric and hybrid offerings, leveraging strong engineering capabilities and certification experience to capture environmentally conscious buyers. Simultaneously, niche players like M-Squared and Quicksilver Aircraft continue to capitalize on core expertise in lightweight airframes and modular designs, catering to recreational pilots seeking affordability and simplicity.

Strategic partnerships have emerged as a key differentiator, with several companies entering joint ventures to co-develop battery systems, avionics suites, and composite manufacturing techniques. Component suppliers specializing in advanced materials and miniaturized electronics are forging alliances with OEMs to integrate next-generation technologies. Moreover, service providers focused on pilot training and maintenance are expanding networks through licensing agreements and digital platforms, reinforcing aftermarket revenue streams. Collectively, these collaborative strategies are intensifying competition, accelerating innovation cycles, and expanding the ultralight ecosystem beyond traditional aircraft manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultralight Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeropro s.r.o.

- American Champion Aircraft Corporation

- American Legend Aircraft Company

- AutoGyro GmbH

- BRM Aero s.r.o.

- CubCrafters Inc.

- Czech Sport Aircraft

- Diamond Aircraft Industries

- Ekolot

- Evektor-Aerotechnik

- Flight Design General Aviation GmbH

- Icon Aircraft

- Jabiru Aircraft Pty Ltd

- Just Aircraft, LLC

- Kitfox Aircraft

- Pipistrel d.o.o.

- Progressive Aerodyne

- Quicksilver Aircraft

- Remos AG

- Shark.Aero

- TL-Ultralight s.r.o.

- Zenith Aircraft Company

Providing Actionable Strategic Recommendations for Industry Leaders to Capitalize on Market Opportunities and Navigate Emerging Challenges in Ultralight Aviation

To thrive in a dynamic ultralight aviation environment, industry leaders should prioritize investments in electric and hybrid propulsion development, fostering partnerships with battery and motor specialists to accelerate certification timelines. Embracing modular design principles will enable rapid configuration changes, catering to diverse mission profiles from agricultural surveying to flight training. In parallel, establishing flexible supply chain arrangements that balance global sourcing with localized production will enhance resilience against tariff fluctuations and logistical disruptions.

Engaging proactively with regulatory authorities to shape evolving certification standards is equally critical, ensuring that emerging technologies gain timely approval and market acceptance. Companies should also leverage data analytics and digital platforms to optimize fleet operations, offering predictive maintenance services that reduce downtime and enhance safety. Finally, focusing on under-penetrated regions such as select Asia-Pacific and Latin American markets by forming local partnerships or joint ventures will unlock new demand pockets. By executing these strategic initiatives, industry participants can secure competitive advantages and drive sustainable growth in the ultralight aircraft sector.

Detailing the Rigorous Research Methodology Data Collection Approaches and Analytical Frameworks Underpinning the Ultralight Aircraft Market Study

This market study utilized a rigorous research methodology combining primary and secondary data collection, triangulated through qualitative and quantitative analytical frameworks. Primary research involved in-depth interviews with key stakeholders, including ultralight manufacturers, component suppliers, regulatory officials, distributors, and end-use customers. Insights from these interactions were corroborated with survey data to capture prevailing sentiment on technological preferences, purchasing criteria, and regulatory challenges.

Secondary research encompassed a comprehensive review of industry publications, technical journals, patent databases, and public filings to chart historical trends and benchmark competitive offerings. Proprietary databases and trade association reports provided additional context on production processes, supply chain configurations, and regional regulatory developments. Data validation was achieved through cross-referencing multiple sources and iterative stakeholder consultations, ensuring the findings reflect current market realities. Advanced analytical tools were employed to segment the market, identify value chain dynamics, and assess strategic implications, underpinning the study’s objectivity and depth.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultralight Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultralight Aircraft Market, by Type

- Ultralight Aircraft Market, by Propulsion

- Ultralight Aircraft Market, by End Use

- Ultralight Aircraft Market, by Distribution Channel

- Ultralight Aircraft Market, by Region

- Ultralight Aircraft Market, by Group

- Ultralight Aircraft Market, by Country

- United States Ultralight Aircraft Market

- China Ultralight Aircraft Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Illuminate the Future Trajectory and Strategic Imperatives of the Ultralight Aircraft Sector

This executive summary has distilled the ultralight aircraft sector’s evolution, examining technological breakthroughs, regulatory shifts, and the tangible influence of U.S. tariffs on supply chains. It has illuminated nuanced segmentation across types, propulsion systems, end-use verticals, and distribution channels, while revealing divergent regional growth patterns and competitive strategies. The insights underscore a transformative juncture for ultralight aviation, driven by the convergence of sustainability imperatives, digital integration, and geopolitical shifts.

Looking ahead, the sector is poised to expand as electric propulsion matures and regulatory frameworks adapt to novel aircraft configurations. Industry participants who embrace agile supply chains, foster collaborative innovation, and engage proactively with policymakers will be well positioned to lead this next phase. The culmination of these factors paints a promising outlook where ultralight aircraft play an increasingly integral role in personal mobility, commercial services, and specialized operations.

Take Immediate Action and Secure Your Comprehensive Ultralight Aircraft Market Intelligence Report by Connecting with Ketan Rohom at 360iResearch Today

Ready to elevate your strategic decision-making with in-depth market insights for ultralight aircraft? Connect with Ketan Rohom (Associate Director, Sales & Marketing) today to purchase the comprehensive market research report and stay ahead in a rapidly evolving industry landscape. Experience unparalleled analysis, actionable recommendations, and expert guidance tailored to your business needs by requesting the full report now.

- How big is the Ultralight Aircraft Market?

- What is the Ultralight Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?