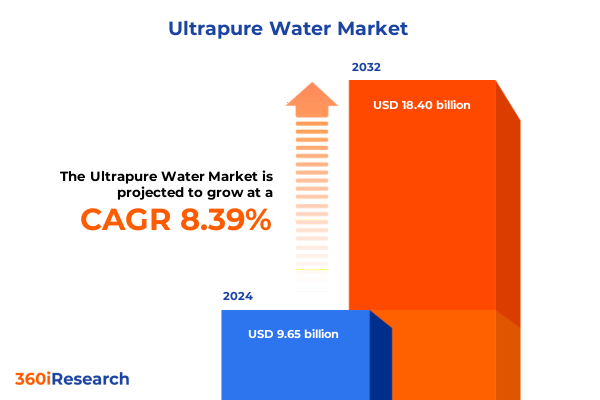

The Ultrapure Water Market size was estimated at USD 10.48 billion in 2025 and expected to reach USD 11.26 billion in 2026, at a CAGR of 8.37% to reach USD 18.40 billion by 2032.

The Strategic Imperative of Ultrapure Water Technologies in Driving Operational Excellence and Regulatory Compliance

Ultrapure water stands at the forefront of advanced industrial processes, underpinning critical operations across pharmaceuticals, semiconductors, and research laboratories. As purity standards tighten and industries demand ever-higher quality, the role of ultrapure water systems has expanded beyond mere utility to become a strategic enabler of innovation and compliance. With escalating regulatory scrutiny on contaminants and increasingly sophisticated production protocols, organizations are compelled to reevaluate their water treatment infrastructures and embrace technologies that deliver exceptional reliability and consistency.

In the wake of global supply chain disruptions and evolving geopolitical dynamics, the strategic importance of in-house water purification capabilities has intensified. Businesses are no longer passive consumers of ultrapure water; instead, they are actively investing in integrated solutions that reduce dependency on external suppliers and safeguard against material shortages. This transition underscores a broader shift in priorities, where resilience and quality assurance converge to drive operational excellence. Against this backdrop, stakeholders must navigate complex factors-from capital expenditure considerations to long-term sustainability goals-when assessing their ultrapure water strategies.

How Technological and Digital Innovations Are Reshaping Ultrapure Water Production and Management

In recent years, the ultrapure water landscape has undergone profound transformation, propelled by breakthroughs in membrane science, digital monitoring, and system integration. Continuous electrodeionization and ultraviolet oxidation have emerged as cornerstone technologies, enabling near-real-time contaminant removal and system self-optimization. These innovations, coupled with advances in high-precision sensors, allow operators to maintain resistivity levels beyond 18.2 megohm-cm and total organic carbon below stringent thresholds, thereby meeting the exacting demands of next-generation semiconductor fabs and biopharmaceutical processes.

Simultaneously, the convergence of water purification and Industry 4.0 principles has given rise to smart water ecosystems. Predictive analytics leverage historical performance data to forecast maintenance needs, minimize unplanned downtime, and extend membrane life cycles. Cloud-based platforms facilitate centralized oversight of distributed installations, empowering multinational enterprises to enforce uniform quality standards across disparate geographies. As a result, the ultrapure water sector is not only improving the purity and availability of water but also redefining how organizations monitor, manage, and monetize this critical utility.

Navigating the 2025 U.S. Tariff Environment and Its Pervasive Effects on Ultrapure Water Supply Chains

The cumulative impact of the United States’ tariff measures in 2025 has introduced significant cost pressures across the ultrapure water value chain. A 25% tariff on imported steel and aluminum, essential for filters, housings, and piping, has driven up manufacturing expenses for both recirculation and single-pass systems, compelling suppliers to reassess sourcing strategies and absorb margin contraction. This increase has narrowed pricing differentials between domestic and off-shore equipment, strengthening the position of North American manufacturers that can deliver tariff-free components and assemblies.

Moreover, the reinstatement of Section 301 duties on Chinese water treatment apparatus-absent any exclusion for reverse osmosis membranes-has elevated import costs by approximately 20%, directly influencing the procurement budgets of downstream sectors such as semiconductor fabrication and life sciences research. Faced with these higher expenses, end users are accelerating capital deployment toward in-house purification skids and modular units sourced from tariff-exempt suppliers, reinforcing supply chain resilience.

Supply chain disruptions have further compounded these dynamics. Delays in shipments of ultrafiltration membranes and UV oxidation modules due to logistical constraints have prompted original equipment manufacturers to diversify supply agreements and localize component production within North America. As a result, businesses are witnessing extended lead times for critical spare parts, leading to increased inventories and working capital requirements. Trade policy volatility has thus become a pivotal factor in strategic planning, shaping procurement decisions and driving vertical integration initiatives.

Uncovering Industry-Specific Drivers and Technology Preferences That Define Ultrapure Water Demand

Segmentation insights reveal nuanced demand drivers across industries and applications, underscoring the need for tailored solutions that address specific purity requirements and operational contexts. In pharmaceutical manufacturing, the differentiation between biopharmaceuticals and generic drug production has amplified focus on resistivity performance and total organic carbon control, prompting end users to favor continuous electrodeionization for consistent contaminant removal and minimal chemical usage. Meanwhile, semiconductor fabs-whether front-end wafer fabrication or back-end assembly and testing-prioritize reliability and scalability; the ability to maintain ultrapure water chemistry within tight process windows can be a key competitive lever for yield optimization.

System type segmentation highlights that recirculation systems, encompassing ultrafiltration, ultraviolet oxidation, and continuous electrodeionization, are increasingly selected for high-volume, closed-loop operations where water reuse and minimal discharge are paramount. Conversely, single pass systems based on reverse osmosis and ion exchange find favor in smaller laboratories and specialized analytical testing setups, where ease of installation and modularity outweigh the need for complex instrumentation.

Purity grade further delineates system selection. Type I water, characterized by a resistivity of 18.2 megohm-cm and total organic carbon below 10 ppb, is the standard for critical analytical and semiconductor applications, driving investment toward configurations that integrate high-precision sensors with automated validation protocols. Type II and Type III grades serve broader utility functions, including boiler feed and cleaning, where regulatory compliance and operational efficiency converge.

Application segmentation underscores the role of ultrapure water in diverse contexts. Analytical testing demands the highest purity for reliable assay results, while boiler feed water must meet specific conductivity thresholds to protect high-pressure steam systems. In formulation and rinsing processes, water quality directly impacts product consistency and contamination control, leading to innovations in in-line cleaning and batch cleaning modules that minimize downtime and chemical usage.

This comprehensive research report categorizes the Ultrapure Water market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Purity Grade

- Application

- End Use Industry

Examining Geographical Variations in Policy, Innovation Adoption, and Supply Chain Localization Trends

Regional insights illustrate divergent adoption patterns and strategic priorities across the Americas, EMEA, and Asia-Pacific. In the Americas, robust life sciences investment and semiconductor capacity expansions have fuelled demand for integrated ultrapure water solutions, with emphasis on local manufacturing to mitigate trade risks and reduce lead times. In EMEA, stringent environmental regulations and circular economy initiatives are accelerating uptake of recirculation systems that support water reuse and effluent reduction, driving partnerships between equipment providers and water utilities to deliver turnkey services.

The Asia-Pacific region remains the largest adopter by volume, propelled by rapid industrialization, growing pharmaceutical hubs in South Korea and India, and ambitious semiconductor roadmap developments in Taiwan and mainland China. Here, cost sensitivity coexists with an appetite for advanced digital features, leading to hybrid models that combine cloud-based monitoring with modular hardware designed for incremental scaling. As infrastructure matures, regional players are forging alliances with local engineering firms to customize solutions for diverse regulatory ecosystems and project financing frameworks.

This comprehensive research report examines key regions that drive the evolution of the Ultrapure Water market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players’ Strategies in Technology Integration, Service Innovation, and Global Operations

Leading companies are navigating the competitive landscape by leveraging technological differentiation, strategic partnerships, and geographic diversification. Equipment manufacturers with vertically integrated offerings-from membrane fabrication to control software-are gaining traction by delivering end-to-end solutions that streamline commissioning and validation. Service providers that blend remote monitoring with preventative maintenance programs are strengthening customer retention by addressing uptime and compliance challenges.

Collaborations between membrane innovators and sensor technology firms are yielding high-fidelity analytics platforms that detect trace contaminants in real time, elevating quality assurance for sensitive applications. At the same time, original equipment manufacturers are investing in modular assembly lines across North America, Europe, and Asia to sidestep trade barriers and ensure responsive support networks. These initiatives underscore a shift from product-centric to outcome-driven business models, where subscription-based water quality as a service offerings complement traditional capital sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrapure Water market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aqua-Chem, Inc.

- Aquaporin A/S

- Aries Water Technologies Inc.

- Bio-Microbics, Inc.

- Culligan International Company

- Danaher Corporation

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Ecolab Inc.

- GE Water & Process Technologies

- Gradiant Corporation

- Hyflux Ltd.

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Marcor Corporation

- Organo Corporation

- Pentair plc

- Pure Water Solutions LLC

- Siemens AG

- Suez S.A.

- Veolia Environnement S.A.

- Xylem Inc.

Actionable Blueprint for Strengthening Resilience, Driving Innovation, and Advancing Sustainability in Ultrapure Water Operations

Industry leaders should adopt a multifaceted approach to thrive in the evolving ultrapure water landscape. First, forging partnerships with membrane and sensor developers can fast-track access to cutting-edge purification and analytics technologies, enabling differentiation in high-stakes segments such as semiconductor fabrication and biopharma.

Second, organizations must diversify procurement channels by establishing dual-sourcing agreements and localized assembly hubs to reduce tariff exposure and logistical delays. Integration of predictive maintenance and remote monitoring within service contracts can further enhance system availability while optimizing cost structures.

Third, aligning ultrapure water initiatives with broader sustainability objectives-such as circular water reuse and energy efficiency-will deliver tangible environmental benefits and strengthen stakeholder trust. Engaging with regulatory bodies to shape evolving water quality standards can position companies as thought leaders while ensuring compliance readiness.

Implementing these strategies within a cohesive roadmap will empower industry stakeholders to capture value from emerging technologies, mitigate geopolitical risks, and elevate operational resilience.

Rigorous Multi-Source Methodological Framework Combining Primary Stakeholder Interviews and Comprehensive Secondary Data Analysis

This research undertook a rigorous methodology combining primary and secondary data sources to ensure comprehensive and unbiased insights. Primary interviews were conducted with a diverse cohort of stakeholders, including water treatment engineers, process chemists, industry consultants, and procurement executives across key end-use sectors. These engagements provided qualitative depth on technology adoption drivers, procurement criteria, and emerging pain points in system performance.

Secondary research was anchored in peer-reviewed journals, industry white papers, and regulatory publications, encompassing technical standards from organizations such as ASTM International and ISO. Proprietary databases and patent filings were analyzed to map technology trajectories and competitive landscapes. Market dynamics and policy shifts were reviewed through government trade reports and tariff notices, ensuring that the analysis reflects the latest legislative developments and their practical implications.

Quantitative data integration involved synthesizing input from equipment shipment records, import-export databases, and financial reports of leading participants. Rigorous triangulation techniques and validation workshops were employed to reconcile discrepancies and confirm the robustness of the insights presented. This methodological framework underpins the credibility and actionable value of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrapure Water market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrapure Water Market, by System Type

- Ultrapure Water Market, by Purity Grade

- Ultrapure Water Market, by Application

- Ultrapure Water Market, by End Use Industry

- Ultrapure Water Market, by Region

- Ultrapure Water Market, by Group

- Ultrapure Water Market, by Country

- United States Ultrapure Water Market

- China Ultrapure Water Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate Pathways for Operational Excellence and Strategic Growth in the Ultrapure Water Sector

The ultrapure water market is at a pivotal juncture, where technological advancements, regulatory pressures, and geopolitical factors collectively shape strategic decisions. As purity benchmarks climb and operational imperatives intensify, organizations must embrace innovation in membrane technologies, digital analytics, and modular system design to secure long-term performance and compliance.

Simultaneously, the evolving tariff landscape underscores the need for proactive supply chain strategies, including local assembly and dual sourcing, to mitigate cost volatility and ensure uninterrupted system availability. Aligning these efforts with sustainability goals, particularly in water reuse and energy optimization, will reinforce competitive positioning and foster stakeholder confidence.

Ultimately, success in this domain hinges on the ability to integrate cutting-edge technologies with resilient operational models. By leveraging the insights and recommendations outlined in this report, industry participants can chart a course toward greater efficiency, reliability, and environmental stewardship in ultrapure water management.

Empower Your Organization with Expert Guidance from Ketan Rohom to Secure the Ultrapure Water Market Research Report

To learn more about this comprehensive market research report on ultrapure water and unlock actionable insights tailored to your strategic goals, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in guiding industry leaders toward data-driven decisions and can provide you with detailed information on report features, customization options, and purchasing terms. Connect with Ketan today to ensure your organization leverages the latest intelligence on market dynamics, technological innovations, and regulatory developments. Your next step toward mastering the ultrapure water market begins with a conversation-contact Ketan Rohom now to secure your competitive advantage.

- How big is the Ultrapure Water Market?

- What is the Ultrapure Water Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?