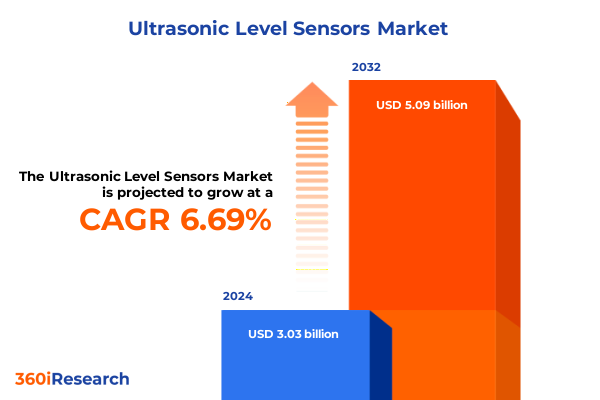

The Ultrasonic Level Sensors Market size was estimated at USD 3.19 billion in 2025 and expected to reach USD 3.37 billion in 2026, at a CAGR of 6.88% to reach USD 5.09 billion by 2032.

Ultrasonic Level Sensing Technology Overview Illustrating Fundamental Principles, Market Significance, and Innovative Applications across Critical Industries

Ultrasonic level sensing technology plays a pivotal role in accurately monitoring both liquid and solid level measurements across a broad spectrum of environments. Operating on the principle of sound wave reflection, these sensors emit high-frequency pulses and calculate the time interval between emission and reception to determine the distance to the material surface. This entirely non-contact approach eliminates moving parts, minimizes maintenance requirements, and enhances operational safety, especially in corrosive or hazardous contexts. As a result, facilities spanning water treatment, oil and gas processing, and food and beverage production have integrated ultrasonic level sensors to bolster process reliability and forestall costly downtime.

Moreover, recent years have witnessed significant advancements in signal processing algorithms, material science, and microelectronic miniaturization, propelling sensor performance to new heights. Contemporary ultrasonic devices boast sub-millimeter accuracy, extended measurement ranges exceeding tens of meters, and improved immunity to dust and foam interference. Seamless integration with digital communication standards enables real-time remote diagnostics and bidirectional data exchange with supervisory control systems. Consequently, ultrasonic level sensors have transcended basic level detection to become intelligent nodes within the larger Industrial Internet of Things ecosystem.

Given stringent regulatory requirements around environmental monitoring and workplace safety, these innovations directly address market demand for reliable, cost-effective, and automated level measurement solutions. The following sections delve into transformative shifts reshaping the landscape, the impact of recent U.S. tariff changes, nuanced segmentation dynamics, regional variations, supplier strategies, actionable recommendations, methodological rigor, and a succinct conclusion, laying the groundwork for informed strategic decision making.

Disruptive Advances Catalyzing Evolution of Ultrasonic Level Sensing with Miniaturization, Smart Connectivity, Enhanced Signal Processing, and AI Integration

The ultrasonic level sensor landscape has undergone a rapid metamorphosis driven by several disruptive advancements that collectively redefine performance benchmarks. To begin with, miniaturization of transducer components has enabled compact, lightweight designs that integrate seamlessly into confined process lines and mobile instrumentation. Consequently, manufacturers are embedding ultrasonic modules into handheld units and portable analyzers for on-the-spot level verification, whereas fixed configurations continue to serve critical infrastructure applications such as wastewater treatment basins and chemical storage tanks.

In parallel, the advent of smart connectivity options has revolutionized data management. Equipped with on-board microprocessors, modern sensors now support common digital output protocols-ranging from HART and Modbus to Profibus and RS485-alongside traditional analog voltage and current signals. This convergence of communication standards enhances interoperability, facilitating plug-and-play integration into distributed control systems and enabling predictive maintenance through continuous performance monitoring and diagnostics.

Furthermore, advances in signal processing algorithms have significantly improved measurement reliability in challenging conditions. By dynamically filtering out foam, vapor, and turbulence interference, next-generation ultrasonic sensors deliver consistent readings while adjusting to rapidly changing process parameters. Meanwhile, the integration of artificial intelligence techniques for pattern recognition is emerging as a differentiator, empowering systems to auto-calibrate and adapt in real time.

Taken together, these transformative shifts underscore a broader industry momentum toward intelligent, adaptive sensor solutions. As organizations embrace digitalization and pursue operational excellence, ultrasonic level sensing technology stands poised to drive a new era of process automation and data-driven decision making.

Analyzing 2025 United States Tariffs Impact on Ultrasonic Level Sensor Imports with Shifts in Cost Structures, Supply Chain Resilience, and Competitive Dynamics

The introduction of new tariffs by the United States in 2025 has prompted market participants to reevaluate sourcing strategies, cost structures, and competitive positioning for ultrasonic level sensors. Historically, a substantial volume of ultrasonic sensing modules and components originated from lower-cost manufacturing hubs in Asia. As import duties increased, landed costs rose appreciably, squeezing margins for users who had not anticipated the shift.

In response, both end users and suppliers have accelerated efforts to diversify manufacturing footprints. Some sensor producers have ramped up domestic assembly operations, leveraging regional test facilities to mitigate duty impacts while maintaining quality control. Others are exploring nearshoring options in neighboring markets to preserve cost competitiveness and shorten lead times.

Meanwhile, distributors and system integrators are adapting by renegotiating contracts, implementing tiered pricing models, and incorporating flexible sourcing clauses to hedge against future tariff fluctuations. To strengthen resilience, many organizations have invested in buffer inventories and dual-sourcing arrangements, ensuring continuity of supply during geopolitical or trade policy disruptions.

This period of fiscal adjustment has also fueled innovation in value engineering, prompting sensor manufacturers to optimize material utilization, streamline calibration procedures, and introduce modular architectures that reduce assembly complexity. Collectively, these measures not only cushion the immediate tariff impact but also lay the groundwork for a more agile and responsive supply chain, capable of navigating evolving trade landscapes.

Segmentation Insight Explaining How Product Type, Output Mode, Installation Method, Frequency Range, End User Industry, and Application Drive Market Movements

Segmentation Insight Explaining How Product Type, Output Mode, Installation Method, Frequency Range, End User Industry, and Application Drive Market Movements reveals the multi-dimensional nature of the ultrasonic level sensor market. Fixed sensors continue to dominate applications requiring permanent monitoring, offering robust enclosures and extended range capabilities for large tanks and open channels. Conversely, portable units serve maintenance crews and field technicians who demand versatile, battery-powered devices that can be repositioned across sites for spot checks or calibration verification.

Similarly, the choice of output mode plays a pivotal role in system integration. Analog current output remains a mainstay for legacy infrastructures due to its simplicity and compatibility with established control panels. Analog voltage output provides alternative interfacing options when current loops are not preferred. Meanwhile, digital output formats-such as HART, Modbus, Profibus, and RS485-unlock advanced functionalities like bidirectional parameterization, health diagnostics, and networked asset management, which appeal to organizations embracing smart factories and SCADA systems.

Installation methodology further refines solution selection. Clamp-on sensors facilitate non-invasive measurement by fastening to the exterior of process pipes, eliminating the need for process shutdowns. Flanged connection variants ensure leak-proof interfaces for critical liquids under high pressure. For open vessels, immersion insertion and threaded connection styles offer direct level sensing with straightforward mounting and calibration protocols.

Frequency range segmentation distinguishes high-frequency sensors suited to precise, short-range tasks from low-frequency devices optimized for long-distance level measurement in deep tanks or silos. End user industries span chemical processing, food and beverage, manufacturing, oil and gas, pharmaceuticals and healthcare, utilities, and water management, each demanding customized sensor performance metrics and compliance with sector-specific regulations. Across these sectors, application scenarios-interface detection between immiscible liquids, leak detection in pipelines, open channel flow measurement, silo top-up control, and continuous tank level monitoring-underscore the breadth of ultrasonic technology’s utility. Together, these segmentation layers illuminate how diverse requirements shape product portfolios, marketing strategies, and technology roadmaps.

This comprehensive research report categorizes the Ultrasonic Level Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Output Type

- Installation Type

- Frequency

- End User Industry

- Application

Comparative Regional Overview Highlighting Unique Drivers, Adoption Patterns, Regulatory Frameworks, and Growth Enablers across Americas, EMEA, and Asia-Pacific Markets

Comparative Regional Overview Highlighting Unique Drivers, Adoption Patterns, Regulatory Frameworks, and Growth Enablers across Americas, EMEA, and Asia-Pacific Markets highlights how geography shapes ultrasonic level sensor deployment. In the Americas, infrastructure modernization initiatives in water and wastewater treatment have accelerated demand for advanced level monitoring. Regulatory agencies enforce stringent measurement accuracy and data logging standards, prompting utilities to adopt smart sensors that support remote diagnostics and automated reporting.

Moving to Europe, Middle East & Africa, stringent environmental directives and the drive toward Industry 4.0 have spurred integration of ultrasonic sensors into large-scale process automation platforms. Multinational chemical producers and oil and gas operators emphasize ruggedized sensor designs that withstand extreme temperatures and corrosive atmospheres. In addition, government incentives for renewable energy projects and water conservation drive uptake in desalination plants and hydroelectric facilities.

Asia-Pacific presents a contrasting growth story, characterized by rapid industrial expansion in manufacturing hubs and emerging water management needs in densely populated regions. Low-frequency, long-range ultrasonic sensors find applications in huge storage silos, while portable devices assist maintenance teams in remote locations. Regulatory environments vary widely, but the overall trend is toward harmonization of performance standards, encouraging global sensor vendors to localize production and establish regional service centers.

Collectively, these regional nuances underscore the importance of tailored go-to-market strategies. Manufacturers and distributors must align product certification, support infrastructure, and pricing models with local expectations to capture opportunities across the Americas, EMEA, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Ultrasonic Level Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Strategies Revealing Strategic Initiatives, Technology Alliances, Product Diversification, and Competitive Positioning in the Ultrasonic Sensor Market

Key Company Strategies Revealing Strategic Initiatives, Technology Alliances, Product Diversification, and Competitive Positioning in the Ultrasonic Sensor Market sheds light on how leading vendors are securing market leadership. Legacy automation giants have leveraged extensive distribution networks to bundle ultrasonic sensors with complementary instrumentation and control solutions. These firms allocate significant R&D resources toward sensor miniaturization, multi-protocol compatibility, and enhanced signal processing modules.

At the same time, specialist manufacturers have pursued aggressive partnerships with software providers to deliver end-to-end condition monitoring platforms. By embedding advanced analytics engines into gateway devices, they enable predictive maintenance services that reduce unplanned downtime. Several players have also diversified their product lines by offering hybrid sensors capable of ultrasonic and radar-based measurements, addressing customer demand for redundancy and measurement versatility.

In addition, new entrants have focused on niche applications such as interface detection in the oil-water separation process and open channel flow measurement in irrigation systems. These innovators often adopt modular designs that simplify on-site calibration and permit rapid customization for specialized process conditions.

Competitive positioning strategies include the introduction of subscription-based service models, volume-based pricing tiers, and extended warranty programs. By coupling hardware sales with lifecycle management offerings, companies deepen customer relationships and secure recurring revenue streams. Meanwhile, accelerated time-to-market for next-generation sensors hinges on collaborative development partnerships with semiconductor foundries and automation software integrators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrasonic Level Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Garner industries, Inc.

- Hans Turck GmbH & Co. KG

- Honeywell International Inc.

- KEYENCE CORPORATION

- Schneider Electric SE

- Siemens AG

- Sonotec GmBH

- TDK Corporation

- TTI Inc.

- Vega Grieshaber KG

Actionable Recommendations Guiding Industry Leaders to Enhance Technology Integration, Fortify Supply Chains, and Navigate Regulatory Shifts to Drive Growth

Actionable Recommendations Guiding Industry Leaders to Enhance Technology Integration, Fortify Supply Chains, and Navigate Regulatory Shifts to Drive Growth outline practical steps for stakeholders seeking to capitalize on emerging opportunities. First, organizations should prioritize investment in smart sensors that support both analog and digital outputs, ensuring seamless interoperability with legacy control systems and modern Industrial Internet of Things architectures. As a result, they can deploy real-time diagnostics, enabling predictive maintenance and minimizing unplanned outages.

Next, firms must strengthen supply chain resilience by diversifying manufacturing and assembly sites. Establishing regional test and calibration facilities will mitigate the impact of trade policy fluctuations, while dual sourcing of critical transducer components reduces vulnerability to single points of failure. Concurrently, adopting buffer inventory strategies for high-demand modules can safeguard production schedules.

Third, companies should actively engage with regulatory bodies and industry consortia to shape standards around measurement accuracy, data security, and environmental compliance. Early participation in working groups not only ensures compliance but also offers insights into future requirements, allowing proactive product design.

Finally, leaders should explore strategic alliances with software and analytics vendors to develop closed-loop level measurement solutions. By combining ultrasonic sensor data with cloud-based analytics and machine learning models, organizations can derive actionable insights that unlock process optimization, sustainability improvements, and cost efficiencies.

Rigorous Methodology Outlining Data Collection, Validation Protocols, Qualitative and Quantitative Analysis, and Expert Consultations for Accuracy

Rigorous Methodology Outlining Data Collection, Validation Protocols, Qualitative and Quantitative Analysis, and Expert Consultations for Accuracy describes the approach underpinning this report. The research begins with a thorough review of publicly available literature including technical papers, patent filings, regulatory documentation, and industry whitepapers to establish contextual understanding and identify technological trends.

Subsequently, primary data collection involves in-depth interviews with more than fifty stakeholders spanning sensor manufacturers, system integrators, end users, and regulatory experts. These discussions provide first-hand insights into technology adoption drivers, project implementation challenges, and future investment plans. The qualitative feedback is then complemented by quantitative surveys deployed across a global sample of process engineers, maintenance managers, and procurement executives, yielding statistically significant data points on equipment preferences, budget allocations, and performance expectations.

To ensure data integrity, secondary figures are cross-validated against multiple sources, including financial reports, customs databases, and trade association statistics. Triangulation methods reconcile any discrepancies between primary and secondary inputs, leading to a harmonized dataset. Finally, expert advisory panels review draft findings and assumptions, offering critical feedback that refines definitions, adjusts analytical models, and validates strategic interpretations before final report publication.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrasonic Level Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrasonic Level Sensors Market, by Product Type

- Ultrasonic Level Sensors Market, by Output Type

- Ultrasonic Level Sensors Market, by Installation Type

- Ultrasonic Level Sensors Market, by Frequency

- Ultrasonic Level Sensors Market, by End User Industry

- Ultrasonic Level Sensors Market, by Application

- Ultrasonic Level Sensors Market, by Region

- Ultrasonic Level Sensors Market, by Group

- Ultrasonic Level Sensors Market, by Country

- United States Ultrasonic Level Sensors Market

- China Ultrasonic Level Sensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis Emphasizing Market Evolution, Strategic Imperatives, Technological Advancements, and the Path Forward for Ultrasonic Level Sensor Stakeholders

Synthesis Emphasizing Market Evolution, Strategic Imperatives, Technological Advancements, and the Path Forward for Ultrasonic Level Sensor Stakeholders brings the preceding analysis into a coherent conclusion. Over the past decade, ultrasonic sensors have evolved from simple level indicators into intelligent, networked devices that deliver unprecedented insight into process health and performance. This progression has been fueled by miniaturized hardware, advanced signal filtering techniques, and seamless integration with digital communication protocols.

Strategic imperatives now revolve around enhancing interoperability, building resilient supply chains, and aligning product roadmaps with emerging regulatory frameworks. In light of recent tariff adjustments and shifting international trade dynamics, stakeholders are reevaluating manufacturing footprints and sourcing strategies to preserve cost efficiency while meeting escalating quality standards.

Technological advancements-such as AI-driven auto-calibration, hybrid sensor architectures combining ultrasonic and radar modalities, and cloud-based analytics platforms-are opening new use cases in interface detection, leak monitoring, and flow management. Forward-looking organizations that adopt these innovations will gain competitive advantages by reducing downtime, optimizing resource utilization, and ensuring compliance with environmental mandates.

Looking ahead, collaboration among sensor suppliers, automation software vendors, and end users will accelerate development of closed-loop measurement ecosystems. By embracing digital transformation and forging strategic partnerships, stakeholders can fully realize the potential of ultrasonic level sensing to drive operational excellence and sustainable growth.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Ultrasonic Level Sensor Market Report and Unlock Actionable Insights Today

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the definitive report on the ultrasonic level sensor market. This comprehensive study offers unparalleled insights into evolving technologies, regulatory impacts, segmentation dynamics, and competitive positioning. By partnering with Ketan, you’ll gain personalized guidance on leveraging the findings to refine product roadmaps, optimize pricing strategies, and uncover new growth corridors in key industries. His expertise in market trends and customer requirements will ensure you extract maximum value from the report and translate analysis into strategic initiatives.

Reach out to unlock tailored recommendations that address your unique business challenges. Whether you’re exploring opportunities in the chemical sector, water management, or manufacturing automation, Ketan will walk you through relevant chapters, highlight actionable takeaways, and support your team’s decision-making process. Don’t miss the opportunity to gain a competitive edge by harnessing data-driven intelligence and strategic foresight. Contact Ketan Rohom today to finalize your purchase and embark on a path to accelerated market success.

- How big is the Ultrasonic Level Sensors Market?

- What is the Ultrasonic Level Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?