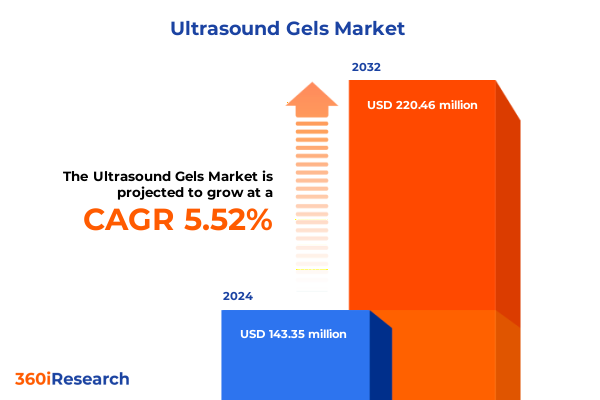

The Ultrasound Gels Market size was estimated at USD 149.00 million in 2025 and expected to reach USD 160.20 million in 2026, at a CAGR of 5.75% to reach USD 220.46 million by 2032.

Unveiling the Critical Role of Ultrasound Gels in Modern Medical Diagnostics and Therapeutic Applications Amidst Accelerating Technological Advancements

Ultrasound coupling gels play an indispensable role in modern healthcare delivery, ensuring that diagnostic imaging and therapeutic procedures are performed with optimal acoustic conductivity. Over the last decade, technological advancements in ultrasound transducer design and imaging software have heightened the importance of coupling media that can maintain consistent acoustic impedance, hypoallergenicity, and ease of application. As the medical community increasingly relies on point-of-care ultrasound in emergency medicine, primary care, and remote diagnostics, the demand for gels that can perform reliably under diverse clinical conditions has surged.

Simultaneously, regulatory bodies worldwide have intensified scrutiny on product safety and environmental impact, prompting manufacturers to innovate beyond traditional aqueous formulations. The growing focus on patient safety, coupled with the need for environmentally responsible packaging solutions, has catalyzed a wave of research into alternative ingredient bases and proprietary viscosity modifiers. Consequently, ultrasound gel producers are now challenged to balance cost efficiencies, performance characteristics, and compliance with evolving global standards.

Looking ahead, the intersection of miniaturized ultrasound platforms and telemedicine initiatives is expected to redefine clinical workflows. Gels that can maintain stability during storage and transport, resist microbial contamination, and integrate seamlessly with single-use formats will be critical to unlocking new market opportunities. In this context, understanding the drivers shaping formulation science and supply chain dynamics becomes essential for stakeholders seeking to capitalize on the next phase of ultrasound market expansion.

Charting the Paradigm Shift in Ultrasound Gel Manufacturing Driven by Sustainable Formulations, Digital Imaging Needs, and Stringent Safety Standards

The ultrasound gel landscape is undergoing a transformative shift driven by three converging trends: sustainability mandates, digital integration, and heightened safety protocols. In recent years, environmental regulators have imposed stricter requirements on disposable medical products, prompting manufacturers to explore biodegradable and plant-based gels that reduce ecological footprint without compromising performance. Concurrently, the proliferation of digital ultrasound devices has underscored the need for gels with precisely calibrated acoustic properties to support emerging high-frequency transducers and specialized imaging modes.

Moreover, infection control imperatives have accelerated demand for sterile, single-use gel packets in hospitals and outpatient settings. The COVID-19 pandemic acted as a catalyst, highlighting vulnerabilities in shared gel dispensers and accelerating industry investment into aseptic packaging technologies. As a result, companies are now optimizing packaging integrity testing and adopting anti-microbial additives while ensuring formulations remain non-irritating and hypoallergenic.

In parallel, advanced manufacturing techniques such as micronized polymer blends and nanoemulsion processes are enabling formulators to fine-tune viscosity and thermal stability. These innovations are creating new product tiers tailored to niche applications, such as veterinary imaging and focused therapeutic ultrasound. Together, these shifts are reshaping competitive dynamics and presenting an array of new growth pathways for agile players who can navigate regulatory complexities, leverage process innovation, and deliver differentiated value propositions.

Analyzing the Multifaceted Impact of 2025 United States Tariff Adjustments on Ultrasound Gel Importation, Manufacturing Expenses, and Supply Chain Resilience

In January 2025, the United States implemented an additional round of Section 301 tariff adjustments on medical product imports, impacting raw materials and finished ultrasound gel shipments sourced from China. These tariffs, which increased duty rates on select HTS codes by up to 25%, have had a tangible effect on global supply chains and cost structures for gel manufacturers. As a result, companies that rely heavily on glycerin, propylene glycol, and polymer thickeners imported under the affected categories have seen procurement expenses rise, prompting a reassessment of sourcing strategies.

Manufacturers responded by diversifying their supplier base, shifting ingredient procurement to Southeast Asia and domestic producers to mitigate exposure. This transition, however, introduced new quality control challenges and incremental logistics expenditures. The cumulative effect of tariff-driven cost increases and accelerated freight rates has translated into narrower profit margins for price-sensitive segments, particularly in veterinary and lower-end diagnostic applications. Meanwhile, premium and sterile gel products, which command higher price points, have absorbed these costs more readily, maintaining stable margins through value-based positioning.

Looking forward, sustained tariff pressures are expected to drive continued localization of production and greater investment in backward integration. Companies that can establish in-house compounding capabilities or secure long-term partnerships with regional raw material vendors will be better positioned to shield themselves from import duty volatility. Ultimately, the 2025 tariff shifts have underscored the importance of agility in procurement, supply chain transparency, and cost engineering to preserve competitiveness in the ultrasound gel market.

Unlocking Actionable Insights from Ultrasound Gel Market Segmentation Across Product Types, Viscosity Levels, Ingredient Bases, Applications, and End-Users

A nuanced segmentation framework reveals the distinct dynamics that define opportunity zones within the ultrasound gel market. When examining product type, non-sterile gels dominate routine diagnostic imaging protocols, offering cost advantages for high-volume settings, while sterile gels are essential in interventional procedures and invasive diagnostics to meet stringent asepsis requirements. In terms of viscosity level, high-viscosity formulations adhere effectively to vertical surfaces and specialized transducers, medium viscosity options provide a balanced compromise for general imaging, and low-viscosity gels enable rapid spread and quick cleanup in time-sensitive scenarios.

Diving deeper into ingredient base segmentation, alcohol-based gels deliver rapid drying and cooling benefits, making them suitable for mobile applications, whereas aloe-based gels emphasize patient comfort and skin conditioning, appealing to wellness-focused clinics. Aqueous-based gels remain the backbone for most radiology departments, with proven acoustic performance and cost predictability. Application segmentation delineates markets into medical diagnostics, where clarity and repeatability are paramount; therapeutic ultrasound, which demands gels with heat dissipation properties; and veterinary applications that require specialized antimicrobial profiles to maintain cross-species safety.

Finally, end-user segmentation underscores divergent buying behaviors. Clinics and diagnostic imaging centers prioritize refillable bulk formats for operational efficiency, hospitals often mandate single-use sterile packets for infection control, and research and academic institutes focus on high-purity formulations to support experimental protocols. By synthesizing these segmentation insights, stakeholders can craft targeted strategies to address unique requirements across market sub-segments and optimize product portfolios for maximum alignment with end-user expectations.

This comprehensive research report categorizes the Ultrasound Gels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Viscosity Level

- Ingredient Base

- Application

- End-User

Distilling Critical Regional Dynamics Influencing Ultrasound Gel Demand Across Americas, Europe Middle East Africa, and Asia Pacific Healthcare Landscapes

Geographic factors exert significant influence on ultrasound gel adoption patterns and procurement models across the Americas, Europe Middle East Africa, and Asia Pacific regions. In North America, mature healthcare infrastructure and the prevalence of large-scale hospital systems drive demand for sterile packet formats and premium formulations that support advanced imaging modalities. Latin America, while exhibiting cost sensitivity, is experiencing growth in outpatient diagnostic clinics, prompting manufacturers to introduce competitively priced aqueous-based and alcohol-based gels with robust distributor networks.

Across Europe, a strong regulatory environment and centralized public healthcare systems set rigorous compliance standards, fueling interest in medical-grade and eco-friendly gels certified to meet regional environmental directives. In the Middle East and Africa, infrastructure expansion and growing investments in private healthcare facilities create new demand corridors, albeit tempered by limited cold chain logistics in remote areas. Demand in these markets is often met through partnerships between global gel suppliers and local distributors, ensuring timely product availability and localized packaging solutions.

In the Asia Pacific, rapid digitization of medical imaging in countries such as China, India, and Southeast Asian markets has elevated requirements for high-performance coupling media. Consequently, gel producers are localizing manufacturing footprints to address import duty challenges and speed delivery. The emphasis on telemedicine and portable ultrasound is stronger in APAC, prompting increased uptake of single-use sterile sachets and multi-purpose gels that can accommodate both diagnostic and therapeutic workflows. Understanding these regional nuances is crucial for designing market entry and expansion strategies that align with localized clinical and logistical requirements.

This comprehensive research report examines key regions that drive the evolution of the Ultrasound Gels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Strengths and Competitive Positions of Leading Ultrasound Gel Manufacturers Propelling Innovation Quality and Market Leadership

The competitive landscape is anchored by a handful of established manufacturers that combine deep formulation expertise with global distribution capabilities. Parker Laboratories, renowned for its Aquasonic 100 line, leads the non-sterile and sterile gel segments with a robust product portfolio and long-standing relationships with equipment OEMs. Eco-Med Pharmaceuticals has differentiated itself through eco-conscious formulations and private-label services, making it a preferred partner for regional distributors seeking customizable branding options.

Medline serves as a pivotal aggregator of ultrasound coupling media under its proprietary and partnered brands, leveraging its extensive sales channels to ensure broad market access. Hartmann further contributes to market diversity with its emphasis on antimicrobial additive technology and bulk gel formats tailored to high-volume settings. In the therapeutic ultrasound space, niche players such as CML BiLinde are gaining traction by introducing gels with enhanced heat transfer properties and specialized conductors that optimize energy delivery for physiotherapy applications.

Emerging entrants and regional producers are also reshaping competitive dynamics by offering cost-effective aqueous-based gels that satisfy price-sensitive markets. To maintain leadership, incumbent firms continue to invest in formulation R&D, expand sterile packaging solutions, and forge distribution alliances that can bolster last-mile availability. Collectively, the strategic moves of these key companies are defining innovation roadmaps and setting benchmarks for quality and performance across market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrasound Gels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AiM Medical Technologies, LLC

- Aquasonic Ultrasound Gels Inc.

- Cardinal Health, Inc.

- Ceracarta S.p.A.

- Compass Health Brands

- EDM Medical Solutions

- General Electric Company

- HR Pharmaceuticals, Inc.

- Jorgensen Laboratories, LLC

- Medline Industries, Inc.

- NEXT Medical Products Company

- NIHON KOHDEN CORPORATION

- P.W. Coole & Son Ltd Trading

- Parker Laboratories Inc.

- Phyto Performance Italia srl

- Rohdé Produits

- Safersonic

- Steroplast Healthcare Limited

- Telic Group

- Trivitron Healthcare Pvt. Ltd

- Turkuaz Health

Implementing Actionable Strategies to Strengthen Ultrasound Gel Product Development, Supply Chain Resilience, and Compliance for Competitive Advantage

Industry leaders can capitalize on evolving market conditions by prioritizing three strategic imperatives. First, accelerating sustainable product innovation will not only meet incoming regulatory requirements but also resonate with environmentally conscious healthcare providers. This entails reformulating gels with biodegradable thickeners and transitioning to recyclable or compostable packaging materials without sacrificing acoustic performance.

Second, enhancing supply chain resilience through supplier diversification and backward integration can mitigate the impact of future tariff shifts and global logistics disruptions. Establishing regional compounding facilities and locked-in contracts with raw material vendors will provide cost stability and quicker response times to demand fluctuations. Concurrently, implementing advanced inventory management systems can enable real-time visibility into stock levels and streamline replenishment cycles.

Third, strengthening collaboration with ultrasound equipment OEMs and healthcare providers will create synergistic opportunities for co-marketing and product bundling. By engaging early in the device design process, gel manufacturers can tailor formulations to transducer specifications and differentiate offerings through joint value propositions. Adopting digital engagement platforms and educational initiatives will further drive product adoption and demonstrate thought leadership in acoustic coupling science.

Detailing a Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation in the Ultrasound Gel Market Assessment

This research integrates a multi-tier methodology to ensure robust market analysis and reliable insights. Primary data was collected through in-depth interviews with procurement managers at leading hospitals, diagnostic imaging centers, and veterinary clinics, complemented by structured discussions with formulation scientists and supply chain specialists. These dialogues provided firsthand perspectives on purchasing criteria, formulation performance expectations, and emerging clinical requirements.

Secondary research encompassed a review of publicly available regulatory filings, tariff schedules, and standards documentation from the U.S. International Trade Commission, World Customs Organization, and environmental regulatory agencies. Company annual reports, product data sheets, and patent filings were analyzed to map innovation trajectories and competitive positioning. Quantitative data points were validated through cross-referencing trade data, distributor sales figures, and industry association publications.

The analysis framework employed triangulation techniques to reconcile disparate data streams, ensuring consistency and accuracy. A rigorous validation protocol, involving statistical checks and expert panel reviews, was applied to key findings. This comprehensive approach enabled the generation of actionable insights and strategic recommendations, furnishing stakeholders with a clear roadmap for navigating the ultrasound gel market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrasound Gels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrasound Gels Market, by Product Type

- Ultrasound Gels Market, by Viscosity Level

- Ultrasound Gels Market, by Ingredient Base

- Ultrasound Gels Market, by Application

- Ultrasound Gels Market, by End-User

- Ultrasound Gels Market, by Region

- Ultrasound Gels Market, by Group

- Ultrasound Gels Market, by Country

- United States Ultrasound Gels Market

- China Ultrasound Gels Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Future Trajectory of Ultrasound Gel Innovation, Market Viability, and the Imperative for Strategic Adaptation in Healthcare

The trajectory of ultrasound gel innovation is poised to accelerate as the convergence of technological, environmental, and regulatory pressures intensifies. Biodegradable and plant-based formulations will become mainstream, reshaping supplier architectures and creating new competitive battlegrounds based on sustainability credentials. Simultaneously, advanced manufacturing techniques will yield gels with ultra-high-frequency compatibility, unlocking novel applications in microvascular imaging and elastography.

From a market viability standpoint, companies that invest in supply chain agility and digital engagement will be best equipped to capture emerging growth pockets in telemedicine and veterinary imaging. The imperative for strategic adaptation is clear: organizations must blend formulation science with intelligent procurement frameworks to maintain margin integrity and deliver differentiated value to end users. As regulatory landscapes evolve, proactive compliance efforts will further distinguish market leaders from laggards.

Ultimately, the ultrasound gel market will reward those who approach coupling media as an integral component of the broader diagnostic and therapeutic ecosystem. Firms that forge collaborative partnerships, embrace sustainability, and embed data-driven decision-making into their product roadmaps will secure enduring competitive advantages in this dynamic landscape.

Encouraging Immediate Engagement with Ketan Rohom to Secure Comprehensive Ultrasound Gel Market Research Insights and Drive Data-Driven Decisions

For personalized consultation and to access the full suite of data tables, charts, and strategic insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s expertise in guiding healthcare organizations and medical device suppliers will help you translate raw market intelligence into actionable business strategies. Secure your competitive edge today by connecting with Ketan to purchase the comprehensive ultrasound gel market research report and accelerate your decision-making process

- How big is the Ultrasound Gels Market?

- What is the Ultrasound Gels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?