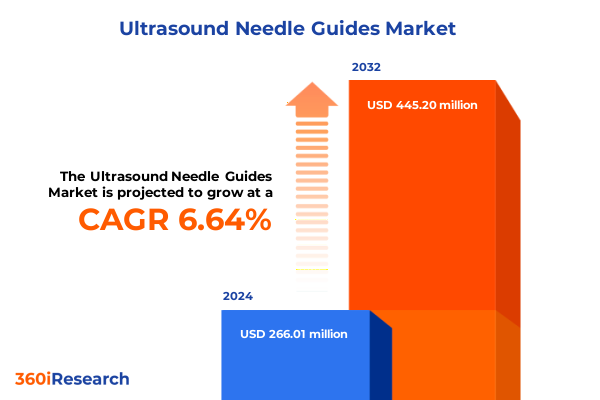

The Ultrasound Needle Guides Market size was estimated at USD 283.56 million in 2025 and expected to reach USD 300.64 million in 2026, at a CAGR of 6.65% to reach USD 445.20 million by 2032.

Understanding the Evolution and Significance of Ultrasound Needle Guides in Clinical Practice and Their Role in Precision Procedures

In an era marked by rapid advancements in medical imaging and minimally invasive procedures, ultrasound needle guides have emerged as indispensable tools for enhancing accuracy and safety during needle-based interventions. These devices serve as precision attachments to ultrasound probes, allowing clinicians to visualize and direct needle trajectories in real time. By bridging the gap between two-dimensional imaging and three-dimensional anatomical complexity, needle guides significantly reduce procedural risks and improve patient outcomes across a spectrum of applications, from regional anesthesia to vascular access.

The growing prevalence of chronic diseases, aging populations, and demand for outpatient care have further underscored the need for technologies that deliver consistent, high-precision results while minimizing patient discomfort. As healthcare providers increasingly prioritize procedural efficiency and resource optimization, ultrasound needle guides have become critical components in operating rooms, ambulatory surgical centers, and diagnostic clinics alike. These devices not only streamline workflow but also shorten learning curves for practitioners, enabling broader adoption of ultrasound-guided techniques.

Against this backdrop of clinical and operational imperatives, market participants are investing heavily in novel materials, smart attachment mechanisms, and ergonomic designs. Concurrent enhancements in probe compatibility and sterilization protocols have expanded the range of reusable and disposable options, creating new pathways for customizing solutions to specific procedural requirements. As the healthcare landscape evolves, the stage is set for sustained innovation in ultrasound needle guidance-a trend that promises to redefine standards of care and procedural excellence.

Examining Groundbreaking Technological Advances and Emerging Trends Revolutionizing the Ultrasound Needle Guides Market Landscape

The ultrasound needle guides market is experiencing a period of profound transformation driven by breakthroughs in imaging, automation, and materials science. Manufacturers are increasingly integrating machine learning algorithms directly into ultrasound platforms, enabling real-time needle trajectory prediction and adaptive imaging that adjust to patient anatomy. According to Grand View Research, the incorporation of artificial intelligence into ultrasound devices has already begun to enhance procedural success rates by offering clinicians automated guidance cues and on-screen prompts for optimized needle paths.

Simultaneously, the rise of point-of-care ultrasound (POCUS) has reshaped traditional clinical settings. Compact, handheld systems with integrated needle guidance attachments now facilitate bedside interventions in critical care units, emergency departments, and remote clinics. New product releases from leading equipment OEMs highlight interactive touchscreen interfaces and automated needle visualization modes that reduce cognitive load during urgent procedures. These developments have lowered barriers to adoption, allowing a broader range of healthcare professionals to perform ultrasound-guided interventions with confidence.

Beyond AI and portability, the market is also witnessing a convergence with robotic-assisted surgery and surgical navigation systems. Customized guide designs compatible with robotic arms enable precise, repeatable needle insertions for complex biopsies and therapies. Industry analysis from Analytica Global underscores growing collaborations between robotics specialists and needle guide manufacturers to deliver automated, high-precision workflows that improve patient safety and procedural efficiency.

As telemedicine expands and remote proctoring platforms gain traction, live-streamed ultrasound guidance paired with digital needle guides is unlocking new paradigms in training and global consultations. This synergy of technologies is redefining the clinician–device interface, fostering a landscape in which adaptability, intelligence, and seamless integration chart the course for future growth.

Assessing the Far-Reaching Consequences of Recent United States Trade Tariffs on the Ultrasound Needle Guides Industry

Recent shifts in U.S. trade policy have introduced new layers of complexity for manufacturers and healthcare providers reliant on imported needle guidance attachments and their components. In May 2024, the U.S. government implemented a 50 percent tariff on syringes and needles imported from China-measures that signal broader scrutiny of critical medical supplies and raw materials. While needle guides are not syringes, their reliance on precision-molded plastics and metal components exposes them to similar cost pressures, particularly as ancillary supplies face escalating duties.

In parallel, a 25 percent duty took effect on medical devices containing steel and aluminum derivatives in March 2025, heightening input costs for guide mechanisms that include metal retention clips or structural supports. The cumulative impact of these tariff measures has reverberated through supply chains, prompting regional manufacturers in North America to reassess procurement strategies and consider reshoring production or expanding domestic tooling capabilities.

Further compounding uncertainty, prospective trade negotiations between the U.S. and key partners have introduced the possibility of additional 15 percent tariffs on European medical device imports, though exemptions for core healthcare equipment remain under discussion. As policy deliberations evolve, stakeholders face a landscape marked by fluctuating duties and procedural delays at customs checkpoints.

These evolving trade dynamics underscore the importance of strategic sourcing, robust supplier diversification, and close monitoring of policy developments. For many industry participants, navigating this tariff environment will require agile cost-management frameworks and close collaboration with trade advisors to safeguard margins and ensure uninterrupted supply of critical ultrasound needle guidance components.

Unlocking Valuable Insights Through Comprehensive Segmentation Analysis of the Ultrasound Needle Guides Market Across Diverse Criteria

A nuanced segmentation analysis reveals divergent growth trajectories and strategic imperatives across product type, operation mode, imaging format, end-use setting, and clinical application. For instance, disposable versus reusable guide variants each present distinct value propositions: disposable models address stringent infection control mandates and carry minimal sterilization burden, whereas reusable attachments offer cost efficiency and material robustness when paired with effective cleaning protocols. As institutional purchasing priorities shift toward lean inventory management, many operators are balancing upfront capital expenditures against lifecycle maintenance costs.

Within operation mode, manual needle guides sustain dominance through simplicity of use and compatibility with traditional ultrasound consoles, while automatic, semi-automated systems leverage motorized adjustment mechanisms to enhance precision in complex trajectories. As robotics integration intensifies, automatic guide formats are gaining traction, particularly in high-volume centers seeking to standardize procedural workflows.

Imaging format also influences adoption patterns, with two-dimensional guides remaining foundational across routine biopsies, vascular cannulations, and block placements. Yet three-dimensional and emerging four-dimensional guide geometries are carving out specialized niches in advanced interventions, where spatial awareness in volumetric imaging is essential for navigating intricate anatomical structures.

End-user segmentation further delineates market dynamics: hospitals and clinics encompass both public, private, and outpatient clinics with robust capital budgets and in-house training infrastructures. Ambulatory surgical centers-whether hospital-owned or independent-prioritize rapid turnover and portable guide solutions aligned with lean clinical pathways. Diagnostic imaging centers and physicians’ offices, including specialist practices, increasingly adopt streamlined guide attachments to expand service offerings without the overhead of full imaging suites.

Lastly, clinical applications drive product customization: regional and general anesthesia procedures demand guides tailored to nerve block techniques, while biopsy attachments accommodate both core needle and fine-needle aspirations. Vascular access-central line placement and peripheral cannulations-benefits from low-profile, rotationally adjustable guides suited for high-frequency use. Across these segments, the convergence of procedural specificity and device adaptability remains paramount for manufacturers aiming to capture diverse practitioner needs.

This comprehensive research report categorizes the Ultrasound Needle Guides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Operation Mode

- Imaging Type

- End User

- Application

Revealing Critical Regional Dynamics and Growth Drivers Shaping the Ultrasound Needle Guides Market in Key Global Territories

Geographic dynamics underscore how regional healthcare priorities, regulatory ecosystems, and economic trajectories shape the ultrasound needle guides market. In the Americas, advanced reimbursement frameworks and widespread adoption of point-of-care ultrasound in emergency and perioperative settings have cemented North America’s leadership position. The United States, in particular, drives demand through substantial investments in ambulatory services and an expanding network of outpatient surgical centers.

Across Europe, the Middle East, and Africa, market growth is propelled by heterogeneous factors. Western European countries leverage well-established medical device approval pathways and strong hospital networks to adopt premium guide attachments, while Middle Eastern health authorities prioritize infrastructure expansion within new specialty hospitals. Meanwhile, select African markets are beginning to embrace portable, cost-effective guide systems as part of broader initiatives to improve access to minimally invasive diagnostics in underserved regions.

In the Asia-Pacific region, rapid economic growth, rising healthcare expenditure, and government-led digital health transformation initiatives have created fertile ground for needle guide innovation. Emerging healthcare hubs in India, China, and Southeast Asia champion tele-ultrasound platforms and mobile POCUS units, accelerating uptake of AI-enabled guidance solutions tailored for remote and resource-constrained environments. As regional manufacturers expand production capabilities, localized device portfolios are aligning cost structures with market affordability thresholds.

These regional distinctions highlight the imperative for market entrants to tailor product strategies, distribution partnerships, and training programs to local clinical workflows and regulatory requirements. A refined regional approach ensures that device offerings resonate with evolving patient care models and government policy objectives.

This comprehensive research report examines key regions that drive the evolution of the Ultrasound Needle Guides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Moves by Leading Players Driving the Ultrasound Needle Guides Market Forward

Leading participants in the ultrasound needle guides market are distinguishing themselves through targeted innovation, strategic alliances, and scalable manufacturing investments. Philips has garnered attention with its Flash 5100 POC ultrasound system, which integrates automated needle visualization and intuitive touchscreen interfaces to support rapid vascular access and trauma interventions in emergency settings. This product underscores the firm’s emphasis on marrying ergonomic design with real-time guidance.

GE Healthcare’s Venue Family of POCUS systems represents another exemplar of strategic differentiation. Since the acquisition of Caption Health, GE has embedded AI-driven caption guidance into its platform, offering clinicians on-screen real-time assistance for cardiac and vascular scans. This integration reduces reliance on specialized operators and facilitates broader diffusion of ultrasound-guided procedures across non-traditional care settings.

Pure-play innovators are also reshaping competitive dynamics. Butterfly Network and Clarius have emerged as front-runners in handheld ultrasound, each promoting wireless, portable devices designed to interface seamlessly with modular needle guide attachments. Their cloud-based AI frameworks enable remote diagnostics and guidance, expanding opportunities for distributed care. The emphasis on affordability and mobility has resonated strongly in emerging markets, where clinical infrastructure gaps persist.

Additionally, legacy imaging companies such as Siemens Healthineers and Samsung are advancing needle guide accuracy through AI algorithms embedded in their premium console systems. Both firms have showcased algorithms capable of predicting optimal needle paths and flagging potential complications based on volumetric imaging data-a capability that reinforces their foothold in high-acuity hospitals and specialty centers.

As competition intensifies, mergers, co-development agreements, and intellectual property acquisitions are likely to accelerate, underscoring the importance of strategic foresight for all market participants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrasound Needle Guides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argon Medical Devices Inc.

- Becton Dickinson and Company

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- CIVCO Medical Solutions

- Clarius Mobile Health

- Cook Medical Inc.

- EchoNous Inc.

- Esaote S.p.A.

- Fujifilm Holdings Corporation

- GE Healthcare

- Hitachi Medical Systems

- Interson Corporation

- Medtronic plc

- Mindray Medical International Limited

- Philips Healthcare

- Rocket Medical plc

- Samsung Medison Co. Ltd.

- Shimadzu Corporation

- Siemens Healthineers

- Stryker Corporation

- Telemed Ultrasound

Crafting Pragmatic Strategies and Actionable Recommendations to Optimize Market Positioning in the Ultrasound Needle Guides Sector

Industry leaders must craft multi-faceted strategies to navigate tariff volatility, accelerate technology adoption, and safeguard supply chains. First, organizations should formalize robust supplier diversification frameworks that prioritize dual sourcing for critical plastics and metal components. Proactive engagement with trade experts and customs authorities will also be essential to anticipate duty fluctuations and secure favorable classifications for guide attachments. Guidance from iData Research emphasizes contingency planning and supplier network resilience as key mitigants against cost escalation and import disruptions.

Second, investing in strategic partnerships with AI software providers and robotic systems integrators can drive differentiated product roadmaps. Co-development initiatives aimed at integrating advanced algorithms, position-sensing modules, and remote guidance capabilities will position companies to lead in next-generation automation offerings. Concurrently, establishing pilot programs with leading healthcare systems will validate performance improvements, smooth regulatory pathways, and accelerate clinician acceptance.

Third, developing dynamic sterilization and waste-management protocols for disposable and reusable guide formats will address evolving infection control requirements. Organizations should collaborate with health authorities to demonstrate compliance and cost–benefit rationale, thereby influencing procurement guidelines in ambulatory and outpatient settings. Finally, actionable market intelligence and scenario planning workshops should be convened regularly, enabling leaders to align R&D roadmaps with shifting reimbursement landscapes and clinical practice guidelines.

Detailing the Thorough Research Methodology and Rigorous Analytical Approaches Underpinning the Ultrasound Needle Guides Market Study

The research underpinning this market study draws upon a rigorous blend of primary and secondary analytical approaches. Secondary research involved a comprehensive review of peer-reviewed journals, regulatory filings, corporate documentation, and industry news sources to establish baseline technology trends, tariff developments, and competitive landscapes. Trade associations and government publications provided contextual data on healthcare expenditure, reimbursement frameworks, and tariff schedules.

Primary research encompassed structured interviews with senior executives at ultrasound OEMs, medical device distributors, and major end users, including hospital procurement directors and leading anesthesiologists. Expert panel workshops afforded opportunity to validate emerging use cases, assess technology adoption barriers, and prioritize feature requirements across guide formats.

Quantitative data modeling integrated input cost analyses, procedure volume estimates, and supplier capacity metrics to evaluate financial thresholds across segmentation variables. Where direct data were unavailable, triangulation techniques were employed, cross-referencing analogous device markets and historical trade flows to ensure robust estimations.

Qualitative insights further enriched the analysis through clinician surveys and product usability assessments, capturing sentiment on ease of use, training needs, and infection control preferences. The combined methodological framework ensures the study’s conclusions rest on a transparent, replicable foundation, offering stakeholders a high-confidence roadmap for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrasound Needle Guides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrasound Needle Guides Market, by Product Type

- Ultrasound Needle Guides Market, by Operation Mode

- Ultrasound Needle Guides Market, by Imaging Type

- Ultrasound Needle Guides Market, by End User

- Ultrasound Needle Guides Market, by Application

- Ultrasound Needle Guides Market, by Region

- Ultrasound Needle Guides Market, by Group

- Ultrasound Needle Guides Market, by Country

- United States Ultrasound Needle Guides Market

- China Ultrasound Needle Guides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Clear Conclusions on Market Evolution Impacts and Future Directions for the Ultrasound Needle Guides Industry

The ultrasound needle guides market is poised for continued evolution as technology advances, regulatory environments shift, and clinical demands diversify. Integrating artificial intelligence and automation promises to drive next-generation guide precision, while portable, point-of-care form factors will expand procedural access beyond traditional hospital walls.

Despite near-term headwinds from U.S. tariff adjustments and input cost pressures, resilient supply chain strategies and strategic onshoring efforts can mitigate disruptions and secure competitive advantage. Segmentation analysis underscores that tailoring product offerings to specific clinical applications, end-user settings, and operational modes will be critical for capturing incremental growth opportunities.

Regionally, nuanced alignment of distribution partnerships, regulatory approvals, and localized manufacturing will determine success across the Americas, EMEA, and Asia-Pacific. Similarly, competitive positioning hinges on deep collaborations with software developers and robotics integrators, enabling device portfolios to anticipate future clinical workflows and reimbursement changes.

In aggregate, the market’s trajectory reflects a confluence of technological innovation, policy recalibration, and evolving healthcare delivery paradigms. Stakeholders who proactively invest in research and development, diversify supplier networks, and engage end users in co-creation of solutions will be best positioned to shape the next chapter of ultrasound-guided clinical practice.

Engage with Ketan Rohom to Secure Your Comprehensive Ultrasound Needle Guides Market Research Report and Drive Informed Decision-Making

If you’re ready to deepen your understanding of evolving clinical imperatives, technological breakthroughs, and strategic market opportunities for ultrasound needle guides, Ketan Rohom invites you to explore the full breadth of insights uncovered in our comprehensive research. As Associate Director of Sales and Marketing, Ketan offers personalized consultations to help you navigate critical findings, from regulatory impacts and supply chain shifts to innovation benchmarks across leading competitors. Empower your strategic planning and operational decisions with data-driven analysis tailored to your organizational goals. Contact Ketan to schedule a demonstration of the report’s highlights, discuss custom scope extensions, or secure immediate access to the complete market research dossier. Stay ahead of emerging trends in ultrasound-guided interventions, optimize procurement strategies in light of tariff developments, and harness actionable recommendations that will position your business at the forefront of the ultrasound needle guides sector.

- How big is the Ultrasound Needle Guides Market?

- What is the Ultrasound Needle Guides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?