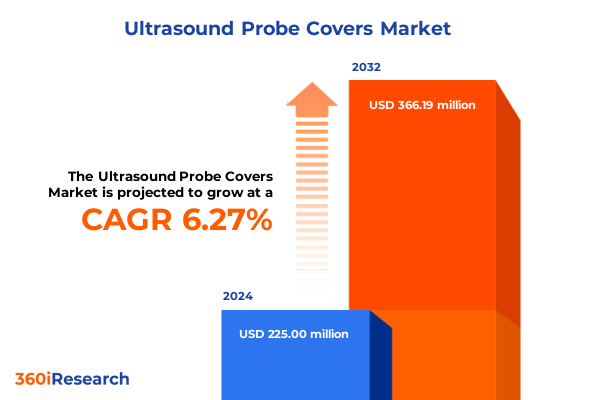

The Ultrasound Probe Covers Market size was estimated at USD 239.02 million in 2025 and expected to reach USD 252.85 million in 2026, at a CAGR of 6.28% to reach USD 366.19 million by 2032.

Exploring the Critical Role of Ultrasound Probe Covers in Ensuring Precision, Patient Safety, and Operational Efficiency in Modern Healthcare

Ultrasound probe covers serve as an essential barrier that prevents cross-contamination during diagnostic imaging procedures, ensuring both patient safety and clinician protection. By maintaining a sterile interface between the ultrasound transducer and the patient’s skin or mucosal surfaces, these covers minimize the risk of pathogen transmission, a concern that has only intensified under heightened infection control protocols in modern healthcare settings. The growing emphasis on stringent disinfection guidelines has spurred widespread adoption of single-use and high-barrier covers, reinforcing their role as a fundamental component of ultrasound workflows and patient safety initiatives.

Beyond infection prevention, dependable probe covers enhance the reliability of diagnostic imaging by preserving transducer performance. With the expansion of point-of-care and bedside ultrasound across multiple specialties, from emergency medicine to obstetrics and cardiology, clinicians rely on cover materials that maintain sound wave fidelity and reduce signal attenuation. As handheld and portable ultrasound devices become more prevalent in diverse clinical environments, the need for high-quality covers that withstand frequent handling and maintain acoustic transparency has never been greater.

Simultaneously, environmental considerations are reshaping procurement priorities, with healthcare providers seeking biodegradable and eco-conscious alternatives that align with sustainability goals. This shift toward greener materials underscores the dual mandate to uphold rigorous infection control standards while reducing medical waste. In this context, ultrasound probe covers emerge not merely as disposable accessories but as strategic enablers of safe, efficient, and sustainable diagnostic care.

Uncovering Transformative Technological, Regulatory, and Sustainability Shifts Driving the Evolution of Ultrasound Probe Cover Solutions Worldwide

The ultrasound probe cover landscape is undergoing a profound transformation driven by interlinked technological, regulatory, and sustainability trends. First, the rising demand for eco-friendly materials is prompting manufacturers to develop biodegradable polymers that address the environmental impact of single-use products. In response, research efforts are focusing on plant-based and bioresorbable materials that deliver equivalent barrier protection without compromising acoustic properties, meeting hospitals’ dual objectives of infection control and waste reduction.

Concurrently, the integration of artificial intelligence and telemedicine capabilities into ultrasound workflows is influencing cover design and functionality. Teleultrasound systems now enable remote specialists to guide image acquisition in real time, often in resource-limited or rural settings where disposable covers must be rugged, compatible with portable devices, and easily deployable. The expansion of remote imaging has heightened the need for covers that maintain consistent performance across a spectrum of devices and usage conditions.

Finally, evolving regulatory frameworks are tightening infection prevention standards, driving widespread adoption of antimicrobial and high-barrier covers. Enhanced regulatory scrutiny of reprocessing protocols and cross-contamination risks is encouraging healthcare facilities to prioritize covers with validated performance data. This convergence of material innovation, digital integration, and regulatory reinforcement is reshaping market expectations, elevating ultrasound probe covers from simple protective accessories to sophisticated solutions integral to modern imaging.

Assessing the Comprehensive Effects of 2025 United States Tariff Changes on Supply Chain Dynamics and Pricing Structures for Ultrasound Probe Covers

The 2025 adjustments to United States import tariffs have exerted a notable influence on the ultrasound probe cover industry, reshaping both cost frameworks and supply chain strategies. The policy instituted a baseline 10 percent duty on most imported goods, alongside steeper levies on specific medical device inputs, including materials sourced from Canadian and Mexican suppliers. Meanwhile, raw materials imported from China are subject to a wider range of duties, compelling manufacturers to reevaluate sourcing decisions and recalibrate procurement channels.

Domestic producers have responded to these cost pressures through strategic supply chain realignments. Some have relocated portions of production to tariff-exempt jurisdictions, while others are renegotiating long-term agreements to stabilize pricing. These adjustments have increased the emphasis on nearshoring and supplier diversification as pathways to mitigate volatility. By shifting to regional material suppliers and optimizing production footprints, companies aim to shield manufacturing margins and ensure continuity of supply under evolving trade conditions.

End users and distributors have likewise adapted to the new tariff environment. Large hospital systems leverage bulk purchasing contracts and volume discounts to buffer against price increases, whereas smaller clinics and ambulatory centers face tighter margin constraints, prompting demand for flexible purchasing arrangements and promotional incentives. Online retail channels have intensified marketing efforts to sustain competitive pricing and customer loyalty, highlighting the importance of dynamic inventory management and responsive distribution networks. These collective responses underscore the critical role of supply chain resilience and proactive pricing strategies in navigating the shifting tariff landscape.

Illuminating Key Segmentation Insights to Navigate the Ultrasound Probe Cover Landscape Across Product, Material, Application, End User, and Distribution Channels

Insights into the ultrasound probe cover market reveal a complex mosaic of product types, materials, applications, end users, and distribution channels that shape purchasing decisions. In terms of product type, providers weigh the comparative advantages of non-sterile covers for routine imaging against sterile options designed for invasive or interventional procedures, balancing cost considerations with risk profiles. Material innovation further refines these choices, as latex alternatives such as polyisoprene and polyurethane gain prominence for their hypoallergenic properties, while polyethylene remains a foundational barrier material valued for its durability and cost efficiency.

Application-driven segmentation highlights distinct performance requirements across clinical specialties. Cardiology demands covers with high acoustic fidelity for both transesophageal and transthoracic exams, whereas obstetrics and gynecology cover options adapt to both transabdominal and transvaginal procedures. General imaging, musculoskeletal, urology, and vascular studies each introduce unique considerations for cover elasticity, grip texture, and tear resistance, reflecting the diverse operational contexts in which ultrasound is deployed.

End users shape procurement pathways, with ambulatory surgical centers and diagnostic centers often prioritizing high-throughput disposable covers to maintain rapid turnaround, while hospitals and clinics integrate cover choice into broader sterilization and inventory management protocols. Distribution channels complete the ecosystem, as manufacturers leverage direct sales to establish customized service agreements, empower distributor networks to extend market reach, and harness online retail platforms to meet emerging digital procurement preferences. Together, these segmentation insights underscore the nuanced decision drivers guiding cover selection across the continuum of ultrasound practice.

This comprehensive research report categorizes the Ultrasound Probe Covers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End User

- Distribution Channel

Revealing Distinct Regional Dynamics Influencing Ultrasound Probe Cover Adoption Across the Americas, Europe Middle East & Africa, and Asia Pacific

Regional dynamics exert a significant influence on ultrasound probe cover adoption, reflecting distinct healthcare infrastructure, regulatory environments, and procurement practices across key geographies. In the Americas, the United States leads with rigorous infection control mandates and high utilization of point-of-care ultrasound, which drives demand for sterile, single-use covers. Telehealth expansion in the U.S. has amplified this trend, with telehealth usage surging more than sixty-fold during the pandemic era, elevating the importance of reliable covers in remote and in-home diagnostic settings. Latin American markets are following suit, as private and public providers invest in ultrasound imaging to enhance diagnostic access.

Within Europe, Middle East & Africa, stringent regulatory frameworks such as the EU Medical Device Regulation catalyze adoption of advanced cover solutions that meet elevated biocompatibility and traceability requirements. Environmental directives in European Union member states accelerate the transition toward recyclable and biodegradable covers, while Middle Eastern healthcare expansions prioritize high-volume procurement strategies in emerging medical hubs. African markets, though still developing infrastructure, are increasingly integrating ultrasound into primary healthcare initiatives, creating new vectors for cover procurement.

Asia-Pacific encompasses diverse healthcare ecosystems, from established markets with mature ultrasound programs to rapidly expanding systems in China, India, and Southeast Asia. Government investments in hospital modernization and rural outreach programs reinforce the need for robust cover supply chains, while growth in diagnostic imaging devices in the region highlights the importance of cost-effective, high-performance covers. As Asia-Pacific continues to lead global diagnostic device growth, manufacturers are partnering with local distributors to tailor cover solutions to rapidly evolving clinical needs.

This comprehensive research report examines key regions that drive the evolution of the Ultrasound Probe Covers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Innovations Shaping the Ultrasound Probe Cover Manufacturing and Distribution Ecosystem Today

The ultrasound probe cover industry is shaped by a competitive landscape where innovation, quality assurance, and distribution expertise define market leadership. Leading manufacturers such as Sheathing Technologies Inc have established a strong reputation through the development of sterile cover solutions that prioritize material integrity and sterility assured packaging standards. Their offerings are complemented by Medical Components Inc, which leverages advanced polymer extrusion techniques to produce high-clarity, tear-resistant covers tailored for specialized probe geometries.

Dynarex Corporation has differentiated itself through a focus on ergonomic design and cost-effective supply models, enabling broad adoption in high-volume clinical settings. Meanwhile, global healthcare conglomerates like BD have entered the probe cover space with integrated accessory kits designed for point-of-care ultrasound applications, underscoring the strategic value of comprehensive solution bundles that streamline procurement. Additional players such as SteriMed provide alternative cover ranges that emphasize antimicrobial coatings, reflecting the sector’s pivot toward enhanced infection prevention features.

Distribution partnerships play a pivotal role in ensuring market penetration, with major medical supply distributors and e-commerce channels collaborating to optimize inventory management and delivery responsiveness. These collaborations enable end users to maintain consistent cover availability, reducing procedure delays. Strategic investments in research and development continue to fuel proprietary material formulations and packaging innovations, reinforcing the importance of IP-driven differentiation as technology and usage scenarios evolve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultrasound Probe Covers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun SE

- Cantel Medical Corp.

- Cardinal Health Inc.

- Civco Medical Solutions

- DePuy Synthes

- Eckert Healthcare GmbH

- GE HealthCare Technologies Inc.

- Germiphene Corporation

- Medi-Dose Inc.

- Mediplus India Ltd.

- Medivators

- Medline Industries LP

- MedPro Healthcare Products

- Medtronic plc

- Parker Laboratories Inc.

- Smyth Companies LLC

- Sonic Essentials

- SonoSource Inc.

Delivering Actionable Recommendations to Enhance Sustainability, Supply Chain Resilience, and Product Differentiation Strategies for Ultrasound Probe Cover Leaders

To navigate the evolving ultrasound probe cover environment, industry leaders should prioritize sustainable material development, investing in the research and production of biodegradable and recyclable polymers that align with both regulatory directives and institutional sustainability objectives. Collaborations with material science experts and academic institutions can accelerate access to next-generation compounds, enabling first-mover differentiation in an increasingly eco-conscious market.

Concurrent diversification of supply chains is essential to mitigate trade policy risks and ensure uninterrupted cover availability. Manufacturers and distributors should pursue multi-regional sourcing strategies, establishing contingencies in low-tariff jurisdictions and forging strategic partnerships with local suppliers to reduce exposure to import duty fluctuations. Implementing real-time supply chain monitoring tools will enhance visibility into potential disruptions.

Finally, strengthening value propositions through bundled service agreements and telemedicine-ready cover solutions can unlock new market segments. By integrating covers into comprehensive diagnostic kits customized for remote and point-of-care applications, companies can address the unique performance and logistic needs of teleultrasound deployments. Engaging directly with major end users to co-develop tailored offerings will foster deeper customer loyalty and support premium pricing models in specialized applications.

Detailing a Robust Research Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Rigorous Insight Generation

This research report synthesizes insights derived from a systematic blend of primary and secondary data collection methodologies. Primary research encompassed in-depth interviews with clinical stakeholders, procurement managers, and industry experts, providing nuanced perspectives on cover performance requirements and evolving purchase criteria. These firsthand accounts were supplemented by secondary analysis of peer-reviewed literature, regulatory publications, and trade press articles, ensuring comprehensive contextualization of market dynamics.

Quantitative data were triangulated through cross-referencing of product catalogs, procurement records, and manufacturer disclosures, while qualitative themes were validated using iterative expert feedback loops. Rigorous data validation protocols were applied to minimize bias, enhance reliability, and confirm the accuracy of material trend assessments. Additionally, supply chain analyses incorporated customs data and tariff schedules to map sourcing patterns and cost implications across key geographies.

Findings were structured to balance depth of insight with strategic clarity, ensuring that decision-makers gain actionable intelligence on segmentation, regional dynamics, and competitive positioning. The resulting framework supports evidence-based strategy development, enabling stakeholders to anticipate regulatory shifts, optimize procurement strategies, and prioritize innovation pathways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultrasound Probe Covers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultrasound Probe Covers Market, by Product Type

- Ultrasound Probe Covers Market, by Material

- Ultrasound Probe Covers Market, by Application

- Ultrasound Probe Covers Market, by End User

- Ultrasound Probe Covers Market, by Distribution Channel

- Ultrasound Probe Covers Market, by Region

- Ultrasound Probe Covers Market, by Group

- Ultrasound Probe Covers Market, by Country

- United States Ultrasound Probe Covers Market

- China Ultrasound Probe Covers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights on the Future Imperatives for Innovation, Collaboration, and Strategic Positioning Within the Ultrasound Probe Cover Sector

The ultrasound probe cover sector is positioned at the intersection of clinical safety imperatives, environmental stewardship goals, and rapidly evolving healthcare delivery models. As single-use and advanced barrier solutions continue to underpin stringent infection control frameworks, sustainability-driven material innovation and adaptive supply chain strategies will define future market leaders. Regional variations in regulatory rigor, infrastructure maturity, and telemedicine adoption further underscore the need for localized go-to-market approaches.

Looking ahead, collaborative partnerships between cover manufacturers, device OEMs, and healthcare providers will accelerate development of integrated offerings tailored to specialized diagnostics and remote care. By aligning product roadmaps with emerging clinical applications-such as AI-guided imaging and expanded tele-ultrasound services-industry participants can secure a competitive edge. Additionally, proactive engagement with policymakers on environmental regulations and tariff policies will mitigate compliance risks and support smoother market access.

In summary, success in the ultrasound probe cover domain hinges on balancing robust infection prevention capabilities with sustainable practices, responsive distribution networks, and a keen understanding of diverse end-user needs. Those who embrace material innovation, supply chain resilience, and collaborative solution design are best positioned to lead the next phase of industry evolution.

Take the Next Step: Engage with Ketan Rohom to Access the Comprehensive Ultrasound Probe Cover Report and Drive Strategic Decision Making Today

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore this in-depth analysis and secure your organization’s competitive advantage. Reach out for a consultation to discuss how the insights within this report can be tailored to your strategic priorities, from material innovation and supply chain resilience to segmentation strategies and regional growth dynamics. Don’t miss the opportunity to harness expert guidance as you navigate emerging trends and regulatory shifts. Contact Ketan Rohom today to arrange a personalized briefing and obtain full access to the comprehensive ultrasound probe cover market research report.

- How big is the Ultrasound Probe Covers Market?

- What is the Ultrasound Probe Covers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?