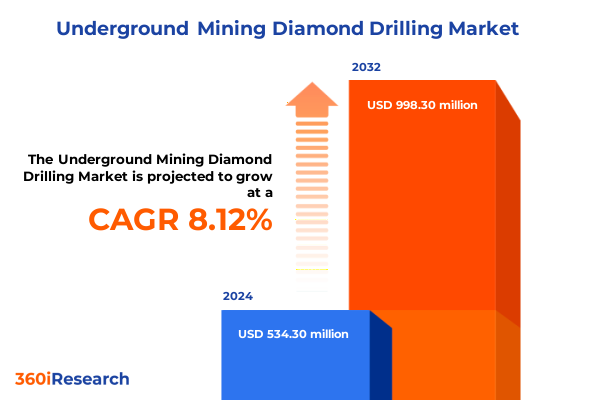

The Underground Mining Diamond Drilling Market size was estimated at USD 575.20 million in 2025 and expected to reach USD 622.55 million in 2026, at a CAGR of 8.19% to reach USD 998.30 million by 2032.

Exploring the Critical Foundations and Emerging Drivers Shaping Underground Mining Diamond Drilling to Inform Strategic Industry Decisions

Underground mining diamond drilling stands at the forefront of global resource extraction, weaving together advanced equipment, specialized techniques, and strategic insights to unlock critical mineral reserves deep beneath the earth’s surface. This introduction delves into the essential context and foundational drivers that underpin diamond drilling in underground environments, setting the stage for an in-depth exploration of its evolving role in meeting surging demand for metals and minerals. As technology adoption accelerates and sustainability priorities intensify, mining operations are rethinking how diamond drilling can deliver precision, efficiency, and reliability in demanding conditions.

Over recent years, the diamond drilling sector has shifted from purely labor-intensive approaches to an era characterized by automation, digital integration, and remote operation capabilities. These transformative trends not only enhance drilling accuracy and reduce downtime, but also support rigorous safety standards and environmental stewardship. Beyond technical progress, the industry landscape is influenced by shifting commodity prices, geopolitical developments, and changing regulatory frameworks, all of which shape investment decisions and operational strategies.

By framing the current state of underground mining diamond drilling through this multifaceted lens, stakeholders gain a holistic understanding of the forces driving innovation and competitive differentiation. This introduction paves the way for deeper analysis of transformative shifts, tariff implications, segmentation nuances, regional dynamics, industry leader profiles, actionable recommendations, and research methodology, culminating in strategic insights that inform executive-level decision-making.

Assessing the Transformative Technological, Regulatory, and Operational Shifts Redefining Underground Mining Diamond Drilling Strategies Globally

The landscape of underground mining diamond drilling is undergoing profound shifts as technological breakthroughs, regulatory evolution, and operational reconfiguration converge to redefine how boreholes are drilled and data is collected. Innovations in automation have introduced remotely controlled drill rigs capable of operating in restricted underground corridors, minimizing human exposure to hazardous conditions while enhancing precision in targeting mineralized zones. Complementing these advances, digital solutions such as real-time data analytics, Internet of Things-enabled sensors, and predictive maintenance algorithms are enabling drilling teams to optimize bit performance, anticipate equipment failures, and reduce unscheduled downtime.

Simultaneously, environmental and safety regulations are becoming more stringent, prompting operators to adopt less invasive drilling fluids, enhance ground support techniques, and integrate continuous monitoring systems that detect seismic events and ground movement. This regulatory impetus drives further investment in drilling technologies that lower carbon footprints and bolster worker protection. In parallel, evolving energy markets and mine electrification initiatives are encouraging the development of electric drill rigs, which offer reduced emissions and quieter operation, addressing both sustainability objectives and community relations concerns.

As these transformative shifts gain momentum, companies are forging strategic partnerships with technology providers, research institutions, and regulatory bodies to co-develop next-generation drilling platforms tailored to underground environments. This collaborative approach is fostering a new era of efficiency and resilience, as the industry adapts to mounting operational challenges while positioning itself for long-term growth within a dynamic global mining sector.

Analyzing the Comprehensive Impact of United States 2025 Tariffs on Underground Mining Diamond Drilling Supply Chains and Cost Structures

The implementation of United States tariffs on imported diamond drilling equipment and consumables in early 2025 has introduced a new set of challenges and strategic considerations for mining operators and service providers. By imposing levies on drill rigs, diamond bits, and associated hardware sourced from key exporting nations, the tariff measures aim to bolster domestic manufacturing but have also contributed to higher acquisition costs and supply chain complexity. These elevated costs are particularly pronounced for high-precision diamond bits and specialized drill rig components, which often rely on global supply networks for critical raw materials such as industrial diamonds and alloyed steels.

In response to tariff-induced price increases, many operators have reevaluated procurement strategies, exploring local sourcing options and negotiating long-term supply agreements to secure favorable terms. Some mining companies have accelerated in-house maintenance capabilities and parts manufacturing, reducing reliance on imported spares and mitigating exposure to further tariff adjustments. Meanwhile, manufacturers of electric and hydraulic drill rigs are assessing the feasibility of localized assembly plants and technology transfer partnerships to serve the U.S. market from within, thereby minimizing cross-border cost implications.

While these measures have introduced additional layers of complexity, they have also stimulated innovation in design and production processes, as equipment suppliers seek cost-effective alternatives to tariff-sensitive components. By fostering closer collaboration between operators, OEMs, and parts producers, the industry is navigating the cumulative impact of 2025 tariffs with a blend of adaptive sourcing, strategic investment in domestic capacity, and targeted process improvements that maintain drilling performance and operational continuity.

Uncovering Deep Segmentation Insights Across Drill Type, Depth Range, Borehole Diameter, Application, and End User Profiles for Targeted Strategies

A nuanced understanding of market segmentation provides valuable insights into how underground mining diamond drilling solutions are deployed across diverse operational requirements. Drill type segmentation reveals distinct usage patterns across electric drill rigs favored for low-emission tunnels, hydraulic drill rigs selected for their high penetration rates and payload capacity-especially in contexts where automated rigs offer enhanced data integration-alongside manual hydraulic units that deliver cost-effective flexibility. Pneumatic drill rigs continue to serve specific niches requiring robust performance in water-sensitive environments, balancing air-driven simplicity with reliability.

Depth range segmentation further distinguishes applications, as shallow drilling supports tunnel development and orebody delineation near surface levels, medium-depth drilling addresses transitional zones critical for grade control, and deep drilling underpins exploration of lower-lying mineral deposits where advanced downhole monitoring is essential. Borehole diameter segmentation, categorized by HQ, NQ, and PQ core sizes, highlights the trade-offs between sample volume, core integrity, and logistical constraints-each core dimension aligning with different geological profiling objectives and equipment specifications.

Application segmentation illuminates drilling’s multifaceted role, encompassing development phases that establish underground infrastructure, exploration campaigns that generate geological intelligence, and production operations focused on reserve delineation and grade control, the latter demanding high repeatability and minimal deviation. Finally, end-user segmentation underscores the varying demands of contract drilling service providers seeking versatile rig fleets, independent operators prioritizing cost efficiency, and large mining companies requiring integrated drilling and data analytics solutions. Together, these segmentation lenses offer a comprehensive view of how specialized drilling technologies and service models converge to meet diverse underground mining objectives.

This comprehensive research report categorizes the Underground Mining Diamond Drilling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drill Type

- Depth Range

- Borehole Diameter

- Application

- End User

Highlighting Regional Dynamics and Growth Drivers Shaping Underground Mining Diamond Drilling in Americas, EMEA, and Asia-Pacific Markets

Regional variations in underground mining diamond drilling reflect a confluence of geological, regulatory, and economic factors that shape equipment adoption and service models. In the Americas, established mining jurisdictions in Canada, the United States, and Latin America combine advanced regulatory frameworks with substantial exploration budgets, driving demand for sophisticated drill rigs and digital monitoring solutions. Operators in the region often emphasize productivity gains, safety improvements, and environmental compliance, fostering a robust market for automated and electric drilling platforms. Moreover, North and South American collaboration on technology transfer and joint ventures continues to exchange best practices across multiple deposit types.

Within Europe, Middle East & Africa, drilling dynamics are heavily influenced by resource-rich African nations that rely on both legacy mechanical rigs and emerging automation technologies to exploit deep ore bodies. European markets contribute stringent environmental standards and greenhouse gas reduction targets, accelerating the uptake of low-carbon electric drill rigs and advanced fluid management systems. Simultaneously, Middle Eastern sovereign wealth funds are investing in remote mining projects, prompting interest in turnkey drilling solutions that integrate remote operation capabilities and lifecycle service contracts.

Asia-Pacific underscores the importance of Australia as a global leader in underground diamond drilling, with extensive operator experience driving rapid incorporation of digital analytics, remote support centers, and advanced downhole surveying tools. Southeast Asian and Pacific Island initiatives are ramping up exploration efforts, leveraging modular drilling units to navigate challenging terrains and support burgeoning nickel, copper, and rare earth programs. Across these regions, collaborative research partnerships between operators, equipment manufacturers, and academic institutions continue to refine drilling methodologies for diverse geological settings.

This comprehensive research report examines key regions that drive the evolution of the Underground Mining Diamond Drilling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Industry Players, Innovations, and Strategic Collaborations Driving Competitive Advantage in Underground Mining Diamond Drilling

Key industry participants are actively shaping the competitive landscape through product innovation, strategic alliances, and targeted acquisitions. Established original equipment manufacturers are introducing next-generation drill rigs featuring hybrid power systems, integrated fleet management software, and modular design architectures that accommodate a range of core diameter requirements. By embedding sensors and analytics platforms directly into drilling equipment, these suppliers are redefining maintenance paradigms, enabling condition-based servicing that reduces unplanned stoppages and optimizes component lifecycles.

Concurrently, specialized tooling providers are advancing diamond bit geometries and bonding techniques to improve ROP (rate of penetration) and core recovery, addressing the industry’s need for high-quality geological data in deep, complex ore bodies. Partnership models between drill rig OEMs and bit manufacturers are expanding, allowing collaborative development of endpoint solutions that streamline rig-to-bit integration and performance tuning.

New entrants and regional OEMs are also emerging, offering competitively priced manual and hydraulic rigs tailored to specific markets with compact footprints and simplified service requirements. These players often collaborate with local service providers to bundle drilling equipment with workforce training and aftermarket support, enhancing value propositions in price-sensitive jurisdictions. Through joint ventures, licensing agreements, and co-engineering arrangements, both global and regional firms are broadening their reach, driving technological diffusion and elevating service standards across the underground mining diamond drilling ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Underground Mining Diamond Drilling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ausdrill Limited

- Boart Longyear Limited

- Capital Drilling Limited

- Epiroc AB

- Foraco International SA

- Geodrill Limited

- Major Drilling Group International Inc.

- Sandvik AB

- Wuxi Geological Drilling Equipment Co., Ltd.

- Zinex Mining Corp

Delivering Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency and Unlock Value in Diamond Drilling Practices

To capitalize on the evolving landscape of underground mining diamond drilling, industry leaders should prioritize the integration of automation and digital analytics to enhance operational efficiency and data accuracy. By investing in remotely operated rig platforms and real-time monitoring systems, drilling teams can reduce nonproductive time, improve hole straightness, and accelerate exploration cycles without increasing workforce risk. Additionally, implementing predictive maintenance frameworks-fueled by machine-learning algorithms that identify wear patterns and component fatigue-can mitigate unplanned downtime and optimize total cost of ownership.

Strengthening supply chain resilience demands a dual approach of diversifying sourcing strategies and cultivating domestic manufacturing partnerships. Contract drilling service providers and mining companies alike can benefit from long-term procurement agreements linked to performance incentives, ensuring continuity of critical consumables and parts. Concurrently, operators should explore additive manufacturing for wear components to reduce lead times and adapt tooling designs swiftly to geological variances.

Embracing sustainability imperatives involves adopting electric and low-emission drilling platforms, alongside rigorous waste management and water recycling protocols. By aligning drilling practices with environmental standards and social license requirements, companies can enhance community relations and meet investor expectations around ESG metrics. Furthermore, fostering cross-sector collaboration-engaging with academic institutions and technology incubators-will accelerate the development of next-generation drilling solutions and cultivate a skilled workforce capable of navigating future challenges.

Detailing Robust Research Methodology and Analytical Approaches Underpinning Insights for Credible Underground Mining Diamond Drilling Intelligence

This research leverages a rigorous mixed-methods approach combining primary and secondary data to ensure comprehensive, reliable insights. Primary research included structured interviews with drilling operations managers, procurement specialists, and technical experts across contract service providers, independent operators, and major mining companies. In-field observations and site visits to active underground drilling operations provided firsthand perspectives on equipment performance, maintenance protocols, and safety practices. These qualitative inputs were supplemented by an online survey of drilling personnel to quantify preferences, pain points, and adoption drivers.

Secondary research involved an extensive review of academic publications, technical white papers, regulatory filings, and company disclosures to triangulate market intelligence and validate emerging trends. Data synthesis utilized thematic analysis to identify recurring patterns in technology uptake, regulatory impact, and supply chain adjustments, while scenario planning exercises helped anticipate the implications of tariff shifts and geopolitical developments. A dedicated analyst team conducted comparative benchmarking of drill rig specifications, bit performance metrics, and aftermarket support models, ensuring that insights reflect both product capabilities and end-user priorities.

All findings underwent a multi-tier validation process, with expert review panels providing critical feedback on assumptions, segmentation frameworks, and regional nuances. This methodological rigor underpins the credibility of the research, offering industry stakeholders a clear, evidence-based guide to strategic decision-making in underground mining diamond drilling.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Underground Mining Diamond Drilling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Underground Mining Diamond Drilling Market, by Drill Type

- Underground Mining Diamond Drilling Market, by Depth Range

- Underground Mining Diamond Drilling Market, by Borehole Diameter

- Underground Mining Diamond Drilling Market, by Application

- Underground Mining Diamond Drilling Market, by End User

- Underground Mining Diamond Drilling Market, by Region

- Underground Mining Diamond Drilling Market, by Group

- Underground Mining Diamond Drilling Market, by Country

- United States Underground Mining Diamond Drilling Market

- China Underground Mining Diamond Drilling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Strategic Takeaways and Future Outlook for Underground Mining Diamond Drilling to Guide Stakeholder Decision-Making

In conclusion, the underground mining diamond drilling sector is navigating a period of dynamic transformation driven by technological innovation, tariff realignments, and evolving market segmentation profiles. Advances in automation and digitalization are redefining operational standards, while new U.S. tariffs are prompting agile sourcing strategies and encouraging greater domestic manufacturing capacity. A granular appraisal of drill type, depth range, borehole diameter, application, and end-user segments has elucidated critical use cases and strategic imperatives across the value chain.

Regional analyses reinforce the importance of tailored approaches, as established markets in the Americas demand cutting-edge rigs and data solutions, EMEA jurisdictions balance environmental imperatives with raw resource potential, and Asia-Pacific leads in both equipment innovation and exploration intensity. Competitive dynamics underscore the role of strategic collaborations, product differentiation, and service excellence in securing market share and driving performance enhancements.

Looking ahead, continued emphasis on sustainability, workforce safety, and digital integration will shape the next wave of drilling solutions, while geopolitical and regulatory developments will remain key variables in supply chain and cost management. By synthesizing these insights and applying the actionable recommendations provided, industry stakeholders can navigate uncertainties, capitalize on emerging opportunities, and secure a decisive competitive advantage in underground mining diamond drilling.

Engaging with Ketan Rohom to Acquire Comprehensive Underground Mining Diamond Drilling Market Research for Informed Strategic Advancement

We invite you to engage with Ketan Rohom (Associate Director, Sales & Marketing) today to secure your exclusive copy of the underground mining diamond drilling market research report. Ketan combines deep industry acumen with a strategic understanding of market dynamics to guide you through the nuances of drilling equipment technologies, tariff implications, segmentation profiles, regional landscapes, and competitive positioning. Partnering with him ensures you access tailored insights that empower your organization to anticipate challenges, optimize procurement strategies, and align investment priorities with emerging opportunities.

By reaching out to Ketan, you gain a direct line to expert consultation that can be customized to your unique operational context-whether you represent an independent operator seeking to refine exploration programs, a contract drilling service provider aiming to expand technological capabilities, or a mining company planning large-scale production initiatives. Ketan will walk you through the report’s actionable recommendations, segmentation deep dives, regional assessments, and competitive analyses to help you transform raw data into strategic outcomes.

Don’t let uncertainty limit your ability to make informed decisions in a rapidly evolving drilling environment. Connect with Ketan Rohom today to purchase the comprehensive report that will equip your team with the knowledge and confidence to drive sustainable growth and maintain a decisive edge in underground mining diamond drilling.

- How big is the Underground Mining Diamond Drilling Market?

- What is the Underground Mining Diamond Drilling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?