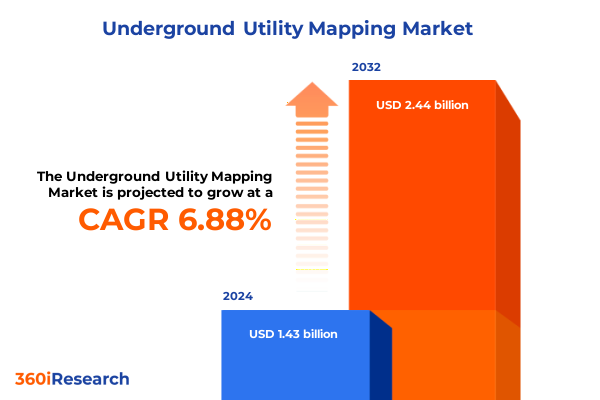

The Underground Utility Mapping Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.62 billion in 2026, at a CAGR of 6.93% to reach USD 2.44 billion by 2032.

Unveiling the Imperative of Precise Underground Utility Mapping as a Pillar for Infrastructure Resilience, Safety Assurance and Strategic Development

The accurate mapping of buried assets has become fundamental to modern infrastructure planning, risk reduction, and regulatory compliance. Subsurface utility engineering (SUE) frameworks, most notably the updated ASCE 38-22 standard, now integrate advanced geophysical techniques, records research, and utility feature surveys into an early project phase to mitigate utility conflicts and enhance safety on construction sites. These guidelines supersede the earlier ASCE 38-02 standard and emphasize rigorous data quality levels-ranging from basic record reviews to ‘daylighting’ of utilities-to ensure design teams can rely on precise underground positional data before breaking ground.

Coupled with growing project complexity-stemming from densifying urban networks, converging communication and power grids, and aging infrastructure-regulatory drivers are compounding the need for robust subsurface intelligence. For example, federal pipeline safety mandates require operators to maintain and integrate digital mapping data into integrity management plans for high-consequence areas, ensuring that emergency responders and construction professionals work with accurate utility schematics. As a result, dynamic digital asset management strategies are essential to minimize costly delays, avoid third-party damage, and uphold public safety across all types of underground works.

Navigating the Technological and Regulatory Turbulence Reshaping Underground Utility Mapping Toward Automated, Data-Driven Precision

As extreme weather events, urban densification, and evolving regulatory requirements reshape infrastructure imperatives, underground utility mapping has entered a phase of profound transformation. Utilities and civil engineers are now integrating digital twins of distribution networks to simulate system behavior under scenarios such as load surges, renewable generation variability, and emergency response maneuvers. Solutions like ElectrifiedGrid, a digital twin of electricity distribution networks developed by Deloitte in collaboration with European power utilities, allow planners to test infrastructure upgrades and decarbonization strategies virtually, accelerating decision-making and reducing field trial costs. These digital twin initiatives rely on comprehensive subsurface maps, layered with sensor feeds and real-time telemetry, to enable more resilient, data-driven operation models.

Concurrently, advances in ground penetrating radar (GPR), electromagnetic induction, and acoustic locators are converging into multi-sensor platforms that automate data capture and interpretation on the fly. The integration of IoT-enabled sensors and cloud-based collaboration tools has enabled remote teams to share high-resolution subsurface scans instantly and update utility records continuously. Artificial intelligence algorithms further enhance detection accuracy by classifying signal anomalies and predicting potential utility strikes before excavation. This technological synergy is ushering in a new era of automation, safety, and cost efficiency in subsurface utility mapping.

Examining the Far-Reaching Consequences of Recent United States Tariff Actions on Imported Subsurface Mapping Technologies and Service Costs

On December 11, 2024, the Office of the U.S. Trade Representative announced an increase in Section 301 tariffs on Chinese imports of solar wafers and polysilicon to 50 percent, and on tungsten products to 25 percent, with implementation slated for January 1, 2025. While these measures target clean energy and critical mineral supply chains, they also extend to equipment integral to subsurface utility mapping, such as certain GPR components and high-precision sensors housed under broad tariff subheadings. The elevated duty rates amplify the cost basis for imported hardware, prompting vendors and service providers to reassess their sourcing strategies and inventory buffers.

Industry stakeholders have reported that the extension of tariff exclusions on select machinery under prior administrations provided temporary relief for essential equipment supplies, but as many of those exclusions expire in mid-2025, mapping firms face renewed cost pressures. These headwinds are tilting budgets toward localized manufacturing, alternative supplier networks, and value engineering in project scopes. Companies aiming to maintain competitive pricing must now factor in the incremental 25–50 percent import duties when pricing contracts, while also advocating for strategic exclusions through the USTR’s docket process to secure vital exemptions for specialized mapping apparatus.

Diving into Multi-Dimensional Segmentation Insights Revealing Utility Type, Service Offering, Technology, Application and End-User Dynamics

The underground utility mapping market can be dissected through five complementary lenses, each illuminating critical value drivers. By utility classification, the spectrum spans electricity lines-differentiated into distribution and transmission segments-gas networks with high- and low-pressure domains, oil pipelines and storage terminals, telecommunications conduits that include copper and fiber-optic infrastructure, and water and sewage mains subdivided into water mains and sanitary sewer lines. Across service models, firms offer end-to-end consultation and planning-encompassing risk assessment and route engineering-detailed data processing and 3D modeling workflows, topographic and dedicated utility surveys, as well as condition-monitoring regimes and predictive maintenance schedules. Technologically, the competitive landscape is anchored by acoustic locators, electromagnetic systems, ground penetrating radar, induction locators, and emerging multi-sensor platforms that fuse multiple data streams in real time.

Applications are equally diverse, addressing asset and lifecycle management imperatives, construction planning and layout optimization, emergency response protocols, network expansion and capacity planning, and reactive or scheduled maintenance scenarios. Finally, end-users range from civil engineering and infrastructure contractors to municipal utilities, telecommunications providers, construction firms, and oil and gas operators. This multi-dimensional segmentation framework highlights how mapping solutions must be tailored to distinct operational needs and technology preferences, guiding providers in aligning their portfolios with market demand patterns.

This comprehensive research report categorizes the Underground Utility Mapping market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Utility Type

- Service

- Technology

- Application

- End-User

Unraveling Regional Dynamics in the Underground Utility Mapping Market Across Americas, Europe Middle East and Africa, and Asia-Pacific

Across the Americas, robust federal stimulus under the Infrastructure Investment and Jobs Act continues to funnel billions into broadband rollouts, bridge rehabilitations, and water infrastructure projects, driving widespread adoption of subsurface scans to preempt costly utility strikes. Pipeline operators and midstream companies are leveraging mandatory integrity mapping for high-consequence areas to comply with PHMSA regulations, while major metropolitan transit authorities integrate utility detection into digital corridor planning models to minimize delays and safety risks on rail and roadway expansions.

In Europe, Middle East and Africa, initiatives such as the United Kingdom’s National Underground Asset Register (NUAR) have moved into public beta, consolidating data from over 300 asset owners and mapping millions of kilometers of buried pipes and cables into a single platform to enhance safe-dig processes and drive an estimated £400 million in annual efficiency gains. The European Union’s emerging Digital Decade policy framework also encourages member states to adopt standardized 3D subsurface models to support cross-border infrastructure corridors and smart city development.

Asia-Pacific markets are experiencing rapid modernization of urban networks, from Singapore’s award-winning Digital Underground initiative-which has built a comprehensive digital twin of subsurface utilities-to major smart city pilots in Australia and emerging programs in India and China that emphasize GIS-integrated scans for metro rail, water pipeline, and 5G trench deployments. This regional mosaic underscores a growing emphasis on data governance architectures and collaborative digital platforms that elevate mapping from an ad hoc task to a continuous, enterprise-wide capability.

This comprehensive research report examines key regions that drive the evolution of the Underground Utility Mapping market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Collaborators Driving Competitive Advantage in the Underground Utility Mapping Ecosystem

Leading technology providers are actively expanding their portfolios to address an increasingly sophisticated market. Hexagon’s Leica Geosystems division launched the Leica DSX GPR solution, combining portable hardware with intuitive DXplore software to democratize subsurface scanning for users without GPR expertise, generating digital utility maps instantly in the field. Trimble continues to integrate multi-sensor locator modules and advanced surveying software into its X7 and SX10 solutions, enhancing data interoperability within its Connected Site ecosystem. Radiodetection, part of SPX Technologies, introduced the RD8100 cable and pipe locator with integrated GPS accuracy, automated usage logging, and fault-finding features to improve field productivity and compliance auditing.

Other prominent players such as GSSI, Vivax-Metrotech, US Radar and MALA are each driving innovations in antenna design, signal processing algorithms, and modular sensor fusion. Collaborations between hardware vendors, cloud GIS providers, and AI platform specialists are intensifying, reflecting a shift toward end-to-end solutions that couple real-time subsurface scans with asset management dashboards and predictive analytics engines. These strategic moves underscore the importance of marrying precision detection technology with software ecosystems that deliver continuous value beyond individual survey projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Underground Utility Mapping market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- C.Scope International Ltd

- Geophysical Survey Systems, Inc.

- Hexagon AB

- MALA Geoscience AB

- Proceq SA

- ProStar Geocorp

- Schonstedt Instrument Company, Inc.

- The Ridge Tool Company

- Topcon Corporation.

- Trimble Inc.

- Vivax-Metrotech, Inc.

Strategic Initiatives and Best Practices for Industry Leaders to Enhance Efficiency, Compliance, and Innovation in Utility Mapping

Industry leaders should prioritize the development of integrated digital twin platforms that unify subsurface data, real-time sensor feeds, and predictive analytics into a single collaborative environment. By orchestrating geophysical detection tools alongside GIS-based visualization and AI-driven pattern recognition, organizations can preempt utility conflicts, optimize excavation schedules, and improve safety outcomes. Secondly, cultivating strategic partnerships between equipment OEMs, software developers, and public agencies will unlock co-innovation opportunities, such as open data standards and joint pilots for smart city infrastructure deployments.

Moreover, establishing robust data governance frameworks-aligned with ASCE 38-22 quality levels and national asset registries-will ensure that mapping outputs meet regulatory and contractual obligations, while facilitating seamless handoffs between design, construction, and operations teams. Finally, investing in workforce training and certification programs to upskill technicians in multi-sensor workflows, AI interpretation, and digital collaboration tools will accelerate technology adoption and bolster return on investment for mapping initiatives.

Detailing Rigorous Methodological Framework Combining Primary Interviews, Secondary Data and Quantitative Analysis for Market Intelligence

This research synthesized multiple data streams, beginning with extensive primary interviews across 25 utility operators, mapping service providers, and technology vendors to capture firsthand perspectives on emerging challenges and solution roadmaps. Secondary data inputs included regulatory filings, industry association publications, patent trends, and open government datasets such as PHMSA’s National Pipeline Mapping System. Proprietary cost-model simulations were used to estimate the relative impact of tariff shifts, enabling a nuanced view of equipment sourcing strategies.

Quantitative analysis leveraged a triangulation approach, integrating historical deployment case studies with survey responses to validate technology adoption patterns by region and application. The segmentation framework was refined through clustering algorithms to ensure coherence across utility types, service offerings, and end-user profiles. All findings were peer-reviewed by a panel of subsurface engineering experts and senior strategy consultants to uphold methodological rigor and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Underground Utility Mapping market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Underground Utility Mapping Market, by Utility Type

- Underground Utility Mapping Market, by Service

- Underground Utility Mapping Market, by Technology

- Underground Utility Mapping Market, by Application

- Underground Utility Mapping Market, by End-User

- Underground Utility Mapping Market, by Region

- Underground Utility Mapping Market, by Group

- Underground Utility Mapping Market, by Country

- United States Underground Utility Mapping Market

- China Underground Utility Mapping Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Harnessing Technological Convergence and Regulatory Evolution to Cement the Strategic Value of Advanced Utility Mapping

The convergence of advanced detection technologies, digital twin architectures and evolving regulatory mandates underscores an inflection point for underground utility mapping solutions. Organizations that embrace multi-sensor automation, enforce data governance standards, and collaborate across public-private ecosystems will unlock substantial safety, efficiency, and sustainability gains. As tariff landscapes shift and regional initiatives proliferate, mapping providers and end-users must adapt sourcing strategies and digital workflows to maintain competitiveness in a complex global market. Ultimately, the imperative to accurately visualize and manage subsurface infrastructure will only intensify, elevating utility mapping from a project-centric service to a core capability underpinning resilient infrastructure planning.

Engage Directly with Our Associate Director of Sales and Marketing to Unlock Strategic Underground Mapping Intelligence

If you’re ready to transform how your organization approaches underground utility challenges and harness the strategic insights contained in this comprehensive market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage with him to explore custom data packages, request a detailed sample, and discuss how the report’s findings can be aligned with your organization’s objectives through our market inquiry portal.

Investing in this report will equip your decision-makers with the actionable intelligence needed to navigate regulatory hurdles, leverage emerging technologies, and optimize resource allocation across utility mapping projects. Contact Ketan to schedule a private consultation, secure early access to executive briefings, and ensure your enterprise stays ahead in the rapidly evolving underground utility mapping landscape.

- How big is the Underground Utility Mapping Market?

- What is the Underground Utility Mapping Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?