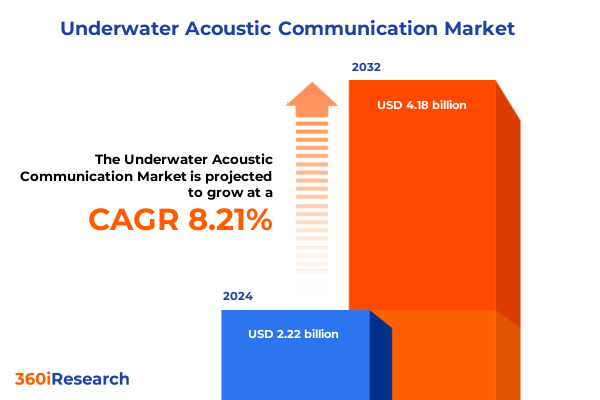

The Underwater Acoustic Communication Market size was estimated at USD 2.40 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 8.25% to reach USD 4.18 billion by 2032.

Discover how innovations in underwater acoustic communication are revolutionizing subsea connectivity and empowering stakeholders across marine environments

Underwater acoustic communication represents the cornerstone of subsea connectivity, enabling the transmission of data, voice, and control signals across challenging marine environments where electromagnetic waves rapidly attenuate. By leveraging the unique properties of sound propagation in water, this technology underpins a wide array of applications ranging from oceanographic research and environmental monitoring to defense surveillance and offshore energy operations. The inherent complexity of the underwater medium-characterized by variable salinity, temperature gradients, and multipath effects-demands sophisticated signal processing techniques and robust hardware solutions to maintain reliable links over distances spanning from a few meters to several kilometers.

This executive summary synthesizes key developments in underwater acoustic communication, exploring technological breakthroughs, regulatory influences, and market segmentation insights critical for decision makers. It outlines how recent advancements in transducer design, digital signal processing, and platform integration are redefining subsea data exchange. Additionally, the analysis illuminates the effects of United States tariffs introduced in 2025 on supply chains and procurement strategies, while distilling regional and competitive intelligence across leading industry participants. Throughout the report, emphasis is placed on actionable insights and strategic recommendations to empower stakeholders in navigating the evolving landscape of underwater acoustic communication.

Unveiling the transformative impact of digital signal processing and autonomous platform convergence that is redefining underwater acoustic communication

Over the past several years, the underwater acoustic communication landscape has experienced a paradigm shift fueled by breakthroughs in digital signal processing and the convergence of autonomous platforms. Digital transducers capable of dynamic beamforming have enhanced data throughput and range, enabling more reliable links in complex acoustic channels. In parallel, the integration of machine learning algorithms for real-time channel estimation and noise mitigation has elevated performance under challenging conditions, reducing packet loss and improving link stability. Consequently, subsea networks are evolving from simple point-to-point links to more sophisticated mesh architectures, supporting multi-node communications across fleets of autonomous underwater vehicles and distributed sensor arrays.

Furthermore, emerging energy harvesting techniques-such as piezoelectric conversion of ambient vibrations and thermal gradients-are extending the operational endurance of untethered systems. This enhancement complements the proliferation of modular communication suites that can be seamlessly integrated into buoys, fixed stations, and mobile vessels. In addition, new open‐source protocols for underwater Internet of Things deployments are simplifying interoperability, accelerating the adoption of interconnected sensor networks for environmental monitoring and infrastructure inspection. Altogether, these transformative shifts are converging to redefine the capabilities and applications of underwater acoustic communication, forging a more resilient and versatile subsea connectivity ecosystem.

Analyzing how United States tariffs enacted in 2025 have reshaped supply chains sourcing practices and cost dynamics in subsea acoustic technology

The tariffs enacted by the United States in 2025 on imported electronic components and high-precision transducer assemblies have exerted a pronounced influence on subsea acoustic technology supply chains. Faced with increased duties on key bearings, piezoelectric ceramics, and semiconductor chips, many original equipment manufacturers have recalibrated sourcing strategies to mitigate cost pressures. This recalibration has prompted a strategic shift toward qualifying alternative suppliers in allied markets and stockpiling critical components to hedge against tariff volatility. Consequently, procurement cycles have lengthened, requiring enhanced coordination between engineering teams and supply chain managers to avoid production delays.

Moreover, the cost dynamics introduced by these tariffs have catalyzed investments in domestic manufacturing capabilities, as stakeholders recognize the value of near-shore fabrication for high-value acoustic modules. In tandem, some firms have explored collaborative ventures with regional electronics producers to secure preferential trade terms and local incentives. These adaptations have not only influenced price negotiation tactics but also underscored the importance of supply chain resilience. As a result, industry leaders are reevaluating inventory strategies, prioritizing flexibility and supplier diversification to maintain consistent delivery schedules and safeguard long-term program commitments.

Deriving actionable segmentation insights from product type platform frequency depth and application dimensions in underwater acoustic communication markets

Insights derived from product type segmentation reveal that transceivers, particularly those leveraging digital modulation schemes, are commanding increasing attention due to their adaptability across varying channel conditions and ability to support higher data rates. Analog transceivers remain relevant for legacy applications, yet the digital variants’ programmable architectures and software-defined enhancements are driving forward-looking investments. In contrast, modems continue to serve as the backbone for low-power, short-range networking in sensor arrays, while standalone sensors are gaining traction within distributed environmental monitoring deployments.

Platform-based segmentation illustrates that autonomous underwater vehicles have emerged as critical enablers of dynamic data collection, integrating acoustic communication modules for real-time command and control. Buoys equipped with long-range modems facilitate shore-to-sea links, while fixed stations offer reliable infrastructure for permanent monitoring networks. Mobile vessels, outfitted with directional transducers, support intermittent data bursts during transit. These platform distinctions underscore the necessity of tailored system architectures that balance mobility, power availability, and communication requirements.

Frequency-based analysis indicates that low-frequency channels are preferred for long-haul links due to reduced attenuation, whereas high-frequency bands facilitate high-bandwidth exchanges over shorter distances. Medium-frequency operation, offering an intermediary compromise between range and throughput, has become foundational for mission-critical applications requiring moderate data rates. Additionally, depth-based segmentation highlights that deep-water deployments demand robust housing and compensation for extreme pressure, mid-range installations benefit from modular designs, and shallow-water scenarios prioritize compact form factors to navigate complex littoral environments.

Application-driven perspectives underscore that defense networks require encryption-hardened communication suites capable of operating under jamming threats, while commercial ventures such as offshore construction rely on robust links for equipment diagnostics. Environmental monitoring favors energy-efficient modems paired with wideband sensors, and oil & gas platforms depend on hybrid architectures to integrate real-time flow monitoring. Scientific research initiatives, meanwhile, leverage adaptive transceivers for oceanographic data transmission in remote locales.

This comprehensive research report categorizes the Underwater Acoustic Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Platform

- Frequency

- Depth

- Application

- End User

Illuminating regional dynamics and growth drivers across the Americas Europe Middle East Africa and Asia Pacific for underwater acoustic communication adoption

Regional dynamics in the Americas continue to be shaped by robust investment in offshore energy exploration and government-sponsored defense programs. In North America, collaborations between technology providers and academic institutions have accelerated the development of multi-node acoustic networks for environmental assessment and marine resource management. Latin American nations, recognizing the strategic importance of coastal surveillance, are increasingly adopting turnkey communication solutions to enhance maritime security. This confluence of commercial and defense drivers has fostered a vibrant ecosystem of integrators and service providers focused on subsea connectivity.

In the Europe, Middle East & Africa corridor, regulatory frameworks promoting sustainable offshore wind farms and marine habitat monitoring have opened new avenues for underwater acoustic communication deployments. European Union research grants are fueling cross-border initiatives that deploy interoperable sensor grids, while Middle Eastern desalination and offshore engineering projects utilize acoustic links for remote monitoring and control. Africa’s expanding coastal infrastructure needs have spurred investments in low-cost, energy-harvesting modems to support fisheries management and pollution tracking. Collectively, these regional projects underscore a growing demand for scalable and resilient acoustic networks.

Across the Asia-Pacific region, the convergence of extensive maritime trade lanes with rising defense budgets has propelled the pace of technology adoption. National research agencies in Japan and Australia are pioneering hybrid acoustic-optical communication systems to balance range and throughput requirements. Southeast Asian nations, grappling with maritime boundary surveillance, are deploying autonomous platforms equipped with advanced transceivers for persistent network coverage. In addition, China’s rapid expansion of subsea cable infrastructure has highlighted the critical role of acoustic monitoring in detecting and mitigating potential threats to undersea assets.

This comprehensive research report examines key regions that drive the evolution of the Underwater Acoustic Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting key industry players pioneering innovation collaboration and competitive positioning within the underwater acoustic communication ecosystem

Key industry players are distinguishing themselves through strategic collaborations, comprehensive product portfolios, and targeted research initiatives. Teledyne Marine has leveraged its deep ocean expertise to integrate high-fidelity transducers with advanced signal processing suites, enabling extended-range communication in deep-sea applications. Kongsberg’s focus on modular, scalable architectures has facilitated rapid deployment across a spectrum of platforms, from autonomous vehicles to fixed observatories. Similarly, Sonardyne has solidified its position by offering encrypted acoustic modems tailored for both defense networks and commercial monitoring operations.

L3Harris is advancing digital modem technology with an emphasis on low-latency, high-throughput channels designed for real-time video and data streaming, while EvoLogics continues to push the envelope on smart transducer arrays and adaptive networking protocols. Collaborations between these vendors and leading universities are fostering innovations in machine learning–driven channel estimation, acoustic positioning, and fault-tolerant network designs. Moreover, partnerships with energy harvesting specialists are yielding low-power, self-sustaining communication nodes optimized for long-term oceanographic missions. Through these concerted efforts, the competitive landscape is evolving to support more integrated, resilient, and intelligence-driven underwater acoustic communication solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Underwater Acoustic Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aquatec Group Ltd

- Ceebus Technologies, LLC

- Covelya Group Limited

- DSPComm

- EvoLogics GmbH

- Fujitsu Limited

- Hydroacoustic, Inc.

- Hydromea SA

- Jiangsu Zhongtian Technology Co., Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nortek AS

- Ocean Reef Group

- Rafael Advanced Defense Systems Ltd.

- RJE International, Inc.

- Saab AB

- Sercel S.A.S by Viridien Group

- Sonardyne International

- Subnero Pte. Ltd.

- Teledyne Technologies Incorporated

- Thales Group

- Undersea Systems International, Inc.

- WSENSE S.r.l.

Offering strategic recommendations to industry leaders on leveraging emerging technologies and optimizing supply chains for subsea acoustic communication success

To capitalize on the current momentum in subsea connectivity, industry leaders should prioritize the integration of software-defined frameworks that enable in-field reconfiguration of transceiver parameters, thus ensuring adaptability to diverse mission profiles. Additionally, cultivating strategic partnerships with chip manufacturers and material science experts can mitigate supply chain risks and foster the co-development of next-generation components tailored for extreme marine environments. Implementing just-in-time inventory practices alongside geographic diversification of suppliers will further enhance resilience against tariff-induced cost fluctuations.

Furthermore, organizations should invest in interoperable communication protocols that facilitate unified mesh networking across heterogeneous platforms, thereby unlocking collective intelligence and streamlined data sharing. Establishing collaborative research consortia with academic and governmental bodies can accelerate the validation of emerging technologies such as AI-driven channel modeling and energy-harvesting transducer designs. By embedding these recommendations into a forward-looking innovation roadmap, stakeholders can optimize operational efficiency, reduce total cost of ownership, and secure a competitive edge in the rapidly evolving underwater acoustic communication sector.

Detailing the research methodology that integrates primary interviews secondary data and systematic analysis to deliver actionable subsea communication insights

The research methodology underpinning this analysis combines insights from in-depth interviews with C-suite executives and technical experts at leading subsea communication firms alongside comprehensive review of publicly available technical papers, regulatory filings, and patent portfolios. Primary interviews were structured to capture qualitative nuances around technology adoption barriers, procurement challenges, and future R&D priorities, while secondary data sources provided context on historical deployment scenarios and standardization efforts.

Subsequently, data triangulation techniques were applied to align divergent perspectives, ensuring robust validation of key findings. Structured analysis frameworks facilitated the categorization of market dynamics across product, platform, frequency, depth, and application dimensions. Emphasis was placed on cross-sectional analysis to identify overlapping trends and strategic inflection points. This rigorous approach guarantees that the insights presented are both actionable and reflective of the multifaceted underwater acoustic communication ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Underwater Acoustic Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Underwater Acoustic Communication Market, by Product Type

- Underwater Acoustic Communication Market, by Platform

- Underwater Acoustic Communication Market, by Frequency

- Underwater Acoustic Communication Market, by Depth

- Underwater Acoustic Communication Market, by Application

- Underwater Acoustic Communication Market, by End User

- Underwater Acoustic Communication Market, by Region

- Underwater Acoustic Communication Market, by Group

- Underwater Acoustic Communication Market, by Country

- United States Underwater Acoustic Communication Market

- China Underwater Acoustic Communication Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing critical findings and outlining implications for stakeholders driving innovation and strategic decisions in underwater acoustic communication

This report’s critical findings underscore a transformative era for underwater acoustic communication, where digital transceiver technology, autonomous platform integration, and energy-harvesting capabilities converge to enhance reliability and operational flexibility. The impacts of United States tariffs have highlighted the importance of agile supply chain management and strategic supplier partnerships, reshaping procurement and manufacturing strategies. Segmentation insights reveal distinct growth vectors across product types, platforms, frequency bands, depth categories, and application sectors, each presenting unique opportunities and challenges for stakeholders.

Regional analyses demonstrate that while the Americas lead in defense and offshore energy deployments, EMEA is advancing sustainable monitoring networks through regulatory incentives, and Asia-Pacific continues to drive innovation via large-scale maritime projects. Key player insights reveal a competitive landscape characterized by collaborative R&D and modular product offerings. Collectively, these conclusions inform strategic prioritization and underscore the imperative for organizations to adopt adaptive frameworks, foster cross-disciplinary partnerships, and maintain a relentless focus on technological differentiation to thrive in the evolving subsea communication domain.

Encouraging readers to engage with Ketan Rohom to access comprehensive market insights and secure the specialized underwater acoustic communication report

For personalized guidance and to delve deeper into the comprehensive insights of this underwater acoustic communication analysis, readers are invited to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who can facilitate access to the specialized research report, discuss tailored solutions, and ensure seamless procurement. Engaging with this expert will not only grant immediate visibility into the latest technological developments, regulatory impacts, and market dynamics but also enable stakeholders to align their strategic objectives with actionable intelligence tailored to their unique operational needs.

By connecting with Ketan Rohom, organizations can secure invaluable resources that support informed decision making, accelerate product development timelines, and strengthen competitive positioning within the subsea communications ecosystem. This collaborative interaction promises to enhance understanding of critical trends, optimize technology investments, and unlock new opportunities in commercial, defense, and environmental applications of underwater acoustic communication.

- How big is the Underwater Acoustic Communication Market?

- What is the Underwater Acoustic Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?