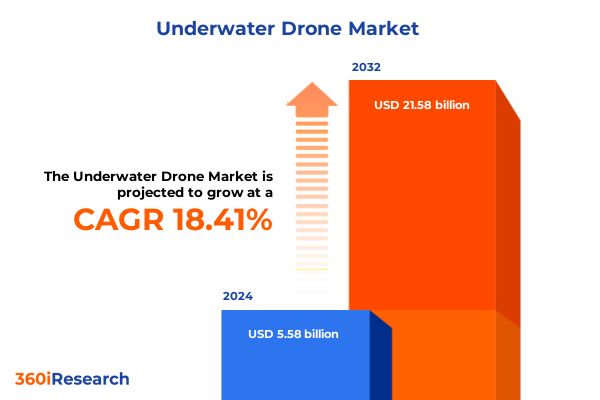

The Underwater Drone Market size was estimated at USD 6.57 billion in 2025 and expected to reach USD 7.74 billion in 2026, at a CAGR of 18.51% to reach USD 21.58 billion by 2032.

Exploring the Emergence, Technological Advancements, and Strategic Importance of Underwater Drones in Modern Maritime Operations Globally

Over the past decade, underwater drones have transitioned from experimental prototypes to mission-critical platforms, heralding a new era in underwater exploration and operations. Advances in battery technology, sensor miniaturization, and data processing have converged to deliver vehicles capable of executing complex tasks with minimal human intervention. This introduction offers a panoramic view of how these autonomous and remotely operated systems are reshaping subsea activities, from scientific research to industrial applications.

As maritime industries increasingly grapple with sustainability goals, safety imperatives, and cost pressures, the deployment of advanced underwater drones has emerged as a strategic response. Whether inspecting offshore infrastructure, conducting environmental surveys, or supporting search and rescue missions, these platforms deliver enhanced situational awareness and precision without exposing personnel to hazardous conditions. Furthermore, as the volume and granularity of underwater data grow, stakeholders across government, commercial, and academic sectors are recalibrating their operational models to integrate drone-enabled insights seamlessly.

This executive summary synthesizes the most pertinent developments, structural shifts, and strategic considerations defining the underwater drone landscape. It establishes the foundation for a deeper exploration of technological trends, tariff implications, segmentation nuances, regional dynamics, and competitive strategies that inform investment and operational decisions. By the end of this report, decision-makers will be equipped with a clear understanding of the forces driving market evolution and the pathways to achieving sustained competitive advantage.

Analyzing Critical Technological and Regulatory Shifts That Are Redefining the Underwater Drone Market Ecosystem Worldwide

Underwater drone technology is experiencing a period of rapid transformation driven by breakthroughs in autonomy, energy efficiency, and networked communications. Modern platforms now leverage advanced machine learning algorithms to navigate complex underwater terrains and adapt to changing environmental conditions without constant human oversight. Concurrent developments in high-density energy storage have extended mission durations, allowing both autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) to undertake deeper, longer, and more data-intensive surveys than ever before.

Equally consequential are regulatory evolutions and standardization efforts that seek to harmonize safety protocols and data privacy norms across jurisdictions. International maritime authorities are crafting guidelines to accommodate unmanned submersible operations within established shipping lanes and sensitive marine habitats. These frameworks not only reduce barriers to deployment but also create a predictable environment for technology developers and end-users to invest confidently in R&D and operational capabilities.

In parallel, strategic partnerships between drone manufacturers, academic institutions, and oceanographic bodies are accelerating innovation cycles. Collaborative ecosystems foster knowledge exchange and catalyze modular system architectures, enabling rapid integration of emerging sensors and communication modules. Collectively, these technological and regulatory shifts are redefining the underwater drone market, unlocking new applications and shaping the competitive landscape for years to come.

Evaluating the Cumulative Effects of the 2025 United States Tariff Adjustments on the Global Underwater Drone Supply Chain and Market Dynamics

In 2025, the United States implemented targeted tariff adjustments on key components imported for underwater drone assembly, aiming to level the playing field for domestic manufacturers. While the intention was to bolster local production, the cumulative effect has rippled across the global supply chain, affecting procurement timelines and component pricing. Companies reliant on advanced sensors and propulsion modules from overseas suppliers have faced extended lead times, prompting a reassessment of sourcing strategies.

As a result, a number of manufacturers have accelerated investments in domestic R&D to mitigate exposure to import levies. In doing so, they are fostering closer collaborations with local electronics firms and academic research centers to design and produce critical subsystems onshore. These efforts have begun to yield dual dividends: reduced dependence on imported parts and the emergence of homegrown innovation hubs that can customize solutions for specialized operational theaters.

Despite short-term cost pressures, the longer-term landscape suggests a gradual realignment rather than a market contraction. Enterprises are diversifying supplier networks and deploying hybrid procurement models that blend in-country production with selective imports. Through strategic procurement planning and agile design practices, industry players are navigating tariff-induced disruptions, transforming potential headwinds into catalysts for innovation and supply chain resilience.

Unveiling Deep Insights Across Product Types, Components, Depth Capabilities, Sizes, Applications, and Distribution Channels for Underwater Drones

The underwater drone ecosystem encompasses a diverse array of vehicle categories, each tailored to specific mission profiles. Autonomous underwater vehicles excel in preprogrammed survey operations, while hybrid configurations offer flexible switching between autonomous navigation and remote control. Remotely operated vehicles remain indispensable in scenarios requiring real-time human oversight, such as intricate inspection tasks or emergency interventions. These distinctions inform procurement decisions and mission planning across industries.

Beneath the chassis of each platform lies a complex interplay of hardware and software components. From high-capacity batteries and precision control systems to multispectral cameras and advanced sensors, the hardware suite dictates a vehicle’s endurance and environmental compatibility. Meanwhile, proprietary software stacks orchestrate navigation, data acquisition, and communication, enabling seamless integration with surface vessels and command centers.

Operating depth capabilities further segment the market, with deep water drones venturing beyond 1,000 meters to map abyssal plains or inspect deep-sea installations, mid-depth platforms covering the 200- to 1,000-meter range for infrastructure surveys, and shallow water vehicles conducting coastal environmental monitoring at depths under 200 meters. Size classifications, from large heavy-lift systems to micro drones, determine payload capacity and maneuverability, while applications span environmental monitoring, fisheries management, oceanographic research, offshore energy exploration, search and rescue missions, security surveillance, and underwater cinematography. Distribution channels vary from direct engagements with end-users to strategic partnerships with distributors, complemented by burgeoning online platforms that simplify procurement workflows.

By understanding how these categories intersect, stakeholders can pinpoint optimal solutions that align with operational goals, technical requirements, and budgetary parameters.

This comprehensive research report categorizes the Underwater Drone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Operating Depth

- Size

- Applications

- Distribution Channel

Examining Regional Variations and Growth Drivers across the Americas, EMEA, and Asia-Pacific Underwater Drone Markets

The Americas region continues to lead in commercial adoption and technological innovation, driven by robust defense expenditures and an active offshore oil and gas sector. North American operators leverage advanced platforms for infrastructure inspection and environmental compliance initiatives, while Latin American markets are ramping up investment in marine conservation and fisheries applications. In addition, the extensive coastline and maritime trade routes reinforce demand for reliable underwater inspection and surveillance solutions.

Within Europe, Middle East, and Africa, regulatory frameworks are harmonizing to support unmanned maritime operations across diverse jurisdictions. European Union directives on marine data sharing and offshore wind farm monitoring are catalyzing procurement of specialized systems, while Middle Eastern energy producers are incorporating drone-assisted surveys to optimize resource extraction. African research institutions are forging partnerships with global manufacturers to deploy low-cost platforms for coral reef monitoring and coastal erosion studies, reflecting a broader emphasis on sustainability.

The Asia-Pacific region exhibits some of the highest growth momentum, with governments in China, Japan, South Korea, and Australia injecting capital into oceanographic research and maritime security initiatives. The region’s shipbuilding clusters are integrating drone technologies to enhance new vessel capabilities, while aquaculture operations in Southeast Asia adopt underwater platforms for stock assessment and health monitoring. These varied drivers underscore the regional nuances shaping market trajectories and investment priorities.

This comprehensive research report examines key regions that drive the evolution of the Underwater Drone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Underwater Drone Developers and Their Strategic Innovations Driving Competitive Differentiation in the Market

A cohort of specialized technology providers is spearheading the underwater drone revolution by balancing innovative feature sets with operational reliability. Some companies distinguish themselves through in-house development of advanced propulsion systems that extend mission endurance, while others invest heavily in modular architectures that simplify payload integration. Collaborations with sensor manufacturers and software firms have produced turnkey solutions designed for rapid deployment in complex subsea environments.

In addition to established original equipment manufacturers, a wave of agile startups is gaining traction by targeting niche segments such as micro-drone applications or data analytics services for environmental monitoring. These emerging players are capitalizing on low-cost production techniques and cloud-based data platforms to offer subscription-based models, broadening market accessibility for smaller operators and research organizations.

Strategic alliances between defense contractors and commercial drone developers are also reshaping competitive dynamics. By leveraging cross-sector expertise in autonomous navigation and cybersecurity, these partnerships are delivering systems that meet stringent security requirements without compromising scientific and commercial functionality. As a result, industry leaders are expanding their footprints across defense, energy, and research markets, positioning themselves for sustained growth and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Underwater Drone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Aquabotix Technology Corporation

- Atlas Elektronik GmbH

- Chasing Innovation Technology Co., Ltd.

- Deep Trekker Inc. by Halma plc.

- ecoSUB Robotics Limited

- Elbit Systems Ltd.

- Fugro N.V.

- GAO Tek & GAO Group Inc.,

- General Dynamics Mission Systems, Inc.

- IROV Technologies Pvt Ltd

- Kongsberg Gruppen ASA

- Kraken Robotics Inc.

- L3Harris Technologies, Inc

- Notilo Plus. by Delair

- Oceaneering International, Inc

- QYSEA Technology Co., Ltd.

- Robosea Intelligent Tech Co., Ltd.

- Saab AB

- Teledyne Technologies Incorporated

- Terradepth Inc.

- Thales S.A.

- The Boeing Company

- VideoRay LLC by BlueHalo

Delivering Actionable Strategic Recommendations to Future-Proof Investments and Operational Excellence in the Underwater Drone Industry

Industry leaders can accelerate their market positioning by forging strategic partnerships across the value chain. Collaborating with component suppliers and software developers enables faster integration of cutting-edge technologies, while joint ventures with research institutions foster early adoption of emerging capabilities. In parallel, diversifying supplier networks mitigates exposure to regional disruptions and ensures continuity of critical subsystems.

Organizations should also invest in scalable software architectures that support iterative enhancements and enable seamless upgrades of navigation algorithms, data analytics modules, and mission planning interfaces. Prioritizing cybersecurity measures from the design phase onward safeguards data integrity and protects networked operations against evolving threats. Moreover, aligning R&D roadmaps with regulatory trajectories helps anticipate compliance requirements, reducing time to market and minimizing adaptation costs.

Sustainability must remain central to product development and operational strategies. By incorporating eco-friendly materials and low-impact propulsion technologies, companies can address regulatory scrutiny and public expectations on environmental stewardship. Finally, adopting flexible business models-such as as-a-service offerings or subscription-based analytics platforms-creates recurring revenue streams and enhances customer retention by delivering ongoing value beyond initial equipment sales.

Detailing the Robust Multimethod Research Methodology Underpinning the Comprehensive Underwater Drone Market Analysis

The foundation of this analysis rests on a multimethod research framework, combining rigorous secondary data review with structured primary engagements. Industry literature, patent filings, and regulatory documents were examined to map technological trajectories and policy developments. These sources were complemented by a systematic analysis of company disclosures, white papers, and investment filings to validate competitive positioning and innovation pipelines.

Primary insights were obtained through in-depth interviews with market stakeholders, including technology developers, end-users, academic experts, and regulatory authorities. This qualitative data provided granular perspectives on adoption barriers, performance benchmarks, and emerging use cases. To ensure robustness, findings were cross-verified through data triangulation, reconciling interview outcomes with publicly available financial reports, trade statistics, and third-party assessments.

A structured segmentation approach underpins the analysis, categorizing the market by product typology, component architecture, operating depth, platform size, application domain, and distribution channel dynamics. Regional breakdowns align with macroeconomic indicators, regulatory climates, and industry-specific drivers. Throughout the process, an iterative validation cycle with external experts reinforced the integrity of insights and minimization of bias, yielding a comprehensive and reliable portrayal of the underwater drone market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Underwater Drone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Underwater Drone Market, by Product Type

- Underwater Drone Market, by Component

- Underwater Drone Market, by Operating Depth

- Underwater Drone Market, by Size

- Underwater Drone Market, by Applications

- Underwater Drone Market, by Distribution Channel

- Underwater Drone Market, by Region

- Underwater Drone Market, by Group

- Underwater Drone Market, by Country

- United States Underwater Drone Market

- China Underwater Drone Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Provide a Clear and Cohesive Perspective on Underwater Drone Market Trajectories and Opportunities

The compilation of findings reveals a market at the cusp of significant expansion, fueled by technological innovation, shifting regulatory landscapes, and evolving operational priorities. As platforms become more autonomous, energy-dense, and cost-effective, their applicability broadens across scientific, commercial, and defense sectors. Simultaneously, tariff-driven supply chain adjustments are prompting a recalibration of sourcing strategies, spurring domestic innovation hubs and hybrid procurement models.

Segmentation insights illustrate that no single vehicle configuration or operating depth holds universal appeal; instead, mission-specific requirements dictate platform selection and associated component architectures. Regional analyses underscore that growth trajectories are not uniform, with each geography presenting distinct drivers and regulatory nuances that shape adoption rates and investment appetites.

Ultimately, companies that integrate strategic partnerships, invest in scalable software ecosystems, and maintain a strong orientation toward sustainability will command the competitive high ground. By anticipating regulatory shifts and diversifying their technology portfolios, industry leaders can harness emerging opportunities and navigate potential disruptions with confidence. The convergence of these dynamics sets the stage for a vibrant and resilient underwater drone market in the years ahead.

Connect Directly with Associate Director of Sales & Marketing to Secure the Most Comprehensive Underwater Drone Market Research Report Today

To obtain the most in-depth and up-to-date insights into the underwater drone market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise will guide you toward the optimal research package suited to your strategic objectives.

Engaging with Ketan Rohom ensures personalized support through the end-to-end research procurement process. By discussing your unique requirements and industry focus, you will gain access to tailored recommendations that align with your investment priorities and operational needs. Secure the comprehensive market research report today to reinforce your decision-making with authoritative data and actionable intelligence.

- How big is the Underwater Drone Market?

- What is the Underwater Drone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?