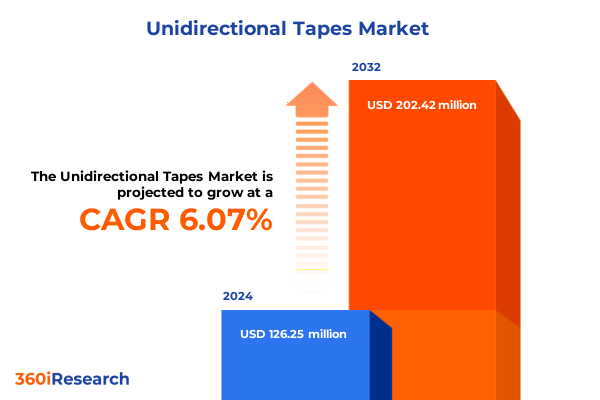

The Unidirectional Tapes Market size was estimated at USD 133.86 million in 2025 and expected to reach USD 146.79 million in 2026, at a CAGR of 6.08% to reach USD 202.41 million by 2032.

Unidirectional tapes redefining performance standards across aerospace automotive electronics and healthcare while unlocking new material possibilities

Unidirectional tapes are emerging as indispensable components in the pursuit of lightweight, high-strength solutions across a spectrum of industries. As advanced materials with fibers aligned in a single direction, they deliver targeted reinforcement that boosts structural integrity while minimizing weight. This specialized profile has garnered widespread attention from aerospace engineers seeking fuel efficiency, automotive designers aiming for performance improvement, and electronics manufacturers pursuing miniaturization. Beyond these applications, the healthcare sector is exploring novel unidirectional tape constructs for medical imaging and wearable diagnostics, setting the stage for next-generation material innovations.

Against this backdrop of surging demand, this executive summary offers a concise yet comprehensive overview of the forces shaping the unidirectional tape market. It synthesizes the pivotal shifts in technology, regulatory landscapes-particularly the recent United States tariffs-and evolving end-user preferences that collectively influence strategic decision-making. By distilling the most critical insights from our in-depth analysis, stakeholders can quickly grasp the market’s core dynamics without wading through extensive technical data.

Finally, this document highlights segmentation and regional nuances, profiles leading industry players, and identifies actionable recommendations designed to seize emerging opportunities. The goal is to furnish decision-makers with a clear roadmap for navigating complexity, optimizing supply chains, and aligning R&D investments with the most promising applications. Whether you are a materials scientist, procurement executive, or corporate strategist, this summary equips you with the strategic vision needed to capitalize on the transformative potential of unidirectional tapes.

Exploring how cutting-edge materials technologies digital manufacturing and sustainability initiatives are reshaping the competitive landscape of unidirectional tapes

The unidirectional tape market is undergoing a profound transformation driven by converging technological breakthroughs and shifting customer priorities. Innovations in resin chemistries now enable tapes to withstand extreme temperatures and harsh chemical environments, leading to broader adoption in aerospace thermal protection systems and industrial electronics insulation. Concurrently, digital manufacturing techniques-such as automated tape laying and advanced simulation tools-are accelerating design cycles, reducing production lead times, and cutting material waste.

In tandem, sustainability imperatives are fueling demand for bio-resin and recycled fiber variants, compelling producers to integrate circular economy principles into their processes. This shift not only addresses regulatory pressures around carbon footprints but also resonates with end users seeking to bolster their environmental credentials. Moreover, the rise of Industry 4.0 has introduced real-time quality monitoring and end-to-end supply-chain transparency, enabling manufacturers to pinpoint process efficiencies and mitigate risks before they impact production.

Together, these transformative shifts are redefining the competitive landscape of unidirectional tapes. The fusion of advanced materials science, digitalization, and sustainability is creating new value propositions for both suppliers and end-use industries. As these dynamics continue to evolve, companies that proactively embrace innovation and operational agility will set the pace for market leadership.

Assessing the cumulative implications of 2025 United States tariff actions on supply chains cost structures and strategic sourcing dynamics for unidirectional tapes

In early 2025, the United States implemented a series of tariffs targeting a range of imported composite materials, including unidirectional tapes. These measures, enacted in response to broader trade disputes, have introduced incremental duty rates that vary by adhesive resin and fiber composition. As a result, domestic producers and end users are grappling with higher material acquisition costs, prompting a reevaluation of sourcing strategies and supplier contracts established prior to the tariff imposition.

The cumulative impact has manifested in several ways. Manufacturers dependent on cross-border supply chains have experienced lead-time extensions as procurement teams navigate revised trade documentation and compliance procedures. Price pressures have prompted some OEMs to negotiate cost-sharing arrangements with tape suppliers, while others have explored domestic alternatives or increased vertical integration to shield margins. Importantly, these adaptations are occurring amidst fluctuating currency exchange rates, which have further compounded cost volatility for international transactions.

Looking beyond the immediate cost implications, the tariff environment has catalyzed strategic shifts across the value chain. Suppliers are accelerating investments in localized production capacity within North America to mitigate exposure, while distributors are expanding warehousing footprints to buffer against supply disruptions. For end-use industries, the net effect is a greater emphasis on total cost of ownership analysis, factoring in logistics efficiencies and potential duty reclaim mechanisms. These cumulative impacts underscore the necessity of dynamic tariff management and proactive supply-chain optimization in 2025 and beyond.

Unlocking critical segmentation insights from adhesive chemistries to end-use industries product types backing materials and key application domains

Understanding how unidirectional tape demand varies across adhesive types is fundamental to strategic positioning. Tapes formulated with acrylic adhesives are prized for their balance of shear strength and UV resistance, making them a go-to solution for outdoor applications and high-temperature bonding. Rubber-based formulations, by contrast, offer rapid tack and flexibility, ideal for masking during complex composite layups. Meanwhile, silicone adhesives provide exceptional thermal stability and electrical insulation properties, catering to high-performance electronics and thermal management systems.

The end-use landscape further differentiates market prospects. Aerospace manufacturers rely on unidirectional tapes for primary structural reinforcement and vibration damping, while the automotive sector leverages these tapes in both passenger vehicle trim assemblies and heavy commercial components to improve fuel efficiency. In construction, the demand bifurcates between commercial projects-where unidirectional tapes enable façade and curtain wall installations-and residential applications that value rapid installation and long-term weather resistance. Electronics producers split their usage between consumer devices, where thin-film fibers enhance device durability, and industrial equipment requiring robust insulation. Additionally, the healthcare field is steadily adopting biocompatible variants for medical device lamination and imaging technologies.

Product type selection is equally critical. Polyethylene terephthalate backing (PET) is widely used for its dimensional stability, while polyimide (PI) tapes excel in extreme temperature applications such as automotive under-hood components. Polypropylene and PTFE backings offer chemical resistance and low friction, serving specialized industrial needs, whereas PVC provides cost-effective solutions for general-purpose applications. Backing material choices-ranging from cloth for heavy-duty mechanical protection to film for uniform thickness control and paper for economical surface protection-further tailor tape performance. Finally, applications span from electrical insulation in demanding power electronics to precision masking in automated paint lines, packaging solutions that require clean removal, and surface protection during transit and assembly.

This comprehensive research report categorizes the Unidirectional Tapes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Adhesive Type

- Backing Material

- End Use Industry

- Application

Illuminating diverse growth drivers and adoption trends across the Americas Europe Middle East Africa and Asia-Pacific unidirectional tape markets

Regional dynamics exert a profound influence on unidirectional tape adoption patterns. In the Americas, robust aerospace and automotive markets are driving sustained demand, underpinned by significant investments in next-generation aircraft and electric vehicle platforms. North American manufacturers are also benefiting from trade agreements that facilitate cross-border material flows and incentivize near-shoring of critical composite components.

Over in Europe, the Middle East, and Africa, regulatory emphasis on sustainability and energy efficiency is catalyzing the uptake of eco-friendly tape variants. The European Union’s rigorous REACH standards and the Middle East’s burgeoning infrastructure development programs are creating pockets of high growth, while Africa’s nascent composites industry is exploring unidirectional tapes for modular construction and renewable energy installations.

Meanwhile, the Asia-Pacific region is witnessing rapid expansion driven by consumer electronics production hubs in East Asia and automotive manufacturing clusters across Southeast Asia. Government incentives in countries such as China, Japan, and South Korea are spurring research into novel fiber composites, while India’s infrastructure modernization efforts are generating fresh demand for tapes in bridge reinforcement and mass transit systems. These varied regional narratives collectively shape a dynamic global marketplace where localized strategies can unlock differentiated value.

This comprehensive research report examines key regions that drive the evolution of the Unidirectional Tapes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and strategic partnerships driving technological breakthroughs competitive differentiation and evolving business models

Leading players in the unidirectional tape arena are distinguished by their commitment to material innovation and strategic collaborations. Global conglomerates have established dedicated research centers focused on next-generation resin chemistries and automated manufacturing processes, seeking to outpace competitors by offering superior thermal, mechanical, and environmental performance. At the same time, agile midsize firms are forging partnerships with niche fiber producers to co-develop application-specific solutions, enabling rapid response to evolving end-user requirements.

Collaborative ventures between tape manufacturers and OEMs have become increasingly common, with joint development programs aimed at integrating real-time performance monitoring capabilities into composite assemblies. These partnerships not only deliver tailored products but also facilitate direct feedback loops, accelerating iterative improvements. Furthermore, strategic acquisitions of specialty tape providers are reshaping competitive positioning, as larger entities seek to broaden their product portfolios and geographic footprints. Amidst this activity, a handful of new entrants are disrupting traditional supply chains by leveraging digital platforms to offer on-demand production runs and engineering support, signaling a shift toward more customer-centric business models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unidirectional Tapes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. Algeo Ltd.

- Arkema S.A.

- Arrow Technical Textiles Private Limited

- Barrday Corporation

- BASF SE

- Bemis Associates Inc.

- Champion Tape

- Chomarat Group

- Colan Products Pty. Ltd.

- Composites Evolution Ltd.

- Eurocarbon B.V.

- Evonik Industries AG

- Hexcel Corporation

- Intertape Polymer Group Inc.

- Koninklijke DSM N.V.

- Kordsa Teknik Tekstil Anonim Şirketi

- MaruHachi Group

- Mitsui Chemicals, Inc.

- Plastic Reinforcement Fabrics Ltd.

- Profol GmbH

- Saudi Basic Industries Corporation

- SGL Carbon SE

- Sheldahl Flexible Technologies, Inc.

- SK Group

- Solvay S.A.

- TCR Composites, Inc.

- Teijin Limited

- Tesa SE

- TOPOLO

- Toray Industries, Inc.

- Victrex PLC

Actionable strategies for industry leaders to drive innovation streamline supply chains and fortify customer collaborations in the unidirectional tape sector

To capitalize on the evolving unidirectional tape landscape, industry leaders should prioritize investments in advanced resin research that deliver enhanced temperature and chemical resilience. Developing proprietary adhesive formulations will yield a compelling value proposition for high-performance applications, while aligning with sustainability goals through bio-based alternatives can unlock new market segments and meet stringent regulatory standards.

Diversifying supply chains is equally critical. Organizations ought to establish multi-regional procurement strategies that hedge against tariff fluctuations and geopolitical risks, complemented by increased warehousing capabilities to buffer short-term disruptions. Collaboration with local manufacturing partners can further reduce lead times and logistics costs, fostering greater responsiveness to end-user demand.

Additionally, stakeholders should embrace digital transformation across production and quality assurance processes. Integrating sensors and data analytics within automated tape-laying equipment can optimize material usage, minimize defects, and enable predictive maintenance. Finally, forging deeper alliances with OEMs through co-development agreements will facilitate seamless product integration and create co-innovation pipelines, ensuring that unidirectional tape solutions remain tightly aligned with emerging application requirements.

Comprehensive research methodology integrating stakeholder interviews rigorous data validation and established analytical frameworks for reliable insights

This research leveraged a multi-tiered methodology to deliver robust, reliable insights. Primary research entailed in-depth interviews with key stakeholders, including composite material engineers, procurement executives, and industry association representatives. These dialogues provided direct perspectives on technology adoption, tariff impacts, and regional growth drivers, enabling us to capture qualitative nuances often absent from public data.

Secondary research involved meticulous analysis of trade publications, regulatory filings, patent databases, and company financial reports. This phase ensured a comprehensive understanding of competitive landscapes, material innovations, and policy developments across key markets. Quantitative data were cross-verified through industry associations’ import/export statistics and customs records to validate trends in supply chain shifts and tariff implications.

Finally, all findings underwent rigorous triangulation against established analytical frameworks such as PESTEL and Porter’s Five Forces, ensuring that macro-environmental factors, competitive intensity, and stakeholder influences were systematically evaluated. This structured approach guarantees the integrity of conclusions and the practical relevance of recommendations for strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unidirectional Tapes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unidirectional Tapes Market, by Product Type

- Unidirectional Tapes Market, by Adhesive Type

- Unidirectional Tapes Market, by Backing Material

- Unidirectional Tapes Market, by End Use Industry

- Unidirectional Tapes Market, by Application

- Unidirectional Tapes Market, by Region

- Unidirectional Tapes Market, by Group

- Unidirectional Tapes Market, by Country

- United States Unidirectional Tapes Market

- China Unidirectional Tapes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Distilling key findings strategic imperatives and actionable pathways for stakeholders to thrive in the dynamic unidirectional tape market

The unidirectional tape market stands at the intersection of advanced materials innovation, complex trade dynamics, and differentiated end-use requirements. Technological advancements in resin chemistries and digital manufacturing are driving new performance thresholds, while 2025 tariff measures have underscored the importance of agile supply-chain management. Segmentation analysis reveals that adhesive type, end-use industry, product backing, and application domain each present unique value levers, demanding tailored strategies rather than one-size-fits-all approaches.

Regionally, North America’s manufacturing resurgence, EMEA’s sustainability mandates, and Asia-Pacific’s production scale form a tripartite growth narrative that rewards localized investments and market access initiatives. Leading companies are distinguishing themselves through collaborative innovation, strategic acquisitions, and customer-centric business models that leverage digital platforms. For industry participants, the path forward lies in deepening R&D commitments, diversifying procurement, and embedding data-driven process controls.

This executive summary highlights the strategic imperatives for stakeholders across the value chain. By aligning material development roadmaps with emerging regulatory standards, enhancing operational resilience, and cultivating co-innovation partnerships, organizations can secure a leadership position in the dynamic unidirectional tape sector.

Empower your competitive edge by partnering with Ketan Rohom to access the definitive unidirectional tape market research report and drive future growth

Are you ready to transform your strategic initiatives with comprehensive insights into the unidirectional tape market? Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is your dedicated partner in unlocking the full potential of this industry’s evolution. By securing the complete market research report, you will gain unparalleled visibility into the dynamics shaping advanced material applications, tariff impacts, segmentation drivers, and regional trends.

Connect with Ketan Rohom today to explore customized engagement options, discuss tailored data deliverables, and align your corporate strategy with the actionable findings presented in this research. Don’t miss out on the opportunity to harness data-driven intelligence for competitive advantage-reach out now to secure your copy and set the course for sustained growth in the unidirectional tape sector.

- How big is the Unidirectional Tapes Market?

- What is the Unidirectional Tapes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?