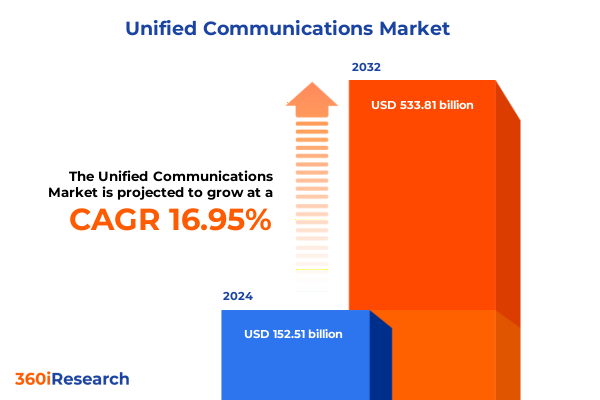

The Unified Communications Market size was estimated at USD 177.13 billion in 2025 and expected to reach USD 205.92 billion in 2026, at a CAGR of 17.06% to reach USD 533.81 billion by 2032.

Establishing the Context for Strategic Decision-Making by Navigating Emerging Trends and Core Dynamics Shaping the Unified Communications Landscape

In an era defined by rapid digital transformation, understanding the intricate evolution of unified communications is paramount to informed leadership. Organizations must adapt to shifting collaboration paradigms driven by remote work expansion, cloud migration, and the integration of advanced technologies. This executive summary lays the groundwork for strategic decision-makers seeking to harness these dynamics, weaving together qualitative insights and thematic analysis drawn from stakeholder interviews and industry observations.

By framing the discussion around core drivers-such as user experience priorities, interoperability challenges, and emerging regulatory frameworks-this introduction clarifies the scope and intent of the research. It highlights how converging communication channels are reshaping workflows and underscores the need for robust, future-proof strategies. Ultimately, this opening section orients readers to the critical narratives that will inform subsequent deep dives into market shifts, tariff impacts, segmentation nuances, and region-specific opportunities within the unified communications domain.

Unveiling the Next Generation of Collaboration through Cloud-Native Innovation Artificial Intelligence Integration and Hybrid Work Enablement

The unified communications arena is undergoing transformative shifts as enterprises transition from siloed voice and messaging solutions to cohesive, intelligent collaboration platforms. The proliferation of cloud-native architectures has accelerated adoption of as-a-service models, democratizing access to high-fidelity audio and video conferencing tools while reducing infrastructure overhead. Concurrently, artificial intelligence is being embedded into virtual assistants and real-time translation features, enhancing user productivity and breaking down organizational and geographic barriers.

Meanwhile, the rise of hybrid work environments has compelled providers to rethink interoperability and security postures, leading to the integration of zero-trust frameworks and device-agnostic experiences. These dual forces-cloud-driven scalability and intelligence-led engagement-are converging to catalyze the next generation of unified communications, where seamless collaboration and data-driven decision support become indispensable.

Analyzing the Ripple Effects of Elevated Trade Duties on Procurement Practices Supply Chains and Service Innovation in Unified Communications

The implementation of new U.S. tariffs in early 2025 has introduced a complex set of headwinds for unified communications stakeholders, particularly in the hardware segment. Elevated duties on imported conferencing endpoints, network appliances, and telephony equipment have driven up unit costs, prompting organizations to reassess supply chain strategies and total cost of ownership considerations. As a result, many service providers have accelerated efforts to develop localized manufacturing partnerships and diversify vendor portfolios.

On the software side, licensing expenditures have experienced indirect inflationary pressures as vendors adjust pricing models to offset hardware cost escalations. This has spurred a recalibration of service bundles, with an emphasis on managed and professional services to deliver greater value and operational continuity. Cumulatively, these tariff-induced shifts are reshaping procurement practices, driving consolidation among mid-tier suppliers, and reinforcing the imperative for agile sourcing frameworks.

Deriving Strategic Clarity by Interweaving Component Offerings Solution Types and Application Contexts across Deployment Models and Industry Verticals

Distinct insights emerge when dissecting the unified communications landscape through a series of strategic lenses. Components divide into tangible offerings like hardware and software, juxtaposed against services that span managed and professional domains to support deployment and ongoing optimization. By solution category, audio and video conferencing tools are continuing to converge with instant and unified messaging platforms, while IP telephony retains its fundamental role in enterprise voice networks.

In application contexts, the spectrum ranges from desktop video conferencing and web-based collaboration suites to room-based deployments that incorporate advanced cameras and immersive audio. Speech recognition capabilities and unified messaging systems are weaving intelligence into everyday interactions. Deployment modes bifurcate between cloud-hosted frameworks that promise rapid scalability and on-premises configurations prized for control. Across organizational tiers, large enterprises demand extensive customization and compliance services, whereas small and medium enterprises prioritize ease of use and cost efficiency. Finally, end-user industries such as banking and insurance, healthcare, and IT & telecommunications are driving differentiated requirements, while sectors like media, retail, transport, and government each bring unique regulatory and performance imperatives to the forefront.

This comprehensive research report categorizes the Unified Communications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Solution

- Deployment Mode

- Organization Size

- Application

- End User Industry

Understanding Regional Variances and Growth Drivers from North American Cloud Acceleration to EMEA Regulatory Nuances and Asia-Pacific Digital Expansion

Regional dynamics continue to redefine competitive intensity and growth trajectories within unified communications. In the Americas, mature adoption of cloud conferencing and messaging solutions has been buoyed by progressive regulatory frameworks and robust investment in digital infrastructure. As North America pushes toward AI-enhanced user experiences, Latin American enterprises are increasingly seeking cost-effective cloud-based offerings to support distributed teams across diverse geographies.

Across Europe, the Middle East, and Africa, interoperability standards and data sovereignty considerations are shaping deployment strategies, with on-premises solutions remaining prevalent in highly regulated markets. The region’s growth is driven by public sector modernization initiatives and the proliferation of hybrid work mandates. Meanwhile, Asia-Pacific markets are exhibiting rapid uptake of unified communications platforms, propelled by burgeoning SMB demand in Southeast Asia and large-scale digital transformation programs in powerhouse economies. This confluence of regional drivers underscores the necessity for adaptable, localized approaches.

This comprehensive research report examines key regions that drive the evolution of the Unified Communications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing How Leading Vendors and Emerging Challengers Are Shaping Competition through Partnerships Innovation and Industry-Specific Solution Bundles

Leading technology vendors and agile disruptors are actively redefining the competitive landscape through strategic partnerships, targeted acquisitions, and continuous platform enhancements. Established incumbents have consolidated their positions by integrating advanced analytics and AI-driven orchestration into core offerings, while cloud-native challengers leverage nimble architecture to rapidly roll out innovative features.

Collaborations between infrastructure providers and software developers are creating more seamless end-to-end experiences, enabling users to transition effortlessly between device-agnostic endpoints. Additionally, a surge in vertical-specific solution bundles is allowing key players to address industry-specific pain points, such as compliance in financial services or secure telehealth in healthcare. As competitive intensity mounts, companies are prioritizing customer success programs and ecosystem expansion strategies to drive stickiness and unlock new revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unified Communications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2600Hz Inc. by Ooma Company

- 3CX, Inc.

- 8x8, Inc.

- ALE International SAS

- Amazon Web Services, Inc.

- Avaya LLC

- Broadcom Inc.

- Cisco Systems, Inc.

- Connect Solutions, Inc.

- Crexendo, Inc.

- Dialpad, Inc.

- Genesys Cloud Services, Inc.

- Google LLC by Alphabet Inc.

- GoTo Group, Inc.

- HP Inc.

- Infosys Limited

- Intermedia.net, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Mitel Networks Corporation

- NEC Corporation

- Nextiva, Inc.

- Nokia Corporation

- Oracle Corporation

- Ribbon Communications Inc.

- RingCentral, Inc.

- Salesforce, Inc.

- Sangoma Technologies Corporation

- Smart IMS Inc.

- Tata Communications Limited

- Telefonaktiebolaget LM Ericsson

- Twilio Inc.

- Verizon Communications Inc.

- Vitel Global Communications

- Xiamen Yeastar Information Technology Co., Ltd.

- Yamaha Corporation

- Zayo Group, LLC

- Zoho Corporation Pvt. Ltd.

- Zoom Communications, Inc.

Balancing Innovation with Supply Chain Agility and Strategic Alliances to Secure Leadership in Unified Communications

Industry leaders must adopt a dual focus on technological innovation and operational resilience to maintain momentum in unified communications. Investing in AI-powered features that deliver contextual insights and automate routine tasks will differentiate premium offerings and foster user engagement. Equally important is the establishment of flexible supply chain frameworks that mitigate tariff risks and ensure consistent hardware availability.

Moreover, fostering strategic alliances with complementary service providers can accelerate time to market for integrated solutions while enhancing value propositions. Leaders should also prioritize comprehensive training and change management initiatives to ensure seamless user adoption across organizational layers. By combining proactive technology roadmapping with resilient business models, enterprises can capitalize on emergent opportunities and navigate continuing market complexities.

Detailing the Comprehensive Mixed-Methods Research Framework Combining Executive Interviews Secondary Analysis and Expert Validation

This research engages a rigorous mixed-methods approach, combining primary interviews with senior IT and communications executives across multiple industries and geographies with secondary analysis of publicly available financial reports, regulatory filings, and technology white papers. Qualitative insights have been validated through a Delphi panel of subject matter experts, ensuring balanced perspectives on emerging trends and challenges.

Data triangulation techniques were applied to reconcile divergent viewpoints and to surface high-confidence findings. The study emphasizes transparency in methodology by documenting interview guides, thematic coding frameworks, and quality assurance protocols. This structured process underpins the credibility of insights and ensures that conclusions are grounded in a robust evidentiary base.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unified Communications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unified Communications Market, by Component

- Unified Communications Market, by Solution

- Unified Communications Market, by Deployment Mode

- Unified Communications Market, by Organization Size

- Unified Communications Market, by Application

- Unified Communications Market, by End User Industry

- Unified Communications Market, by Region

- Unified Communications Market, by Group

- Unified Communications Market, by Country

- United States Unified Communications Market

- China Unified Communications Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Converging Insights into a Unified Narrative That Illuminates Strategic Imperatives and Guides Collaboration Roadmaps for Future Success

Bringing together these multifaceted insights underscores the transformative trajectory of unified communications, where technological innovation, regulatory shifts, and evolving user expectations coalesce to redefine how organizations collaborate. From the impact of tariffs on procurement to the segmentation-driven demand nuances, this executive summary highlights the strategic imperatives confronting decision-makers.

By synthesizing regional variations, competitive dynamics, and future-focused trends, the overview delivers a cohesive narrative that can guide investment priorities and operational roadmaps. As enterprises prepare for the next wave of digital collaboration, grounding strategies in this comprehensive analysis will ensure resilience, scalability, and sustained competitive advantage.

Secure Strategic Advantage Today with a Personalized Consultation on Cutting-Edge Unified Communications Insights and Tailored Research Offerings

Elevate your communications strategy by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through how this comprehensive research unlocks actionable insights and strategic clarity. By partnering with him, you can secure prioritized delivery of in-depth analysis tailored to your organizational needs, enabling faster decision-making and competitive differentiation. Reach out to arrange a personalized consultation and gain exclusive access to the full unified communications report, ensuring you stay ahead of industry shifts and capitalize on emerging opportunities.

- How big is the Unified Communications Market?

- What is the Unified Communications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?